Landnet 33 - Land Registry

Landnet 33 - Land Registry

Landnet 33 - Land Registry

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Welcome to <strong><strong>Land</strong>net</strong> <strong>33</strong>.We’re living in an increasinglydigital age, with this magazine – apaper publication until two yearsago – just one item of evidence.Digital technology is becomingincreasingly sophisticated andnew possibilities are opening upall the time.That’s the main reason we’reclosing our telephone orderingservices for business customers.Demand for the once popularservices has not simply fallen; it haspractically disappeared as appetitefor our online services has grown.The launch of our electronicDocument Registration Serviceon the portal means that as wesay goodbye to one service wewelcome another. The new serviceis fast, efficient and cost-effective– just what the digital revolutionhas always promised.Gavin Curry, Editor0300 006 7299gavin.curry@landregistry.gsi.gov.ukContentsNewsClosure of telephone ordering servicesCopy documentsChristmas and New Year opening hours<strong>Land</strong> <strong>Registry</strong> wins prize at the Fighting Fraud AwardsFinal students graduate as qualifications closeWarning about land banking schemesAddress for service – fraud preventionServicesNow available: e-DRS via the portalAdd Value services: helping your businessPracticeProtecting third party interests: restrictionsFeaturesThe fraud challenge: fighting registration fraud togetherPublicationsPractice and public guides, annual reports and business plan<strong><strong>Land</strong>net</strong> can be made availablein other formats on request.If you require <strong><strong>Land</strong>net</strong> in ananother format, please contactCustomer Support by emailcustomersupport@landregistry.gsi.gov.uk or on 0844 892 1111.To receive a bulletin every time<strong><strong>Land</strong>net</strong> is published, pleasesend your name, job title andemail address to gavin.curry@landregistry.gsi.gov.ukFollow <strong>Land</strong> <strong>Registry</strong>Designed by Peter Sim, Design Services;published by <strong>Land</strong> <strong>Registry</strong>, Head Office, TrafalgarHouse, 1 Bedford Park, Croydon CR0 2AQ© Crown copyright 2012 <strong>Land</strong> <strong>Registry</strong>2

Christmas and NewYear opening hours<strong>Land</strong> <strong>Registry</strong> offices will closefor the festive period at 3pmon Christmas Eve (Monday 24December) but our customerinformation centres will close at1pm. Customer Support will beavailable until 2pm and Businesse-services until 3pm.Our online Find a property servicewill remain available as normal from4am to midnight on Christmas Eveand throughout the festive period.Our offices, Customer Supportand Business e-services will beclosed on Christmas Day (Tuesday25 December) and Boxing Day(Wednesday 26 December). Normalservice hours will resume onThursday 27 December except thatour offices and Customer Supportwill close at 5pm on Thursday, Fridayand New Year’s Eve (Monday 31December).Our offices, Customer Support andBusiness e-services will be closed onNew Year’s Day (Tuesday 1 January)and return to normal service hourson Wednesday 2 January.Season’s greetings to all ourcustomers. We wish you a peacefuland prosperous new year.<strong>Land</strong> <strong>Registry</strong> winsprize at the FightingFraud Awards<strong>Land</strong> <strong>Registry</strong>’s anti-fraud strategyhas been recognised at theinaugural Fighting Fraud Awards.Our Registration Counter FraudUnit picked up the top prize in thePrevention category.Presenting the award StephenHarrison, Chief Executive of theNational Fraud Authority and chairof the judges panel, said: “Thejudges were particularly impressedwith the commitment, ingenuityand dedication of <strong>Land</strong> <strong>Registry</strong>’sRegistration Counter Fraud Unit.<strong>Land</strong> <strong>Registry</strong>’s dedicated CounterFraud Unit works closely with thepolice and other agencies to reducethe risk of property fraud. SinceSeptember 2009 our measureshave prevented fraud valued at £52million.See page 14 for the second partof our series The fraud challenge:fighting registration fraud together.— — <strong>Land</strong> <strong>Registry</strong> has beenshortlisted in two categoriesof the Institute of CustomerService’s UK CustomerSatisfaction Awards: TheLeadership Factor Best CustomerSatisfaction Strategy Awardand the ABa Quality MonitoringCustomer Focus Award – Large.“The unit has achieved fraudprevention successes despitethe limitations it faces havingno regulatory, investigation orprosecution powers available tothem. They also demonstrated goodlevels of stakeholder engagementand effective means of marshallinglimited resources.”The awards, supported by theNational Fraud Authority, recognisethe efforts of individuals or bodieswithin the public sector who havedone the most to combat andprevent fraud.4

