HDFC Fixed Maturity Plans - Series XVIII - HDFC Mutual Fund

HDFC Fixed Maturity Plans - Series XVIII - HDFC Mutual Fund

HDFC Fixed Maturity Plans - Series XVIII - HDFC Mutual Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

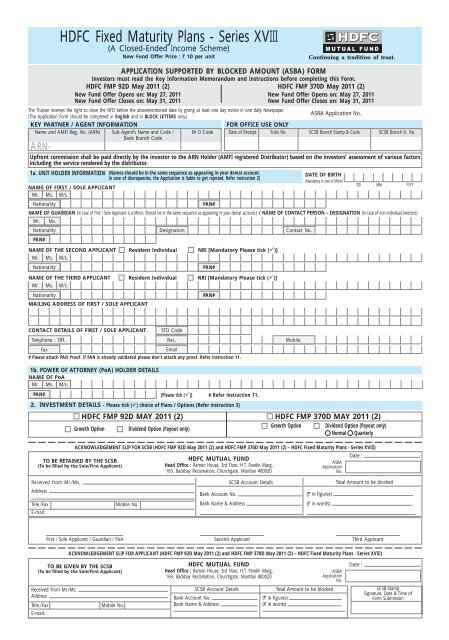

<strong>HDFC</strong> <strong>Fixed</strong> <strong>Maturity</strong> <strong>Plans</strong> - <strong>Series</strong> <strong>XVIII</strong>(A Closed-Ended Income Scheme)New <strong>Fund</strong> Offer Price : R 10 per unitContinuing a tradition of trust.ARN-Upfront commission shall be paid directly by the investor to the ARN Holder (AMFI registered Distributor) based on the investors’ assessment of various factorsincluding the service rendered by the distributor.1a. UNIT HOLDER INFORMATION (Names should be in the same sequence as appearing in your demat account.DATE OF BIRTHIn case of discrepancies, the Application is liable to get rejected. Refer instruction 2)(Mandatory in case of Minor)DD MM YYYYNAME OF FIRST / SOLE APPLICANTMr. Ms. M/s.NationalityPAN#NAME OF GUARDIAN (in case of First / Sole Applicant is a Minor. Should be in the same sequence as appearing in your demat account.) / NAME OF CONTACT PERSON – DESIGNATION (in case of non-individual Investors)Mr.NationalityPAN#Ms.DesignationNAME OF THE SECOND APPLICANT Resident Individual NRI [Mandatory Please tick (̌)]Mr. Ms. M/s.NationalityNAME OF THE THIRD APPLICANT Resident Individual NRI [Mandatory Please tick (̌)]Mr. Ms. M/s.NationalityAPPLICATION SUPPORTED BY BLOCKED AMOUNT (ASBA) FORMInvestors must read the Key Information Memorandum and Instructions before completing this Form.<strong>HDFC</strong> FMP 92D May 2011 (2) <strong>HDFC</strong> FMP 370D May 2011 (2)New <strong>Fund</strong> Offer Opens on: May 27, 2011 New <strong>Fund</strong> Offer Opens on: May 27, 2011New <strong>Fund</strong> Offer Closes on: May 31, 2011 New <strong>Fund</strong> Offer Closes on: May 31, 2011The Trustee reserves the right to close the NFO before the abovementioned date by giving at least one day notice in one daily Newspaper.(The Application Form should be completed in English and in BLOCK LETTERS only.)ASBA Application No.KEY PARTNER / AGENT INFORMATIONFOR OFFICE USE ONLYName and AMFI Reg. No. (ARN) Sub Agent’s Name and Code / M O Code Date of Receipt Folio No. SCSB Branch Stamp & Code SCSB Branch Sr. No.Bank Branch CodeMAILING ADDRESS OF FIRST / SOLE APPLICANTPAN#PAN#Contact No.CONTACT DETAILS OF FIRST / SOLE APPLICANTSTD CodeTelephone : Off. Res. MobileFax# Please attach PAN Proof. If PAN is already validated please don’t attach any proof. Refer instruction 11.1b. POWER OF ATTORNEY (PoA) HOLDER DETAILSNAME OF PoAMr. Ms. M/s.PAN# [Please tick (̌)] # Refer instruction 11.Email2. INVESTMENT DETAILS - Please tick () choice of <strong>Plans</strong> / Options (Refer instruction 3)<strong>HDFC</strong> FMP 92D MAY 2011 (2)Growth OptionDividend Option (Payout only)<strong>HDFC</strong> FMP 370D MAY 2011 (2)Growth OptionDividend Option (Payout only)Normal QuarterlyACKNOWLEDGEMENT SLIP FOR SCSB (<strong>HDFC</strong> FMP 92D May 2011 (2) and <strong>HDFC</strong> FMP 370D May 2011 (2) – <strong>HDFC</strong> <strong>Fixed</strong> <strong>Maturity</strong> <strong>Plans</strong> - <strong>Series</strong> <strong>XVIII</strong>)TO BE RETAINED BY THE SCSB(To be filled by the Sole/First Applicant)<strong>HDFC</strong> MUTUAL FUNDHead Office : Ramon House, 3rd Floor, H.T. Parekh Marg,169, Backbay Reclamation, Churchgate, Mumbai 400020ASBAApplicationNo.Date :Received from Mr./Ms.AddressBank Account No.SCSB Account Details(R in figures)Total Amount to be blockedTele./FaxE-mail:Mobile No.Bank Name & Address(R in words)First / Sole Applicant / Guardian / PoA Second Applicant Third ApplicantACKNOWLEDGEMENT SLIP FOR APPLICANT (<strong>HDFC</strong> FMP 92D May 2011 (2) and <strong>HDFC</strong> FMP 370D May 2011 (2) – <strong>HDFC</strong> <strong>Fixed</strong> <strong>Maturity</strong> <strong>Plans</strong> - <strong>Series</strong> <strong>XVIII</strong>)TO BE GIVEN BY THE SCSB(To be filled by the Sole/First Applicant)Received from Mr./Ms.AddressTele./FaxE-mail:Mobile No.<strong>HDFC</strong> MUTUAL FUNDHead Office : Ramon House, 3rd Floor, H.T. Parekh Marg,169, Backbay Reclamation, Churchgate, Mumbai 400020SCSB Account DetailsBank Account No.Bank Name & AddressASBAApplicationNo.Total Amount to be blocked(R in figures)(R in words)Date :SCSB StampSignature, Date & Time ofForm Submission

3. SCSB / ASBA ACCOUNT DETAILS OF THE APPLICANT (refer instruction 5) (Application Money to be blocked from this Account)Pay-in BankAccount No.Name of the BankBranch5. DEMAT ACCOUNT DETAILS - (Mandatory - refer instruction 8)Please ()NSDLDP ID # #First / Sole Applicant / Guardian I NBank CityAccount Type [Please tick (̌)] SAVINGS CURRENT NRE NRO FCNR OTHERS ______________________ (please specify)Total Amount to be blocked Amount in figures (R)in words (Rupees)IFSC Code***The 9 digit MICR Code number of my/our Bank & Branch is**4. BANK ACCOUNT PAY-OUT DETAILS OF FIRST / SOLE APPLICANT (refer instruction 6a)Fill in these details only if the ASBA Account details provided in Section 3 are different from the Bank Account details linked with the Demat Account as mentioned under Section 5 below.Account No.BranchAccount Type [Please tick (̌)]IFSC Code***Name of the BankBank CitySAVINGS CURRENT NRE NRO FCNR OTHERS _______________________ (please specify)The 9 digit MICR Code number of my/our Bank & Branch is**(Please note that as per SEBI Regulations it is mandatory for investors to provide their bank account details)*** Refer Instruction 6b (Mandatory for Credit via NEFT / RTGS) (11 Character code appearing on your cheque leaf. If you do not find this on your cheque leaf, please check for the same with your bank)** Refer Instruction 7 (Mandatory for Dividend Payout via ECS) (The 9 digit code appears on your cheque next to the cheque number)DP NameCDSLBeneficiary Account No.# # Not Applicable if the Depositary Participant is CDSL. The details of the Bank Account linked with the Demat account mentioned above be provided under Section 4.6. NOMINATION (refer instruction 10) The Nomination details will be as provided in your demat account.7. MODE OF PAYMENT OF REDEMPTION / DIVIDEND PROCEEDS (refer instruction 9) [Please tick (̌)]Unitholders will receive redemption/ dividend proceeds directly into their bank account (as furnished in Section 4) via Direct credit/ NEFT/ECS facilityI/We want to receive the redemption / dividend proceeds (if any) by way of a cheque / demand draft instead of direct credit / credit through NEFT system / credit through ECS into my /our bank account8. DECLARATIONS & SIGNATURE/S (refer instruction 9)General Declaration : I/We have read and understood the contents of the Scheme Information Document (SID) of (<strong>HDFC</strong> FMP 92D May 2011 (2) and <strong>HDFC</strong> FMP 370D May 2011 (2) – <strong>HDFC</strong> <strong>Fixed</strong><strong>Maturity</strong> <strong>Plans</strong> - <strong>Series</strong> <strong>XVIII</strong>) and Statement of Additional Information. I/We hereby apply to the Trustee of <strong>HDFC</strong> <strong>Mutual</strong> <strong>Fund</strong> for allotment of Units of the Plan (as mentioned in the KIM) of (<strong>HDFC</strong><strong>Fixed</strong> <strong>Maturity</strong> <strong>Plans</strong> - <strong>Series</strong> <strong>XVIII</strong>) and agree to abide by the terms, conditions, rules and regulations of the Scheme and I / we have not received nor been induced by any rebate or gifts, directly orindirectly, in making this investment. The ARN holder (AMFI registered Distributor) has disclosed to me/us all the commissions (in the form of trail commission or any other mode),payable to him/them for the different competing Schemes of various <strong>Mutual</strong> <strong>Fund</strong>s from amongst which the Scheme is being recommended to me/us. I/We hereby declare that I/Weam/are authorised to make this investment and that the amount invested in the Scheme is through legitimate sources only and does not involve and is not designed for the purpose of anycontravention or evasion of any Act, Rules, Regulations, Notifications or Directions issued by any regulatory authority in India. I/We declare that the information given in this application form is correct,complete and truly stated.I/WE HEREBY CONFIRM THAT I/WE HAVE NOT BEEN OFFERED/COMMUNICATED ANY INDICATIVE PORTFOLIO AND/OR ANY INDICATIVE YIELD BY <strong>HDFC</strong> MUTUAL FUND/ <strong>HDFC</strong>ASSET MANAGEMENT COMPANY LIMITED / ITS DISTRIBUTOR FOR THIS INVESTMENT.ASBA Authorisation : 1)I/We hereby undertake that I/We am/are an ASBA Investor as per the applicable provisions of the SEBI (Issue of Capital and Disclosure Requirements), Regulations 2009 (‘SEBIRegulations’) as amended from time to time. 2) In accordance with ASBA process provided in the SEBI Regulations and as disclosed in this application, I/We authorize (a) the SCSB to do all necessaryacts including blocking of application money towards the Subscription of Units of the Scheme, to the extent mentioned above in the “SCSB / ASBA Account details” or unblocking of funds in thebank account maintained with the SCSB specified in this application form, transfer of funds to the Bank account of the Scheme/<strong>HDFC</strong> <strong>Mutual</strong> <strong>Fund</strong> on receipt of instructions from the Registrar andTransfer Agent after the allotment of the Units entitling me/us to receive Units on such transfer of funds, etc. (b) Registrar and Transfer Agent to issue instructions to the SCSB to remove the blockon the funds in the bank account specified in the application, upon allotment of Units and to transfer the requisite money to the Scheme’s account / Bank account of <strong>HDFC</strong> <strong>Mutual</strong> <strong>Fund</strong>. 3) In casethe amount available in the bank account specified in the application is insufficient for blocking the amount equivalent to the application money towards the Subscription of Units, the SCSB shall rejectthe application 4) If the DP ID, Beneficiary Account No. or PAN furnished by me/us in the application is incorrect or incomplete or not matching with the depository records, the application shall berejected and the <strong>HDFC</strong> <strong>Mutual</strong> <strong>Fund</strong> or <strong>HDFC</strong> Asset Management Company Limited or <strong>HDFC</strong> Trustee Company Limited or SCSBs shall not be liable for losses, if any.Applicable to NRIs only : I/We confirm that I am/We are Non-Resident of IndianNationality/Origin and I/We hereby confirm that the funds for subscription have beenremitted from abroad through normal banking channels or from funds in my / ourNon-Resident External / Ordinary Account /FCNR Account.I/We am/are not prohibitedfrom accessing capital markets under any order/ruling/judgment etc. of any regulation,including SEBI. I/We confirm that my application is in compliance with applicable Indianand foreign laws.Please () Yes NoIf yes, () Repatriation basisNon-repatriation basisDD MM YYYYSIGNATURE/SFirst / Sole Second ThirdApplicant / Guardian Applicant Applicant

<strong>HDFC</strong> <strong>Fixed</strong> <strong>Maturity</strong> <strong>Plans</strong> - <strong>Series</strong> <strong>XVIII</strong>(A Closed-Ended Income Scheme)New <strong>Fund</strong> Offer Price : R 10 per unitContinuing a tradition of trust.ARN-Upfront commission shall be paid directly by the investor to the ARN Holder (AMFI registered Distributor) based on the investors’ assessment of various factorsincluding the service rendered by the distributor.1a. UNIT HOLDER INFORMATION (Names should be in the same sequence as appearing in your demat account.DATE OF BIRTHIn case of discrepancies, the Application is liable to get rejected. Refer instruction 2)(Mandatory in case of Minor)DD MM YYYYNAME OF FIRST / SOLE APPLICANTMr. Ms. M/s.NationalityPAN#NAME OF GUARDIAN (in case of First / Sole Applicant is a Minor. Should be in the same sequence as appearing in your demat account.) / NAME OF CONTACT PERSON – DESIGNATION (in case of non-individual Investors)Mr.NationalityPAN#Ms.DesignationNAME OF THE SECOND APPLICANT Resident Individual NRI [Mandatory Please tick (̌)]Mr. Ms. M/s.NationalityNAME OF THE THIRD APPLICANT Resident Individual NRI [Mandatory Please tick (̌)]Mr. Ms. M/s.NationalityAPPLICATION SUPPORTED BY BLOCKED AMOUNT (ASBA) FORMInvestors must read the Key Information Memorandum and Instructions before completing this Form.<strong>HDFC</strong> FMP 92D May 2011 (2) <strong>HDFC</strong> FMP 370D May 2011 (2)New <strong>Fund</strong> Offer Opens on: May 27, 2011 New <strong>Fund</strong> Offer Opens on: May 27, 2011New <strong>Fund</strong> Offer Closes on: May 31, 2011 New <strong>Fund</strong> Offer Closes on: May 31, 2011The Trustee reserves the right to close the NFO before the abovementioned date by giving at least one day notice in one daily Newspaper.(The Application Form should be completed in English and in BLOCK LETTERS only.)ASBA Application No.KEY PARTNER / AGENT INFORMATIONFOR OFFICE USE ONLYName and AMFI Reg. No. (ARN) Sub Agent’s Name and Code / M O Code Date of Receipt Folio No. SCSB Branch Stamp & Code SCSB Branch Sr. No.Bank Branch CodeMAILING ADDRESS OF FIRST / SOLE APPLICANTPAN#PAN#Contact No.CONTACT DETAILS OF FIRST / SOLE APPLICANTSTD CodeTelephone : Off. Res. MobileFax# Please attach PAN Proof. If PAN is already validated please don’t attach any proof. Refer instruction 11.1b. POWER OF ATTORNEY (PoA) HOLDER DETAILSNAME OF PoAMr. Ms. M/s.PAN# [Please tick (̌)] # Refer instruction 11.Email2. INVESTMENT DETAILS - Please tick () choice of <strong>Plans</strong> / Options (Refer instruction 3)<strong>HDFC</strong> FMP 92D MAY 2011 (2)Growth OptionDividend Option (Payout only)<strong>HDFC</strong> FMP 370D MAY 2011 (2)Growth OptionDividend Option (Payout only)Normal QuarterlyACKNOWLEDGEMENT SLIP FOR SCSB (<strong>HDFC</strong> FMP 92D May 2011 (2) and <strong>HDFC</strong> FMP 370D May 2011 (2) – <strong>HDFC</strong> <strong>Fixed</strong> <strong>Maturity</strong> <strong>Plans</strong> - <strong>Series</strong> <strong>XVIII</strong>)TO BE RETAINED BY THE SCSB(To be filled by the Sole/First Applicant)<strong>HDFC</strong> MUTUAL FUNDHead Office : Ramon House, 3rd Floor, H.T. Parekh Marg,169, Backbay Reclamation, Churchgate, Mumbai 400020ASBAApplicationNo.Date :Received from Mr./Ms.AddressBank Account No.SCSB Account Details(R in figures)Total Amount to be blockedTele./FaxE-mail:Mobile No.Bank Name & Address(R in words)First / Sole Applicant / Guardian / PoA Second Applicant Third ApplicantACKNOWLEDGEMENT SLIP FOR APPLICANT (<strong>HDFC</strong> FMP 92D May 2011 (2) and <strong>HDFC</strong> FMP 370D May 2011 (2) – <strong>HDFC</strong> <strong>Fixed</strong> <strong>Maturity</strong> <strong>Plans</strong> - <strong>Series</strong> <strong>XVIII</strong>)TO BE GIVEN BY THE SCSB(To be filled by the Sole/First Applicant)Received from Mr./Ms.AddressTele./FaxE-mail:Mobile No.<strong>HDFC</strong> MUTUAL FUNDHead Office : Ramon House, 3rd Floor, H.T. Parekh Marg,169, Backbay Reclamation, Churchgate, Mumbai 400020SCSB Account DetailsBank Account No.Bank Name & AddressASBAApplicationNo.Total Amount to be blocked(R in figures)(R in words)Date :SCSB StampSignature, Date & Time ofForm Submission

