Entire ETF-Range - ETFs - Deutsche Bank

Entire ETF-Range - ETFs - Deutsche Bank

Entire ETF-Range - ETFs - Deutsche Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

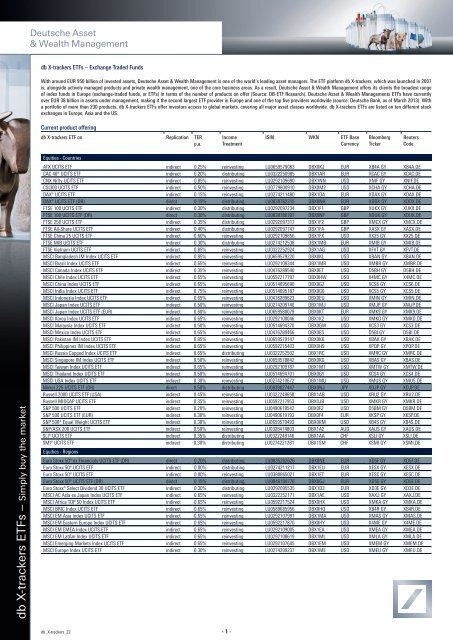

<strong>Deutsche</strong> Asset& Wealth Managementdb X-trackers <strong>ETF</strong>s – Exchange Traded FundsWith around EUR 950 billion of invested assets, <strong>Deutsche</strong> Asset & Wealth Management is one of the world‘s leading asset managers. The <strong>ETF</strong> platform db X-trackers, which was launched in 2007is, alongside actively managed products and private wealth management, one of the core business areas. As a result, <strong>Deutsche</strong> Asset & Wealth Management offers its clients the broadest rangeof index funds in Europe (exchange-traded funds, or <strong>ETF</strong>s) in terms of the number of products on offer (Source: DB-<strong>ETF</strong> Research). <strong>Deutsche</strong> Asset & Wealth Managements <strong>ETF</strong>s have currentlyover EUR 38 billion in assets under management, making it the second largest <strong>ETF</strong> provider in Europe and one of the top five providers worldwide (source: <strong>Deutsche</strong> <strong>Bank</strong>, as of March 2013). Witha portfolio of more than 230 products, db X-trackers <strong>ETF</strong>s offer investors access to global markets, covering all major asset classes worldwide. db X-trackers <strong>ETF</strong>s are listed on ten different stockexchanges in Europe, Asia and the US.Current product offeringdb X-trackers <strong>ETF</strong> on Replication TER Income ISIN WKN <strong>ETF</strong> Base Bloomberg Reutersp.a. Treatment Currency Ticker Codedb X-trackers <strong>ETF</strong>s – Simply buy the marketEquities - CountriesATX UCITS <strong>ETF</strong> indirect 0.25% reinvesting LU0659579063 DBX0KJ EUR XB4A GY XB4A.DECAC 40® UCITS <strong>ETF</strong> indirect 0.20% distributing LU0322250985 DBX1AR EUR XCAC GY XCAC.DECNX Nifty UCITS <strong>ETF</strong> indirect 0.85% reinvesting LU0292109690 DBX1NN USD XNIF GY XNIF.DECSI300 UCITS <strong>ETF</strong> indirect 0.50% reinvesting LU0779800910 DBX0M2 USD XCHA GY XCHA.DEDAX® UCITS <strong>ETF</strong> indirect 0.15% reinvesting LU0274211480 DBX1DA EUR XDAX GY XDAX.DEDAX® UCITS <strong>ETF</strong> (DR) direct 0.15% distributing LU0838782315 DBX0NH EUR XDDX GY XDDX.DEFTSE 100 UCITS <strong>ETF</strong> indirect 0.30% distributing LU0292097234 DBX1F1 GBP XUKX GY XUKX.DEFTSE 100 UCITS <strong>ETF</strong> (DR) direct 0.30% distributing LU0838780707 DBX0NF GBP XDUK GY XDUK.DEFTSE 250 UCITS <strong>ETF</strong> indirect 0.35% distributing LU0292097317 DBX1F2 GBP XMCX GY XMCX.DEFTSE All-Share UCITS <strong>ETF</strong> indirect 0.40% distributing LU0292097747 DBX1FA GBP XASX GY XASX.DEFTSE China 25 UCITS <strong>ETF</strong> indirect 0.60% reinvesting LU0292109856 DBX1FX USD XX25 GY XX25.DEFTSE MIB UCITS <strong>ETF</strong> indirect 0.30% distributing LU0274212538 DBX1MB EUR XMIB GY XMIB.DEFTSE Vietnam UCITS <strong>ETF</strong> indirect 0.85% reinvesting LU0322252924 DBX1AG USD XFVT GY XFVT.DEMSCI