Now available: e-DRS via the portalOur new electronicDocument RegistrationService (e-DRS) – nowavailable via the portal andBusiness Gateway – offersa fast and cost-effectiveway to submit and receiveapplications to changeproperty registers.With e-DRS, you can send andreceive the majority of yourapplications to change the registerelectronically – rather than throughthe post.There are no additional fees forusing e-DRS. The fees payable forsubmitting applications via e-DRSare based on the current <strong>Land</strong>Registration Fee Order.“We’ve experienced anenvironmental benefit and acost saving because we nolonger need to photocopy ontopaper. We simply scan relevantdocuments and upload themto <strong>Land</strong> <strong>Registry</strong> with theapplication.”Jonathan Sharp – Solicitor, Hartley& Worstenholme SolicitorsWhy join e-DRS?——Speed. Reduce average end-toendprocessing times throughelectronic submission ofapplications.——Cost and environmental impact.Cut back on paper consumptionand reduce costs such as postaland manual processing.——Electronic audit trail. Allapplications will be receivedand responded to electronically,creating an audit trail that willhelp to prevent fraud.“We have an electronic record ofevery document that we sendto <strong>Land</strong> <strong>Registry</strong>. There’s no riskof losing hard copy documentsas they never leave our offices.”David Inch – Partner, SprattEndicott SolicitorsSubmitting an applicationWith e-DRS and the correct portaluser level (e-conveyancer editand submit) you can submit anapplication with as few as eightsimple steps.1 Scan the documents toaccompany your e-DRSapplication.2 Log on to Business e-servicesand select ‘Registration Service’.3 Enter ‘Your reference’ and ‘Titlenumber’ for each title. Eachapplication has to be madeseparately and you can enterup to 20 title numbers perapplication.4 Select the correct applicationform, and attach the correctscanned document.5 Select the appropriatecertification statement for yourattachment.6 Repeat steps 4 and 5 until allattachments have been added.7 Additional information tosupport your application can beadded to the ‘Notes’ box.8 Submit your application.We will send you confirmationif your application has beensuccessfully submitted.Processing your application andreceiving resultsWhen we receive the applicationwe process it in the same way weprocess paper applications. Wesend you the completed documentselectronically and you can retrievethem from your portal ‘PDFDownloads’ area. You can sign up toour e-notification service to receivealerts when documents have arrivedin your ‘downloads’ area.6

Electronic requisitionsIf you submit an application and weraise a requisition it will be sent toyou electronically. Simply select the‘Reply to requisition service’ in theportal and resubmit any amendedattachments.Are you ready for e-DRS?You and your teams will be able touse e-DRS through the portal if yourbusiness has the following in place.——A <strong>Land</strong> <strong>Registry</strong> portal account– the portal is a secure websiteplatform used to access ourBusiness e-services.——A Network Access Agreementso your authorised users canlodge applications to change theregister electronically.——A variable direct debitagreement to allow the amountand frequency of a debit to bevaried to correctly reflect theapplications made.——Authorised users set up withthe correct portal access level –e-conveyancer edit and submit.——The ability to scan documents toallow supporting documents tobe uploaded electronically withapplications.Visitwww.landregistry.gov.uk/e-drs——Watch videos, demonstrationsand view interactive training.——Find information andguidance about signing up toand using e-DRS.——View a full list of applicationsyou can send and receive withe-DRS.“The speed is the primedifference as e-DRS eliminatesthe time applications used tospend in the post. <strong>Land</strong> <strong>Registry</strong>has been able to return someapplications on the same day aswe lodged them, the benefits ofwhich are quite significant.”Gareth Williams – Head of Property,Royds SolicitorsFullapplicationjourney7