Name of the AMC :<strong>HDFC</strong> Asset Management Company LimitedKEY INFORMATION MEMORANDUM<strong>HDFC</strong> <strong>Fixed</strong> <strong>Maturity</strong> <strong>Plans</strong> - <strong>Series</strong> <strong>XVIII</strong>(A Closed-Ended Income Scheme)Offer of Units at R 10 per unit for cash during the New <strong>Fund</strong> Offer (NFO) Period<strong>HDFC</strong> FMP 92D May 2011 (2)New <strong>Fund</strong> Offer Opens on: May 27, 2011New <strong>Fund</strong> Offer Closes on: May 31, 2011<strong>HDFC</strong> FMP 370D May 2011 (2)New <strong>Fund</strong> Offer Opens on: May 27, 2011New <strong>Fund</strong> Offer Closes on: May 31, 2011The Units of the <strong>Plans</strong> will not be available for Subscription / Switch-in after the closure of NFO period. The Units of the Scheme will be listed onthe NSE / any other Stock Exchange. Investors can purchase / sell Units on a continuous basis on the Stock Exchange(s) on which the Units are listed.As the Units are listed on the Stock Exchange, the <strong>Plans</strong> will not provide redemption facility until the date of <strong>Maturity</strong> / Final Redemption date.The Trustee may close the New <strong>Fund</strong> Offer before the above mentioned date by giving at least one day notice in one daily Newspaper.This Key Information Memorandum (KIM) sets forth the information, which a prospective investor ought to know before investing. For further detailsof the Scheme / <strong>Mutual</strong> <strong>Fund</strong>, due diligence certificate by the AMC, Key Personnel, investors’ rights & services, risk factors, penalties & pendinglitigations, etc. investors should, before investment, refer to the Scheme Information Document (SID) and Statement of Additional Information (SAI)available free of cost at any of the Investor Service Centres or distributors or from the website www.hdfcfund.comThe Scheme particulars have been prepared in accordance with Securities and Exchange Board of India (<strong>Mutual</strong> <strong>Fund</strong>s) Regulations, 1996, as amendedtill date, and filed with Securities and Exchange Board of India (SEBI). The units being offered for public subscription have not been approved ordisapproved by SEBI, nor has SEBI certified the accuracy or adequacy of this KIM. The date of this Key Information Memorandum is May 17, 2011.1. Investment ObjectiveThe investment objective of the <strong>Plans</strong> under the Scheme is to generateincome through investments in Debt / Money Market Instruments andGovernment Securities maturing on or before the maturity date of therespective Plan(s).2. Asset Allocation Pattern of the SchemeType of InstrumentsMinimum MaximumAllocation Allocation(% of Net (% of NetAssets) Assets)Debt and Money Market Instruments 60 100Government Securities 0 40The Scheme shall not invest in securitised debt.The Scheme may take derivative position (maximum 20% of the net assetsof the respective <strong>Plans</strong>), for Hedging and Portfolio Balancing, based onopportunities available subject to SEBI Regulations. The Scheme may seekinvestment opportunity in Foreign Debt Securities (maximum 75% of NetAssets of respective <strong>Plans</strong>) in accordance with the guidelines stipulated inthis regard by SEBI and RBI from time to time.The total gross exposure investment in debt + money market instruments+ derivatives (fixed income) shall not exceed 100% of net assets of theScheme. Security wise hedge positions using derivatives such as InterestRate Swaps, etc. will not be considered in calculating above exposure.3. Risk Profile of the Scheme<strong>Mutual</strong> <strong>Fund</strong> Units involve investment risks including the possible loss ofprincipal. Please read the Scheme Information Document carefully fordetails on risk factors before investment. Scheme specific Risk Factorsinclude but are not limited to the following :Risk factors associated with investing in <strong>Fixed</strong> Income Securities Trading volumes, settlement periods and transfer procedures may restrictthe liquidity of the investments made by the Scheme. Different segmentsof the Indian financial markets have different settlement periods andsuch periods may be extended significantly by unforeseen circumstancesleading to delays in receipt of proceeds from sale of securities. The NAVof the Plan under the Scheme can go up or down because of variousfactors that affect the capital markets in general.The NAV of the Plan will be affected by changes in the general levelof interest rates. The NAV of the Plan is expected to increase from afall in interest rates while it would be adversely affected by an increasein the level of interest rates.Money market securities, while fairly liquid, lack a well developedsecondary market, which may restrict the selling ability of the Schemeand may lead to the Scheme incurring losses till the security is finallysold.Investment in Debt Securities are subject to the risk of an issuer'sinability to meet interest and principal payments on its obligations andmarket perception of the creditworthiness of the issuer.Government securities where a fixed return is offered run price-risk likeany other fixed income security. Generally, when interest rates rise,prices of fixed income securities fall and when interest rates drop, theprices increase. The extent of fall or rise in the prices is a function ofthe existing coupon, days to maturity and the increase or decrease inthe level of interest rates. The new level of interest rate is determinedby the rates at which government raises new money and/or the pricelevels at which the market is already dealing in existing securities. Theprice-risk is not unique to Government Securities. It exists for all fixedincome securities. However, Government Securities are unique in thesense that their credit risk generally remains zero. Therefore, their pricesare influenced only by movement in interest rates in the financialsystem.Different types of fixed income securities in which the Scheme wouldinvest as given in the Scheme Information Document carry differentlevels and types of risk. Accordingly, the Scheme risk may increase ordecrease depending upon its investment pattern. e.g. corporate bondscarry a higher level of risk than Government securities. Further evenamong corporate bonds, bonds, which are AAA rated, are comparativelyless risky than bonds, which are AA rated.The AMC may, considering the overall level of risk of the portfolio,invest in lower rated / unrated securities offering higher yields as wellas zero coupon securities that offer attractive yields. This may increasethe absolute level of risk of the portfolio.As zero coupon securities do not provide periodic interest payments tothe holder of the security, these securities are more sensitive to changesin interest rates. Therefore, the interest rate risk of zero coupon securitiesis higher. The AMC may choose to invest in zero coupon securities thatoffer attractive yields. This may increase the risk of the portfolio.While securities that are listed on the stock exchange carry lowerliquidity risk, the ability to sell these investments is limited by the overalltrading volume on the stock exchanges. Securities, which are not quoted on the stock exchanges, are inherentlyilliquid in nature and carry a larger amount of liquidity risk, in comparisonto securities that are listed on the exchanges or offer other exit optionsto the investor, including a put option. The AMC may choose to investin unlisted securities that offer attractive yields. This may increase therisk of the portfolio.Risk factors associated with investing in Foreign Debt Securities Currency RiskMoving from Indian Rupee (INR) to any other currency entails currencyrisk. To the extent that the assets of the Scheme will be invested insecurities denominated in foreign currencies, the Indian Rupee equivalentof the net assets, distributions and income may be adversely affected

