TheColumbia Valley - Columbia Valley Pioneer

TheColumbia Valley - Columbia Valley Pioneer

TheColumbia Valley - Columbia Valley Pioneer

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

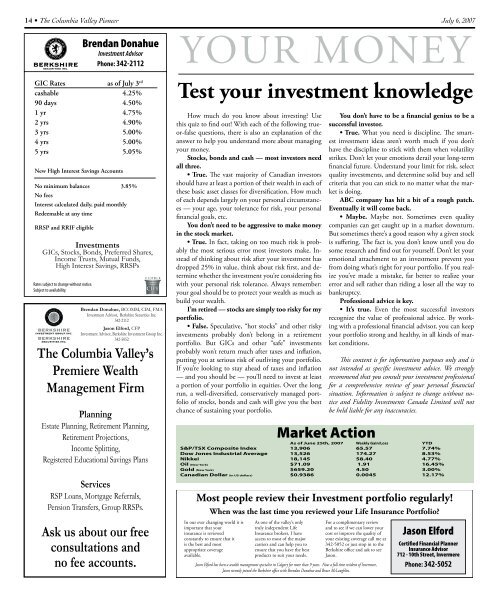

14 • The <strong>Columbia</strong> <strong>Valley</strong> <strong>Pioneer</strong> July 6, 2007<br />