Protecting third party interests part 3:restrictionsThis is the third article of a series of three looking at protecting third party interests in registered land.The first article in <strong><strong>Land</strong>net</strong> 30looked at the topic in general andincluded a step-by-step guide toprotecting a third party interest;the second article in <strong><strong>Land</strong>net</strong> 31identified interests in land thatcan be protected by notice andconsidered agreed and unilateralnotices in detail, including how toapply to enter and cancel them.This final article will concentrate onrestrictions, looking both at issuesin relation to the entry of restrictionsand those to do with restrictionsthat have already been entered.The basics: what are restrictionsand how do you spot them?Restrictions are entries thatregulate the circumstances in whichdispositions of a registered estateor charge can be registered. Mostdispositions have to be completedby registration before they operateat law – in other words, they willonly operate in equity until they areregistered. In practice restrictionsprevent these dispositions frombeing completed.Most restrictions are enteredeither to prevent some form ofunlawfulness or invalidity in relationto a disposition or to protect a rightor claim relating to a registeredestate or charge and the form ofcont’d9

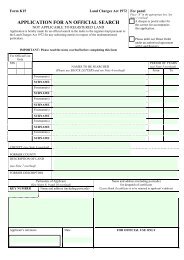

straightforward to understand andeasy for us to administer.If at all possible a standard formrestriction should be applied forin preference to drafting a nonstandardrestriction. Not only canthe applicant then be confident thatthe restriction will not be refusedas being unreasonable or overlycumbersome to administer, but theapplication fee will be less (in somecircumstances, there will not be afee at all) and, as explained later,there is greater flexibility in the waythat the application can be made.Most standard form restrictionscan be tailored to suit particularcircumstances so when draftinga restriction, great care should betaken to make sure that it will catchall intended dispositions but that itwill not apply to dispositions thatneed not be affected. Ill thought outor outdated restrictions regularlycause conveyancing problemsthat can be very time consumingand thus expensive for the partiesinvolved to resolve. Points thatshould be considered when draftinga restriction include:——what types of disposition shouldbe affected? If not specified,all dispositions including thegrant of legal easements, legalmortgages and longer leaseswill be caught. If only transfersare to be affected, should therestriction apply just to transfersby the estate owner? Whatabout transfers of the estate bya legal mortgagee?——where a disposition can only beregistered if certain provisionsare complied with, who shouldbe responsible for policing this?Restrictions that require theconsent of a named individualmay fail if circumstanceschange: what if that individualdies? What if the underlyinginterest is assigned? Might theindividual decide to withholdconsent for other reasons notintended to be covered by therestriction? A more flexibleapproach might be to require acertificate from a conveyancerthat the necessary provisionshave been complied with (orthat they do not apply to thedisposition in question).In exceptional circumstances itmay be that none of the standardform restrictions is suitable and anon-standard restriction has to bedrafted. If that is the case, the termsof the restriction should be basedas far as possible on one of thestandard form restrictions. If entryof the restriction is to form part ofa binding agreement, the terms ofthe restriction should be checkedwith us before the agreement iscompleted. This will avoid the needfor the parties to renegotiate theterms of a restriction after the eventif we do not accept the originalwording.Even though non-standardrestrictions may be drafted tobe very similar to one or morestandard form restrictions, thereare specific drafting considerationsthat will need to be adhered to. Forexample the phrase ‘no [dispositionetc] is to be registered’ must bechanged to ‘no [disposition etc] is tobe completed by registration’.Guidance about the drafting of nonstandardrestrictions and how bestto adapt standard form restrictionsto the circumstances is given inPractice Guide 19.How to apply for a restrictionRestrictions may be applied for inform RX1. If the application is notmade by or with the consent of theproprietor it must be accompaniedby appropriate evidence to establishthe claims made by the applicant.One advantage of applying fora standard form restriction isthat form RX1 does not need tobe lodged if the application ismade within certain prescribeddispositionary forms such as theTR, TP and AS forms or made in the‘prescribed clauses’ of registrableleases.Dealing with titles that alreadyhave restrictions registeredA restriction will usually remain inthe register until an applicationis made for it to be cancelled orwithdrawn. However we may cancela restriction without any applicationbeing made if we are satisfied thatit is no longer required.Instances where we might decideto cancel a restriction ourselvesinclude:——where the restriction clearlyrelated to limitations onthe powers of an outgoingproprietor and will not apply tothe new proprietor——where the restriction was only toapply for a limited time period,which has elapsed, or——where the restriction related toan interest under a trust of landand where we are satisfied thatthe title is no longer subject tothat trust – perhaps because theinterest has been overreached.Someone intending to take adisposition of a title that is subjectto a restriction will need to considerboth whether the restriction is likelyto cause problems for registrationof that disposition and whether itmay cause future problems if therestriction remains in the registerafter registration of the disposition.cont’d11