y changes in the value of certain foreign currencies relative to theIndian Rupee.Interest Rate RiskThe pace and movement of interest rate cycles of various countries,though loosely co-related, can differ significantly. Hence by investingin securities of countries other than India, the Scheme stand exposedto their interest rate cycles.Credit RiskThis is substantially reduced since the SEBI (MF) Regulations stipulateinvestments only in debt instruments with rating not below investmentgrade by accredited/registered credit rating agency.To manage risks associated with foreign currency and interest rateexposure, the <strong>Mutual</strong> <strong>Fund</strong> may use derivatives for efficient portfoliomanagement including hedging and in accordance with conditions asmay be stipulated by SEBI / RBI from time to time.Risk factors associated with investing in Derivatives The AMC, on behalf of the Plan, may use various derivative products,from time to time, in an attempt to protect the value of the portfolioand enhance Unit holders' interest. Derivative products are specializedinstruments that require investment techniques and risk analysis differentfrom those associated with stocks and bonds. The use of a derivativerequires an understanding not only of the underlying instrument butof the derivative itself. Other risks include, the risk of mispricing orimproper valuation and the inability of derivatives to correlate perfectlywith underlying assets, rates and indices. Derivative products are leveraged instruments and can providedisproportionate gains as well as disproportionate losses to the investor.Execution of such strategies depends upon the ability of the fundmanager to identify such opportunities. Identification and execution ofthe strategies to be pursued by the fund manager involve uncertaintyand decision of fund manager may not always be profitable. No assurancecan be given that the fund manager will be able to identify or executesuch strategies. The risks associated with the use of derivatives are different from orpossibly greater than, the risks associated with investing directly insecurities and other traditional investments.Risk factors associated with Securities LendingAs with other modes of extensions of credit, there are risks inherent tosecurities lending, including the risk of failure of the other party, in this casethe approved intermediary, to comply with the terms of the agreemententered into between the lender of securities i.e. the Scheme and theapproved intermediary. Such failure can result in the possible loss of rightsto the collateral put up by the borrower of the securities, the inability ofthe approved intermediary to return the securities deposited by the lenderand the possible loss of any corporate benefits accruing to the lender fromthe securities deposited with the approved intermediary.Risk Factors associated with Market TradingAlthough Units of the respective Plan(s) are to be listed on the Exchange,there can be no assurance that an active secondary market will developor be maintained.Trading in Units of the respective Plan(s) on the Exchange may be haltedbecause of market conditions or for reasons that in view of ExchangeAuthorities or SEBI, trading in Units of the respective Plan(s) is not advisable.In addition, trading in Units of the Scheme is subject to trading halts causedby extraordinary market volatility and pursuant to Exchange and SEBI'circuit filter' rules. There can be no assurance that the requirements ofExchange necessary to maintain the listing of Units of the respective Plan(s)will continue to be met or will remain unchanged.Any changes in trading regulations by the Stock Exchange(s) or SEBI mayinter-alia result in wider premium/ discount to NAV.The Units of the respective Plan(s) may trade above or below their NAV.The NAV of the respective Plan(s) will fluctuate with changes in the marketvalue of Plan's holdings. The trading prices of Units of the respective Plan(s)will fluctuate in accordance with changes in their NAV as well as marketsupply and demand for the Units of the respective Plan(s).The Units will be issued in demat form through depositories. The recordsof the depository are final with respect to the number of Units availableto the credit of Unit holder. Settlement of trades, repurchase of Units bythe <strong>Mutual</strong> <strong>Fund</strong> on the maturity date / final redemption date will dependupon the confirmations to be received from depository(ies) on which the<strong>Mutual</strong> <strong>Fund</strong> has no control.The market price of the Units of the respective Plan(s), like any other listedsecurity, is largely dependent on two factors, viz., (1) the intrinsic value ofthe Unit (or NAV), and (2) demand and supply of Units in the market.Sizeable demand or supply of the Units in the Exchange may lead to marketprice of the Units to quote at premium or discount to NAV.As the Units allotted under respective Plan(s) of the Scheme will be listedon the Exchange, the <strong>Mutual</strong> <strong>Fund</strong> shall not provide for redemption /repurchase of Units prior to maturity / final redemption date of the respectivePlan(s).4. <strong>Plans</strong> and Options<strong>HDFC</strong> FMP 92D May 2011 (2) and <strong>HDFC</strong> FMP 370D May 2011 (2)<strong>HDFC</strong> FMP 92D May 2011 (2) offers Growth and Dividend Option. DividendOption offers Payout facility only.<strong>HDFC</strong> FMP 370D May 2011 (2) offers Growth and Dividend Option.Dividend Option offers Quarterly Dividend Option and Normal DividendOption with Payout facility only.5. Applicable NAV (after the scheme opens for repurchase)Applicable NAV For Purchases including switch-insThe Units of the Plan will not be available for subscriptions / switchinafter the closure of NFO Period.Applicable NAV For Redemptions including switch-outsUnits of the Plan cannot be redeemed / switched-out by the investorsdirectly with the <strong>Fund</strong> until the date of <strong>Maturity</strong> / Final Redemption.Therefore, the provisions of Cut off timing for redemptions includingswitch-outs will not be applicable to the Plan.Units of the Plan will be automatically redeemed on the <strong>Maturity</strong> /Final Redemption date, except requests for switch-out received by the<strong>Fund</strong>.Switch-out request will be accepted upto 3.00 p.m. on the <strong>Maturity</strong>Date/Final Redemption Date.6. Minimum Application Amount / Number of UnitsPurchase Additional RepurchasePurchaseM 5,000 Not Not Applicableand in Applicable As the Units are listed on themultiplesStock Exchange, the Plan will notof M 10provide redemption facility untilthereafter the date of <strong>Maturity</strong> /Final Redemption date.7. Despatch of Repurchase (Redemption) RequestWithin 10 working days from the date of final maturity / final redemption.8. Benchmark IndexThe Benchmark Index for the above mentioned Plan(s) under the Schemewould be Crisil Short Term Bond <strong>Fund</strong> Index.9. Dividend PolicyIt is proposed to declare dividends subject to availability of distributableprofits, as computed in accordance with SEBI (<strong>Mutual</strong> <strong>Fund</strong>s) Regulations,1996.Dividends, if declared, will be paid (subject to deduction of tax at source,if any) to those unit holders whose names appear in the register of unitholders on the notified record date.There is no assurance or guarantee to unit holders as to the rate of dividenddistribution nor that dividends will be paid regularly. On payment ofdividends, the NAV will stand reduced by the amount of dividend anddividend tax (if applicable) paid.10. Name of the <strong>Fund</strong> ManagerMr. Bharat PareekMr. Miten Lathia (Dedicated <strong>Fund</strong> Manager for Overseas Investments)11. Name of the Trustee Company<strong>HDFC</strong> Trustee Company Limited12. Performance of the Scheme / PlanThis Scheme is a new scheme and does not have any performance trackrecord.