Bangladesh IM Index UCITS <strong>ETF</strong> indirect 0.85% reinvesting LU0659579220 DBX0KL USD XBAN GY XBAN.DEMSCI Brazil Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0292109344 DBX1MR USD XMBR GY XMBR.DEMSCI Canada Index UCITS <strong>ETF</strong> indirect 0.35% reinvesting LU0476289540 DBX0ET USD D5BH GY D5BH.DEMSCI Chile Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0592217797 DBX0HW USD X4MC GY X4MC.DEMSCI China Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0514695690 DBX0G2 USD XCS6 GY XCS6.DEMSCI India Index UCITS <strong>ETF</strong> indirect 0.75% reinvesting LU0514695187 DBX0G0 USD XCS5 GY XCS5.DEMSCI Indonesia Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0476289623 DBX0EU USD XMIN GY XMIN.DEMSCI Japan Index UCITS <strong>ETF</strong> indirect 0.50% reinvesting LU0274209740 DBX1MJ USD XMJP GY XMJP.DEMSCI Japan Index UCITS <strong>ETF</strong> (EUR) indirect 0.60% reinvesting LU0659580079 DBX0KT EUR XMK9 GY XMK9.DEMSCI Korea Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0292100046 DBX1K2 USD XMKO GY XMKO.DEMSCI Malaysia Index UCITS <strong>ETF</strong> indirect 0.50% reinvesting LU0514694370 DBX0GW USD XCS3 GY XCS3.DEMSCI Mexico Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0476289466 DBX0ES USD D5BI GY D5BI.DEMSCI Pakistan IM Index UCITS <strong>ETF</strong> indirect 0.85% reinvesting LU0659579147 DBX0KK USD XBAK GY XBAK.DEMSCI Philippines IM Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0592215403 DBX0H9 USD XPQP GY XPQP.DEMSCI Russia Capped Index UCITS <strong>ETF</strong> indirect 0.65% distributing LU0322252502 DBX1RC USD XMRC GY XMRC.DEMSCI Singapore IM Index UCITS <strong>ETF</strong> indirect 0.50% reinvesting LU0659578842 DBX0KG USD XBAS GY XBAS.DEMSCI Taiwan Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0292109187 DBX1MT USD XMTW GY XMTW.DEMSCI Thailand Index UCITS <strong>ETF</strong> indirect 0.50% reinvesting LU0514694701 DBX0GY USD XCS4 GY XCS4.DEMSCI USA Index UCITS <strong>ETF</strong> indirect 0.30% reinvesting LU0274210672 DBX1MU USD XMUS GY XMUS.DENikkei 225 UCITS <strong>ETF</strong> (DR) direct 0.50% distributing LU0839027447 DBX0NJ JPY XDJP GY XDJP.DERussell 2000 UCITS <strong>ETF</strong> (USA) indirect 0.45% reinvesting LU0322248658 DBX1AB USD XRU2 GY XRU2.DERussell MIDCAP UCITS <strong>ETF</strong> indirect 0.35% reinvesting LU0592217953 DBX0JB USD XMKR GY XMKR.DES&P 500 UCITS <strong>ETF</strong> indirect 0.20% reinvesting LU0490618542 DBX0F2 USD D5BM GY D5BM.DES&P 500 UCITS <strong>ETF</strong> (EUR) indirect 0.30% reinvesting LU0490619193 DBX0F4 EUR XKSP GY XKSP.DES&P 500® Equal Weight UCITS <strong>ETF</strong> indirect 0.30% reinvesting LU0659579493 DBX0KM USD XB4S GY XB4S.DES&P/ASX 200 UCITS <strong>ETF</strong> indirect 0.50% reinvesting LU0328474803 DBX1A2 AUD XAUS GY XAUS.DESLI® UCITS <strong>ETF</strong> indirect 0.35% distributing LU0322248146 DBX1AA CHF XSLI GY XSLI.DESMI® UCITS <strong>ETF</strong> indirect 0.30% distributing LU0274221281 DBX1SM CHF XSMI GY XSMI.DEEquities - RegionsEuro Stoxx 50® ex Financials UCITS <strong>ETF</strong> (DR) direct 