For example, a restriction thatapplies only to transfers will notprevent the registration of a legalcharge. However, depending onhow the restriction is worded it mayrestrict the later registration of atransfer by the chargee exercisingits power of sale.We regularly encounter problemsarising from restrictions enteredin the register and in many casesthese problems are only discoveredby the parties when we inform themthat the restriction prevents theapplication being completed. It maybe more difficult for a purchaser (orother disponee) to resolve problemsafter completion of the dispositionhas taken place than it wouldhave been had the problems beenanticipated.The problems that arise are varied.Some just relate to compliancewith a restriction, some relate tocancelling the entry when it is nolonger needed and others arisewhere for whatever the reason therestriction is not or is no longeroperating in the way that it should.Complying with a restrictionAll restrictions should have beendrafted in a way that makes themeasy to understand and for us toadminister. It should be clear fromeach restriction whether or not aparticular disposition is caught and,if so, whether it is prevented fromregistration outright or whether it ispossible for registration to proceedif certain provisions are compliedwith.A restriction that permitsregistration if certain provisions arecomplied with will usually requireeither a person’s written consent ora certificate confirming compliancerather than requiring us to makea judgement about whether theunderlying provisions have beenmet. We will then only be concernedwith whether the necessaryconsent or certificate has beenprovided rather than whether ornot the applicant can demonstratecompliance with the underlyingprovisions.To be sure that it will be accepted,the wording of a certificate shouldfollow the wording required by therestriction precisely.Any consent or certificate must beprovided by the appropriate person.Where that person is a company orother corporation aggregate, rule 91Bof the <strong>Land</strong> Registration Rules 2003provides who can sign the consent orcertificate (unless otherwise specifiedin the restriction) and requires thefull name of the signatory and thecapacity in which they sign to bestated.A consent or certificate from anassignee or from the personalrepresentatives of the person namedin the restriction is unlikely to beacceptable.Cancelling a restriction that is nolonger requiredIf a restriction is no longer required,then, unless we decide to cancel itautomatically, an application willneed to be made to remove the entry.This is most straightforward wherethe persons with the benefit of therestriction apply for or consent toits being withdrawn in form RX4. Ifthe restriction requires a consent orcertificate from a named person, itis that person who should apply foror consent to the withdrawal of therestriction.Alternatively, anyone may apply tocancel a restriction in form RX3, but todo so they must produce evidence toshow that the restriction is no longerrequired. The applicant does not needto provide the consent of anyone forwhose benefit the restriction mayappear to have been lodged, but wemay decide in appropriate cases tonotify such persons of the applicationbefore proceeding.Restrictions that are not or are nolonger suitableMany of the problems that weencounter are with restrictions thatare not working in the way thatthey should. This may be becauseof mistakes made at the time theywere sought, or perhaps becausethe circumstances have sincechanged.Occasionally we make mistakesin drafting restrictions despite theapplications being properly made.If this has occurred, please contactus so we can investigate and decidehow best to correct the problems.In other instances errors aremade by the parties applying forrestrictions. The proprietor mayclaim that a restriction has beendrafted too widely (for example thatit prevents charges or leases frombeing registered when that wasnever intended) or that the wrongclause numbers in a documenthave been specified as having tobe complied with. In such casesthe parties may agree to apply fora more suitable restriction andat the same time to withdraw theexisting restriction (RX1 and RX4).If the persons with the benefit ofthe restriction are not available ordo not agree to the arrangementthe proprietors will need insteadto apply to cancel the existingrestriction (RX3).cont’d12