Brendan Donahue<br />

Investment Advisor<br />

Phone: 342-2112 YOUR MONEY<br />

GIC Rates as of July 3 rd<br />

cashable 4.25%<br />

90 days 4.50%<br />

1 yr 4.75%<br />

2 yrs 4.90%<br />

3 yrs 5.00%<br />

4 yrs 5.00%<br />

5 yrs 5.05%<br />

New High Interest Savings Accounts<br />

No minimum balances 3.85%<br />

No fees<br />

Interest calculated daily, paid monthly<br />

Redeemable at any time<br />

RRSP and RRIF eligible<br />

Investments<br />

GICs, Stocks, Bonds, Preferred Shares,<br />

Income Trusts, Mutual Funds,<br />

High Interest Savings, RRSPs<br />

Rates subject to change without notice.<br />

Subject to availability.<br />

Brendan Donahue, BCOMM, CIM, FMA<br />

Investment Advisor, Berkshire Securities Inc.<br />

342-2112<br />

Jason Elford, CFP<br />

Investment Advisor, Berkshire Investment Group Inc.<br />

342-5052<br />

The <strong>Columbia</strong> <strong>Valley</strong>’s<br />

Premiere Wealth<br />

Management Firm<br />

Planning<br />

Estate Planning, Retirement Planning,<br />

Retirement Projections,<br />

Income Splitting,<br />

Registered Educational Savings Plans<br />

Services<br />

RSP Loans, Mortgage Referrals,<br />

Pension Transfers, Group RRSPs.<br />

Ask us about our free<br />

consultations and<br />

no fee accounts.<br />

Test your investment knowledge<br />

How much do you know about investing? Use<br />

this quiz to fi nd out! With each of the following trueor-false<br />

questions, there is also an explanation of the<br />

answer to help you understand more about managing<br />

your money.<br />

Stocks, bonds and cash — most investors need<br />

all three.<br />

• True. Th e vast majority of Canadian investors<br />

should have at least a portion of their wealth in each of<br />

these basic asset classes for diversifi cation. How much<br />

of each depends largely on your personal circumstances<br />

— your age, your tolerance for risk, your personal<br />

fi nancial goals, etc.<br />

You don’t need to be aggressive to make money<br />

in the stock market.<br />

• True. In fact, taking on too much risk is probably<br />

the most serious error most investors make. Instead<br />

of thinking about risk after your investment has<br />

dropped 25% in value, think about risk fi rst, and determine<br />

whether the investment you’re considering fi ts<br />

with your personal risk tolerance. Always remember:<br />

your goal should be to protect your wealth as much as<br />

build your wealth.<br />

I’m retired — stocks are simply too risky for my<br />

portfolio.<br />

• False. Speculative, “hot stocks” and other risky<br />

investments probably don’t belong in a retirement<br />

portfolio. But GICs and other “safe” investments<br />

probably won’t return much after taxes and infl ation,<br />

putting you at serious risk of outliving your portfolio.<br />

If you’re looking to stay ahead of taxes and infl ation<br />

— and you should be — you’ll need to invest at least<br />

a portion of your portfolio in equities. Over the long<br />

run, a well-diversifi ed, conservatively managed portfolio<br />

of stocks, bonds and cash will give you the best<br />

chance of sustaining your portfolio.<br />

Market Action<br />

As of June 25th, 2007 Weekly Gain/Loss YTD<br />

S&P/TSX Composite Index 13,906 65.57 7.74%<br />

Dow Jones Industrial Average 13,526 174.27 8.53%<br />

Nikkei 18,145 58.40 4.77%<br />

Oil (New York) $71.09 1.91 16.45%<br />

Gold (New York) $659.20 4.50 3.00%<br />

Canadian Dollar (in US dollars) $0.9386 0.0045 12.17%<br />

Most people review their Investment portfolio regularly!<br />

When was the last time you reviewed your Life Insurance Portfolio?<br />

In our ever changing world it is<br />

important that your<br />

insurance is reviewed<br />

constantly to ensure that it<br />

is the best and most<br />

appropriate coverage<br />

available.<br />

As one of the valley’s only<br />

truly independent Life<br />

Insurance brokers, I have<br />

access to most of the major<br />

carriers and can help you to<br />

ensure that you have the best<br />

products to suit your needs.<br />

For a complimentary review<br />

and to see if we can lower your<br />

cost or improve the quality of<br />

your existing coverage call me at<br />

342-5052 or just stop in to the<br />

Berkshire offi ce and ask to see<br />

Jason.<br />

Jason Elford has been a wealth management specialist in Calgary for more than 9 years. Now a full time resident of Invermere,<br />

Jason recently joined the Berkshire offi ce with Brendan Donahue and Bruce McLaughlin.<br />

You don’t have to be a fi nancial genius to be a<br />

successful investor.<br />

• True. What you need is discipline. Th e smartest<br />

investment ideas aren’t worth much if you don’t<br />

have the discipline to stick with them when volatility<br />

strikes. Don’t let your emotions derail your long-term<br />

fi nancial future. Understand your limit for risk, select<br />

quality investments, and determine solid buy and sell<br />

criteria that you can stick to no matter what the market<br />

is doing.<br />

ABC company has hit a bit of a rough patch.<br />

Eventually it will come back.<br />

• Maybe. Maybe not. Sometimes even quality<br />

companies can get caught up in a market downturn.<br />

But sometimes there’s a good reason why a given stock<br />

is suff ering. Th e fact is, you don’t know until you do<br />

some research and fi nd out for yourself. Don’t let your<br />

emotional attachment to an investment prevent you<br />

from doing what’s right for your portfolio. If you realize<br />

you’ve made a mistake, far better to realize your<br />

error and sell rather than riding a loser all the way to<br />

bankruptcy.<br />

Professional advice is key.<br />

• It’s true. Even the most successful investors<br />

recognize the value of professional advice. By working<br />

with a professional fi nancial advisor, you can keep<br />

your portfolio strong and healthy, in all kinds of market<br />

conditions.<br />

Th is content is for information purposes only and is<br />

not intended as specifi c investment advice. We strongly<br />

recommend that you consult your investment professional<br />

for a comprehensive review of your personal fi nancial<br />

situation. Information is subject to change without notice<br />

and Fidelity Investments Canada Limited will not<br />

be held liable for any inaccuracies.<br />

Jason Elford<br />

Certifi ed Financial Planner<br />

Insurance Advisor<br />

712 - 10th Street, Invermere<br />

Phone: 342-5052