BlueMedicare PPO - Florida Blue

BlueMedicare PPO - Florida Blue

BlueMedicare PPO - Florida Blue

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

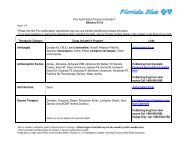

A Medicare Advantage <strong>PPO</strong> Plan<strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>2009 Summary of BenefitsLee, Manatee and Sarasota Counties (H5434 014)

Section 1- Introduction to the Summary of Benefitsfor <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>January 1, 2009 - December 31, 2009Thank you for your interest in <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>. Our plan is offered by<strong>Blue</strong> Cross and <strong>Blue</strong> Shield of <strong>Florida</strong>, Inc., a Medicare AdvantagePreferred Provider Organization (<strong>PPO</strong>). This Summary of Benefits tellsyou some features of our plan. It doesn’t list every service that we cover orlist every limitation or exclusion. To get a complete list of our benefits,please call <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong> and ask for the “Evidence of Coverage.”You have choices in your health care.As a Medicare beneficiary, you can choose from different Medicareoptions. One option is the Original (fee-for-service) Medicare Plan.Another option is a Medicare health plan, like <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>. Youmay have other options too. You make the choice. No matter what youdecide, you are still in the Medicare Program.You may be able to join or leave a plan only at certain times. Please call<strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong> at the number listed at the end of this introduction or1-800-MEDICARE (1-800-633-4227) for more information. TTY usersshould call 1-877-486-2048. You can call this number 24 hours a day, 7days a week.How can I compare my options?You can compare <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong> and the Original Medicare Planusing this Summary of Benefits. The charts in this booklet list someimportant health benefits. For each benefit, you can see what our plancovers and what the Original Medicare Plan covers.Our members receive all of the benefits that the Original Medicare Planoffers. We also offer more benefits, which may change from year to year.Where is <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong> available?The service area for this plan includes: Lee, Manatee and Sarasota counties,<strong>Florida</strong>. You must live in one of these areas to join the plan.Who is eligible to join <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>?You can join <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong> if you are entitled to Medicare Part A andenrolled in Medicare Part B and live in the service area. However,individuals with End-Stage Renal Disease are generally not eligible toenroll in <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong> unless they are members of our organizationand have been since their dialysis began.Can I choose my doctors?<strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong> has formed a network of doctors, specialists, andhospitals. You can use any doctor who is part of our network. You mayalso go to doctors outside of our network. The health providers in ournetwork can change at any time. You can ask for a current ProviderDirectory, or, for an up-to-date list, visit us at www.bcbsfl.com. OurMember Services number is listed at the end of this introduction.What happens if I go to a doctor who’s not in yournetwork?You can go to doctors, specialists, or hospitals in or out of network. Youmay have to pay more for the services you receive outside the network, andyou may have to follow special rules prior to getting services in and/or outof network. For more information, please call the Member Services numberat the end of this introduction.Does my plan cover Medicare Part B or Part D drugs?<strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong> does cover both Medicare Part B prescription drugsand Medicare Part D prescription drugs.Where can I get my prescriptions if I join this plan?<strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong> has formed a network of pharmacies. You must use anetwork pharmacy to receive plan benefits. We may not pay for yourprescriptions if you use an out-of-network pharmacy, except in certaincases. The pharmacies in our network can change at any time. You can askfor a pharmacy directory or visit us at www.myrxassistant.com. OurMember Services number is listed at the end of this introduction.1

