About Termination Payments

About Termination Payments

About Termination Payments

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

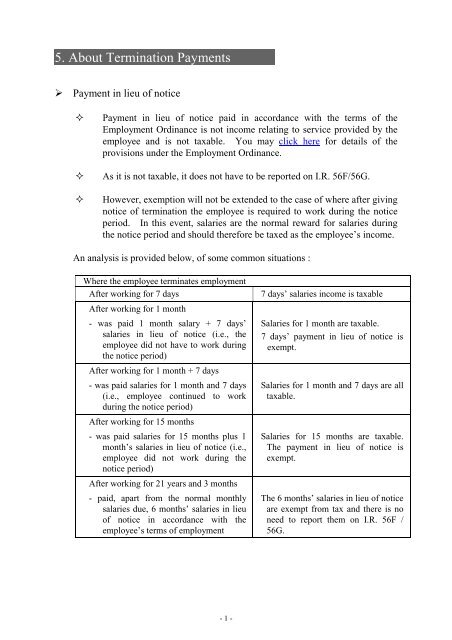

5. <strong>About</strong> <strong>Termination</strong> <strong>Payments</strong>‣ Payment in lieu of noticePayment in lieu of notice paid in accordance with the terms of theEmployment Ordinance is not income relating to service provided by theemployee and is not taxable. You may click here for details of theprovisions under the Employment Ordinance.As it is not taxable, it does not have to be reported on I.R. 56F/56G.However, exemption will not be extended to the case of where after givingnotice of termination the employee is required to work during the noticeperiod. In this event, salaries are the normal reward for salaries duringthe notice period and should therefore be taxed as the employee’s income.An analysis is provided below, of some common situations :Where the employee terminates employmentAfter working for 7 daysAfter working for 1 month- was paid 1 month salary + 7 days’salaries in lieu of notice (i.e., theemployee did not have to work duringthe notice period)After working for 1 month + 7 days- was paid salaries for 1 month and 7 days(i.e., employee continued to workduring the notice period)After working for 15 months- was paid salaries for 15 months plus 1month’s salaries in lieu of notice (i.e.,employee did not work during thenotice period)After working for 21 years and 3 months- paid, apart from the normal monthlysalaries due, 6 months’ salaries in lieuof notice in accordance with theemployee’s terms of employment7 days’ salaries income is taxableSalaries for 1 month are taxable.7 days’ payment in lieu of notice isexempt.Salaries for 1 month and 7 days are alltaxable.Salaries for 15 months are taxable.The payment in lieu of notice isexempt.The 6 months’ salaries in lieu of noticeare exempt from tax and there is noneed to report them on I.R. 56F /56G.- 1 -

‣ Payment in lieu of leavePayment of salaries to the employee whilst he is on holidays constitutes partof his normal income and is taxable. We call this “leave pay”.Where an employment is terminated and there is “earned but untaken leave”at the termination of employment, the employer may wish to make a cashpayment in lieu of leave so as to instantly wipe out the accumulated leavebalance. Cash in lieu of leave is by nature similar to the salaries paid whenthe employee takes leave. Hence it is taxable and must be reported on I.R.56F/56G.Furthermore, an employee is entitled to annual leave upon completion of oneyear’s service. Sometimes for business reasons he may have to defer hisannual leave entitlement. On termination of employment, he may take hisentitlement leave before leaving. If, the employer asks the employee toforego his option to take leave and tops up the payment for his earned butuntaken leave with a cash element as compensation, the topped-up element isin nature similar to leave pay and should be reported by the employer astaxable income.‣ Employees’ Compensation arising from injuryIf an employee suffered personal injury by accident arising out of and in thecourse of employment, the payments received by him/her under theEmployees’ Compensation Ordinance (Cap. 282) are not income even thepayments were calculated by reference to his/her salary/wages.As compensation for injury is not taxable, there is no need to report it on theI.R. 56B/I.R. 56F/I.R. 56G.‣ Severance payment/long service payment You need not report on form IR56F/G• If the amount paid to employees is calculated in accordance with theprovisions in the Employment Ordinance- 2 -

You must report on form IR56F/G• Sums paid in excess of the employee’s entitlement under theEmployment Ordinance.Example– Amount in accordance with Employment Ordinance $50,000– Amount paid to employee $70,000– should report $20,000 as income of employee initem 13(d) of I.R.56Fitem 11(d) of I.R.56GClick here for how toreport the terminationpayments made toemployees on I.R. 56F/ I.R. 56GClick here for the LeafletPAM 45 (e) “ Which sumsreceived at the terminationof employment are taxable”Click here for the method of calculation of severance payment/long service payment underthe Employment Ordinance- 3 -

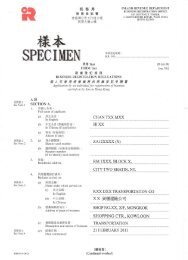

<strong>Termination</strong> of Employment by Giving NoticeorMaking Payment in lieu of Notice(as required under the provisions of the “Employment Ordinance”)A contract of employment may be terminated by giving due notice or paying wages in lieu ofnotice. In the case of a continuous contract of employment, the length of notice or the amountof wages in lieu of notice required are:Length of notice Wages in lieu of noticeDuring Within the 1 st month of probation Not required Not requiredProbationAfter theWith agreement as toAs per agreement, An amount equivalentPeriod1st month ofthe length of noticebut not less than to the amount of wagesprobation7 daysfor the notice periodWithout agreement asNot less than 7 An amount not lessto the length of noticedays noticethan 7 days’ wagesNo / AfterProbationPeriodWith agreement to the length of noticeAs per agreement, An amount equivalentbut not less than to the amount of wages7 days for the notice periodWithout agreement to the length ofnoticeNot less than 1 An amount not lessmonth than 1 months’ wagesNote :The notice period should not include maternity leave or annual leave.- 4 -

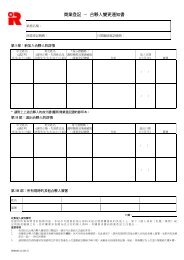

How to Report <strong>Termination</strong> <strong>Payments</strong> to Employeeson form I.R. 56F/I.R. 56G to the IRDIn completing the Form I.R. 56F/I.R. 56G, the employer should analyze the componentsof the payments to the employee, and report as follows:Salary for the last month of service – to be included in “salary/wages”.Payment in lieu of leave – to be included in “leave pay”.Payment in lieu of notice paid in accordance with the EmploymentOrdinance or employment contract – no need to report.Severance payment/long service payment paid in accordance with theEmployment Ordinance – there is no need to report if the amount paid iscalculated in accordance with the Employment Ordinance, but if theemployer has paid a higher amount, the amount in excess should bereported under the item “Terminal Awards”.- 5 -

Method of Calculation of Severance Payment/Long Service Paymentunder the Employment OrdinanceMethod of calculation of severance payment/long service payment under theEmployment Ordinance :For monthly paid employee:(Monthly wages x 2/3)* x reckonable years of serviceFor daily-rated/piece-rated employee:18 days’ wages* x reckonable years of serviceRemarks:(1) *The sum should not exceed $15,000, i.e. 2/3 of $22,500(2) If the employment is terminated on or after 1 October 2003, the maximumamount is $390,000.(3) If you need further information, please visit the Web site of the LabourDepartment at http://www.labour.gov.hk/eng/public/wcp/ConciseGuide.pdf for“A Concise Guide to the Employment Ordinance”.- 6 -