0.20% distributing LU0835262626 DBX0NE EUR XD5F GY XD5F.DEEuro Stoxx 50® UCITS <strong>ETF</strong> indirect 0.00% distributing LU0274211217 DBX1EU EUR XESX GY XESX.DEEuro Stoxx 50® UCITS <strong>ETF</strong> indirect 0.00% reinvesting LU0380865021 DBX1ET EUR XESC GY XESC.DEEuro Stoxx 50® UCITS <strong>ETF</strong> (DR) direct 0.15% distributing LU0846194776 DBX0GJ EUR XD5E GY XD5E.DEEuro Stoxx® Select Dividend 30 UCITS <strong>ETF</strong> indirect 0.30% distributing LU0292095535 DBX1D3 EUR XD3E GY XD3E.DEMSCI AC Asia ex Japan Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0322252171 DBX1AE USD XAXJ GY XAXJ.DEMSCI Africa TOP 50 Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0592217524 DBX0HX USD XMKA GY XMKA.DEMSCI BRIC Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0589685956 DBX0HQ USD XB4R GY XB4R.DEMSCI EM Asia Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0292107991 DBX1MA USD XMAS GY XMAS.DEMSCI EM Eastern Europe Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0592217870 DBX0HY USD X4ME GY X4ME.DEMSCI EM EMEA Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0292109005 DBX1EA USD XMEA GY XMEA.DEMSCI EM LatAm Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0292108619 DBX1ML USD XMLA GY XMLA.DEMSCI Emerging Markets Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0292107645 DBX1EM USD XMEM GY XMEM.DEMSCI Europe Index UCITS <strong>ETF</strong> indirect 0.30% reinvesting LU0274209237 DBX1ME USD XMEU GY XMEU.DEdb_X-trackers_22- 1 -

<strong>Deutsche</strong> Asset& Wealth Managementdb X-trackers <strong>ETF</strong> on Replication TER Income ISIN WKN <strong>ETF</strong> Base Bloomberg Reutersp.a. Treatment Currency Ticker Codedb X-trackers <strong>ETF</strong>s – Simply buy the marketEquities - RegionsMSCI Europe Mid Cap Index UCITS <strong>ETF</strong> indirect 0.40% reinvesting LU0322253732 DBX1AT USD XEUM GY XEUM.DEMSCI Europe Small Cap Index UCITS <strong>ETF</strong> indirect 0.40% reinvesting LU0322253906 DBX1AU USD XXSC GY XXSC.DEMSCI Europe Value Index UCITS <strong>ETF</strong> indirect 0.40% reinvesting LU0486851024 DBX0FK EUR D5BL GY D5BL.DEMSCI Pacific ex Japan Index UCITS <strong>ETF</strong> indirect 0.45% reinvesting LU0322252338 DBX1AF USD XPXJ GY XPXJ.DEMSCI Pan-Euro Index UCITS <strong>ETF</strong> indirect 0.30% reinvesting LU0412624271 DBX0B7 EUR XMPE GY XMPE.DEMSCI World Index UCITS <strong>ETF</strong> indirect 0.45% reinvesting LU0274208692 DBX1MW USD XMWO GY XMWO.DES&P Select Frontier UCITS <strong>ETF</strong> indirect 0.95% reinvesting LU0328476410 DBX1A9 USD XSFR GY XSFR.DEStoxx® Europe 600 UCITS <strong>ETF</strong> indirect 0.20% reinvesting LU0328475792 DBX1A7 EUR XSX6 GY XSX6.DEStoxx® Global Select Dividend 100 UCITS <strong>ETF</strong> indirect 0.50% distributing LU0292096186 DBX1DG EUR XGSD GY XGSD.DEEquities - SectorsCSI300 <strong>Bank</strong>s UCITS <strong>ETF</strong> indirect 0.50% reinvesting LU0781021877 DBX0M6 USD XCHB GY XCHB.DECSI300 Consumer Discretionary UCITS <strong>ETF</strong> indirect 0.50% reinvesting LU0781021950 DBX0M7 USD XCHD GY XCHD.DECSI300 Energy UCITS <strong>ETF</strong> indirect 0.50% reinvesting LU0781022172 DBX0M9 USD XCHE GY XCHE.DECSI300 Health Care UCITS <strong>ETF</strong> indirect 0.50% reinvesting LU0781022339 DBX0NA USD XCHC GY XCHC.DECSI300 Real Estate UCITS <strong>ETF</strong> indirect 0.50% reinvesting LU0781022099 DBX0M8 USD XCHR GY XCHR.DEFTSE EPRA/NAREIT Developed Europe Real Estate UCITS <strong>ETF</strong> indirect 0.40% reinvesting LU0489337690 DBX0F1 EUR D5BK GY D5BK.DEFTSE EPRA/NAREIT Eurozone Real Estate UCITS <strong>ETF</strong> indirect 0.35% reinvesting LU0489336965 DBX0FY EUR D5BJ GY D5BJ.DEMSCI EM Consumer Discretionary Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0592216476 DBX0HZ USD XMKD GY XMKD.DEMSCI EM Consumer Staples Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0592216559 DBX0H0 USD XMKS GY XMKS.DEMSCI EM Energy Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0592216633 DBX0H1 USD XMKE GY XMKE.DEMSCI EM Financials Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0592216807 DBX0H2 USD XMKF GY XMKF.DEMSCI EM Healthcare Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0592216989 DBX0H3 USD XMKH GY XMKH.DEMSCI EM Industrials Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0592217011 DBX0H4 USD XMKI GY XMKI.DEMSCI EM Information Technology Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0592217102 DBX0H5 USD XMK1 GY XMK1.DEMSCI EM Materials Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0592217284 DBX0H6 USD XMKM GY XMKM.DEMSCI EM Telecommunication Services Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0592217367 DBX0H7 USD XMKT GY XMKT.DEMSCI EM Utilities Index UCITS <strong>ETF</strong> indirect 0.65% reinvesting LU0592217441 DBX0H8 USD XMKU GY XMKU.DEMSCI World Consumer Discretionary Index UCITS <strong>ETF</strong> indirect 0.45% reinvesting LU0540979720 DBX0G5 USD DBPP GY DBPP.DEMSCI World Consumer Staples Index UCITS <strong>ETF</strong> indirect 0.45% reinvesting LU0540980066 DBX0G6 USD DBPQ GY DBPQ.DEMSCI World Energy Index UCITS <strong>ETF</strong> indirect 0.45% reinvesting LU0540980736 DBX0HC USD DBPW GY DBPW.DEMSCI World Financials Index UCITS <strong>ETF</strong> indirect 0.45% reinvesting LU0540980140 DBX0G7 USD DBPR GY DBPR.DEMSCI World Health Care Index UCITS <strong>ETF</strong> indirect 0.45% reinvesting LU0540980223 DBX0G8 USD DBPS GY DBPS.DEMSCI World Industrials Index UCITS <strong>ETF</strong> indirect 0.45% reinvesting LU0540981387 DBX0HE USD DBPX GY DBPX.DEMSCI World Information Technology Index UCITS <strong>ETF</strong> indirect 0.45% reinvesting LU0540980496 DBX0G9 USD DBPT GY DBPT.DEMSCI World Materials Index UCITS <strong>ETF</strong> indirect 0.45% reinvesting LU0540980819 DBX0HD USD DBPY GY DBPY.DEMSCI World Telecom Services Index UCITS <strong>ETF</strong> indirect 0.45% reinvesting LU0540980579 DBX0HA USD DBPU GY DBPU.DEMSCI World Utilities Index UCITS <strong>ETF</strong> indirect 0.45% reinvesting LU0540980652 DBX0HB USD DBPV GY DBPV.DES&P Global Infrastructure UCITS <strong>ETF</strong> indirect 0.60% reinvesting LU0322253229 DBX1AP USD XSGI GY XSGI.DEStoxx® Europe 600 <strong>Bank</strong>s