Some straightforward changes incircumstances following registrationof a restriction can be reflectedby simple changes in the register,such as the change of address orname of someone referred to in arestriction. We may also be ableto make some more substantialchanges to a restriction to bringit up to date – for example toreflect a statutory transmission ofpowers following governmentalreorganisation or a transfer ofengagements between buildingsocieties. An application for sucha change should be made in formAP1.Other changing circumstancescan, as with mistakes made, beaccommodated by applying for anupdated restriction at the sametime as applying for the existingrestriction to be withdrawn – RX4 (orcancelled – RX3).Where existing restrictions arereplaced by updated or correctedrestrictions in this way, careshould be taken to consider theeffect that the replacement mayhave on charges that have beenregistered since entry of the existingrestriction. As new restrictions maynot affect dispositions made by theproprietors of those charges, anadditional restriction to restrict thechargees’ powers may need to beconsidered.Although not a common procedure,the registrar does have discretion tomake an order either to disapply orto modify the effect of a restrictioninsofar as it affects a specificdisposition or specified kinds ofdisposition.Such orders can only be madefollowing an application in formRX2 made by someone who candemonstrate a sufficient interest.They are usually only made whereit is not practicable for the partiesto sort out problems by applying forreplacement restrictions.For example the consent of amanagement company of an estateof properties may be requiredunder a restriction before a transferor charge is registered but thecompany has been dissolved.We will be unlikely to agree tothe restriction being cancelledfor so long as the company canbe restored to the register ofcompanies. The company mayhave important managementfunctions that the restriction isintended to protect. However, if anapplicant can demonstrate that theyhave taken all reasonable stepsto comply with the terms of therestriction, the registrar may orderthat the restriction is disapplied sothat specific dispositions (such asa transfer or a transfer and charge)can be registered.For more detailed guidanceabout restrictions, and aboutthe other means of protectingthird party interests in theregister, please refer to PracticeGuide 19.13

