BREAKTHROUGH IN THE CITY Why London's ... - Union Investment

BREAKTHROUGH IN THE CITY Why London's ... - Union Investment

BREAKTHROUGH IN THE CITY Why London's ... - Union Investment

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2005, DIFA purchased the Tamayo 100 office building for its<br />

open-ended real estate fund DIFA-Global for 22 million euros.<br />

Other international property investors represented in Monterrey<br />

include GE Capital, <strong>IN</strong>G and Calpers.<br />

The financial specialists from property consultants Jones Lang<br />

LaSalle report high demand for commercial and industrial property<br />

along the US border as well as at other, strategically important<br />

transport junctions in central Mexico. Owing to its proximity to the<br />

US, Mexico enjoys special status among the emerging markets in<br />

Latin America. “Apart from low labour costs similar to those in,<br />

say, Asia, Mexico also has a clear political advantage in trading with<br />

the USA,” confirmed Frank Ehrich of <strong>Union</strong> <strong>Investment</strong>.<br />

FUR<strong>THE</strong>R EXPANSION <strong>IN</strong> FUTURE<br />

These are all very good reasons for DIFA to continue charting<br />

its course of expansion in Mexico. “Due to the positive experiences<br />

we’ve had in Mexico and the prospect of strong economic<br />

growth in the future, we’re looking into further expansion of our<br />

portfolio in very good office locations,” said Kutscher. <strong>Investment</strong><br />

is to be focused on high-quality, fully-let office buildings meeting<br />

the standards of international corporations. A prime example<br />

is Reforma 265 – an office block next door to the Mexican<br />

stock exchange in Mexico City, which was bought in September<br />

by DIFA for the DIFA-Global fund.<br />

Deanne Corbett, Nikolaus von Raggamby<br />

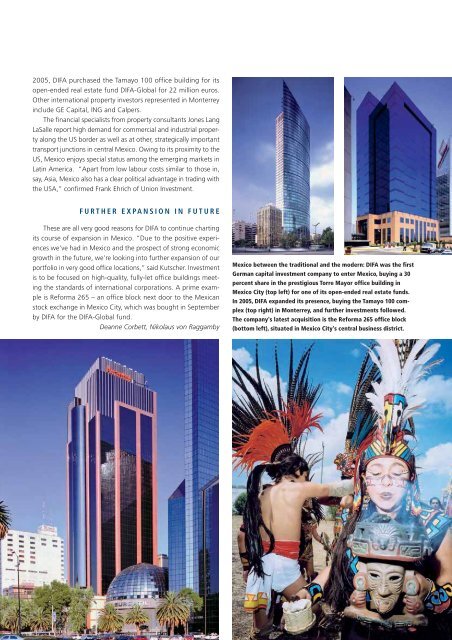

Mexico between the traditional and the modern: DIFA was the first<br />

German capital investment company to enter Mexico, buying a 30<br />

percent share in the prestigious Torre Mayor office building in<br />

Mexico City (top left) for one of its open-ended real estate funds.<br />

In 2005, DIFA expanded its presence, buying the Tamayo 100 complex<br />

(top right) in Monterrey, and further investments followed.<br />

The company's latest acquisition is the Reforma 265 office block<br />

(bottom left), situated in Mexico City's central business district.