Business Report 2011 - Prisma Kreditversicherungs AG

Business Report 2011 - Prisma Kreditversicherungs AG

Business Report 2011 - Prisma Kreditversicherungs AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management <strong>Report</strong><br />

What a performance!<br />

The introduction to this annual report takes us into the world of the theatre – a fitting metaphor for<br />

the events we witnessed during <strong>2011</strong>. However, as the foreword points out, we at PRISMA refused to<br />

be diverted by the drama of the debt crisis, the Italian comedy, and the ongoing Greek farce. We con-<br />

tinued to play our parts with the utmost professionalism and, where appropriate, in a distinctive style.<br />

Not all of last year’s events raised a smile. But looking back, we can say with a clear conscience that<br />

the overall impression we made was a convincing one. We encourage you to cast a critical eye over<br />

this review – the figures speak for themselves.<br />

In the first half of the year it was fairly plain sailing, but from the autumn onwards, it was widely felt<br />

that the rules of the game no longer applied. Since then, all economic actors have sensed that there<br />

is something in the air – something we can’t quite put our finger on, but which is causing ever more<br />

uncertainty. The prevailing climate has a strange feel to it, even though on the surface everything<br />

seems to be in perfect order. <strong>Business</strong> as usual, you may ask? We think not, but finding the facts to<br />

back up our view is proving difficult. We are cautiously optimistic about the prospects for 2012 and<br />

hope we are not deluding ourselves. But even if that is the case, we are well placed to handle any challenges<br />

that may come our way. And if we are not in a position to say that, who is?<br />

At the end of <strong>2011</strong>, we wanted to find out how Austrian companies view the current situation and the<br />

risks they face in receivables management. Together with our sister company OeKB Versicherung <strong>AG</strong><br />

and market research institute Gallup, we commissioned a representative survey of non-credit insured<br />

suppliers. The results provided plenty of food for thought. Two thirds of the chief financial officers<br />

surveyed said they expected both the economic climate to deteriorate and growth to slow. Some<br />

15 percent mentioned that some clients were already in arrears, and 35 percent anticipated a rise in<br />

defaults due to customers filing for bankruptcy.<br />

However, we are still finding that prospective clients are very reluctant to take out credit insurance.<br />

In this regard, two thoughts spring to mind. First, no insurer will be willing to increase its exposure<br />

to risks that have become highly toxic or are threatening to do so. But that could soon increasingly be<br />

the case with respect to defaults. Secondly, we are appealing to clients to take a prudent approach by<br />

safeguarding receivables before problems arise.<br />

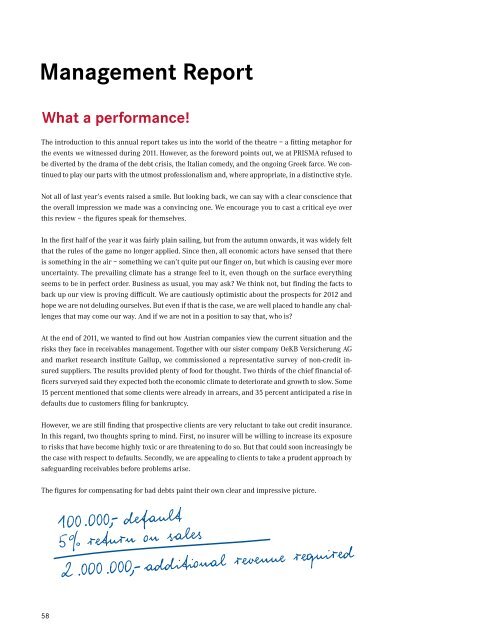

The figures for compensating for bad debts paint their own clear and impressive picture.<br />

58

![AVB [pdf] - Prisma Kreditversicherungs AG](https://img.yumpu.com/23153341/1/184x260/avb-pdf-prisma-kreditversicherungs-ag.jpg?quality=85)

![Terms and Conditions [pdf] - Prisma Kreditversicherungs AG](https://img.yumpu.com/6151271/1/184x260/terms-and-conditions-pdf-prisma-kreditversicherungs-ag.jpg?quality=85)