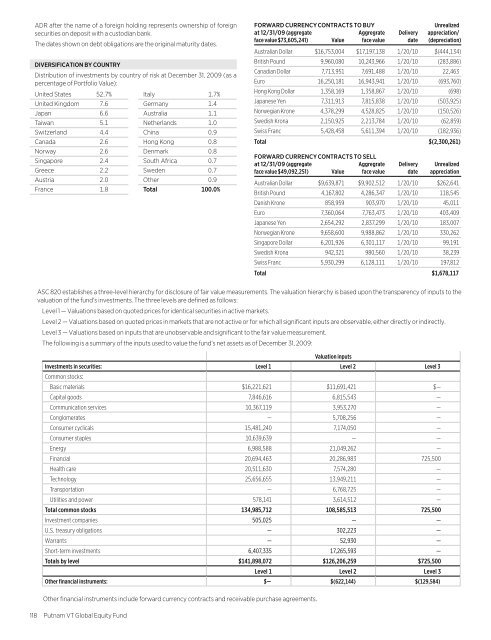

ADR after the name of a foreign holding represents ownership of foreignsecurities on deposit with a custodian bank.The dates shown on debt obligations are the original maturity dates.DIVERSIFICATION BY COUNTRYDistribution of investments by country of risk at December 31, 2009 (as apercentage of Portfolio Value):United States 52.7%United Kingdom 7.6Japan 6.6Taiwan 5.1Switzerland 4.4Canada 2.6Norway 2.6Singapore 2.4Greece 2.2Austria 2.0France 1.8Italy 1.7%Germany 1.4Australia 1.1Netherlands 1.0China 0.9Hong Kong 0.8Denmark 0.8South Africa 0.7Sweden 0.7Other 0.9Total 100.0%FORWARD CURRENCY CONTRACTS TO BUYUnrealizedat 12/31/09 (aggregate Aggregrate Delivery appreciation/face value $73,605,241) Value face value date (depreciation)Australian Dollar $16,753,004 $17,197,138 1/20/10 $(444,134)British Pound 9,960,080 10,243,966 1/20/10 (283,886)Canadian Dollar 7,713,951 7,691,488 1/20/10 22,463Euro 16,250,181 16,943,941 1/20/10 (693,760)Hong Kong Dollar 1,358,169 1,358,867 1/20/10 (698)Japanese Yen 7,311,913 7,815,838 1/20/10 (503,925)Norwegian Krone 4,378,299 4,528,825 1/20/10 (150,526)Swedish Krona 2,150,925 2,213,784 1/20/10 (62,859)Swiss Franc 5,428,458 5,611,394 1/20/10 (182,936)Total $(2,300,261)FORWARD CURRENCY CONTRACTS TO SELLat 12/31/09 (aggregate Aggregrate Delivery Unrealizedface value $49,092,251) Value face value date appreciationAustralian Dollar $9,639,871 $9,902,512 1/20/10 $262,641British Pound 4,167,802 4,286,347 1/20/10 118,545Danish Krone 858,959 903,970 1/20/10 45,011Euro 7,360,064 7,763,473 1/20/10 403,409Japanese Yen 2,654,292 2,837,299 1/20/10 183,007Norwegian Krone 9,658,600 9,988,862 1/20/10 330,262Singapore Dollar 6,201,926 6,301,117 1/20/10 99,191Swedish Krona 942,321 980,560 1/20/10 38,239Swiss Franc 5,930,299 6,128,111 1/20/10 197,812Total $1,678,117ASC 820 establishes a three-level hierarchy for disclosure of fair value measurements. The valuation hierarchy is based upon the transparency of inputs to thevaluation of the fund’s investments. The three levels are defined as follows:Level 1 — Valuations based on quoted prices for identical securities in active markets.Level 2 — Valuations based on quoted prices in markets that are not active or for which all significant inputs are observable, either directly or indirectly.Level 3 — Valuations based on inputs that are unobservable and significant to the fair value measurement.The following is a summary of the inputs used to value the fund’s net assets as of December 31, 2009:Valuation inputs<strong>Investments</strong> in securities: Level 1 Level 2 Level 3Common stocks:Basic materials $16,221,621 $11,691,421 $—Capital goods 7,846,616 6,815,543 —Communication services 10,367,119 3,953,270 —Conglomerates — 5,708,256 —Consumer cyclicals 15,481,240 7,174,050 —Consumer staples 10,639,639 — —Energy 6,988,588 21,049,262 —Financial 20,694,463 20,286,983 725,500Health care 20,511,630 7,574,280 —Technology 25,656,655 13,949,211 —Transportation — 6,768,725 —Utilities and power 578,141 3,614,512 —Total common stocks 134,985,712 108,585,513 725,500Investment companies 505,025 — —U.S. treasury obligations — 302,223 —Warrants — 52,930 —Short-term investments 6,407,335 17,265,593 —Totals by level $141,898,072 $126,206,259 $725,500Level 1 Level 2 Level 3Other financial instruments: $— $(622,144) $(129,584)Other financial instruments include forward currency contracts and receivable purchase agreements.118 <strong>Putnam</strong> VT Global Equity Fund

