A CALL TO ARMS - National Association of Professional Allstate ...

A CALL TO ARMS - National Association of Professional Allstate ...

A CALL TO ARMS - National Association of Professional Allstate ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

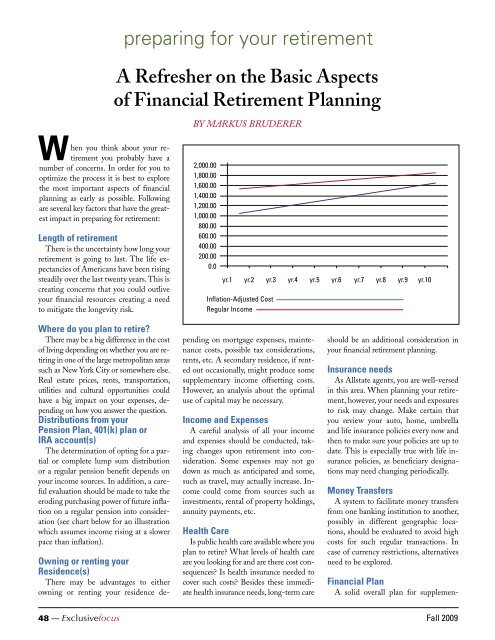

Length <strong>of</strong> retirementThere is the uncertainty how long yourretirement is going to last. The life expectancies<strong>of</strong> Americans have been risingsteadily over the last twenty years. This iscreating concerns that you could outliveyour financial resources creating a needto mitigate the longevity risk.preparing for your retirementA Refresher on the Basic Aspects<strong>of</strong> Financial Retirement PlanningWhen you think about your retirementyou probably have anumber <strong>of</strong> concerns. In order for you to 2,000.00optimize the process it is best to explore 1,800.00the most important aspects <strong>of</strong> financial 1,600.00planning as early as possible. Following 1,400.00are several key factors that have the greatestimpact in preparing for retirement:1,000.001,200.00800.00600.00400.00200.000.0BY MARKUS BRUDERERyr.1 yr.2 yr.3 yr.4 yr.5 yr.6 yr.7 yr.8 yr.9 yr.10Inflation-Adjusted CostRegular IncomeWhere do you plan to retire?There may be a big difference in the cost<strong>of</strong> living depending on whether you are retiringin one <strong>of</strong> the large metropolitan areassuch as New York City or somewhere else.Real estate prices, rents, transportation,utilities and cultural opportunities couldhave a big impact on your expenses, dependingon how you answer the question.Distributions from yourPension Plan, 401(k) plan orIRA account(s)The determination <strong>of</strong> opting for a partialor complete lump sum distributionor a regular pension benefit depends onyour income sources. In addition, a carefulevaluation should be made to take theeroding purchasing power <strong>of</strong> future inflationon a regular pension into consideration(see chart below for an illustrationwhich assumes income rising at a slowerpace than inflation).Owning or renting yourResidence(s)There may be advantages to eitherowning or renting your residence dependingon mortgage expenses, maintenancecosts, possible tax considerations,rents, etc. A secondary residence, if rentedout occasionally, might produce somesupplementary income <strong>of</strong>fsetting costs.However, an analysis about the optimaluse <strong>of</strong> capital may be necessary.Income and ExpensesA careful analysis <strong>of</strong> all your incomeand expenses should be conducted, takingchanges upon retirement into consideration.Some expenses may not godown as much as anticipated and some,such as travel, may actually increase. Incomecould come from sources such asinvestments, rental <strong>of</strong> property holdings,annuity payments, etc.Health CareIs public health care available where youplan to retire? What levels <strong>of</strong> health careare you looking for and are there cost consequences?Is health insurance needed tocover such costs? Besides these immediatehealth insurance needs, long-term careshould be an additional consideration inyour financial retirement planning.Insurance needsAs <strong>Allstate</strong> agents, you are well-versedin this area. When planning your retirement,however, your needs and exposuresto risk may change. Make certain thatyou review your auto, home, umbrellaand life insurance policies every now andthen to make sure your policies are up todate. This is especially true with life insurancepolicies, as beneficiary designationsmay need changing periodically.Money TransfersA system to facilitate money transfersfrom one banking institution to another,possibly in different geographic locations,should be evaluated to avoid highcosts for such regular transactions. Incase <strong>of</strong> currency restrictions, alternativesneed to be explored.Financial PlanA solid overall plan for supplemen-48 — Exclusivefocus Fall 2009