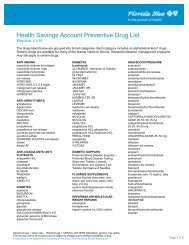

What is a prescription drug formulary?<strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong> uses a formulary. A formulary is a list of drugs coveredby your plan to meet patient needs. We may periodically add, remove, ormake changes to coverage limitations on certain drugs or change howmuch you pay for a drug. If we make any formulary change that limits ourmembers' ability to fill their prescriptions, we will notify the affectedenrollees before the change is made. We will send a formulary to you andyou can see our complete formulary on our web site atwww.myrxassistant.com.If you are currently taking a drug that is not on our formulary or subject toadditional requirements or limits, you may be able to get a temporarysupply of the drug. You can contact us to request an exception or switch toan alternative drug listed on our formulary with your physician's help. Callus to see if you can get a temporary supply of the drug or for more detailsabout our drug transition policy.How can I get extra help with prescription drug plancosts?If you qualify for extra help with your Medicare prescription drug plancosts, your premium and costs at the pharmacy will be lower. When youjoin <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>, Medicare will tell us how much extra help you aregetting. Then we will let you know the amount you will pay. If you are notgetting this extra help you can see if you qualify by calling 1-800-MEDICARE(1-800-633-4227), TTY users should call 1-877-486-2048. You can callthis number 24 hours a day, 7 days a week.What are my protections in this plan?All Medicare Advantage Plans agree to stay in the program for a full year ata time. Each year, the plans decide whether to continue for another year.Even if a Medicare Advantage Plan leaves the program, you will not loseMedicare coverage. If a plan decides not to continue, it must send you aletter at least 90 days before your coverage will end. The letter will explainyour options for Medicare coverage in your area.As a member of <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>, you have the right to request acoverage determination, which includes the right to request an exception,the right to file an appeal if we deny coverage for a prescription drug, andthe right to file a grievance. You have the right to request a coveragedetermination if you want us to cover a Part D drug that you believe shouldbe covered. An exception is a type of coverage determination. You may askus for an exception if you believe you need a drug that is not on our list ofcovered drugs or believe you should get a non-preferred drug at a lowerout-of-pocket cost. You can also ask for an exception to cost utilizationrules, such as a limit on the quantity of a drug. If you think you need anexception, you should contact us before you try to fill your prescription at apharmacy. Your doctor must provide a statement to support your exceptionrequest. If we deny coverage for your prescription drug(s), you have theright to appeal and ask us to review our decision. Finally, you have the rightto file a grievance if you have any type of problem with us or one of ournetwork pharmacies that does not involve coverage for a prescription drug.What is a Medication Therapy Management (MTM)Program?A Medication Therapy Management (MTM) Program is a free service wemay offer. You may be invited to participate in a program designed foryour specific health and pharmacy needs. You may decide not to participatebut it is recommended that you take full advantage of this covered service ifyou are selected. Contact <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong> for more details.2

What types of drugs may be covered under MedicarePart B?Some outpatient prescription drugs may be covered under Medicare Part B.These may include, but are not limited to, the following types of drugs.Contact <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong> for more details.• Some Antigens: If they are prepared by a doctor and administeredby a properly instructed person (who could be the patient) underdoctor supervision.• Osteoporosis Drugs: Injectable drugs for osteoporosis for certainwomen with Medicare.• Erythropoietin (Epoetin alpha or Epogen ® ): By injection if youhave End-Stage Renal Disease (permanent kidney failure requiringeither dialysis or transplantation) and need this drug to treat anemia.• Hemophilia Clotting Factors: Self-administered clotting factors ifyou have hemophilia.• Injectable Drugs: Most injectable drugs administered incident to aphysician’s service.• Immunosuppressive Drugs: Immunosuppressive drug therapy fortransplant patients if the transplant was paid for by Medicare, orpaid by a private insurance that paid as a primary payer to yourMedicare Part A coverage, in a Medicare-certified facility.• Some Oral Cancer Drugs: If the same drug is available in injectableform.• Oral Anti-Nausea Drugs: If you are part of an anti-cancerchemotherapeutic regimen.• Inhalation and infusion drugs provided through DME.Please call <strong>Blue</strong> Cross and <strong>Blue</strong> Shield of<strong>Florida</strong>, Inc. for more information about<strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>.Visit us at www.bcbsfl.com or, call us:Member Services Hours:Sunday, Monday, Tuesday, Wednesday, Thursday, Friday,Saturday, 8:00 a.m. - 9:00 p.m. Eastern- Current members should call toll-free 1-800-926-6565for questions related to the Medicare Advantageprogram. (TTY/TDD: 711)- Prospective members should call toll-free 1-800-876-2227 for questions related to the Medicare Advantageprogram. (TTY/TDD: 711)- Current members should call toll-free 1-800-926-6565for questions related to the Medicare Part D PrescriptionDrug program. (TTY/TDD: 711)- Prospective members should call toll-free 1-800-876-2227 for questions related to the Medicare Part Dprescription drug program. (TTY/TDD: 711)For more information about Medicare, please call Medicareat 1-800-MEDICARE (1-800-633-4227); TTY usersshould call 1-877-486-2048. You can call 24 hours a day, 7days a week. Or, visit www.medicare.gov on the Web.If you have special needs, this document may be availablein other formats.3

