The Vorwerk Annual Report 2OO8

The Vorwerk Annual Report 2OO8

The Vorwerk Annual Report 2OO8

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

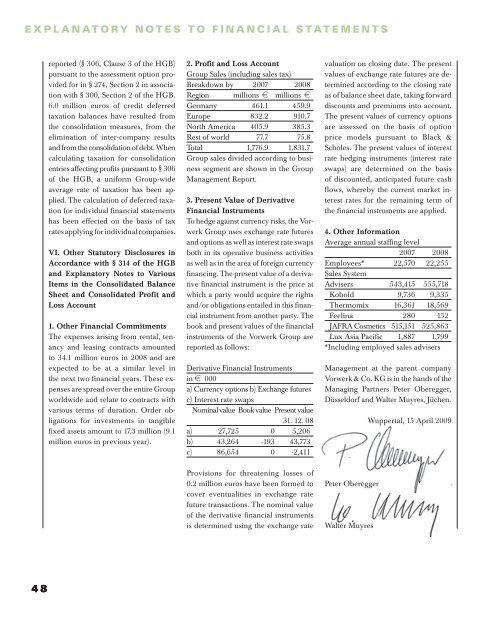

EXPLANATORY NOTES TO FINANCIAL STATEMENTSreported (§ 306, Clause 3 of the HGB)pursuant to the assessment option providedfor in § 274, Section 2 in associationwith § 300, Section 2 of the HGB.6.0 million euros of credit deferredtaxation balances have resulted fromthe consolidation measures, from theelimination of inter-company resultsand from the consolidation of debt. Whencalculating taxation for consolidationentries affecting profits pursuant to § 306of the HGB, a uniform Group-wideaverage rate of taxation has been applied.<strong>The</strong> calculation of deferred taxationfor individual financial statementshas been effected on the basis of taxrates applying for individual companies.VI. Other Statutory Disclosures inAccordance with § 314 of the HGBand Explanatory Notes to VariousItems in the Consolidated BalanceSheet and Consolidated Profit andLoss Account1. Other Financial Commitments<strong>The</strong> expenses arising from rental, tenancyand leasing contracts amountedto 34.1 million euros in 2008 and areexpected to be at a similar level inthe next two financial years. <strong>The</strong>se expensesare spread over the entire Groupworldwide and relate to contracts withvarious terms of duration. Order obligationsfor investments in tangiblefixed assets amount to 17.3 million (9.1million euros in previous year).2. Profit and Loss AccountGroup Sales (including sales tax)Breakdown by 2007 2008Region millions 1 millions 1Germany 461.1 459.9Europe 832.2 910.7North America 405.9 385.3Rest of world 77.7 75.8Total 1,776.9 1,831.7Group sales divided according to businesssegment are shown in the GroupManagement <strong>Report</strong>.3. Present Value of DerivativeFinancial InstrumentsTo hedge against currency risks, the <strong>Vorwerk</strong>Group uses exchange rate futuresand options as well as interest rate swapsboth in its operative business activitiesas well as in the area of foreign currencyfinancing. <strong>The</strong> present value of a derivativefinancial instrument is the price atwhich a party would acquire the rightsand/or obligations entailed in this financialinstrument from another party. <strong>The</strong>book and present values of the financialinstruments of the <strong>Vorwerk</strong> Group arereported as follows:Derivative Financial Instrumentsin 1 000a) Currency options b) Exchange futuresc) Interest rate swapsNominal value Book value Present value31. 12. 08a) 27,725 0 5,206b) 43,264 -193 43,773c) 86,654 0 -2,411valuation on closing date. <strong>The</strong> presentvalues of exchange rate futures are determinedaccording to the closing rateas of balance sheet date, taking forwarddiscounts and premiums into account.<strong>The</strong> present values of currency optionsare assessed on the basis of optionprice models pursuant to Black &Scholes. <strong>The</strong> present values of interestrate hedging instruments (interest rateswaps) are determined on the basisof discounted, anticipated future cashflows, whereby the current market interestrates for the remaining term ofthe financial instruments are applied.4. Other InformationAverage annual staffing level2007 2008Employees* 22,570 22,255Sales SystemAdvisers 543,415 555,718Kobold 9,736 9,335<strong>The</strong>rmomix 16,361 18,569Feelina 280 152JAFRA Cosmetics 515,151 525,863Lux Asia Pacific 1,887 1,799*Including employed sales advisersManagement at the parent company<strong>Vorwerk</strong> & Co. KG is in the hands of theManaging Partners Peter Oberegger,Düsseldorf and Walter Muyres, Jüchen.Wuppertal, 15 April 2009Provisions for threatening losses of0.2 million euros have been formed tocover eventualities in exchange ratefuture transactions. <strong>The</strong> nominal valueof the derivative financial instrumentsis determined using the exchange ratePeter ObereggerWalter Muyres48