UCITS <strong>ETF</strong> indirect 0.30% reinvesting LU0292103651 DBX1SF EUR XS7R GY XS7R.DEStoxx® Europe 600 Basic Resources UCITS <strong>ETF</strong> indirect 0.30% reinvesting LU0292100806 DBX1SB EUR XSPR GY XSPR.DEStoxx® Europe 600 Food & Beverage UCITS <strong>ETF</strong> indirect 0.30% reinvesting LU0292105359 DBX1FB EUR XS3R GY XS3R.DEStoxx® Europe 600 Health Care UCITS <strong>ETF</strong> indirect 0.30% reinvesting LU0292103222 DBX1SH EUR XSDR GY XSDR.DEStoxx® Europe 600 Industrial Goods UCITS <strong>ETF</strong> indirect 0.30% reinvesting LU0292106084 DBX1F0 EUR XSNR GY XSNR.DEStoxx® Europe 600 Insurance UCITS <strong>ETF</strong> indirect 0.30% reinvesting LU0292105193 DBX1SN EUR XSIR GY XSIR.DEStoxx® Europe 600 Oil & Gas UCITS <strong>ETF</strong> indirect 0.30% reinvesting LU0292101796 DBX1SG EUR XSER GY XSER.DEStoxx® Europe 600 Technology UCITS <strong>ETF</strong> indirect 0.30% reinvesting LU0292104469 DBX1TE EUR XS8R GY XS8R.DEStoxx® Europe 600 Telecommunications UCITS <strong>ETF</strong> indirect 0.30% reinvesting LU0292104030 DBX1ST EUR XSKR GY XSKR.DEStoxx® Europe 600 Utilities UCITS <strong>ETF</strong> indirect 0.30% reinvesting LU0292104899 DBX1SU EUR XS6R GY XS6R.DEEquities - ThemesDJ Islamic Market Titans 100 UCITS <strong>ETF</strong> indirect 0.50% reinvesting LU0328475529 DBX1A6 USD XIMT GY XIMT.DEGlobal Fund Supporters UCITS <strong>ETF</strong> (DR) direct 0.25% distributing IE00B46F7724 A1C6JX USD XGED GY XGED.DES&P 500 Shariah UCITS <strong>ETF</strong> indirect 0.50% reinvesting LU0328475362 DBX1A5 USD XSHU GY XSHU.DES&P Europe 350 Shariah UCITS <strong>ETF</strong> indirect 0.50% reinvesting LU0328475107 DBX1A3 EUR XSHE GY XSHE.DES&P Japan 500 Shariah UCITS <strong>ETF</strong> indirect 0.50% reinvesting LU0328475289 DBX1A4 USD XSHJ GY XSHJ.DES&P U.S. Carbon Efficient UCITS <strong>ETF</strong> indirect 0.50% reinvesting LU0411076002 DBX0B1 USD XGRC GY XGRC.DEStoxx® Europe Christian UCITS <strong>ETF</strong> (DR) direct 0.40% distributing IE00B3QWFQ10 A1C45W EUR XECD GY XECD.DEFixed Income - SovereignsGlobal Sovereign UCITS <strong>ETF</strong> (EUR) indirect 0.25% reinvesting LU0378818131 DBX0A8 EUR DBZB GY XGSH.DEGlobal Sovereign UCITS <strong>ETF</strong> (EUR) indirect 0.25% distributing LU0690964092 DBX0MF EUR XGVD GY XGVD.DEiBoxx Germany 1-3 UCITS <strong>ETF</strong> indirect 0.15% distributing LU0468897110 DBX0C9 EUR XB13 GY XB13.DEiBoxx Germany 3-5 UCITS <strong>ETF</strong> indirect 0.15% distributing LU0613540854 DBX0JE EUR XGN5 GY XGN5.DEiBoxx Germany 7-10 UCITS <strong>ETF</strong> indirect 0.15% distributing LU0730820569 DBX0MJ EUR XG71 GY XG71.DEiBoxx Germany UCITS <strong>ETF</strong> indirect 0.15% distributing LU0468896575 DBX0C7 EUR XBTR GY XBTR.DEiBoxx Germany UCITS <strong>ETF</strong> 4% - D indirect 0.15% distributing LU0643975161 DBX0KA EUR X03G GY X03G.DEiBoxx Sovereigns Eurozone 1-3 UCITS <strong>ETF</strong> indirect 0.15% reinvesting LU0290356871 DBX0AD EUR X13E GY X13E.DEiBoxx Sovereigns Eurozone 1-3 UCITS <strong>ETF</strong> indirect 0.15% distributing LU0614173549 DBX0JH EUR X03B GY X03B.DEiBoxx Sovereigns Eurozone 10-15 UCITS <strong>ETF</strong> indirect 0.15% reinvesting LU0290357333 DBX0AH EUR X105 GY X105.DEiBoxx Sovereigns Eurozone 15+ UCITS <strong>ETF</strong> indirect 0.15% reinvesting LU0290357507 DBX0AJ EUR X15E GY X15E.DE- 2 -