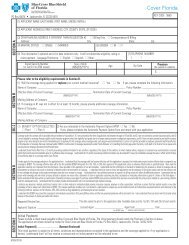

Section 2 - Summary of BenefitsIf you have any questions about this plan’s benefits or costs, please contact us at 1-800-926-6565 (for current members) or1-800-876-2227 (for prospective members). If you are hearing or speech impaired, please call the <strong>Florida</strong> TTY Relay Service at 711.Benefit Original Medicare <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>Important Information1. Premium and OtherImportant Information2. Doctor and Hospital Choice(For more information, seeEmergency - #15 and UrgentlyNeeded Care - #16.)• In 2008 the monthly Part B Premium was$96.40 and will change for 2009 and theyearly Part B deductible amount was $135and will change for 2009.• If a doctor or supplier does not acceptassignment, their costs are often higher, whichmeans you pay more.• You may go to any doctor, specialist orhospital that accepts Medicare.General• $46.00 monthly plan premium in addition toyour monthly Medicare Part B premium.In-Network• $3,300 in-network out-of-pocket limit.• All plan services covered under the out-ofpocketlimit.Out-of-Network• $6,000 out-of-network out-of-pocket limit.• All plan services covered under the out-ofpocketlimit.In-Network• No referral required for network doctors,specialists and hospitals.• You may have to pay a separate copay forcertain doctor office visits.4

Benefit Original Medicare <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>Inpatient Care3. Inpatient Hospital Care(includes Substance Abuse andRehabilitation Services)4. Inpatient Mental Health Care• In 2008 the amounts for each benefit periodwere:- Days 1-60: $1024 deductible- Days 61-90: $256 per day- Days 91-150: $512 per lifetime reservedayThese amounts will change for 2009.• Call 1-800-MEDICARE(1-800-633-4227) for information aboutlifetime reserve days.• Lifetime reserve days can only be used once.• A “benefit period” starts the day you go into ahospital or skilled nursing facility. It endswhen you go for 60 days in a row withouthospital or skilled nursing care. If you go intothe hospital after one benefit period hasended, a new benefit period begins. You mustpay the inpatient hospital deductible for eachbenefit period. There is no limit to the numberof benefit periods you can have.• Same deductible and copay as inpatienthospital care (see “Inpatient Hospital Care”above).• 190-day lifetime limit in a PsychiatricHospital.5In-Network• For Medicare-covered hospital stays:- Days 1-7: $150 copay per day- Days 8-90: $0 copay per day- $0 copay for additional hospital days• No limit to the number of days covered by theplan each benefit period.• Except in an emergency, your doctor must tellthe plan that you are going to be admitted tothe hospital.Out-of-Network• For hospital stays:- Days 1-7: $200 copay per day- Days 8 and beyond: $0 copay per dayIn-Network• For hospital stays:- Days 1-7: $150 copay per day- Days 8-90: $0 copay per day• You get up to 190 days in a psychiatrichospital in a lifetime.• Except in an emergency, your doctor must tellthe plan that you are going to be admitted tothe hospital.Out-of-Network• For hospital stays:- Days 1-7: $200 copay per day- Days 8 and beyond: $0 copay per day

