Aircraft Maintenance Repair and Overhaul Market Study. - OBSA

Aircraft Maintenance Repair and Overhaul Market Study. - OBSA

Aircraft Maintenance Repair and Overhaul Market Study. - OBSA

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

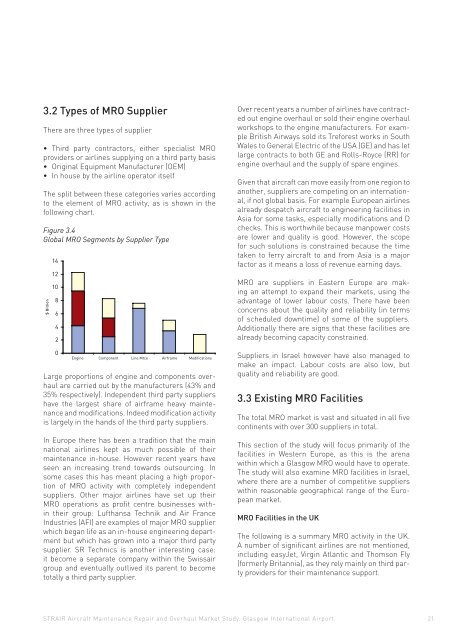

3.2 Types of MRO SupplierThere are three types of supplier• Third party contractors, either specialist MROproviders or airlines supplying on a third party basis• Original Equipment Manufacturer (OEM)• In house by the airline operator itselfThe split between these categories varies accordingto the element of MRO activity, as is shown in thefollowing chart.Figure 3.4Global MRO Segments by Supplier Type$ Billion14121086420Engine Component Line Mtce Airframe ModificationsLarge proportions of engine <strong>and</strong> components overhaulare carried out by the manufacturers (43% <strong>and</strong>35% respectively). Independent third party suppliershave the largest share of airframe heavy maintenance<strong>and</strong> modifications. Indeed modification activityis largely in the h<strong>and</strong>s of the third party suppliers.In Europe there has been a tradition that the mainnational airlines kept as much possible of theirmaintenance in-house. However recent years haveseen an increasing trend towards outsourcing. Insome cases this has meant placing a high proportionof MRO activity with completely independentsuppliers. Other major airlines have set up theirMRO operations as profit centre businesses withintheir group: Lufthansa Technik <strong>and</strong> Air FranceIndustries (AFI) are examples of major MRO supplierwhich began life as an in-house engineering departmentbut which has grown into a major third partysupplier. SR Technics is another interesting case:it become a separate company within the Swissairgroup <strong>and</strong> eventually outlived its parent to becometotally a third party supplier.Over recent years a number of airlines have contractedout engine overhaul or sold their engine overhaulworkshops to the engine manufacturers. For exampleBritish Airways sold its Treforest works in SouthWales to General Electric of the USA (GE) <strong>and</strong> has letlarge contracts to both GE <strong>and</strong> Rolls-Royce (RR) forengine overhaul <strong>and</strong> the supply of spare engines.Given that aircraft can move easily from one region toanother, suppliers are competing on an international,if not global basis. For example European airlinesalready despatch aircraft to engineering facilities inAsia for some tasks, especially modifications <strong>and</strong> Dchecks. This is worthwhile because manpower costsare lower <strong>and</strong> quality is good. However, the scopefor such solutions is constrained because the timetaken to ferry aircraft to <strong>and</strong> from Asia is a majorfactor as it means a loss of revenue earning days.MRO are suppliers in Eastern Europe are makingan attempt to exp<strong>and</strong> their markets, using theadvantage of lower labour costs. There have beenconcerns about the quality <strong>and</strong> reliability (in termsof scheduled downtime) of some of the suppliers.Additionally there are signs that these facilities arealready becoming capacity constrained.Suppliers in Israel however have also managed tomake an impact. Labour costs are also low, butquality <strong>and</strong> reliability are good.3.3 Existing MRO FacilitiesThe total MRO market is vast <strong>and</strong> situated in all fivecontinents with over 300 suppliers in total.This section of the study will focus primarily of thefacilities in Western Europe, as this is the arenawithin which a Glasgow MRO would have to operate.The study will also examine MRO facilities in Israel,where there are a number of competitive supplierswithin reasonable geographical range of the Europeanmarket.MRO Facilities in the UKThe following is a summary MRO activity in the UK.A number of significant airlines are not mentioned,including easyJet, Virgin Atlantic <strong>and</strong> Thomson Fly(formerly Britannia), as they rely mainly on third partyproviders for their maintenance support.STRAIR <strong>Aircraft</strong> <strong>Maintenance</strong> <strong>Repair</strong> <strong>and</strong> <strong>Overhaul</strong> <strong>Market</strong> <strong>Study</strong>. Glasgow International Airport. 21