will involve an impersonation of oneor more of the parties, as well as theforgery of some document.——Is the seller the registeredproprietor or an imposter?——Has the discharge been providedby the real lender?——Is the buyer or tenant genuine?——Is a conveyancer with whom youare dealing actually an imposter?Checks you carry out as part ofthe general conveyancing processare therefore essential not only toprotect yourself and the parties butto satisfy us that we are not dealingwith potentially void applications.We may ask for further identityevidence to be provided and wemay also notify the proprietors thatwe have received an application,allowing a period for them tochallenge its validity. This can bea very effective way of exposing afraudulent application.Notices served on the proprietorswill, of course, only be effective ifreceived by them. It is imperativethat the address of each proprietoras set out in the register (knownas the ‘address for service’) isboth current and sufficient for thereceipt of notices or other vitalcorrespondence. Payments madeto victims of registration fraudunder the indemnity provisionsof the <strong>Land</strong> Registration Act 2002can be discounted or withheld ifthe registration of the fraud waspartially or wholly attributable tothe claimant’s own lack of propercare. In appropriate cases we doapply a discount to our offersof indemnity where proprietorsto whom we send notice of anapplication miss their opportunityto prevent a fraud because theiraddress in the register is out ofdate.Ensure that the proprietors’contact details in the register aresufficientEven where a particular title mightbe considered at low risk fromregistration fraud, the proprietorsand any registered lender shouldalways ensure their contact detailsare up to date and sufficient. If thatceases to be the case, applicationshould be made to update themwithout delay. We publish guidanceabout how to apply. There is no feepayable for applications to update oradd to a proprietor’s address in theregister.Each proprietor may have up tothree addresses set out in theregister. One of these must be apostal address, whether in the UKor abroad, but the other addressesmay include an email address and/or a UK document exchange (DX)address. The statutory notice periodsallowed for responses are short(effectively three weeks), so evena long holiday or a hospital staycould result in vital deadlines beingmissed. We recommend that fulluse is made of the ability to specifyadditional addresses, includingemail addresses.A proprietor who has specified anemail address should rememberto keep this up to date also if theaddress changes, for example onchanging internet service provider.Where more than one addressis specified we will send officialcorrespondence and notices to eachaddress.Where appropriate register arestriction to ensure care is takenby conveyancers checking theidentity of a proprietorA restriction may be entered inthe register by a proprietor whois concerned about their risk fromimpersonation, such as where theyhave already been the target ofidentity theft. This restriction (listedas Form LL in Schedule 4 to the<strong>Land</strong> Registration Rules 2003 asamended) prevents the registrationof any disposition by the proprietorwithout a certificate being providedby a conveyancer confirming theyare satisfied that the person makingthe disposition is the same personas the proprietor.The purpose of this formof restriction is to require aconveyancer to state explicitly thatthey have satisfied themselves asto the identity of the proprietor. Itis therefore likely to result in morecareful checking by the conveyancer.The conveyancer has to be named,so the restriction ensures the matterof certifying identity is undertakenby a suitably qualified person.The Form LL restriction is notexpected to be sought as a matterof course, but should be consideredwhere there is an enhanced risk ofregistration fraud, perhaps becauseof a known matrimonial disputeinvolving the proprietors or becausethey do not reside at the property.Form LL restrictions may be soughtfree of charge at the same time thata disposition is registered or (usingform RQ) where the proprietor doesnot reside or intend to reside at theproperty. In other cases a fee will bepayable.Consider fraud prevention steps attimes other than when a client hasjust acquired a propertyThe most obvious occasion fora legal adviser to discuss fraudprevention with their client is whenthe property is first acquired.However, often properties becomemore vulnerable to fraud over time.cont’d15

Typically, proprietors who wereregistered some years ago may nothave considered the importanceof keeping their addresses in theregister up to date or specifyingadditional addresses, less still thepossible need to seek a restriction.Over time the property may havebecome more tempting a targetto a fraudster as the equity in theproperty has increased. If you getan opportunity to advise your clientsabout protecting their existingproperty against registration fraudyou should take it. For example:——when clients owning more thanone property move house youshould advise them to updatetheir contact details for all theirproperties. If they retain existingproperties to let and resideelsewhere, their address in theregister should be updated and aForm LL restriction considered——when you advise oncircumstances that increase yourclients’ vulnerability to fraudsuch as matrimonial breakdown,a partner’s business failure,mental incapacity or moving intoresidential care. Family lawyersare used to advising clients tosever a joint tenancy after theirclient has moved out, but theyshould also consider updating oradding to the client’s addresses(perhaps including a ‘care of’address) and applying for a FormLL restriction——where a client dies leaving theirproperty vacant, although itis not possible to update thecontact address for the proprietorunless or until a personalrepresentative is registeredas proprietor, you can at leastnotify us of the death so thatwe may record that fact in theregister and we will also includethe address of the notifyingconveyancer. This will assist inpreventing impersonation of thedeceased proprietor.Prevention where there is moreserious cause for concernOccasionally you may be asked toadvise in circumstances where youor your clients suspect there is a reallikelihood that someone is about tocommit registration fraud or whenthe fraud has already occurred,whether or not an application maybe pending. In such circumstances,time may well be of the essence.As well as any other action youmight consider appropriate, wherepossible you should notify us ofyour concerns immediately as wemay decide to enter a restrictiontemporarily to prevent anydisposition from being registered.This should have the effect ofalerting any prospective purchasersto the possibility of fraud as wellas effectively freezing the registerto allow urgent investigation to becarried out.Protecting you and your firmConveyancers are often in the frontline in preventing registration fraud.<strong>Land</strong> <strong>Registry</strong> and the Law Societyhave recently updated our jointguidance, Property and registrationfraud, to help practitioners preventregistration fraud.Your clients, your insurers and <strong>Land</strong><strong>Registry</strong> rely on the checks you maketo ensure that the parties and otherconveyancers are all genuine. Whereyou act for a seller or borrower, thechecks that you make are likely alsoto be relied upon by the buyer orlender. The true proprietor (if notyour client) will also expect you tohave checked that they are not beingimpersonated. You may have a dutyof care to ensure that your checksare sufficient.In a case where our own checkslead us to reject an applicationbecause of fraud, the buyer orlender may seek to recover theirlosses from you on the basis thatyou have breached a warranty yougave that you were authorised toact for the proprietor. This mayleave you with liability even thoughyou may not have been negligent inyour checks.In a case where the fraud becomesregistered, the victims are likelyto seek indemnity from <strong>Land</strong><strong>Registry</strong> for their losses. The <strong>Land</strong>Registration Act 2002 entitles usto recover the sums we pay out asindemnity by enforcing rights heldby anyone in whose favour theregister is rectified or to whom apayment is made. We will take stepsto do so if we consider a conveyancerhas not taken appropriate steps tocheck identity or has missed tell-talesigns that impersonation was takingplace.So what identity checks do youneed to carry out? As you mightexpect, this will depend onthe circumstances. Given thatimpersonation is on the increase,you should not assume that the typeof checks undertaken in the pastwill still suffice. In determining whatchecks you need to make for a newclient a good starting point may bethe Law Society’s money launderingguidelines. You should also takecare before relying on documentaryevidence of identity that you areoffered.——Where possible you shouldalways examine originaldocuments rather than copies. Ifcertified copies are offered youcont’d16