Benefit Original Medicare <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>5. Skilled Nursing Facility(in a Medicare-certified skillednursing facility)6. Home Health Care(includes medically necessaryintermittent skilled nursing care,home health aide services, andrehabilitation services, etc.)• In 2008 the amounts for each benefit periodafter at least a 3-day covered hospital staywere:- Days 1-20: $0 per day- Days 21-100: $128 per dayThese amounts will change for 2009.• 100 days for each benefit period.• A “benefit period” starts the day you go into ahospital or SNF. It ends when you go for 60days in a row without hospital or skillednursing care. If you go into the hospital afterone benefit period has ended, a new benefitperiod begins. You must pay the inpatienthospital deductible for each benefit period.There is no limit to the number of benefitperiods you can have.General• Authorization rules may apply.In-Network• For SNF stays:- Days 1-6: $0 copay per day- Days 7-25: $100 copay per day- Days 26-100: $0 copay per day• Plan covers up to 100 days each benefitperiod.• No prior hospital stay is required.Out-of-Network• For each SNF stay:- Days 1-6: $0 copay per SNF day- Days 7-25: $100 copay per SNF day- Days 26-100: $0 copay per SNF day• $0 copay In-Network• $0 copay for:- Medicare-covered home health visits- respite careOut-of-Network• $50 copay for home health visits7. Hospice • You pay part of the cost for outpatient drugsand inpatient respite care.• You must get care from a Medicare-certifiedhospice.General• You must get care from a Medicare-certifiedhospice.6

Benefit Original Medicare <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>Outpatient Care8. Doctor Office Visits • 20% coinsurance General• See “Physical Exams” for more information.In-Network• $5 copay for each primary care doctor visitfor Medicare-covered benefits.• $5 to $20 copay for each in-area, networkurgent care Medicare-covered visit• $20 copay for each specialist visit forMedicare-covered benefits.Out-of-Network• $15 copay for each primary care doctor visit• $50 copay for each specialist visit9. Chiropractic Services • Routine care not covered.• 20% coinsurance for manual manipulation ofthe spine to correct subluxation (adisplacement or misalignment of a joint orbody part) if you get it from a chiropractor orother qualified providers.10. Podiatry Services • Routine care not covered.• 20% coinsurance for medically necessary footcare, including care for medical conditionsaffecting the lower limbs.In-Network• $5 to $20 copay for Medicare-covered visits.• Medicare-covered chiropractic visits are formanual manipulation of the spine to correct adisplacement or misalignment of a joint orbody part.Out-of-Network• $50 copay for chiropractic benefitsIn-Network• $20 copay for each Medicare-covered visit.• $20 copay for up to 6 routine visits everyyear.• Medicare-covered podiatry benefits are formedically necessary foot care.Out-of-Network• $50 copay for podiatry benefits7

Benefit Original Medicare <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>11. Outpatient Mental HealthCare• 50% coinsurance for most outpatient mentalhealth services.In-Network• $20 copay for each Medicare-coveredindividual or group therapy visit.Out-of-Network• $50 copay for mental health benefits• $50 copay for mental health benefits with apsychiatrist12. Outpatient SubstanceAbuse Care• 20% coinsurance In-Network• $20 copay for Medicare-covered individual orgroup visits.Out-of-Network• $50 copay for outpatient substance abusebenefits13. OutpatientServices/Surgery• 20% coinsurance for the doctor• 20% of outpatient facility chargesIn-Network• $100 copay for each Medicare-coveredambulatory surgical center visit.• $15 to $150 copay for each Medicare-coveredoutpatient hospital facility visit.Out-of-Network• $100 copay for ambulatory surgical centerbenefits• $0 to $150 copay for outpatient hospitalfacility benefits14. Ambulance Services(medically necessaryambulance services)• 20% coinsurance In-Network• $100 copay for Medicare-covered ambulancebenefits.Out-of-Network• $100 copay for ambulance benefits8

