- Page 2 and 3:

Corporate ProfileGlobal Active Limi

- Page 4 and 5:

Future PlansRetail BusinessSingapor

- Page 6 and 7:

PageMoratorium . . . . . . . . . .

- Page 8 and 9:

CORPORATE INFORMATIONBoard of Direc

- Page 10 and 11:

DEFINITIONSIn this Prospectus, the

- Page 12 and 13:

``Nominating Committee'' : The nomi

- Page 14 and 15:

GLOSSARY OF TECHNICAL TERMSTo facil

- Page 16 and 17:

SPECIAL NOTE REGARDING FORWARD-LOOK

- Page 18 and 19:

DETAILS OF OUR INVITATIONLISTING ON

- Page 20 and 21:

INDICATIVE TIMETABLE FOR LISTINGIn

- Page 22 and 23:

To meet the varied needs of our cus

- Page 24 and 25:

. Secure more exclusive distributio

- Page 26 and 27:

We have secured exclusive distribut

- Page 28 and 29:

PLAN OF DISTRIBUTIONThe Issue Price

- Page 30 and 31:

RISK FACTORSPrior to making an inve

- Page 32 and 33:

(v)(vi)(vii)in the event the respec

- Page 34 and 35:

margins have not been adversely aff

- Page 36 and 37:

We have to reduce our stake in our

- Page 38 and 39:

Our Share price may be volatile, wh

- Page 40 and 41:

Price to Net Operating Cash Flow Ra

- Page 42 and 43:

AUDITED CONSOLIDATED FINANCIAL POSI

- Page 44 and 45:

GMP-certi®ed plants. Sale of our p

- Page 46 and 47:

Administrative expenses comprise ma

- Page 48 and 49:

The contribution by third party pro

- Page 50 and 51:

The above increase in gross profit

- Page 52 and 53:

Current LiabilitiesOur current liab

- Page 54 and 55:

Based on the above, our Directors a

- Page 56 and 57:

DIVIDEND POLICYWe have not paid any

- Page 58 and 59:

After listing, our Directors who ha

- Page 60 and 61:

GENERAL INFORMATION ON OUR COMPANY

- Page 62 and 63:

Our authorised share capital and sh

- Page 64 and 65:

The interests and voting rights of

- Page 66 and 67:

Following the Restructuring Exercis

- Page 68 and 69:

USB also agreed with DB that in the

- Page 70 and 71:

Nutri-Active is the distributor of

- Page 72 and 73:

We have been consistently recognise

- Page 74 and 75:

BUSINESSNUTRACEUTICALS Ð THE PRODU

- Page 76 and 77:

Our GNC products cover the entire s

- Page 78 and 79:

All our GNC retail outlets comply w

- Page 80 and 81:

consignment basis. If not for these

- Page 82 and 83:

QUALITY ASSURANCEThe import, distri

- Page 84 and 85:

MAJOR SUPPLIERSNutri-Active and Vic

- Page 86 and 87:

We welcome feedback from our custom

- Page 88 and 89:

BUSINESS ARRANGEMENTS WITH GNC INCT

- Page 90 and 91:

insolvent or a receiver or other cu

- Page 92 and 93:

As at the Latest Practicable Date,

- Page 94 and 95:

Location14 Geylang Serai15 Tanjong

- Page 96 and 97:

Location49 Turf City200 Turf Club R

- Page 98 and 99:

INSURANCEINSURANCEWe are covered by

- Page 100 and 101:

Management Organisation ChartGlobal

- Page 102 and 103:

Mr Tan Seng Leong was appointed as

- Page 104 and 105:

Name List of Present Directorships

- Page 106 and 107:

Ms Leo Mui Leng joined Nutri-Active

- Page 108 and 109:

The breakdown of our staff as at th

- Page 110 and 111:

SERVICE AGREEMENTSOn 23 December 20

- Page 112 and 113:

CORPORATE GOVERNANCEOur Company wil

- Page 114 and 115:

INTERESTED PERSON TRANSACTIONSSave

- Page 117 and 118:

On 22 August 2003, an agreement was

- Page 119 and 120:

Our Audit Committee is of the view

- Page 121 and 122:

(d)(e)(f)(g)(h)(i)Residents with no

- Page 123 and 124:

In addition, Nutri-Active (M) has a

- Page 125 and 126:

TAXATIONThe following is a discussi

- Page 127 and 128:

normal business activities and, in

- Page 129 and 130:

Persons who qualify under the categ

- Page 131 and 132:

Employees and Executive Directors a

- Page 133 and 134:

option on the grant date. While sha

- Page 135 and 136:

