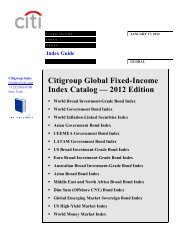

Citigroup Global Fixed-Income Index Catalog ... - The Yield Book

Citigroup Global Fixed-Income Index Catalog ... - The Yield Book

Citigroup Global Fixed-Income Index Catalog ... - The Yield Book

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

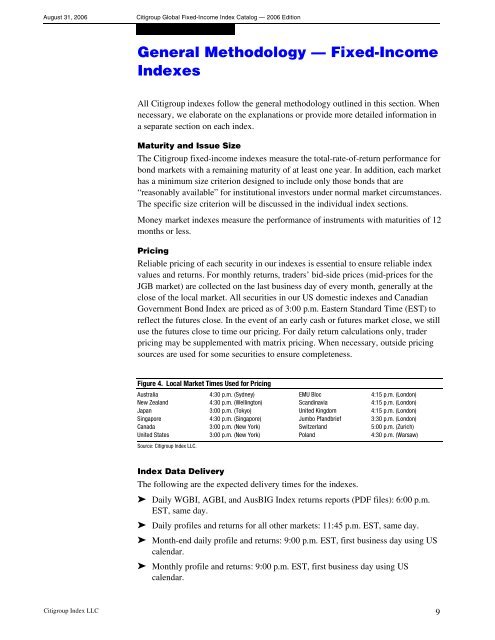

August 31, 2006<strong>Citigroup</strong> <strong>Global</strong> <strong>Fixed</strong>-<strong>Income</strong> <strong>Index</strong> <strong>Catalog</strong> — 2006 EditionGeneral Methodology — <strong>Fixed</strong>-<strong>Income</strong><strong>Index</strong>esAll <strong>Citigroup</strong> indexes follow the general methodology outlined in this section. Whennecessary, we elaborate on the explanations or provide more detailed information ina separate section on each index.Maturity and Issue Size<strong>The</strong> <strong>Citigroup</strong> fixed-income indexes measure the total-rate-of-return performance forbond markets with a remaining maturity of at least one year. In addition, each markethas a minimum size criterion designed to include only those bonds that are“reasonably available” for institutional investors under normal market circumstances.<strong>The</strong> specific size criterion will be discussed in the individual index sections.Money market indexes measure the performance of instruments with maturities of 12months or less.PricingReliable pricing of each security in our indexes is essential to ensure reliable indexvalues and returns. For monthly returns, traders’ bid-side prices (mid-prices for theJGB market) are collected on the last business day of every month, generally at theclose of the local market. All securities in our US domestic indexes and CanadianGovernment Bond <strong>Index</strong> are priced as of 3:00 p.m. Eastern Standard Time (EST) toreflect the futures close. In the event of an early cash or futures market close, we stilluse the futures close to time our pricing. For daily return calculations only, traderpricing may be supplemented with matrix pricing. When necessary, outside pricingsources are used for some securities to ensure completeness.Figure 4. Local Market Times Used for PricingAustralia 4:30 p.m. (Sydney) EMU Bloc 4:15 p.m. (London)New Zealand 4:30 p.m. (Wellington) Scandinavia 4:15 p.m. (London)Japan 3:00 p.m. (Tokyo) United Kingdom 4:15 p.m. (London)Singapore 4:30 p.m. (Singapore) Jumbo Pfandbrief 3:30 p.m. (London)Canada 3:00 p.m. (New York) Switzerland 5:00 p.m. (Zurich)United States 3:00 p.m. (New York) Poland 4:30 p.m. (Warsaw)Source: <strong>Citigroup</strong> <strong>Index</strong> LLC.<strong>Index</strong> Data Delivery<strong>The</strong> following are the expected delivery times for the indexes.➤ Daily WGBI, AGBI, and AusBIG <strong>Index</strong> returns reports (PDF files): 6:00 p.m.EST, same day.➤ Daily profiles and returns for all other markets: 11:45 p.m. EST, same day.➤ Month-end daily profile and returns: 9:00 p.m. EST, first business day using UScalendar.➤ Monthly profile and returns: 9:00 p.m. EST, first business day using UScalendar.<strong>Citigroup</strong> <strong>Index</strong> LLC 9