should check who has made thecertificate and whether it can berelied upon. A certificate bearingan illegible and unidentifiablesignature will be of little value.——Take care before relying onutility bills, as there are several‘novelty’ internet sites willing tocreate fictitious utility bills for afee.——Take time to scrutinise thedocuments for inconsistenciesthat should arouse yoursuspicions: is the informationavailable from the documentsconsistent with what you alreadyknow about the proprietor?For example, is the date ofregistration consistent with theage of the client?However, these may not be enoughfor you to verify who your client isand that they are indeed the trueproprietor. You should thereforeconsider whether to carry outface-to-face identity checks. Thisis because, depending on ourestimation of the risk posed by aspecific application, we may makethis a requirement ourselves, forexample by requiring you to providea form ID1 identity certificateeven where this is not one ofour standard requirements. Bycarrying out your own face-to-facechecks and completing form ID1,particularly for new clients, youwould avoid the difficulty of havingto get back in touch with your clientafter completion.Fraudsters may create a ‘story’ toexplain why they should not have tomeet you face to face. For examplethey may claim to live some distancefrom your office or even overseas.Today’s technology, such as Skypeand Facetime, may allow you tomake a visual check of an individualagainst their identity documentswithout the need to visit youroffices. A client who refuses such asuggestion may give you cause forconcern.Bear in mind it is not onlyindividuals who may be victimsof impersonation. The same maybe true of companies owningproperty. There have also beeninstances where fraudsters haveposed as conveyancing firms withprofessional-looking websites andstationery to give credence to thefrauds being perpetrated. Fraudstershave also impersonated genuinelegal firms, with forged stationeryand fictitious branch offices.In March 2012 the SolicitorsRegulation Authority issued awarning notice, Bogus law firms andidentity theft, providing guidance tosolicitors about this risk. To ensurethat your firm has not been targetedyou should check your web presenceperiodically and should be alertto possible indicators such as thereceipt of correspondence or noticesfrom us or from others where youcannot identify the case owner orreference.If you are acting for a buyer orlender, you should satisfy yourselfas to the legitimacy of the seller’s orborrower’s conveyancer. There havebeen instances where conveyancershave been duped into sendingcompletion monies to a bogus firmor fictitious branch office or intocompleting a remortgage basedon an undertaking from a bogusconveyancer to discharge an existingcharge.What should be done when a fraudis discovered?If the fraud has been registered thenit is vital you contact us and thepolice as soon as possible.Consider making an application foralteration; for example, you maywant to put the register back in thename of the proprietor or removea charge. An application should bemade in form AP1. In some casesalteration will only be possible wheresomeone implicated in the fraud, orwhose lack of care contributed tothe registration, remains registeredas proprietor, so an application toalter the title should be consideredwithout delay.Indemnity can be payable in caseof fraud but, as mentioned above,this can be reduced if the fraud waspartially or wholly attributable to theclaimant’s own lack of proper care.We publish guidance about claimingindemnity under these provisions.The criminal sanctions in the <strong>Land</strong>Registration Act 2002 prohibitmaking an application to change theregister dishonestly or suppressinginformation in the course ofregistration proceedings to concealsomeone’s claim or to substantiatea false claim. If you or your clientsdiscover information that suggeststhat a transaction may be void youmust disclose this before continuingwith an application for it to beregistered. This is the case eventhough your client may have beenan innocent victim of the fraud.Preventing fraud before ithappens is the best way ofdealing with the problem. Inaddition to the informationprovided in this article and inthe guidance and notes I havereferred to, Public Guide 17 – Howto safeguard against propertyfraud contains guidance, aimedprimarily at members of thepublic, on action that can betaken.17

