Record Keeping B Agribusiness Farmers and Land Record Keeping ...

Record Keeping B Agribusiness Farmers and Land Record Keeping ...

Record Keeping B Agribusiness Farmers and Land Record Keeping ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

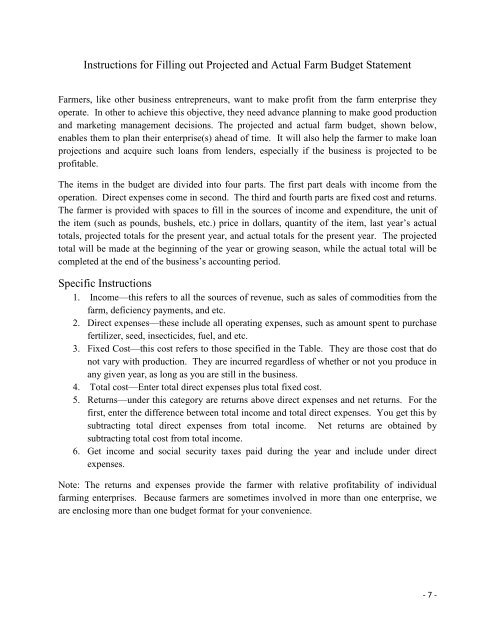

Instructions for Filling out Projected <strong>and</strong> Actual Farm Budget Statement<strong>Farmers</strong>, like other business entrepreneurs, want to make profit from the farm enterprise theyoperate. In other to achieve this objective, they need advance planning to make good production<strong>and</strong> marketing management decisions. The projected <strong>and</strong> actual farm budget, shown below,enables them to plan their enterprise(s) ahead of time. It will also help the farmer to make loanprojections <strong>and</strong> acquire such loans from lenders, especially if the business is projected to beprofitable.The items in the budget are divided into four parts. The first part deals with income from theoperation. Direct expenses come in second. The third <strong>and</strong> fourth parts are fixed cost <strong>and</strong> returns.The farmer is provided with spaces to fill in the sources of income <strong>and</strong> expenditure, the unit ofthe item (such as pounds, bushels, etc.) price in dollars, quantity of the item, last year’s actualtotals, projected totals for the present year, <strong>and</strong> actual totals for the present year. The projectedtotal will be made at the beginning of the year or growing season, while the actual total will becompleted at the end of the business’s accounting period.Specific Instructions1. Income—this refers to all the sources of revenue, such as sales of commodities from thefarm, deficiency payments, <strong>and</strong> etc.2. Direct expenses—these include all operating expenses, such as amount spent to purchasefertilizer, seed, insecticides, fuel, <strong>and</strong> etc.3. Fixed Cost—this cost refers to those specified in the Table. They are those cost that donot vary with production. They are incurred regardless of whether or not you produce inany given year, as long as you are still in the business.4. Total cost—Enter total direct expenses plus total fixed cost.5. Returns—under this category are returns above direct expenses <strong>and</strong> net returns. For thefirst, enter the difference between total income <strong>and</strong> total direct expenses. You get this bysubtracting total direct expenses from total income. Net returns are obtained bysubtracting total cost from total income.6. Get income <strong>and</strong> social security taxes paid during the year <strong>and</strong> include under directexpenses.Note: The returns <strong>and</strong> expenses provide the farmer with relative profitability of individualfarming enterprises. Because farmers are sometimes involved in more than one enterprise, weare enclosing more than one budget format for your convenience.- 7 -