BREAKTHROUGH IN THE CITY Why London's ... - Union Investment

BREAKTHROUGH IN THE CITY Why London's ... - Union Investment

BREAKTHROUGH IN THE CITY Why London's ... - Union Investment

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PLACES & SPACES 26_27 SPACE & <strong>IN</strong>VESTMENT<br />

Special funds up in volume<br />

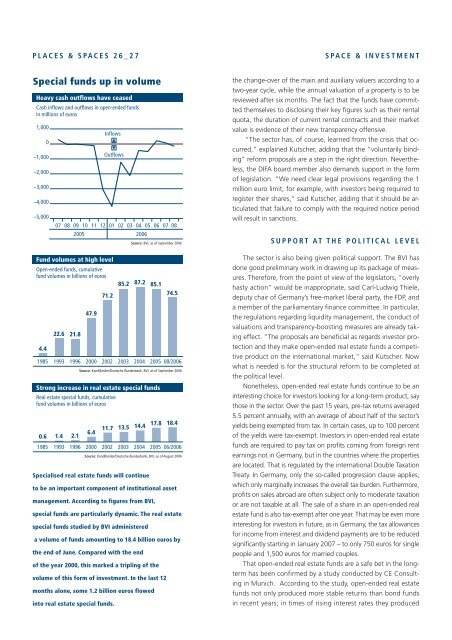

Heavy cash outflows have ceased<br />

Cash inflows and outflows in open-ended funds<br />

in millions of euros<br />

1,000<br />

–1,000<br />

–2,000<br />

–3,000<br />

–4,000<br />

–5,000<br />

Open-ended funds, cumulative<br />

fund volumes in billions of euros<br />

4.4<br />

0<br />

22.6 21.8<br />

47.9<br />

Inflows<br />

Outflows<br />

07 08 09 10 11 12 01 02 03 04 05 06 07 08<br />

2005 2006<br />

Fund volumes at high level<br />

71.2<br />

Source: BVI, as of September 2006<br />

85.2 87.2 85.1<br />

Strong increase in real estate special funds<br />

74.5<br />

1985 1993 1996 2000 2002 2003 2004 2005 08/2006<br />

Real estate special funds, cumulative<br />

fund volumes in billions of euros<br />

Source: Kandlbinder/Deutsche Bundesbank, BVI, as of September 2006<br />

0.6 1.4 2.1<br />

6.4<br />

11.7 13.5 14.4<br />

17.8 18.4<br />

1985 1993 1996 2000 2002 2003 2004 2005 06/2006<br />

Source: Kandlbinder/Deutsche Bundesbank, BVI, as of August 2006<br />

Specialised real estate funds will continue<br />

to be an important component of institutional asset<br />

management. According to figures from BVI,<br />

special funds are particularly dynamic. The real estate<br />

special funds studied by BVI administered<br />

a volume of funds amounting to 18.4 billion euros by<br />

the end of June. Compared with the end<br />

of the year 2000, this marked a tripling of the<br />

volume of this form of investment. In the last 12<br />

months alone, some 1.2 billion euros flowed<br />

into real estate special funds.<br />

the change-over of the main and auxiliary valuers according to a<br />

two-year cycle, while the annual valuation of a property is to be<br />

reviewed after six months. The fact that the funds have committed<br />

themselves to disclosing their key figures such as their rental<br />

quota, the duration of current rental contracts and their market<br />

value is evidence of their new transparency offensive.<br />

“The sector has, of course, learned from the crisis that occurred,”<br />

explained Kutscher, adding that the "voluntarily binding"<br />

reform proposals are a step in the right direction. Nevertheless,<br />

the DIFA board member also demands support in the form<br />

of legislation. “We need clear legal provisions regarding the 1<br />

million euro limit, for example, with investors being required to<br />

register their shares,” said Kutscher, adding that it should be articulated<br />

that failure to comply with the required notice period<br />

will result in sanctions.<br />

SUPPORT AT <strong>THE</strong> POLITICAL LEVEL<br />

The sector is also being given political support. The BVI has<br />

done good preliminary work in drawing up its package of measures.<br />

Therefore, from the point of view of the legislators, “overly<br />

hasty action” would be inappropriate, said Carl-Ludwig Thiele,<br />

deputy chair of Germany’s free-market liberal party, the FDP, and<br />

a member of the parliamentary finance committee. In particular,<br />

the regulations regarding liquidity management, the conduct of<br />

valuations and transparency-boosting measures are already taking<br />

effect. “The proposals are beneficial as regards investor protection<br />

and they make open-ended real estate funds a competitive<br />

product on the international market,” said Kutscher. Now<br />

what is needed is for the structural reform to be completed at<br />

the political level.<br />

Nonetheless, open-ended real estate funds continue to be an<br />

interesting choice for investors looking for a long-term product, say<br />

those in the sector. Over the past 15 years, pre-tax returns averaged<br />

5.5 percent annually, with an average of about half of the sector’s<br />

yields being exempted from tax. In certain cases, up to 100 percent<br />

of the yields were tax-exempt. Investors in open-ended real estate<br />

funds are required to pay tax on profits coming from foreign rent<br />

earnings not in Germany, but in the countries where the properties<br />

are located. That is regulated by the international Double Taxation<br />

Treaty. In Germany, only the so-called progression clause applies,<br />

which only marginally increases the overall tax burden. Furthermore,<br />

profits on sales abroad are often subject only to moderate taxation<br />

or are not taxable at all. The sale of a share in an open-ended real<br />

estate fund is also tax-exempt after one year. That may be even more<br />

interesting for investors in future, as in Germany, the tax allowances<br />

for income from interest and dividend payments are to be reduced<br />

significantly starting in January 2007 – to only 750 euros for single<br />

people and 1,500 euros for married couples.<br />

That open-ended real estate funds are a safe bet in the longterm<br />

has been confirmed by a study conducted by CE Consulting<br />

in Munich. According to the study, open-ended real estate<br />

funds not only produced more stable returns than bond funds<br />

in recent years; in times of rising interest rates they produced