The following is a reconciliation of Level 3 assets as of December 31, 2009:<strong>Investments</strong> in securities:Common stocks:Balance as ofDecember 31,2008Accrueddiscounts/premiumsRealizedgain/(loss)Change in netunrealizedappreciation/(depreciation)Net purchases/salesNet transfers inand/or out ofLevel 3Balance as ofDecember 31,2009Financial $565,308 $— $(479,126) $697,976 $(58,658) $— $725,500Total common stocks $565,308 — (479,126) 697,976 (58,658) — $725,500Totals: $565,308 $— $(479,126) $697,976 $(58,658) $— $725,500Balance as ofDecember 31,2008 ††Accrueddiscounts/premiumsRealizedgain/(loss)Change in netunrealizedappreciation/(depreciation) †Net purchases/salesNet transfers inand/or out ofLevel 3Balance as ofDecember 31,2009 ††Other financial instruments: $(145,285) $— $— $15,701 $— $— $(129,584)† Includes $15,701 related to Level 3 securities still held at period end. Total change in unrealized appreciation/(depreciation) for securities (includingLevel 1 and Level 2) can be found in the Statement of operations.†† Includes amount payable under receivable purchase agreement.The accompanying notes are an integral part of these financial statements.<strong>Putnam</strong> VT Global Equity Fund 119

- Page 1 and 2:

PutnamVariable Trust12 | 31 | 09Ann

- Page 3 and 4:

Message from the TrusteesDear Fello

- Page 5:

This page intentionally left blank.

- Page 8 and 9:

The fund’s portfolio 12/31/09MORT

- Page 10 and 11:

MORTGAGE-BACKED SECURITIES (33.2%)*

- Page 12 and 13:

At December 31, 2009, liquid assets

- Page 14 and 15:

INTEREST RATE SWAP CONTRACTS OUTSTA

- Page 16 and 17:

Statement of changes in net assetsP

- Page 18 and 19:

Putnam VT Capital Opportunities Fun

- Page 20 and 21:

The fund’s portfolio 12/31/09COMM

- Page 22 and 23:

COMMON STOCKS (98.4%)* cont. Shares

- Page 24 and 25:

ASC 820 establishes a three-level h

- Page 26 and 27:

Statement of changes in net assetsP

- Page 28 and 29:

Putnam VT Diversified Income FundIn

- Page 30 and 31:

The fund’s portfolio 12/31/09MORT

- Page 32 and 33:

MORTGAGE-BACKED SECURITIES (51.1%)*

- Page 34 and 35:

MORTGAGE-BACKED SECURITIES (51.1%)*

- Page 36 and 37:

CORPORATE BONDS AND NOTES (19.1%)*

- Page 38 and 39:

CORPORATE BONDS AND NOTES (19.1%)*

- Page 40 and 41:

ASSET-BACKED SECURITIES (8.0%)* con

- Page 42 and 43:

SENIOR LOANS (3.1%)* c Principal am

- Page 44 and 45:

