Citigroup Global Fixed-Income Index Catalog ... - The Yield Book

Citigroup Global Fixed-Income Index Catalog ... - The Yield Book

Citigroup Global Fixed-Income Index Catalog ... - The Yield Book

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

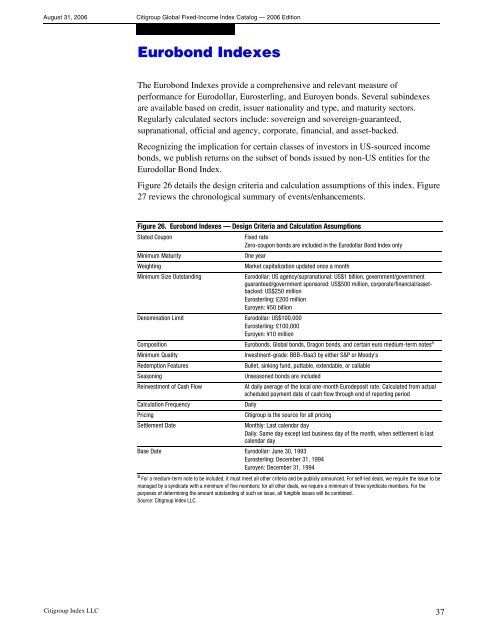

August 31, 2006<strong>Citigroup</strong> <strong>Global</strong> <strong>Fixed</strong>-<strong>Income</strong> <strong>Index</strong> <strong>Catalog</strong> — 2006 EditionEurobond <strong>Index</strong>es<strong>The</strong> Eurobond <strong>Index</strong>es provide a comprehensive and relevant measure ofperformance for Eurodollar, Eurosterling, and Euroyen bonds. Several subindexesare available based on credit, issuer nationality and type, and maturity sectors.Regularly calculated sectors include: sovereign and sovereign-guaranteed,supranational, official and agency, corporate, financial, and asset-backed.Recognizing the implication for certain classes of investors in US-sourced incomebonds, we publish returns on the subset of bonds issued by non-US entities for theEurodollar Bond <strong>Index</strong>.Figure 26 details the design criteria and calculation assumptions of this index. Figure27 reviews the chronological summary of events/enhancements.Figure 26. Eurobond <strong>Index</strong>es — Design Criteria and Calculation AssumptionsStated Coupon<strong>Fixed</strong> rateZero-coupon bonds are included in the Eurodollar Bond <strong>Index</strong> onlyMinimum MaturityOne yearWeightingMarket capitalization updated once a monthMinimum Size OutstandingEurodollar: US agency/supranational: US$1 billion, government/governmentguaranteed/government sponsored: US$500 million, corporate/financial/assetbacked:US$250 millionEurosterling: £200 millionEuroyen: ¥50 billionDenomination LimitEurodollar: US$100,000Eurosterling: £100,000Euroyen: ¥10 millionCompositionEurobonds, <strong>Global</strong> bonds, Dragon bonds, and certain euro medium-term notes aMinimum QualityInvestment-grade: BBB-/Baa3 by either S&P or Moody'sRedemption FeaturesBullet, sinking fund, puttable, extendable, or callableSeasoningUnseasoned bonds are includedReinvestment of Cash FlowAt daily average of the local one-month Eurodeposit rate. Calculated from actualscheduled payment date of cash flow through end of reporting periodCalculation FrequencyDailyPricing<strong>Citigroup</strong> is the source for all pricingSettlement DateMonthly: Last calendar dayDaily: Same day except last business day of the month, when settlement is lastcalendar dayBase Date Eurodollar: June 30, 1993Eurosterling: December 31, 1994Euroyen: December 31, 1994a For a medium-term note to be included, it must meet all other criteria and be publicly announced. For self-led deals, we require the issue to bemanaged by a syndicate with a minimum of five members; for all other deals, we require a minimum of three syndicate members. For thepurposes of determining the amount outstanding of such an issue, all fungible issues will be combined.Source: <strong>Citigroup</strong> <strong>Index</strong> LLC.<strong>Citigroup</strong> <strong>Index</strong> LLC 37