<strong>Deutsche</strong> Asset& Wealth Managementdb X-trackers <strong>ETF</strong> on Replication TER Income ISIN WKN <strong>ETF</strong> Base Bloomberg Reutersp.a. Treatment Currency Ticker CodeFixed Income - SovereignsiBoxx Sovereigns Eurozone 25+ UCITS <strong>ETF</strong> indirect 0.15% reinvesting LU0290357846 DBX0AK EUR X25E GY X25E.DEiBoxx Sovereigns Eurozone 3-5 UCITS <strong>ETF</strong> indirect 0.15% reinvesting LU0290356954 DBX0AE EUR X35E GY X35E.DEiBoxx Sovereigns Eurozone 3-5 UCITS <strong>ETF</strong> indirect 0.15% distributing LU0614173895 DBX0JJ EUR X03C GY X03C.DEiBoxx Sovereigns Eurozone 5-7 UCITS <strong>ETF</strong> indirect 0.15% reinvesting LU0290357176 DBX0AF EUR X57E GY X57E.DEiBoxx Sovereigns Eurozone 7-10 UCITS <strong>ETF</strong> indirect 0.15% reinvesting LU0290357259 DBX0AG EUR X710 GY X710.DEiBoxx Sovereigns Eurozone AAA 1-3 UCITS <strong>ETF</strong> indirect 0.15% reinvesting LU0613540938 DBX0JF EUR XAXA GY XAXA.DEiBoxx Sovereigns Eurozone AAA UCITS <strong>ETF</strong> indirect 0.15% reinvesting LU0484969463 DBX0FE EUR XBAT GY XBAT.DEiBoxx Sovereigns Eurozone UCITS <strong>ETF</strong> indirect 0.15% reinvesting LU0290355717 DBX0AC EUR XGLE GY XGLE.DEiBoxx Sovereigns Eurozone UCITS <strong>ETF</strong> 4% - D indirect 0.15% distributing LU0643975591 DBX0KC EUR X03F GY X03F.DEiBoxx Sovereigns Eurozone Yield Plus UCITS <strong>ETF</strong> indirect 0.15% reinvesting LU0524480265 DBX0HM EUR XY4P GY XY4P.DEMTS Ex-<strong>Bank</strong> of Italy Aggregate UCITS <strong>ETF</strong> indirect 0.20% distributing LU0613540698 DBX0HL EUR XBO3 GY XBO3.DEMTS Ex-<strong>Bank</strong> of Italy BOT UCITS <strong>ETF</strong> indirect 0.15% reinvesting LU0613540268 DBX0HH EUR XBO2 GY XBO2.DEMTS Ex-<strong>Bank</strong> of Italy BTP UCITS <strong>ETF</strong> indirect 0.20% distributing LU0613540185 DBX0HG EUR XBO1 GY XBO1.DEFixed Income - Emerging MarketsEmerging Markets Liquid Eurobond UCITS <strong>ETF</strong> indirect 0.55% reinvesting LU0321462953 DBX0AV EUR XEMB GY XEMB.DEFixed Income - CorporatesiBoxx EUR Liquid Corporate Financials UCITS <strong>ETF</strong> indirect 0.20% reinvesting LU0484968812 DBX0E8 EUR XB4F GY XB4F.DEiBoxx EUR Liquid Corporate Non-Financials UCITS <strong>ETF</strong> indirect 0.20% reinvesting LU0484968655 DBX0E6 EUR XB4N GY XB4N.DEiBoxx EUR Liquid Corporate UCITS <strong>ETF</strong> indirect 0.20% reinvesting LU0478205379 DBX0EY EUR XBLC GY XBLC.DEFixed Income - Covered BondsiBoxx EUR Liquid Covered UCITS <strong>ETF</strong> indirect 0.20% reinvesting LU0820950128 DBX0ND EUR XLIQ GY XLIQ.DEiBoxx Germany Covered 1-3 UCITS <strong>ETF</strong> indirect 0.15% reinvesting LU0548059699 DBX0GK EUR X03A GY X03A.DEiBoxx Germany Covered UCITS <strong>ETF</strong> indirect 0.15% reinvesting LU0321463506 DBX0AX EUR XBCT GY XBCT.DEFixed