Practice and publicguidesYou can find the latest versionsof all our practice guides,practice bulletins and publicguides on our website.Section 5.1 of Practice Guide1 – First registrations has beenamended to confirm that anapplication for first registrationcannot be made in the name ofa deceased estate owner.Practice Guide 7 – Entry of pricepaid or value stated in theregister has an added sectiongiving guidance where a selleroffers discounts or incentives.A new section has been addedto Practice Guide 19 – Notices,restrictions and the protectionof third party interests in theregister to cover situationswhere a charge is protectedby notice and an application isthen made for its substantiveregistration. Appendix C hasbeen amended to includestandard form QQ where anasset of community valuehas been listed under s.87(1) ofthe Localism Act 2011.Sections 2 and 4 of PracticeGuide <strong>33</strong> – Large scaleapplications (calculation offees) have been amended as aresult of the <strong>Land</strong> RegistrationFee Order 2012 that came intoforce on 22 October 2012Practice Guide 44 – Fax facilities,Practice Guide 51 – Areasserved by <strong>Land</strong> <strong>Registry</strong>offices and Public Guide 1 – Aguide to the information wekeep and how you can obtainit have been amended as aresult of a change to WalesOffice’s telephone and faxnumbers.Practice Guide 54 – Acquisitionof land by general vestingdeclaration, Practice Guide56 – Formal apportionmentand redemption of a rent ora rentcharge that affects aregistered estate, PracticeGuide 60 – Commonhold andPractice Guide 74 – Searches ofthe index of proprietors’ nameshave been amended as aresult of the <strong>Land</strong> RegistrationFee Order 2012.Practice Guide 67 – Evidence ofidentity – conveyancers andPublic Guide 20 – Evidence ofidentity – non-conveyancershave been amended to reflectan increase in the thresholdbelow which forms ID1 and ID2are not required from £5,000to £6,000.A section has been added toPublic Guide 9 – What to dowhen a land owner dies to givedetails of what needs to besent to us when a sole ownerdies.Public Guide 25 – Registrationsand notices about mines andminerals, chancel repairs andmanorial rights is a new guidefor members of the publicconcerned about or affectedby third parties seeking toprotect their interests throughregistration of their mineralor other interests, or chancelrepair liability.Annual Report andBusiness PlanRead our 2011/12 AnnualReport and Accounts and our2012/13 Business Plan.IndependentComplaintsReviewer’s annualreport for 2011/12Our Independent ComplaintsReviewer’s annual report for2011/12 describes how weresponded to the issues upheldby our complaints reviewer.<strong><strong>Land</strong>net</strong> archiveRead past issues of <strong><strong>Land</strong>net</strong>.Business GatewaybulletinOur Business Gatewaybulletin provides backgroundinformation on the businessto-businessservice.18