Annual Report 2011 - 12 - Nagarjuna Fertilizers

Annual Report 2011 - 12 - Nagarjuna Fertilizers

Annual Report 2011 - 12 - Nagarjuna Fertilizers

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

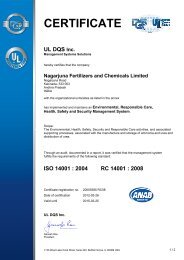

Notes to Financial Statements for the year ended March 31, 20<strong>12</strong>1. CORPORATE OVERVIEWa. <strong>Nagarjuna</strong> <strong>Fertilizers</strong> and Chemicals Limited (Erstwhile NFCL) has during the year undertaken restructuring of its businesses. Accordingly, a Composite Schemeof Arrangement and Amalgamation (“Scheme”) was prepared, which was duly consented by the shareholders at the Court Convened Meeting held on April 15,<strong>2011</strong> and also received the approval of jurisdictional High Courts of Andhra Pradesh at Hyderabad and Bombay at Mumbai. The restructuring envisaged demergerof the Oil business undertaking to a separate company, <strong>Nagarjuna</strong> Oil Refinery Limited (“NORL”). The scheme also provide for merger of residual businessof Erstwhile NFCL into its wholly owned subsidiary viz., Kakinada <strong>Fertilizers</strong> Limited (“KFL”) along with the business operations of iKisan Limited (iKisan). The entirescheme is made effective from July 30, <strong>2011</strong> but operative from April 1, <strong>2011</strong>, being the Appointed Date.The financial statements presented herewith for year ending March 31, 20<strong>12</strong> relates to the combined operations of the Company relating to Fertilizer, MicroIrrigation, Agri Services and Wind Energy generation businesses of merged entities. The figures finalised under previous year March 31, <strong>2011</strong> representspre-merger financials of the erstwhile Kakinada <strong>Fertilizers</strong> Limited (since renamed as NFCL). The Financial statements include operations of branch at Kenya.b. Pursuant to the Scheme:i. Oil Business Undertaking of erstwhile NFCL was demerged into NORL and residual NFCL and iKisan are merged in to KFL.ii. The Effective Date of the Scheme is July 30, <strong>2011</strong> but shall be operative from the Appointed Date i.e. April 1, <strong>2011</strong>. The Record Date for determiningshareholders eligible to receive shares of KFL and NORL was fixed as September 1, <strong>2011</strong>.iii. Equity Shares were allotted to the shareholders of erstwhile NFCL and iKisan on October 1, <strong>2011</strong> and the accounts of the respective shareholders werecredited in electronic mode or share certificates issued, as the case may be. Consequent to the allotment of shares, the existing pre-arrangement issuedcapital of ` 5 Lakhs stood cancelled.iv. The name of KFL stands changed to <strong>Nagarjuna</strong> <strong>Fertilizers</strong> and Chemicals Limited w.e.f. August 19, <strong>2011</strong>.c. The Financial Statements for the year have been drawn-up incorporating necessary adjustments as envisaged in the Scheme and in compliance with purchasemethod of accounting under AS 14 (Accounting for Amalgamations). In accordance with the Scheme:i. the assets and liabilities of residual business of erstwhile NFCL and iKisan have been recorded in the books of KFL at Fair Values as on April 1, <strong>2011</strong>.ii. the Fair Values were determined by the Board of Directors based on the report obtained from a reputed firm of valuers.iii. the difference between the fair value of equity shares and face value of equity shares is considered as Securities Premium.iv. the difference between the value of net assets transferred to KFL over the fair value of Equity shares, and Preference shares allotted is credited to CapitalReserve Account.Capital Reserve:` in LakhsFair Value of Assets taken over by Transferee Company 419,328.74Fair Value of Liabilities taken over by Transferee Company 195,769.00Net Assets Taken over 223,559.74Less: Fair Value of Shares allotted 115,600.00Excess of Assets - over shares allotted 107,959.74Accounted for Reserves:- Debenture Redemption Reserve 16,783.60- Capital Reserve 91,176.14Securities Premium:Fair Value of Shares allotted 115,600.00Less: Face Value of Shares allotted 5,980.65Securities Premium Account 109,619.35v. on and from effective date, the Authorised share capital of NFCL stands increased to ` 801,00,00,000/- comprising of 621,00,00,000 equity shares of` 1/- each and 2,00,00,000 preference shares of ` 90/- each.vi. 59,80,65,003 equity shares of ` 1/- each aggregating to ` 59,80,65,003/- have been allotted to the shareholders of erstwhile NFCL and iKisan on October1, <strong>2011</strong> without payment being received in cash.d. Amalgamation expenses incurred ` 500.16 Lakhs have been adjusted to capital reserve.e. The Bombay Stock Exchange vide letter dated December 14, <strong>2011</strong> approved the application of the company for listing of the equity shares and the NationalStock Exchange vide letter dated January 13, 20<strong>12</strong> accorded in-principle approval for listing of the equity shares subject to relaxation by Securities and ExchangeBoard of India from the fulfilment of requirements under Rule 19(2)(b) of Securities Contracts (Regulation) Rules, 1957.2. SIGNIFICANT ACCOUNTING POLICIES2.1. Basis of preparation:The financial statements of the Company are prepared on accrual basis under historical cost convention in accordance with Generally Accepted AccountingPrinciples (GAAP) applicable in India. The company has prepared these financial statements to comply in all material respects with the Accounting Standardsnotified under Companies (Accounting Standards) Rules, 2006 (as amended) and the provisions of the Companies Act, 1956.The accounting policies adopted in the preparation of financial statements are consistent with those of previous year.The company has prepared these financial statements including previous year as per the format prescribed by Revised Schedule VI to the Companies Act, 1956issued by Ministry of Corporate Affairs, Government of India.2.2. Use of Estimates:The preparation of financial statements requires the management of the company to make estimates and assumptions that affect the reported amount of assetsand liabilities on the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Difference between the<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>-<strong>12</strong> | 43