Issue 149 - The Australian Chamber of Commerce in Hong Kong.

Issue 149 - The Australian Chamber of Commerce in Hong Kong.

Issue 149 - The Australian Chamber of Commerce in Hong Kong.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

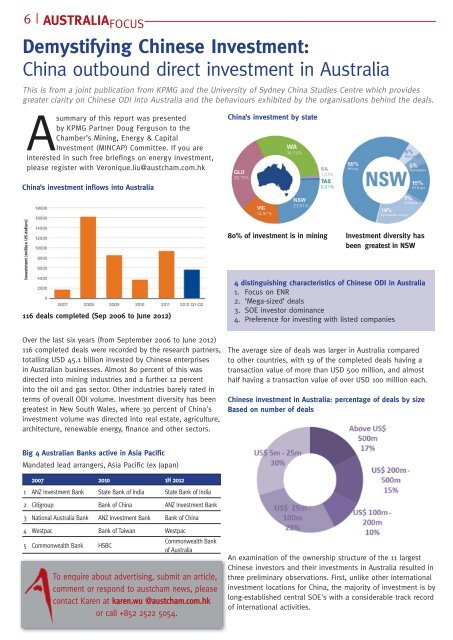

6 | AUSTRALIA FOCUSDemystify<strong>in</strong>g Ch<strong>in</strong>ese Investment:Ch<strong>in</strong>a outbound direct <strong>in</strong>vestment <strong>in</strong> AustraliaThis is from a jo<strong>in</strong>t publication from KPMG and the University <strong>of</strong> Sydney Ch<strong>in</strong>a Studies Centre which providesgreater clarity on Ch<strong>in</strong>ese ODI <strong>in</strong>to Australia and the behaviours exhibited by the organisations beh<strong>in</strong>d the deals.Asummary <strong>of</strong> this report was presentedCh<strong>in</strong>a’s <strong>in</strong>vestment by stateby KPMG Partner Doug Ferguson to the<strong>Chamber</strong>’s M<strong>in</strong><strong>in</strong>g, Energy & CapitalInvestment (MINCAP) Committee. If you are<strong>in</strong>terested <strong>in</strong> such free brief<strong>in</strong>gs on energy <strong>in</strong>vestment,please register with Veronique.liu@austcham.com.hkCh<strong>in</strong>a’s <strong>in</strong>vestment <strong>in</strong>flows <strong>in</strong>to Australia80% <strong>of</strong> <strong>in</strong>vestment is <strong>in</strong> m<strong>in</strong><strong>in</strong>g Investment diversity hasbeen greatest <strong>in</strong> NSW116 deals completed (Sep 2006 to June 2012)Over the last six years (from September 2006 to June 2012)116 completed deals were recorded by the research partners,totall<strong>in</strong>g USD 45.1 billion <strong>in</strong>vested by Ch<strong>in</strong>ese enterprises<strong>in</strong> <strong>Australian</strong> bus<strong>in</strong>esses. Almost 80 percent <strong>of</strong> this wasdirected <strong>in</strong>to m<strong>in</strong><strong>in</strong>g <strong>in</strong>dustries and a further 12 percent<strong>in</strong>to the oil and gas sector. Other <strong>in</strong>dustries barely rated <strong>in</strong>terms <strong>of</strong> overall ODI volume. Investment diversity has beengreatest <strong>in</strong> New South Wales, where 30 percent <strong>of</strong> Ch<strong>in</strong>a's<strong>in</strong>vestment volume was directed <strong>in</strong>to real estate, agriculture,architecture, renewable energy, f<strong>in</strong>ance and other sectors.4 dist<strong>in</strong>guish<strong>in</strong>g characteristics <strong>of</strong> Ch<strong>in</strong>ese ODI <strong>in</strong> Australia1. Focus on ENR2. ‘Mega-sized’ deals3. SOE <strong>in</strong>vestor dom<strong>in</strong>ance4. Preference for <strong>in</strong>vest<strong>in</strong>g with listed companies<strong>The</strong> average size <strong>of</strong> deals was larger <strong>in</strong> Australia comparedto other countries, with 19 <strong>of</strong> the completed deals hav<strong>in</strong>g atransaction value <strong>of</strong> more than USD 500 million, and almosthalf hav<strong>in</strong>g a transaction value <strong>of</strong> over USD 100 million each.Ch<strong>in</strong>ese <strong>in</strong>vestment <strong>in</strong> Australia: percentage <strong>of</strong> deals by sizeBased on number <strong>of</strong> dealsBig 4 <strong>Australian</strong> Banks active <strong>in</strong> Asia PacificMandated lead arrangers, Asia Pacific (ex Japan)2007 2010 1H 20121 ANZ Investment Bank State Bank <strong>of</strong> India State Bank <strong>of</strong> India2 Citigroup Bank <strong>of</strong> Ch<strong>in</strong>a ANZ Investment Bank3 National Australia Bank ANZ Investment Bank Bank <strong>of</strong> Ch<strong>in</strong>a4 Westpac Bank <strong>of</strong> Taiwan Westpac5 Commonwealth Bank HSBCCommonwealth Bank<strong>of</strong> AustraliaTo enquire about advertis<strong>in</strong>g, submit an article,comment or respond to austcham news, pleasecontact Karen at karen.wu @austcham.com.hkor call +852 2522 5054.An exam<strong>in</strong>ation <strong>of</strong> the ownership structure <strong>of</strong> the 11 largestCh<strong>in</strong>ese <strong>in</strong>vestors and their <strong>in</strong>vestments <strong>in</strong> Australia resulted <strong>in</strong>three prelim<strong>in</strong>ary observations. First, unlike other <strong>in</strong>ternational<strong>in</strong>vestment locations for Ch<strong>in</strong>a, the majority <strong>of</strong> <strong>in</strong>vestment is bylong-established central SOE's with a considerable track record<strong>of</strong> <strong>in</strong>ternational activities.