Record Keeping B Agribusiness Farmers and Land Record Keeping ...

Record Keeping B Agribusiness Farmers and Land Record Keeping ...

Record Keeping B Agribusiness Farmers and Land Record Keeping ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

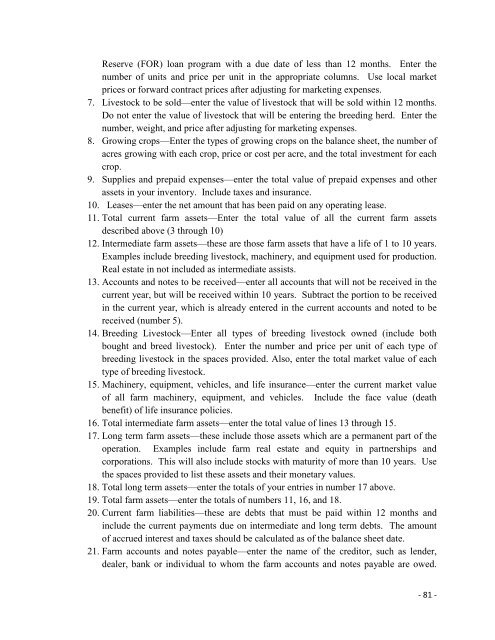

Reserve (FOR) loan program with a due date of less than 12 months. Enter thenumber of units <strong>and</strong> price per unit in the appropriate columns. Use local marketprices or forward contract prices after adjusting for marketing expenses.7. Livestock to be sold—enter the value of livestock that will be sold within 12 months.Do not enter the value of livestock that will be entering the breeding herd. Enter thenumber, weight, <strong>and</strong> price after adjusting for marketing expenses.8. Growing crops—Enter the types of growing crops on the balance sheet, the number ofacres growing with each crop, price or cost per acre, <strong>and</strong> the total investment for eachcrop.9. Supplies <strong>and</strong> prepaid expenses—enter the total value of prepaid expenses <strong>and</strong> otherassets in your inventory. Include taxes <strong>and</strong> insurance.10. Leases—enter the net amount that has been paid on any operating lease.11. Total current farm assets—Enter the total value of all the current farm assetsdescribed above (3 through 10)12. Intermediate farm assets—these are those farm assets that have a life of 1 to 10 years.Examples include breeding livestock, machinery, <strong>and</strong> equipment used for production.Real estate in not included as intermediate assists.13. Accounts <strong>and</strong> notes to be received—enter all accounts that will not be received in thecurrent year, but will be received within 10 years. Subtract the portion to be receivedin the current year, which is already entered in the current accounts <strong>and</strong> noted to bereceived (number 5).14. Breeding Livestock—Enter all types of breeding livestock owned (include bothbought <strong>and</strong> breed livestock). Enter the number <strong>and</strong> price per unit of each type ofbreeding livestock in the spaces provided. Also, enter the total market value of eachtype of breeding livestock.15. Machinery, equipment, vehicles, <strong>and</strong> life insurance—enter the current market valueof all farm machinery, equipment, <strong>and</strong> vehicles. Include the face value (deathbenefit) of life insurance policies.16. Total intermediate farm assets—enter the total value of lines 13 through 15.17. Long term farm assets—these include those assets which are a permanent part of theoperation. Examples include farm real estate <strong>and</strong> equity in partnerships <strong>and</strong>corporations. This will also include stocks with maturity of more than 10 years. Usethe spaces provided to list these assets <strong>and</strong> their monetary values.18. Total long term assets—enter the totals of your entries in number 17 above.19. Total farm assets—enter the totals of numbers 11, 16, <strong>and</strong> 18.20. Current farm liabilities—these are debts that must be paid within 12 months <strong>and</strong>include the current payments due on intermediate <strong>and</strong> long term debts. The amountof accrued interest <strong>and</strong> taxes should be calculated as of the balance sheet date.21. Farm accounts <strong>and</strong> notes payable—enter the name of the creditor, such as lender,dealer, bank or individual to whom the farm accounts <strong>and</strong> notes payable are owed.- 81 -