13. Expenses of the Scheme(i) Load StructureNew <strong>Fund</strong> Offer PeriodEntry Load : Not ApplicablePursuant to SEBI circular no. SEBI/IMD/CIR No.4/ 168230/09 dated June 30,2009, no entry load will be charged by the Scheme to the investor. Upfrontcommission shall be paid directly by the investor to the ARN Holder (AMFIregistered Distributor) based on the investors’ assessment of various factorsincluding the service rendered by the ARN Holder.Exit Load : Not ApplicableThe Units under the Plan cannot be directly redeemed with the <strong>Fund</strong> as theUnits are listed on the stock exchange(s).New <strong>Fund</strong> Offer Expenses : New <strong>Fund</strong> Offer Expenses shall be borne by<strong>HDFC</strong> Asset Management Company Limited / <strong>HDFC</strong> Trustee CompanyLimited.Continuous Offer - Load Structure : Not applicable(ii) Recurring Expenses (% of weekly average Net Assets) First M 100 crores : 2.25% Next M 300 crores : 2.00% Next M 300 crores : 1.75% Balance : 1.50%14. Waiver of Load for Direct ApplicationsPursuant to SEBI circular no. SEBI/IMD/CIR No.4/ 168230/09 dated June 30,2009 no entry load shall be charged for all mutual fund schemes. Therefore,the procedure for waiver of load for direct applications is no longer applicable.15. Tax treatment for the Investors (Unit Holders)Investors are advised to refer to the Section on 'Taxation on investing in<strong>Mutual</strong> <strong>Fund</strong>s' in the Statement of Additional Information and alsoindependently refer to their tax advisor.16. Daily Net Asset Value (NAV) PublicationThe NAV will be declared on all Business Days and will be published in 2newspapers. NAV can also be viewed on www.hdfcfund.com andwww.amfiindia.com. Investors may also contact any of the Investor ServiceCentres of <strong>HDFC</strong> <strong>Mutual</strong> <strong>Fund</strong>.17. For Investor Grievances, Please contactInvestors may contact any of the InvestorService Centres (ISCs) of the AMC for anyqueries / clarifications at telephone number60006767 (Do not prefix STD code) or 1800233 6767 (toll free), Fax number. (022)22821144, e-mail: cliser@hdfcfund.com.Investors can also post their grievances/feedback/suggestions on our websitewww.hdfcfund.com under the section'Customer Care' appearing under 'Contact Us'.The Head Office of the AMC will follow upwith the respective ISCs to ensure timelyredressal and prompt investor services. Mr.John Mathews, Head - Client Services canbe contacted at Mistry Bhavan, 2nd Floor,122, Dinsha Vachha Road, Churchgate,Mumbai - 400 020 at telephone number(Direct) (022) 66316301 or telephonenumber (Board) (022) 66316333. His e-mailcontact is: jmathews@hdfcfund.comRegistrar and Transfer Agent :Computer Age ManagementServices Pvt. Ltd,Unit: <strong>HDFC</strong> <strong>Mutual</strong> <strong>Fund</strong>5th Floor, Rayala Tower,158, Anna Salai,Chennai - 600 002.Telephone No: 044-30212816Fax No: 044-42032955Email: enq_h@camsonline.com18. Unit holder’s InformationAllotment / Refund: The AMC shall allot units / refund money within 5business days from the closure of the NFO.Account Statements: (Applicable to investors who opt to hold Units innon-demat form) An Account Statement reflecting the Units allotted will be mailed toeach Unit holder within 5 business days from the date of closure of theNFO Period. The Account Statement reflecting Redemption / Switch-out of Unitsshall be despatched to the Unit holder within 10 days from the dateof <strong>Maturity</strong> / Final Redemption date. However, under normalcircumstances, the <strong>Mutual</strong> <strong>Fund</strong> shall endeavour to despatch the AccountStatement within 3 Business Days from the <strong>Maturity</strong> / Final Redemptiondate. Annual Account Statement: The <strong>Mutual</strong> <strong>Fund</strong>s shall provide the AccountStatement to the Unitholders who have not transacted during the lastsix months prior to the date of generation of account statements.Theaccount statements in such cases may be generated and issued alongwith the Portfolio Statement or Annual Report of the Scheme.Allotment Advice (for demat holders)An allotment advice will be sent upon allotment of Units stating thenumber of Units allotted to each of the Unit holder(s) who have opted forallotment in dematerialized mode within 5 business days from the date ofclosure of the New <strong>Fund</strong> Offer Period.For more details, please refer the Scheme Information Document (SID) andStatement of Additional Information (SAI).Annual Financial Results: The Scheme wise annual report or an abridgedsummary thereof shall be mailed (e-mailed if opted / requested) to all Unitholders not later than four months from the date of closure of the relevantaccounting year (i.e. 31st March each year) and full annual report shall beavailable for inspection at the Head Office of the <strong>Mutual</strong> <strong>Fund</strong> and a copyshall be made available to the Unit holders on request on payment ofnominal fees, if any. These results shall also be displayed on the websiteof the <strong>Mutual</strong> <strong>Fund</strong> on www.hdfcfund.com and Association of <strong>Mutual</strong><strong>Fund</strong>s in India (AMFI) on www.amfiindia.comHalf Yearly Unaudited Financial Results: Half Yearly Unaudited FinancialResults shall be published in one national English daily newspaper circulatingin the whole of India and in a newspaper published in the language of theregion where the Head Office of the <strong>Mutual</strong> <strong>Fund</strong> is situated before expiryone month from the close of each half-year, that is on March 31 andSeptember 30. It is also displayed on the website of the <strong>Mutual</strong> <strong>Fund</strong> onwww.hdfcfund.com and Association of <strong>Mutual</strong> <strong>Fund</strong>s in India (AMFI) onwww.amfiindia.comHalf yearly Portfolio Disclosure: Full portfolio in the Prescribed formatshall be disclosed either by publishing it in one national English dailynewspaper circulating in the whole of India and in a newspaper publishedin the language of the region where the Head Office of the <strong>Mutual</strong> <strong>Fund</strong>is situated or by sending it to the Unit Holders within one month from theend of each half-year, that is as on March 31 and September 30. It is alsodisplayed on the website of the <strong>Mutual</strong> <strong>Fund</strong> on www.hdfcfund.com andAssociation of <strong>Mutual</strong> <strong>Fund</strong>s in India (AMFI) on www.amfiindia.comIMPORTANT<strong>HDFC</strong> <strong>Mutual</strong> <strong>Fund</strong> (the <strong>Fund</strong>) / <strong>HDFC</strong> Asset Management Company Limited (AMC) and its empaneled broker(s) have not given and shallnot give any indicative portfolio/indicative yield in any communication or manner whatsoever. Investors are advised not to rely on anycommunication regarding indicative yield or portfolio with regard to the Plan(s) under the Scheme.