(c)the financial year ended 31 Marc

- Page 137 and 138:

GENERAL AND STATUTORY INFORMATIONIN

- Page 139 and 140:

Health One owning assets which main

- Page 141 and 142:

(xv) If and only if such disqualifi

- Page 143 and 144:

SHARE CAPITAL17. As at the date of

- Page 145 and 146:

Article 81The Directors may repay t

- Page 147 and 148:

(B)The Directors may retain the div

- Page 149 and 150:

Article 72(A) An instrument appoint

- Page 151 and 152:

(e)Variation of rightsArticle 6(A)

- Page 153 and 154:

Article 29If the requirements of an

- Page 155 and 156:

Article 10(A) The Company may reduc

- Page 157 and 158:

LITIGATION31. Neither our Company n

- Page 159 and 160:

Primary Sub-Underwriters and one of

- Page 161 and 162:

45. Messrs Allen & Gledhill (Advoca

- Page 163 and 164:

APPENDIX ATERMS AND CONDITIONS AND

- Page 165 and 166:

drawn remittance or improper form o

- Page 167 and 168:

(d)(e)warrant the truth and accurac

- Page 169 and 170:

equired to declare whether the bene

- Page 171 and 172:

Applications for Reserved Shares1.

- Page 173 and 174:

that our Company decides to allot a

- Page 175 and 176:

(b)(c)(d)(e)neither our Company, th

- Page 177 and 178: ÐÐÐDo not key in the CDP A/C No.

- Page 179 and 180: APPENDIX BNUTRACEUTICAL PRODUCTS DI

- Page 181 and 182: APPENDIX CRULES OF THE GLOBAL ACTIV

- Page 183 and 184: 2.2 For the purposes of the Scheme:

- Page 185 and 186: 7.2 The Subscription Price for each

- Page 187 and 188: whereupon the Option then remaining

- Page 189 and 190: (b)unless the Scheme Committee afte

- Page 191 and 192: 18. COSTS AND EXPENSES18.1 Each Par

- Page 193 and 194: (e) Vesting Schedule : You may exer

- Page 195 and 196: Schedule C3GLOBAL ACTIVE SHARE OPTI

- Page 197 and 198: APPENDIX DPROFORMA FINANCIAL STATEM

- Page 199 and 200: PROFORMA STATEMENT OF CHANGES IN SH

- Page 201 and 202: NOTES TO PROFORMA FINANCIAL STATEME

- Page 203 and 204: 3. THE GROUP (cont'd)3.5 As at 27 J

- Page 205 and 206: 5. SIGNIFICANT ACCOUNTING POLICIES

- Page 207 and 208: 5. SIGNIFICANT ACCOUNTING POLICIES

- Page 209 and 210: 10. STAFF COSTS2001 2002 2003$ $ $S

- Page 211 and 212: 14. DUE FROM ASSOCIATED COMPANIES20

- Page 213 and 214: 20. DEFERRED INCOME TAXESMovements

- Page 215 and 216: 24. CASH AND CASH EQUIVALENTSFor th

- Page 217 and 218: 30. FINANCIAL RISK MANAGEMENTThe Gr

- Page 219 and 220: 35. STATEMENT OF ADJUSTMENTS (cont'

- Page 221 and 222: APPENDIX E1NUTRI-ACTIVE PTE LTD(Inc

- Page 223 and 224: AUDITORS' REPORT TO THE SHAREHOLDER

- Page 225 and 226: NUTRI-ACTIVE PTE LTDBALANCE SHEETAs

- Page 227: NUTRI-ACTIVE PTE LTDNOTES TO THE FI

- Page 231 and 232: 8. TAX (cont'd)(e)Composition of de

- Page 233 and 234: 15. IMMEDIATE AND ULTIMATE HOLDING

- Page 235 and 236: 21. COMMITMENTS FOR EXPENDITURE(a)

