Employee Handbook (HBEU) - HSBC careers site

Employee Handbook (HBEU) - HSBC careers site

Employee Handbook (HBEU) - HSBC careers site

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

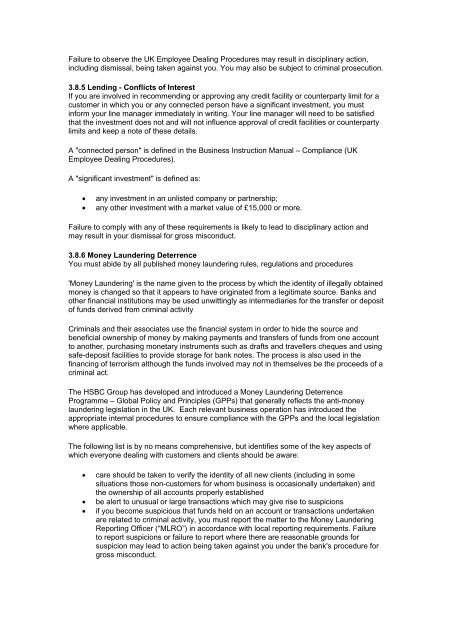

Failure to observe the UK <strong>Employee</strong> Dealing Procedures may result in disciplinary action,including dismissal, being taken against you. You may also be subject to criminal prosecution.3.8.5 Lending - Conflicts of InterestIf you are involved in recommending or approving any credit facility or counterparty limit for acustomer in which you or any connected person have a significant investment, you mustinform your line manager immediately in writing. Your line manager will need to be satisfiedthat the investment does not and will not influence approval of credit facilities or counterpartylimits and keep a note of these details.A "connected person" is defined in the Business Instruction Manual – Compliance (UK<strong>Employee</strong> Dealing Procedures).A "significant investment" is defined as:any investment in an unlisted company or partnership;any other investment with a market value of £15,000 or more.Failure to comply with any of these requirements is likely to lead to disciplinary action andmay result in your dismissal for gross misconduct.3.8.6 Money Laundering DeterrenceYou must abide by all published money laundering rules, regulations and procedures'Money Laundering' is the name given to the process by which the identity of illegally obtainedmoney is changed so that it appears to have originated from a legitimate source. Banks andother financial institutions may be used unwittingly as intermediaries for the transfer or depositof funds derived from criminal activityCriminals and their associates use the financial system in order to hide the source andbeneficial ownership of money by making payments and transfers of funds from one accountto another, purchasing monetary instruments such as drafts and travellers cheques and usingsafe-deposit facilities to provide storage for bank notes. The process is also used in thefinancing of terrorism although the funds involved may not in themselves be the proceeds of acriminal act.The <strong>HSBC</strong> Group has developed and introduced a Money Laundering DeterrenceProgramme – Global Policy and Principles (GPPs) that generally reflects the anti-moneylaundering legislation in the UK. Each relevant business operation has introduced theappropriate internal procedures to ensure compliance with the GPPs and the local legislationwhere applicable.The following list is by no means comprehensive, but identifies some of the key aspects ofwhich everyone dealing with customers and clients should be aware:care should be taken to verify the identity of all new clients (including in somesituations those non-customers for whom business is occasionally undertaken) andthe ownership of all accounts properly establishedbe alert to unusual or large transactions which may give rise to suspicionsif you become suspicious that funds held on an account or transactions undertakenare related to criminal activity, you must report the matter to the Money LaunderingReporting Officer (“MLRO”) in accordance with local reporting requirements. Failureto report suspicions or failure to report where there are reasonable grounds forsuspicion may lead to action being taken against you under the bank's procedure forgross misconduct.