Tax Credit Participation Form - Lake Havasu Unified School District

Tax Credit Participation Form - Lake Havasu Unified School District

Tax Credit Participation Form - Lake Havasu Unified School District

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

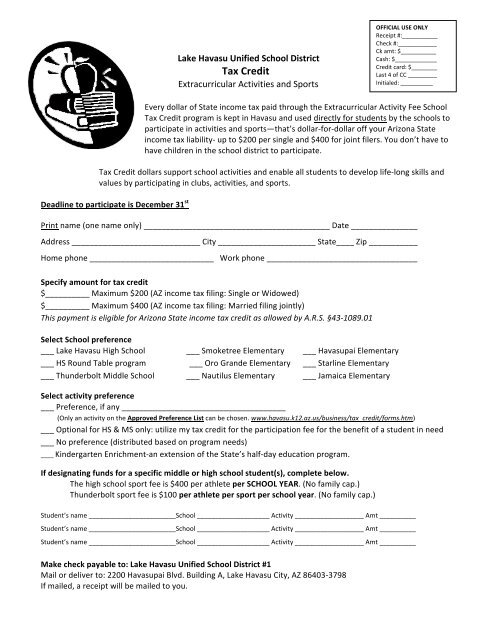

<strong>Lake</strong> <strong>Havasu</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong> <strong>Tax</strong> <strong>Credit</strong> Extracurricular Activities and Sports OFFICIAL USE ONLY Receipt #:___________ Check #:____________ Ck amt: $___________ Cash: $_____________ <strong>Credit</strong> card: $________ Last 4 of CC _________ Initialed: __________ Every dollar of State income tax paid through the Extracurricular Activity Fee <strong>School</strong> <strong>Tax</strong> <strong>Credit</strong> program is kept in <strong>Havasu</strong> and used directly for students by the schools to participate in activities and sports—that’s dollar-‐for-‐dollar off your Arizona State income tax liability-‐ up to $200 per single and $400 for joint filers. You don’t have to have children in the school district to participate. <strong>Tax</strong> <strong>Credit</strong> dollars support school activities and enable all students to develop life-‐long skills and values by participating in clubs, activities, and sports. Deadline to participate is December 31 stPrint name (one name only) __________________________________________ Date _______________ Address _____________________________ City ______________________ State____ Zip ___________ Home phone ____________________________ Work phone __________________________________ Specify amount for tax credit $__________ Maximum $200 (AZ income tax filing: Single or Widowed) $__________ Maximum $400 (AZ income tax filing: Married filing jointly) This payment is eligible for Arizona State income tax credit as allowed by A.R.S. §43-‐1089.01 Select <strong>School</strong> preference ___ <strong>Lake</strong> <strong>Havasu</strong> High <strong>School</strong> ___ Smoketree Elementary ___ <strong>Havasu</strong>pai Elementary ___ HS Round Table program ___ Oro Grande Elementary ___ Starline Elementary ___ Thunderbolt Middle <strong>School</strong> ___ Nautilus Elementary ___ Jamaica Elementary Select activity preference ___ Preference, if any _____________________________________ (Only an activity on the Approved Preference List can be chosen. www.havasu.k12.az.us/business/tax_credit/forms.htm) ___ Optional for HS & MS only: utilize my tax credit for the participation fee for the benefit of a student in need ___ No preference (distributed based on program needs) ____ Kindergarten Enrichment-‐an extension of the State’s half-‐day education program. If designating funds for a specific middle or high school student(s), complete below. The high school sport fee is $400 per athlete per SCHOOL YEAR. (No family cap.) Thunderbolt sport fee is $100 per athlete per sport per school year. (No family cap.) Student’s name ________________________<strong>School</strong> ____________________ Activity ___________________ Amt __________ Student’s name ________________________<strong>School</strong> ____________________ Activity ___________________ Amt __________ Student’s name ________________________<strong>School</strong> ____________________ Activity ___________________ Amt __________ Make check payable to: <strong>Lake</strong> <strong>Havasu</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong> #1 Mail or deliver to: 2200 <strong>Havasu</strong>pai Blvd. Building A, <strong>Lake</strong> <strong>Havasu</strong> City, AZ 86403-‐3798 If mailed, a receipt will be mailed to you.

<strong>Tax</strong> credit is a dollar-‐for-‐dollar subtraction from your AZ state income tax liability. It’s not a donation. It is your tax dollars! <strong>Participation</strong> • Single people can participate up to $200; married filing jointly can participate up to $400. • Family and friends around the state can credit their tax funds to the <strong>Lake</strong> <strong>Havasu</strong> <strong>School</strong>s also. • 100% of your tax credit dollars will go to the school and extra-‐curricular activity of your choice. • You must pay by December 31. Keep your receipt for your Arizona income tax preparation. • Ask if payroll deduction, an automatic payment plan, or regular payment plan is available. How it works• It’s like pre-‐paying your taxes and keeping the money in <strong>Havasu</strong> at the school and activity of your choice instead of sending it to Phoenix. • When you file your AZ State income tax return, subtract the tax credit amount from your tax. • Because this is a dollar-‐for-‐dollar credit it may reduce the amount you owe or may increase your refund. Check with your tax advisor for application of this credit. • A receipt will be issued to use with your tax form to take to your tax preparer. • The amount can be used as a deduction on an itemized Federal <strong>Tax</strong> Schedule. Recipients <strong>Tax</strong> credit money is used to help activities like band, choir, drama, sports, and many other clubs. Give your tax credit for the benefit of: • Student activities at a specific school (no activity preference) • A specific activity at a specific school (activity must be from the Approved Preference List) • A specific student (middle or high school) for use in an approved activity/sport • A student in need of an Athletic or a specific sport participation fee (middle school or high school), or for high school marching band uniforms The middle school sports fee is $100 per athlete per sport per school year. The high school sports fee is $400 per athlete per school year. Give the maximum to high school athletics or a specific high school sport and receive a free pass to the high school regular season home games for the entire school year. Steps to keep your tax credit dollars in <strong>Havasu</strong>, benefiting local students! 1. Fill out an “Extracurricular Activity Fee <strong>Tax</strong> <strong>Credit</strong>” form. 2. Drop your form and payment at any school or at the <strong>District</strong> Office, or mail your form and payment to the <strong>District</strong> Office at 2200 <strong>Havasu</strong>pai Blvd. Building A, <strong>Lake</strong> <strong>Havasu</strong> City, AZ 86403. <strong>Form</strong>s must be postmarked or delivered to the district office by December 31 each year. 3. Many employers offer a payroll deduction program. Talk to your employer about this opportunity. 4. Ask about the payment plans available through the <strong>District</strong> <strong>Tax</strong> <strong>Credit</strong> office (928-‐505-‐6917) or Danica Kitchel, Admin. Asst., L.H.H.S. Athletic Department Office (928-‐854-‐5317). The deadline for accepting tax credit forms and payments is December 31 st each year. If you choose NOT to participate in the <strong>Tax</strong> <strong>Credit</strong> Program your taxes go to the State and will be utilized elsewhere. Learn more at www.havasu.k12.az.us For more information contact: Jackie Taylor, <strong>Tax</strong> <strong>Credit</strong> <strong>Lake</strong> <strong>Havasu</strong> <strong>Unified</strong> <strong>School</strong> <strong>District</strong> # 1 2200 <strong>Havasu</strong>pai Blvd. Building A, <strong>Lake</strong> <strong>Havasu</strong> City, AZ 86403 928-‐505-‐6917 jtaylor@havasu.k12.az.us