- Page 237 and 238: APPENDIX E2NUTRI-ACTIVE PTE LTD(Inc

- Page 239 and 240: AUDITORS' REPORT TO THE SHAREHOLDER

- Page 241 and 242: NUTRI-ACTIVE PTE LTDBALANCE SHEETAs

- Page 243 and 244: NUTRI-ACTIVE PTE LTDCash ¯ows from

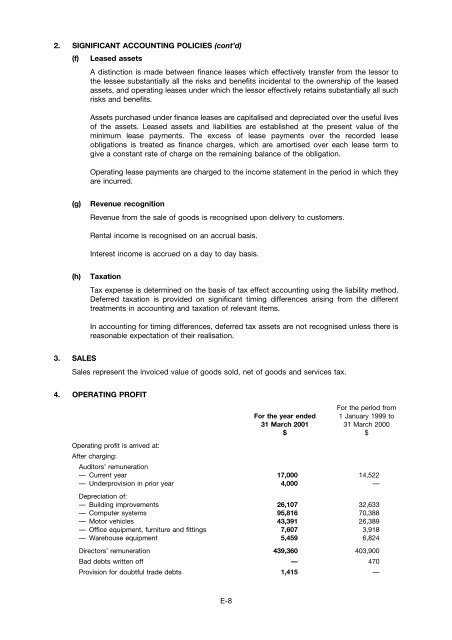

- Page 245 and 246: 2. SIGNIFICANT ACCOUNTING POLICIES

- Page 247 and 248: 4. OPERATING PROFIT2002 2001$ $Oper

- Page 249 and 250: 8. TAX (cont'd)(c)Movements in the

- Page 251 and 252: 13. INVENTORIES2002 2001$ $Merchand

- Page 253 and 254: 18. NON-CURRENT LIABILITIES Ð BORR

- Page 255 and 256: 22. RELATED PARTY TRANSACTIONS (con

- Page 257 and 258: VICTORIA HOUSE PTE LTD(Incorporated

- Page 259 and 260: VICTORIA HOUSE PTE LTDINCOME STATEM

- Page 261 and 262: VICTORIA HOUSE PTE LTDSTATEMENT OF

- Page 263 and 264: 2. SIGNIFICANT ACCOUNTING POLICIES

- Page 265 and 266: 7. STAFF COSTSFor theyear ended31 M

- Page 267 and 268: 12. FRANCHISE COSTSFranchise costs

- Page 269 and 270: 21. RELATED PARTY TRANSACTIONSThe f

- Page 271 and 272: VICTORIA HOUSE PTE LTD(Incorporated

- Page 273 and 274: VICTORIA HOUSE PTE LTDINCOME STATEM

- Page 275 and 276: VICTORIA HOUSE PTE LTDSTATEMENT OF

- Page 277 and 278: VICTORIA HOUSE PTE LTDNOTES TO THE

- Page 279 and 280:

2. SIGNIFICANT ACCOUNTING POLICIES

- Page 281 and 282:

5. FINANCE INCOME2002 2001$ $Intere

- Page 283 and 284:

9. IMMEDIATE AND ULTIMATE HOLDING C

- Page 285 and 286:

15. OTHER CREDITORS AND ACCRUALS200

- Page 287 and 288:

21. COMMITMENTS (cont'd)(b)Other co

- Page 289 and 290:

APPENDIX E5GLOBAL ACTIVE PTE LTD(In

- Page 291 and 292:

AUDITORS' REPORT TO THE SHAREHOLDER

- Page 293 and 294:

GLOBAL ACTIVE PTE LTDBALANCE SHEETA

- Page 295 and 296:

GLOBAL ACTIVE PTE LTDNOTES TO THE F

- Page 297 and 298:

APPENDIX E6GLOBAL ACTIVE LIMITED(In

- Page 299 and 300:

AUDITORS' REPORT TO THE MEMBERS OFG

- Page 301 and 302:

GLOBAL ACTIVE LIMITEDAND ITS SUBSID

- Page 303 and 304:

GLOBAL ACTIVE LIMITEDAND ITS SUBSID

- Page 305 and 306:

GLOBAL ACTIVE LIMITEDAND ITS SUBSID

- Page 307 and 308:

2. SIGNIFICANT ACCOUNTING POLICIES

- Page 309 and 310:

4. OPERATING PROFIT/(LOSS)Operating

- Page 311 and 312:

8. TAX(a)Tax expenseIncome tax expe

- Page 313 and 314:

12. OTHER RECEIVABLES, DEPOSITS AND

- Page 315 and 316:

15. SUBSIDIARIES (cont'd)(ii)Compan

- Page 317 and 318:

18. DEFERRED INCOME TAXESThe GroupT

- Page 319 and 320:

22. NON-CURRENT LIABILITIES Ð BORR

- Page 321 and 322:

27. COMMITMENTSLease commitmentsCom

- Page 323 and 324:

32. EVENTS SUBSEQUENT TO THE BALANC

- Page 325 and 326:

UNAUDITED INCOME STATEMENT OF USB I

- Page 327 and 328:

UNAUDITED BALANCE SHEET OF USB INC

- Page 329 and 330:

Global Active LimitedCorporate Offi