Communiqué November 2009 | 1 - CII

Communiqué November 2009 | 1 - CII

Communiqué November 2009 | 1 - CII

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

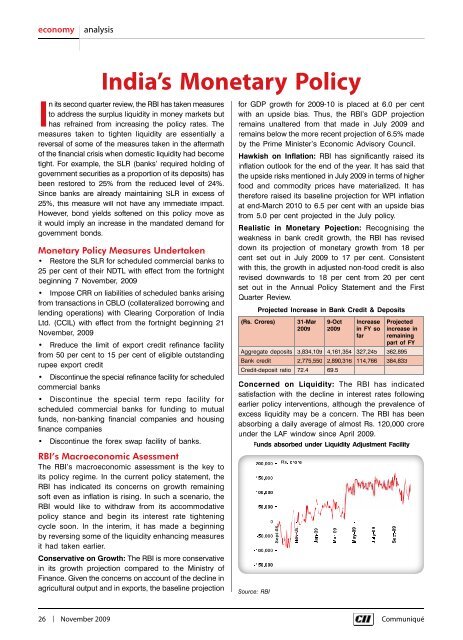

economyanalysisIndia’s Monetary PolicyIn its second quarter review, the RBI has taken measuresto address the surplus liquidity in money markets buthas refrained from increasing the policy rates. Themeasures taken to tighten liquidity are essentially areversal of some of the measures taken in the aftermathof the financial crisis when domestic liquidity had becometight. For example, the SLR (banks’ required holding ofgovernment securities as a proportion of its deposits) hasbeen restored to 25% from the reduced level of 24%.Since banks are already maintaining SLR in excess of25%, this measure will not have any immediate impact.However, bond yields softened on this policy move asit would imply an increase in the mandated demand forgovernment bonds.Monetary Policy Measures Undertaken 25 per cent of their NDTL with effect from the fortnightbeginning 7 <strong>November</strong>, <strong>2009</strong> from transactions in CBLO (collateralized borrowing andlending operations) with Clearing Corporation of IndiaLtd. (CCIL) with effect from the fortnight beginning 21<strong>November</strong>, <strong>2009</strong> from 50 per cent to 15 per cent of eligible outstandingrupee export credit commercial banks scheduled commercial banks for funding to mutualfunds, non-banking financial companies and housingfinance companies RBI’s Macroeconomic AsessmentThe RBI’s macroeconomic assessment is the key toits policy regime. In the current policy statement, theRBI has indicated its concerns on growth remainingsoft even as inflation is rising. In such a scenario, theRBI would like to withdraw from its accommodativepolicy stance and begin its interest rate tighteningcycle soon. In the interim, it has made a beginningby reversing some of the liquidity enhancing measuresit had taken earlier.Conservative on Growth: The RBI is more conservativein its growth projection compared to the Ministry ofFinance. Given the concerns on account of the decline inagricultural output and in exports, the baseline projectionfor GDP growth for <strong>2009</strong>-10 is placed at 6.0 per centwith an upside bias. Thus, the RBI’s GDP projectionremains unaltered from that made in July <strong>2009</strong> andremains below the more recent projection of 6.5% madeby the Prime Minister’s Economic Advisory Council.Hawkish on Inflation: RBI has significantly raised itsinflation outlook for the end of the year. It has said thatthe upside risks mentioned in July <strong>2009</strong> in terms of higherfood and commodity prices have materialized. It hastherefore raised its baseline projection for WPI inflationat end-March 2010 to 6.5 per cent with an upside biasfrom 5.0 per cent projected in the July policy.Realistic in Monetary Pojection: Recognising theweakness in bank credit growth, the RBI has reviseddown its projection of monetary growth from 18 percent set out in July <strong>2009</strong> to 17 per cent. Consistentwith this, the growth in adjusted non-food credit is alsorevised downwards to 18 per cent from 20 per centset out in the Annual Policy Statement and the FirstQuarter Review.Projected Increase in Bank Credit & Deposits(Rs. Crores)31-Mar<strong>2009</strong>9-Oct<strong>2009</strong>Increasein FY sofarProjectedincrease inremainingpart of FYAggregate deposits 3,834,109 4,161,354 327,245 362,895Bank credit 2,775,550 2,890,316 114,766 384,833Credit-deposit ratio 72.4 69.5Concerned on Liquidity: The RBI has indicatedsatisfaction with the decline in interest rates followingearlier policy interventions, although the prevalence ofexcess liquidity may be a concern. The RBI has beenabsorbing a daily average of almost Rs. 120,000 croreunder the LAF window since April <strong>2009</strong>.Funds absorbed under Liquidity Adjustment FacilitySource: RBI26 | <strong>November</strong> <strong>2009</strong> Communiqué