Income - Inflation-linkediBoxx Euro Inflation-Linked UCITS <strong>ETF</strong> indirect 0.20% reinvesting LU0290358224 DBX0AM EUR XEIN GY XEIN.DEiBoxx Global Inflation-linked UCITS <strong>ETF</strong> (EUR) indirect 0.25% reinvesting LU0290357929 DBX0AL EUR XGIN GY XGIN.DECashEONIA UCITS <strong>ETF</strong> indirect 0.15% reinvesting LU0290358497 DBX0AN EUR XEON GY XEON.DEEONIA UCITS <strong>ETF</strong> indirect 0.15% distributing LU0335044896 DBX0A2 EUR XEOD GY XEOD.DEFed Funds Effective Rate UCITS <strong>ETF</strong> indirect 0.15% reinvesting LU0321465469 DBX0A0 USD XFFE GY XFFE.DESterling Cash UCITS <strong>ETF</strong> indirect 0.15% distributing LU0321464652 DBX0A1 GBP XSTR GY XSTR.DECommodities - Diversifieddb Commodity Booster DJ-UBSCI UCITS <strong>ETF</strong> (EUR) indirect 0.95% reinvesting LU0429790743 DBX0CZ EUR XCBE GY XCBE.DEdb Commodity Booster Light Energy Benchmark UCITS <strong>ETF</strong>(EUR)indirect 0.95% reinvesting LU0411078123 DBX0B4 EUR XCBL GY XCBL.DEDBLCI - OY Balanced UCITS <strong>ETF</strong> indirect 0.55% reinvesting LU0292106167 DBX1LC EUR XDBC GY XDBC.DECurrenciesCurrency Carry UCITS <strong>ETF</strong> indirect 0.30% reinvesting LU0328474126 DBX1AY EUR XCCC GY XCCC.DECurrency Momentum UCITS <strong>ETF</strong> indirect 0.30% reinvesting LU0328474043 DBX1AX EUR XMOM GY XMOM.DECurrency Returns UCITS <strong>ETF</strong> indirect 0.30% reinvesting LU0328474472 DBX1AZ EUR XCCR GY XCCR.DECurrency Valuation UCITS <strong>ETF</strong> indirect 0.30% reinvesting LU0328473748 DBX1AW EUR XVAL GY XVAL.DEAlternativesLPX MM® Private Equity UCITS <strong>ETF</strong> indirect 0.70% reinvesting LU0322250712 DBX1AN EUR XLPE GY XLPE.DEBalancedPortfolio Total Return UCITS <strong>ETF</strong> indirect 0.72% reinvesting LU0397221945 DBX0BT EUR XQUI GY XQUI.DEStiftungs-UCITS UCITS <strong>ETF</strong> Stabilität direct 0.75% distributing IE00B4WRDS59 A1C0ZX EUR XSBT GY XSBT.DEStiftungs-UCITS UCITS <strong>ETF</strong> Wachstum direct 0.75% distributing IE00B3Y8D011 A1C1G8 EUR XS7W GY XS7W.DE- 3 -

<strong>Deutsche</strong> Asset& Wealth Managementdb X-trackers <strong>ETF</strong>s – Simply buy the marketFurther information<strong>Deutsche</strong> <strong>Bank</strong> AG<strong>Deutsche</strong> Asset & Wealth Management Hotline: +49 (69) 910 30549 Reuters: DB<strong>ETF</strong>db X-trackers Team Fax: +49 (69) 910 41276 www.dbxtrackers.comGroße Gallusstraße 10–14 <strong>ETF</strong> Handel: +49 (69) 910 3744960311 Frankfurt am Main E-Mail: etf@db.comImportant information: The information contained in this document does not constitute investment advice but instead merely provides a summarised description of the Sub-Fund’s key features. Complete details on the Sub-Fund can be found in the full prospectus, supplemented by the most recent audited annualreport and the respective semi-annual report, if a more recent one is available than the last annual report. The full prospectus constitutes the only binding basis for the purchase of the Sub-Funds. It is available free of charge in electronic or printed form from your advisor