CHECKLIST Please ensure that your ASBA Application Form is complete in all respect and signed by all applicants : Name, Address and Contact Details are mentioned in full. SCSB / ASBA Account and Bank Account Details are entered completely and correctly. Permanent Account Number (PAN) of all Applicants is mentioned irrespective of the amount of purchase and proof attached (if not already validated) Appropriate Plan / Option is selected. Demat account details are entered completely and correctly.Ensure that you receive an acknowledgement from the DB of the concerned SCSB for the submission of your Form.INSTRUCTIONS1. GENERAL INSTRUCTIONSPlease read the terms of the Key InformationMemorandum, the Scheme Information Document (SID)and Statement of Additional Information (SAI) carefullybefore filling the Application Form.Investors are deemed to have accepted the terms subjectto which this offer is being made and bind themselvesto the terms upon signing the Application Form andtendering payment.The Application Form should be completed in ENGLISHand in BLOCK LETTERS only. Please tick in theappropriate box for relevant options wherever applicable.Please do not overwrite. For any correction / changes(if any) made on the application form, applicants arerequested to authenticate the same by canceling andre-writing the correct details and counter-signed by thesole / all applicants.<strong>HDFC</strong> <strong>Mutual</strong> <strong>Fund</strong> extends ASBA facility tothe Investors subscribing for the Units underthis New <strong>Fund</strong> Offer (“NFO”) in addition to itsexisting mode of subscriptions, subject to thesame being extended by all the concernedintermediaries involved in the ASBA process. Foravailing this facility, Investors are requested tocheck with the Designated Branches (“DBs”) ofthe Self Certified Syndicate Banks (“SCSBs”). Thelist of SCSBs is available at the back cover page ofthe KIM and on the websites of SEBI(www.sebi.gov.in), <strong>HDFC</strong> <strong>Mutual</strong> <strong>Fund</strong>(www.hdfcfund.com), NSE (www.nseindia.com)and BSE (www.bseindia.com).Investors shall use the ASBA Application Form bearingthe stamp of the Syndicate Members and/or the DBs ofSCSB, as the case may be, for the purpose of makingan application for Subscription of Units of <strong>HDFC</strong> FMP92D May 2011 (2) and <strong>HDFC</strong> FMP 370D May 2011 (2)– <strong>HDFC</strong> <strong>Fixed</strong> <strong>Maturity</strong> <strong>Plans</strong> - <strong>Series</strong> <strong>XVIII</strong>. Investors arerequired to submit their applications, either in physicalor electronic mode. In case of application in physicalmode, the Investor shall submit the application at theDBs of the SCSB. In case of application in electronicform, the Investor shall submit the application eitherthrough the internet banking facility available with theSCSB, or such other electronically enabled mechanismfor blocking funds in the ASBA account held with SCSB,and accordingly registering such Applications. Onsubmission of the application, the Investors are deemedto have authorised (i) the SCSB to do all acts as arenecessary to make the application including, blockingor unblocking of funds in the bank account maintainedwith the SCSB specified in the application, transfer offunds to the Bank Account of the Scheme/<strong>HDFC</strong> <strong>Mutual</strong><strong>Fund</strong> on receipt of instructions from the Registrar andTransfer Agent after the allotment is made; and (ii) theRegistrar and Transfer Agent to issue instructions to theSCSB to remove the block on the funds in the bankaccount specified in the application (“ASBA Account”),upon rejection of the application / winding up of theScheme, as the case may be.Applications completed in all respects, must besubmitted at the SCSBs with whom the bank accountis maintained.Applications incomplete in any respect are liable to berejected.The AMC / Trustee retains the sole and absolute discretionto reject any application.It may be noted that the Securities and Exchange Boardof India (SEBI) vide its Notification dated May 31, 2010read with Circular dated June 24, 2010 states that witheffect from June 01, 2010, the distributors, agents orany persons employed or engaged or to be employedor engaged in the sale and/or distribution of mutualfund products shall be required to have a validcertification from the National Institute of SecuritiesMarkets (NISM) by passing the certification examination.Further, no agents / distributors would be entitled to sellunits of mutual funds unless the intermediary is registeredwith AMFI.2. UNIT HOLDER INFORMATIONName and address must be written in full. In case theInvestor is an NRI/FII, an overseas address must beprovided. A local address if available may also bementioned in the ASBA Application Form.Name of the Parent or Guardian must be mentioned ifthe investments are being made on behalf of a minorand the same should be as provided in your demataccount.The applicant(s) details mentioned in Section 1a,should be the same as appearing in demat accountheld with a Depository Participant.Applications under a Power of Attorney must beaccompanied by the original Power of Attorney (or acertified true copy of the same duly notarised).Authorised officials should sign the Application Formunder their official designation.Applications not complying with the above areliable to be rejected.All communication and payments shall be made in thename of and favouring the first / sole applicant.In case the application is submitted in joint names, itshould be ensured that the demat account is also heldin the same joint names and are in the same sequencein which they appear in the application form.3. INVESTMENT DETAILSIInvestors should indicate the Plan / Option for whichthe subscription is made by indicating the choice in theappropriate box provided for this purpose in theapplication form. In case of valid applications receivedwithout indicating any choice of Option, it will beconsidered as option for Growth and processedaccordingly. In case of valid application received withoutindicating any choice of Quarterly Dividend Option orNormal Dividend Option, it will be considered as optionfor Normal Dividend Option and processed accordingly.Investors must use separate Application Forms forinvesting simultaneously in both the Options under thePlan.4. ASBA PROCESSThe SCSB shall block amount equivalent to theapplication amount mentioned in the Form, afterverifying that sufficient funds are available in the bankaccount (“ASBA Account”) till the date of allotment ofUnits or upon rejection of the application / winding upof the Scheme, as the case may be.A system generated Transaction Registration Slip (TRS)will be given to the Investor only upon request as proofof the registration of the application of Units. It is theInvestor’s responsibility to obtain the TRS from the DBsof the SCSBs. The registration of the application by theDBs of the SCSB does not guarantee that the Unitsapplied for shall be allotted to the Investor. Such TRSwill be non-negotiable and by itself will not create anyobligation of any kind. It is to be distinctly understoodthat the permission given by the Stock Exchange(s) touse their network and software of the online systemshould not in any way be deemed or construed to meanthat the compliance with various statutory and otherrequirements by <strong>HDFC</strong> <strong>Mutual</strong> <strong>Fund</strong> / <strong>HDFC</strong> AMC or theDBs of the SCSBs are cleared or approved by the StockExchange(s) ; nor does it in any manner warrant, certifyor endorse the correctness or completeness ofcompliance with the statutory and other requirements;nor does it take any responsibility for the financial orother soundness of <strong>HDFC</strong> <strong>Mutual</strong> <strong>Fund</strong> / <strong>HDFC</strong> AMC,our management or any scheme of <strong>HDFC</strong> <strong>Mutual</strong> <strong>Fund</strong>.It is also to be distinctly understood that the approvalgiven by the Stock Exchange(s) should not in any waybe deemed or construed that the application has beencleared or approved by the Stock