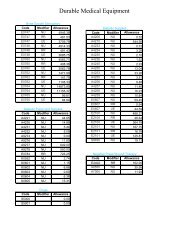

Benefit Original Medicare <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>15. Emergency Care(You may go to any emergencyroom if you reasonably believeyou need emergency care.)16. Urgently Needed Care(This is NOT emergency care,and in most cases is out of theservice area.)17. Outpatient RehabilitationServices(Occupational Therapy, PhysicalTherapy, Speech and LanguageTherapy)Outpatient Medical Services and Supplies18. Durable Medical Equipment(includes wheelchairs, oxygen,etc.)• 20% coinsurance for the doctor• 20% of facility charge, or a set copay peremergency room visit• You don’t have to pay the emergency roomcopay if you are admitted to the hospital for thesame condition within 3 days of the emergencyroom visit.• NOT covered outside the U.S. except underlimited circumstances.• 20% coinsurance, or a set copay• NOT covered outside the U.S. except underlimited circumstances.In-Network• $50 copay for Medicare-covered emergencyroom visits.Out-of-Network• Worldwide coverage.In- and Out-of-Network• If you are immediately admitted to the hospital,you pay $0 for the emergency room visit.General• $20 copay for Medicare-covered urgentlyneeded care visits• 20% coinsurance In-Network• $5 to $20 copay for Medicare-coveredOccupational Therapy visits.• $5 to $20 copay for Medicare-covered Physicaland/or Speech/Language Therapy visits.Out-of-Network• $50 copay for Occupational Therapy visits• $50 copay for Physical and/orSpeech/Language Therapy visits• 20% coinsurance In-Network• $0 to $500 copay for Medicare-covered items.Out-of-Network• $0 to $500 copay for durable medicalequipment19. Prosthetic Devices(includes braces, artificial limbsand eyes, etc.)• 20% coinsurance In-Network• $0 copay for Medicare-covered items.Out-of-Network• $0 copay for prosthetic devices9

Benefit Original Medicare <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>20. Diabetes Self-MonitoringTraining, NutritionTherapy and Supplies(includes coverage for glucosemonitors, test strips, lancets,screening tests and selfmanagementtraining)• 20% coinsurance• Nutrition therapy is for people who havediabetes or kidney disease (but aren’t ondialysis or haven’t had a kidney transplant)when referred by a doctor. These services canbe given by a registered dietitian or include anutritional assessment and counseling to helpyou manage your diabetes or kidney disease.In-Network• $0 copay for diabetes self-monitoringtraining.• $0 copay for nutrition therapy for diabetes.• $0 copay for diabetes supplies.Out-of-Network• $50 copay for diabetes self-monitoringtraining.• $50 copay for nutrition therapy for diabetes.• $50 copay for diabetes supplies.21. Diagnostic Tests, x-raysand Lab Services• 20% coinsurance for diagnostic tests and x-rays• $0 copay for Medicare-covered lab services.• Lab Services: Medicare covers medicallynecessary diagnostic lab services that areordered by your treating doctor when they areprovided by a Clinical LaboratoryImprovement Amendments (CLIA)-certifiedlaboratory that participates in Medicare.Diagnostic lab services are done to help yourdoctor diagnose or rule out a suspected illnessor condition. Medicare does not cover mostroutine screening tests, like checking yourcholesterol.General• Authorization rules may apply.In-Network• $0 to $15 copay for Medicare-covered labservices.• $0 to $150 copay for Medicare-covereddiagnostic procedures and tests.• $5 to $150 copay for Medicare-covered x-rays.• $20 to $150 copay for Medicare-covereddiagnostic radiology services.• $20 to $50 copay for Medicare-coveredtherapeutic radiology services.Out-of-Network• $0 to $150 copay for diagnostic procedures,tests and lab services• $0 to $150 copay for therapeutic radiologyservices• $0 to $150 for outpatient x-rays• $0 to $150 for diagnostic radiology services10