or the location specified in the relevantadditional information for investors. All statements of opinion reflect the current assessment of <strong>Deutsche</strong> <strong>Bank</strong> AG and are subject to change without notice. <strong>Deutsche</strong> <strong>Bank</strong> AG does not guarantee the accuracy, completeness or adequacy of any information contained in this document that may have been obtainedfrom third party sources, even though it only uses sources it deems reliable.As explained in the relevant Prospectus, distribution of the aforementioned Sub-Funds is subject to restrictions in certain jurisdictions. For this reason, the Sub-Funds mentioned herein may neither be offered nor sold in the USA, nor to, or for the account of, US persons or persons residing in the USA. This documentand the information contained herein may only be distributed and published in jurisdictions in which such distribution and publication is permissible in accordance with applicable law in those jurisdictions. Direct or indirect distribution of this document is prohibited in the United States, the United Kingdom, Canadaand Japan as well as to US persons and persons residing in the USA. All prices are provided for informational purposes only and do not serve as an indication of trading prices. The index sponsor is not liable for errors in its index and is not obliged to provide information of such errors. The Management Companyof DB Platinum V, a mutual fund registered in Luxembourg, is DB Platinum Advisors, whose registered office is located at 2, boulevard Konrad Adenauer, L-1115 Luxembourg (RCS no.: B-85.829). The registered office of db x-trackers (RCS No. B119-899) / db x-trackers II (RCS No.: B-124-284), a company registeredin Luxembourg, is 49, avenue J.F. Kennedy, L-1855 Luxembourg. db x-trackers® is a registered trademark of <strong>Deutsche</strong> <strong>Bank</strong> AG. The prospectus, key investor information, articles of association, annual and semi-annual reports are all available in German language in electronic or printed form free of charge from<strong>Deutsche</strong> <strong>Bank</strong> AG, TSS/Global Equity Services, Taunusanlage 12, 60325 Frankfurt am Main (Germany) or the website www.etf.db.com. The prospectus, key investor information, articles of association, annual and semi-annual reports are all available in German language from the Representative free of charge or inelectronic form from the website www.etf.db.com. The prospectus, key investor information documents (KIIDs), articles of association, annual and semi-annual reports are all available in German language in electronic or printed form free of charge from <strong>Deutsche</strong> <strong>Bank</strong> Österreich AG, Stock im Eisen-Platz 3, A-1010Vienna or the website www.etf.db.com. <strong>Deutsche</strong> Asset & Wealth Management represents the asset management and wealth management activities conducted by <strong>Deutsche</strong> <strong>Bank</strong> AG or any of its subsidiaries.© <strong>Deutsche</strong> <strong>Bank</strong> AG 2013 as of 30.04.2013- 4 -