Exchange(s); nor doesit in any manner warrant, certify or endorse thecorrectness or completeness of any of the contents nordoes it warrant that our Units will be listed or willcontinue to be listed on the Stock Exchange(s). OnlyASBA applications that are uploaded on the system ofthe Stock Exchange(s) shall be considered for allocation/allotment. In case of discrepancy of data between theStock Exchange(s) and the DBs of the SCSBs, the decisionof the Registrar and Transfer Agent, in consultationwith <strong>HDFC</strong> <strong>Mutual</strong> <strong>Fund</strong> / <strong>HDFC</strong> AMC and theDesignated Stock Exchange, based on the physicalrecords of the ASBA Application Forms shall be finaland binding on all concerned.On the designated date, the SCSBs shall transfer theamounts from the ASBA Account, in terms of the SEBI(Issue of Capital and Disclosure Requirements)Regulations, 2009, into the Bank Account of the Scheme/ <strong>HDFC</strong> <strong>Mutual</strong> <strong>Fund</strong>.Upon Allotment of Units by the Designated StockExchange, the Registrar and Transfer Agent shall senda list of successful ASBA investors to the ControllingBranches of the SCSBs alongwith the appropriate requestfor unblocking the relevant bank accounts.In case of winding up of the Scheme, the Registrar andTransfer Agent shall notify the SCSBs to unblock theblocked amount of the Investors.No request for withdrawal of ASBA applicationform will be allowed after the closure of New<strong>Fund</strong> Offer Period.5. SCSB DETAILSInvestors shall correctly mention the bank accountnumber in the application and should ensure that fundsequal to the application amount towards theSubscription of Units are available in the ASBA Accountbefore submitting the application to the respective DBs.In case the amount available in the ASBA Accountspecified in the applications is insufficient, the SCSBshall reject the application. NRIs / FIIsRepatriation Basis In the case of NRIs, application towards Subscriptionof Units may be made out of funds held in his Non– Resident (External) Rupee Account (NRE) / ForeignCurrency (Non-Resident) Account (FCNR) maintainedwith the SCSB. FIIs shall pay their subscription out of funds held inForeign Currency Account or Non-Resident RupeeAccount maintained by the FII with a designatedbranch of an authorised SCSB.Non-repatriation Basis In the case of NRIs, payment may be made out offunds held in his NRE / FCNR / Non-Resident OrdinaryRupee Account (NRO) maintained with the SCSB.Not more than 5 applications from one single SCSBaccount can be made by the applicant.

INSTRUCTIONS (Contd.)6a. BANK DETAILSUnit holders holding units in demat mode will be requiredto follow the procedure for change in bank mandateas per the instructions given by their respectiveDepository Participant.In order to protect the interest of Unit holders fromfraudulent encashment of redemption / dividendcheques, SEBI has made it mandatory for investors toprovide their bank details viz. name of bank, branch,address, account type, number, etc. to the <strong>Mutual</strong> <strong>Fund</strong>.Applications without complete bank details shall berejected. The AMC will not be responsible for any lossarising out of fraudulent encashment of cheques /warrants and / or any delay / loss in transit.6b. INDIAN FINANCIAL SYSTEM CODE (IFSC)IFSC is a 11 digit number given by some of the bankson the cheques. IFSC will help to secure transfer ofredemption and dividend payouts, if any via the variouselectronic mode of transfers that are available with thebanks.7. MODE OF PAYMENT OF REDEMPTION /DIVIDEND PROCEEDS-VIA DIRECT CREDIT / NEFT/ ECSThe Units of the Plan cannot be redeemed bythe investors directly with the <strong>Fund</strong> until the<strong>Maturity</strong> / Final Redemption date. Units of thePlan will be automatically redeemed on the<strong>Maturity</strong> / Final Redemption date.Direct CreditThe AMC has entered into arrangements with elevenbanks to facilitate direct credit of redemption(maturity) and dividend proceeds (if any) into thebank account of the respective Unit holdersmaintained with any of these banks. These banksare: ABN AMRO Bank N.V., Axis Bank Ltd., CitibankN.A., Deutsche Bank AG, <strong>HDFC</strong> Bank Limited, TheHongkong and Shanghai Banking Corporation, ICICIBank Limited, IDBI Bank Limited, Kotak MahindraBank Ltd., Standard Chartered Bank and YES BankLimited. The list of banks is subject to change fromtime to time.National Electronic <strong>Fund</strong>s Transfer (NEFT)The AMC provides the facility of 'National Electronic<strong>Fund</strong>s Transfer (NEFT)' offered by Reserve Bank ofIndia(RBI), which aims to provide credit ofredemption (maturity) and dividend payouts (if any)directly into the bank account of the Unit holdermaintained with the banks (participating in theNEFT System). Unit holders can check the list ofbanks participating in the NEFT System from the RBIwebsite i.e. www.rbi.org.in or contact any of ourInvestor Service Centres.However, in the event of the name of Unit holder'sbank not appearing in the 'List of Banks participatingin NEFT' updated on RBI website www.rbi.org.in,from time to time, the instructions of the Unitholder for remittance of redemption(maturity) /dividend (if any) proceeds via NEFT System will bediscontinued by <strong>HDFC</strong> <strong>Mutual</strong> <strong>Fund</strong> / <strong>HDFC</strong> AssetManagement Company Limited without prior noticeto the Unit holder and the payouts of redemption(maturity) / dividend (if any) proceeds shall beeffected by sending the Unit holder(s) a cheque /demand draft.For more details on NEFT or for frequently askedquestions (FAQs) on NEFT, Unit holders are advisedto visit the RBI website www.rbi.org.in / <strong>HDFC</strong><strong>Mutual</strong> <strong>Fund</strong> website www.hdfcfund.comElectronic Clearing Service (ECS)Investors who have opted for the ECS facility of RBIfor dividend payment will receive a direct credit ofthe amount due to them in their mandated accountwhenever the payment is made through ECS. Aseparate advice regarding credit of amount(s) viaECS will be sent to the unit holder. It should benoted that while the <strong>Mutual</strong> <strong>Fund</strong> will make allefforts, there is no commitment that this facility willbe made available to all desirous investors.Applicants in cities not covered under ECS facilitywill receive dividend payments , if any by chequesor demand drafts and the same will be mailed tothe Unit holders. Please note that the ECS Facilityis available only in respect of dividend paymentsand not in the case of Redemption (maturity) ofUnits.Therefore, the Investors will receive their redemption /dividend proceeds (if any) directly into their bankaccounts in the following order:(i) In case the bank account of an investor is coveredunder Direct Credit facility then the payment ofredemption / dividend proceeds (if any) will happenvia direct credit payout mode only. Investors havingthese bank accounts will not receive payouts viaNEFT/ECS*ii) In case the bank account of an investor is notcovered under Direct Credit facility but coveredunder NEFT system offered by the RBI then thepayment of redemption (maturity) / dividendproceeds (if any) shall be effected via NEFTmechanism only.(iii) The facility for payment of dividend proceeds, if anyvia ECS* shall be affected only in case the bankaccount of an investor is not covered under theDirect Credit facility or NEFT system.* available only in respect of dividend payments.Each of the above facilities aims to provide direct creditof the redemption (maturity) proceeds and dividendpayouts (if any) into the bank account (as furnished inSection 4 of the ASBA Application Form) of the Unitholder and eliminates the time lag between despatchof the cheque, its receipt by the Unit holders and theneed to personally bank the instrument and awaitsubsequent credit to the Unit holders account. Further,the potential risk of loss of instruments in transit throughcourier / post is also eliminated. Each of the said facilityas a mode of payment, is faster, safer and reliable.In case the bank account as communicated by the Unitholder is with any of the said banks with whom theAMC has entered into arrangements to facilitate suchdirect credits or with any of the banks participating inthe NEFT System offered by RBI, the AMC shallautomatically extend this facility to the Unit holders.