Benefit Original Medicare <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>Preventive Services22. Bone Mass Measurement(for people with Medicare whoare at risk)23. Colorectal ScreeningExams(for people with Medicare age50 and older)24. Immunizations(Flu vaccine, Hepatitis B vaccine– for people with Medicare whoare at risk, Pneumonia vaccine)25. Mammograms (AnnualScreening)(for women with Medicare age40 and older)• 20% coinsurance• Covered once every 24 months (more often ifmedically necessary) if you meet certainmedical conditions.• 20% coinsurance• Covered when you are high-risk or when youare age 50 and older.• $0 copay for Flu and Pneumonia vaccines• 20% coinsurance for Hepatitis B vaccine• You may only need the Pneumonia vaccineonce in your lifetime. Call your doctor formore information.• 20% coinsurance• No referral needed.• Covered once a year for all women withMedicare age 40 and older. One baselinemammogram covered for women withMedicare between age 35 and 39.11In-Network• $0 copay for Medicare-covered bone massmeasurement.Out-of-Network• $50 copay for Medicare-covered bone massmeasurementIn-Network• $0 copay for- Medicare-covered colorectal screenings and- additional screenings• No limit on the number of covered colorectalscreenings.Out-of-Network• $50 copay for colorectal screeningsIn-Network• $0 copay for Flu and Pneumonia vaccines• $0 copay for Hepatitis B vaccine• No referral needed for Flu and Pneumoniavaccines.Out-of-Network• $50 copay for immunizationsIn-Network• $0 copay for- Medicare-covered screening mammogramsand- additional screening mammograms• No limit on the number of covered screeningmammograms.Out-of-Network• $0 copay for screening mammograms

Benefit Original Medicare <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>26. Pap Smears and PelvicExams(for women with Medicare)• $0 copay for pap smears• Covered once every 2 years. Covered once ayear for women with Medicare at high risk.• 20% coinsurance for pelvic exams.In-Network• $0 copay for- Medicare-covered pap smears and pelvicexams and- additional pap smears and pelvic exams• No limit on the number of covered papsmears and pelvic exams.Out-of-Network• $50 copay for pap smears and pelvic exams27. Prostate Cancer ScreeningExams(for men with Medicare age 50and older)• 20% coinsurance for the digital rectal exam.• $0 for the PSA test; 20% coinsurance forother related services.• Covered once a year for all men withMedicare over age 50.In-Network• $0 copay for- Medicare-covered prostate cancerscreening and- additional screenings• No limit on the number of covered prostatecancer screenings.Out-of-Network• $50 copay for prostate cancer screenings28. End-Stage Renal Disease • 20% coinsurance for renal dialysis• 20% coinsurance for Nutrition Therapy forEnd-Stage Renal Disease• Nutrition Therapy is for people who havediabetes or kidney disease (but aren’t ondialysis or haven’t had a kidney transplant)when referred by a doctor. These services canbe given by a registered dietitian or include anutritional assessment and counseling to helpyou manage your diabetes or kidney disease.In-Network• $30 copay for renal dialysis• $0 copay for Nutrition Therapy for End-StageRenal Disease.Out-of-Network• $30 copay for renal dialysis• $50 copay for Nutrition Therapy for End-Stage Renal Disease12

Benefit Original Medicare <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>29. Prescription Drugs • Most drugs are not covered under OriginalMedicare. You can add prescription drugcoverage to Original Medicare by joining aMedicare Prescription Drug Plan, or you canget all your Medicare coverage, includingprescription drug coverage, by joining aMedicare Advantage Plan or a Medicare CostPlan that offers prescription drug coverage.Drugs Covered under Medicare Part BGeneral• 20% of the cost for Part B-covered drugs (notincluding Part B-covered chemotherapydrugs).• 20% of the cost for Part B-coveredchemotherapy drugs.Drugs Covered under Medicare Part DGeneral• This plan uses a formulary. The plan will sendyou the formulary. You can also see theformulary at www.myrxassistant.com on theweb.• Different out-of-pocket costs may apply forpeople who- have limited incomes,- live in long-term care facilities or- have access to Indian/Tribal/Urban (IndianHealth Service).• The plan offers national in-networkprescription coverage (i.e., this would include50 states and D.C.). This means that you willpay the same cost-sharing amount for yourprescription drugs if you get them at an innetworkpharmacy outside of the plan’sservice area (for instance, when you travel).13