<strong>HDFC</strong> Asset Management Company Limited / <strong>HDFC</strong><strong>Mutual</strong> <strong>Fund</strong> shall not be held liable for any losses /claims, etc. arising on account of processing the directcredit or credit via NEFT / ECS of redemption (maturity) /dividend proceeds on the basis of Bank Account detailsas provided by the unit holder in the Application Form.However, if the Unit holders are not keen on availingof any of the said facilities and prefer receiving cheques/ demand drafts, Unit holders may indicate their intentionin the Application Form in the space provided specifically.The AMC would then ensure that the payouts areeffected by sending the Unit holders a cheque / demanddraft. In case of unforeseen circumstances, the AMCreserves the right to issue a cheque / demand draft.Mode of Payment for Unit holders holdingUnits in Demat formInvestors will receive their maturity / dividendproceeds directly into their bank accounts linked tothe demat accounts. Please ensure to furnish theBank Account details under section 4.Payment of <strong>Maturity</strong> / Final Redemption ProceedsAs per SEBI (MF) Regulations, the <strong>Mutual</strong> <strong>Fund</strong> shalldispatch Redemption (<strong>Maturity</strong>) proceeds within10 Business Days of the <strong>Maturity</strong> / Final Redemptiondate. A penal interest of 15% or such other rate asmay be prescribed by SEBI from time to time, willbe paid in case the Redemption (<strong>Maturity</strong>) proceedsare not made within 10 Business Days of the<strong>Maturity</strong> / Final Redemption Date.However, under normal circumstances, the <strong>Mutual</strong><strong>Fund</strong> would endeavor to despatch the Redemption(<strong>Maturity</strong>) cheque within 3-4 Business Days fromthe date of <strong>Maturity</strong> / Final Redemption.8. DEMATERIALIZATIONThe Applicant intending to invest in the Scheme throughASBA Process will be required to have a beneficiaryaccount with a Depository Participant (DP) of the NSDL/CDSL and will be required to mention in the applicationform DP ID No. and Beneficiary Account No. with theDP at the time of purchasing Units during the NFO.Applicants must ensure that the sequence of names asmentioned in the application form in section 1a matchesto that of the account held with the DepositoryParticipant. Names, Address, PAN details, etc. mentionedin the application form will be verified against theDepository data. Only those applications where thedetails are matched with the depository data, will betreated as valid applications. If the details mentioned inthe application are incomplete / incorrect, not matchingwith the depository data, the application shall be treatedas invalid and shall be liable to be rejected. The Unitsunder the Scheme will be compulsorily issued indematerialised form for application received throughASBA mode and therefore the Know Your Customer(KYC) performed by the Depository Participant of theapplicants will be considered as KYC verification doneby the Trustee / AMC.9. SIGNATURE(S)Signature(s) should be in English or in any IndianLanguage. Applications on behalf of minors should besigned by their Guardian.In case of a HUF, the Karta should sign the ApplicationForm on behalf of the HUF.If you are investing through your Constituted Attorney,please ensure that the Power of Attorney is signed byyou and your Constituted Attorney. The signature inthe Application Form, then, needs to clearly indicatethat the signature is on behalf of the applicant by theConstituted Attorney.10. NOMINATIONThe nomination details provided by the Unit holder tothe depository will be applicable to the Units of theScheme. Such nomination including any variation,cancellation or substitution of Nominee(s) shall begoverned by the rules and bye-laws of the Depository.Payment to the nominee of the sums shall discharge the<strong>Mutual</strong> <strong>Fund</strong> of all liability towards the estate of thedeceased Unit holder and his/her legal successors/legalheirs.In case nomination has been made for DP account withjoint holders, in case of death of any of the joint holder(s),the securities will be transmitted to the survivingholder(s). Only in the event of death of all the jointholders, the securities will be transmitted to the nominee.In case nomination is not made by the sole holder ofDP account, the securities would be transmitted to theaccount of legal heir(s), as may be determined by anorder of the competent court.The provisions of ‘Nomination Facility’ as described inthe SAI will be applicable for Unit holders who haverematerialized the units.11. PERMANENT ACCOUNT NUMBERSEBI has made it mandatory for all applicants (in thecase of application in joint names, each of the applicants)to mention his/her permanent account number (PAN)irrespective of the amount [Except for SIP upto S 50,000/-per year per investor (Micro SIP)]. Where the applicantis a minor, and does not posses his / her own PAN, he /she shall quote the PAN of his/ her father or mother orthe guardian, as the case may be. However PAN is notmandatory in the case of Central Government, StateGovernment entities and the officials appointed by thecourts e.g. Official liquidator, Court receiver etc (underthe category of Government) for transacting in thesecurities market. <strong>HDFC</strong> <strong>Mutual</strong> <strong>Fund</strong> reserves the rightto ascertain the status of such entities with adequatesupporting documents. Applications not complying withthe above requirement may not be accepted/ processed.

INSTRUCTIONS (Contd.)For further details, please refer Section 'PermanentAccount Number' under Statement of AdditionalInformation available at on our websitewww.hdfcfund.com.12. PREVENTION OF MONEY LAUNDERINGSEBI vide its circular reference number ISD/CIR/RR/AML/1/06 dated January 18, 2006 mandated that allintermediaries including <strong>Mutual</strong> <strong>Fund</strong>s should formulateand implement a proper policy framework as per theguidelines on anti money laundering measures and alsoto adopt a Know Your Customer (KYC) policy.The Investor(s) should ensure that the amount investedin the Scheme is through legitimate sources only anddoes not involve and is not designated for the purposeof any contravention or evasion of the provisions of theIncome Tax Act, Prevention of Money Laundering Act,Prevention of Corruption Act and / or any otherapplicable law in force and also any laws enacted by theGovernment of India from to time or any rules,regulations, notifications or directions issued thereunder.To ensure appropriate identification of the Investor(s)and with a view to monitor transactions for theprevention of money laundering, <strong>HDFC</strong> AMC/ <strong>HDFC</strong><strong>Mutual</strong> <strong>Fund</strong> reserves the right to seek information,record investor's telephonic calls and or obtain andretain documentation for establishing the identity ofthe Investor(s), proof of residence, source of funds, etc.It may re-verify identity and obtain any incomplete oradditional information for this purpose.<strong>HDFC</strong> <strong>Mutual</strong> <strong>Fund</strong>, <strong>HDFC</strong> AMC, <strong>HDFC</strong> Trustee CompanyLimited ("<strong>HDFC</strong> Trustee") and their Directors, employeesand agents shall not be liable in any manner for anyclaims arising whatsoever on account of freezing thefolios/rejection of any application / allotment of Unitsor mandatory redemption of Units due to noncompliance with the provisions of the Act, SEBI/AMFIcircular(s) and KYC policy and / or where the AMCbelieves that transaction is suspicious in nature withinthe purview of the Act and SEBI/AMFI circular(s) andreporting the same to FIU-IND.For further details, please refer Section 'Prevention ofMoney Laundering' under the Statement of AdditionalInformation available on our website www.hdfcfund.com.