Benefit Original Medicare <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>29. Prescription Drugs(continued)• Total yearly drug costs are the total drug costspaid by both you and the plan.• The plan may require you to first try one drugto treat your condition before it will coveranother drug for that condition.• Some drugs have quantity limits.• Your provider must get prior authorizationfrom <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong> for certain drugs.• You must go to certain pharmacies for a verylimited number of drugs, due to specialhandling, provider coordination or patienteducation requirements for these drugs thatcannot be met by most pharmacies in yournetwork. These drugs are listed on the plan’swebsite, formulary and printed materials, aswell as on the Medicare Prescription DrugPlan Finder on Medicare.gov.• If the actual cost of a drug is less than thenormal cost-sharing amount for that drug, youwill pay the actual cost, not the higher costsharingamount.IN-NETWORK• $0 deductible.• Some covered drugs don’t count toward yourout-of-pocket drug costs.14

Benefit Original Medicare <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>29. Prescription Drugs(continued)Initial Coverage• You pay the following until total yearly drugcosts reach $2,700:Retail PharmacyTier 1 – Covered Generic- $0 copay for a one-month (31-day) supplyof drugs in this tier- $0 copay for a three-month (90-day)supply of drugs in this tier- $0 copay for a 60-day supply of drugs inthis tierTier 2 – Covered Preferred Brand- $40 copay for a one-month (31-day)supply of drugs in this tier- $120 copay for a three-month (90-day)supply of drugs in this tier- $80 copay for a 60-day supply of drugs inthis tierTier 3 – Covered Brand- $83 copay for a one-month (31-day)supply of drugs in this tier- $249 copay for a three-month (90-day)supply of drugs in this tier- $166 copay for a 60-day supply of drugs inthis tierTier S – Covered Specialty- 33% coinsurance for a one-month (31-day)supply of drugs in this tier- 33% coinsurance for a three-month (90-day) supply of drugs in this tier- 33% coinsurance for a 60-day supply ofdrugs in this tier15

Benefit Original Medicare <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>29. Prescription Drugs(continued)Long-Term Care PharmacyTier 1 – Covered Generic- $0 copay for a one-month (31-day) supplyof drugs in this tierTier 2 – Covered Preferred Brand- $40 copay for a one-month (31-day)supply of drugs in this tierTier 3 – Covered Brand- $83 copay for a one-month (31-day)supply of drugs in this tierTier S – Covered Specialty- 33% coinsurance for a one-month (31-day)supply of drugs in this tierMail OrderTier 1 – Covered Generic- $0 copay for a one-month (31-day) supplyof drugs in this tier- $0 copay for a three-month (90-day)supply of drugs in this tier- $0 copay for a 60-day supply of drugs inthis tierTier 2 – Covered Preferred Brand- $40 copay for a one-month (31-day)supply of drugs in this tier- $80 copay for a three-month (90-day)supply of drugs in this tier- $80 copay for a 60-day supply of drugs inthis tier16

Benefit Original Medicare <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>29. Prescription Drugs(continued)Tier 3 – Covered Brand- $83 copay for a one-month (31-day)supply of drugs in this tier- $166 copay for a three-month (90-day)supply of drugs in this tier- $166 copay for a 60-day supply of drugs inthis tierTier S – Covered Specialty- 33% coinsurance for a one-month (31-day)supply of drugs in this tier- 33% coinsurance for a three-month (90-day) supply of drugs in this tier- 33% coinsurance for a 60-day supply ofdrugs in this tierCoverage Gap• After your total yearly drug costs reach$2,700, you pay 100% until your yearly outof-pocketdrug costs reach $4,350.Catastrophic Coverage• After your yearly out-of-pocket drug costsreach $4,350, you pay the greater of:- a $2.40 copay for generic (including branddrugs treated as generic) and a $6 copayfor all other drugs, or- 5% coinsurance17

Benefit Original Medicare <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>29. Prescription Drugs(continued)OUT-OF-NETWORK• Plan drugs may be covered in specialcircumstances – for instance, illness whiletraveling outside of the plan’s service areawhere there is no network pharmacy. Youmay have to pay more than your normal costsharingamount if you get your drugs at anout-of-network pharmacy. In addition, youwill likely have to pay the pharmacy’s fullcharge for the drug and submitdocumentation to receive reimbursementfrom <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>.Out-of-Network Initial Coverage• You will be reimbursed up to the full cost ofthe drug minus the following for drugspurchased out-of-network until total yearlydrug costs reach $2,700:Out-of-Network PharmacyTier 1 – Covered Generic- $0 copay for a one-month (31-day) supplyof drugs in this tierTier 2 – Covered Preferred Brand- $40 copay for a one-month (31-day)supply of drugs in this tierTier 3 – Covered Brand- $83 copay for a one-month (31-day)supply of drugs in this tierTier S – Covered Specialty- 33% coinsurance for a one-month (31-day)supply of drugs in this tier18

Benefit Original Medicare <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>29. Prescription Drugs(continued)Out-of-Network Coverage Gap• After your total yearly drug costs reach$2,700, you pay 100% of the pharmacy’s fullcharge for drugs purchased out-of-networkuntil your yearly out-of-pocket drug costsreach $4, 350. You will not be reimbursed by<strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong> for out-of-networkpurchases when you are in the coverage gap.However, you should still submitdocumentation to <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong> so wecan add the amounts you spent out-ofnetworkto your total out-of-pocket costs forthe year.Out-of-Network Catastrophic Coverage• After your yearly out-of-pocket drug costsreach $4,350, you will be reimbursed fordrugs purchased out-of-network up to the fullcost of the drug minus the following:- a $2.40 copay for generic (including branddrugs treated as generic) and a $6 copayfor all other drugs, or- 5% coinsurance.19

Benefit Original Medicare <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>30. Dental Services • Preventive dental services (such as cleaning)not covered.In-Network• $0 copay for the following preventive dentalbenefits:- up to 1 oral exam every 6 months- up to 1 cleaning every 6 months- up to 1 fluoride treatment every year- up to 1 dental x-ray every year• $20 copay for Medicare-covered dentalbenefitsOut-of-Network• 25% of the cost for comprehensive dentalbenefitsIn- and Out-of-Network• Contact the plan for availability of additionalin-network and out-of-networkcomprehensive dental benefits.31. Hearing Services • Routine hearing exams and hearing aids notcovered.• 20% coinsurance for diagnostic hearingexams.32. Vision Services • 20% coinsurance for diagnosis and treatmentof diseases and conditions of the eye.• Routine eye exams and glasses not covered.• Medicare pays for one pair of eyeglasses orcontact lenses after cataract surgery.• Annual glaucoma screenings covered forpeople at risk.In-Network• In general, routine hearing exams and hearingaids not covered.• $20 copay for Medicare-covered diagnostichearing exams.Out-of-Network• $50 copay for hearing examsIn-Network• Non-Medicare-covered eye exams andglasses not covered.• $0 copay for one pair of eyeglasses or contactlenses after cataract surgery.• $20 copay for exams to diagnose and treatdiseases and conditions of the eye.Out-of-Network• $50 copay for eye exams• $50 copay for eye wear20

Benefit Original Medicare <strong><strong>Blue</strong>Medicare</strong> <strong>PPO</strong>33. Physical Exams • 20% coinsurance for one exam within thefirst 12 months of your new Medicare Part Bcoverage• When you get Medicare Part B, you can get aone-time physical exam within the first 12months of your new Part B coverage. Thecoverage does not include lab tests.Health and WellnessEducation• Smoking Cessation: Covered if ordered byyour doctor. Includes two counseling attemptswithin a 12-month period if you arediagnosed with a smoking-related illness orare taking medicine that may be affected bytobacco. Each counseling attempt includes upto four face-to-face visits. You paycoinsurance, and the Part B deductibleapplies.In-Network• $0 copay for routine exams• Limited to one exam every yearOut-of-Network• $50 copay for routine examsIn-Network• This plan covers the followinghealth/wellness education benefits:- Written health education materials,including newsletters- Nursing HotlineOut-of-Network• $0 copay for Health and Wellness services21

NOTES

H5434_014 23380 0808 SP A: 09/2008www.bcbsfl.com