CONVERTIBLE BONDS AND NOTES (0.4%)*

- Page 46 and 47:

WRITTEN OPTIONSExpirationOUTSTANDIN

- Page 48 and 49:

INTEREST RATE SWAP CONTRACTS OUTSTA

- Page 50 and 51:

CREDIT DEFAULT CONTRACTS OUTSTANDIN

- Page 52 and 53:

The following is a reconciliation o

- Page 54 and 55:

Statement of changes in net assetsP

- Page 56 and 57:

Putnam VT Equity Income FundInvestm

- Page 58 and 59:

The fund’s portfolio 12/31/09COMM

- Page 60 and 61:

Key to holding’s abbreviationsADR

- Page 62 and 63:

Statement of changes in net assetsP

- Page 64 and 65:

Putnam VT The George Putnam Fund of

- Page 66 and 67:

The fund’s portfolio 12/31/09COMM

- Page 68 and 69:

CORPORATE BONDS AND NOTES (11.5%)*

- Page 70 and 71: CORPORATE BONDS AND NOTES (11.5%)*

- Page 72 and 73: MORTGAGE-BACKED SECURITIES (4.7%)*

- Page 74 and 75: ASSET-BACKED SECURITIES (1.2%)* con

- Page 76 and 77: Statement of assets and liabilities

- Page 78 and 79: Financial highlights (For a common

- Page 80 and 81: Putnam VT Global Asset Allocation F

- Page 82 and 83: The fund’s portfolio 12/31/09COMM

- Page 84 and 85: COMMON STOCKS (48.8%)* cont. Shares

- Page 86 and 87: COMMON STOCKS (48.8%)* cont. Shares

- Page 88 and 89: COMMON STOCKS (48.8%)* cont. Shares

- Page 90 and 91: COMMON STOCKS (48.8%)* cont. Shares

- Page 92 and 93: MORTGAGE-BACKED SECURITIES (14.4%)*

- Page 94 and 95: MORTGAGE-BACKED SECURITIES (14.4%)*

- Page 96 and 97: U.S. GOVERNMENT AND AGENCYMORTGAGE

- Page 98 and 99: CORPORATE BONDS AND NOTES (13.4%)*

- Page 100 and 101: CORPORATE BONDS AND NOTES (13.4%)*

- Page 102 and 103: CORPORATE BONDS AND NOTES (13.4%)*

- Page 104 and 105: ASSET-BACKED SECURITIES (2.9%)* con

- Page 106 and 107: e See Note 6 to the financial state

- Page 108 and 109: WRITTEN OPTIONSExpirationOUTSTANDIN

- Page 110 and 111: CREDIT DEFAULT CONTRACTS OUTSTANDIN

- Page 112 and 113: The following is a reconciliation o

- Page 114 and 115: Statement of changes in net assetsP

- Page 116 and 117: Putnam VT Global Equity FundInvestm

- Page 118 and 119: The fund’s portfolio 12/31/09COMM

- Page 122 and 123: Statement of assets and liabilities

- Page 124 and 125: Financial highlights (For a common

- Page 126 and 127: Putnam VT Global Health Care Fund*I

- Page 128 and 129: The fund’s portfolio 12/31/09COMM

- Page 130 and 131: Statement of assets and liabilities

- Page 132 and 133: Financial highlights (For a common

- Page 134 and 135: Putnam VT Global Utilities Fund*Inv

- Page 136 and 137: The fund’s portfolio 12/31/09COMM

- Page 138 and 139: Statement of assets and liabilities

- Page 140 and 141: Financial highlights (For a common

- Page 142 and 143: Putnam VT Growth and Income FundInv

- Page 144 and 145: The fund’s portfolio 12/31/09COMM

- Page 146 and 147: COMMON STOCKS (97.2%)* cont. Shares

- Page 148 and 149: Statement of assets and liabilities

- Page 150 and 151: Financial highlights (For a common

- Page 152 and 153: Putnam VT Growth Opportunities Fund

- Page 154 and 155: The fund’s portfolio 12/31/09COMM

- Page 156 and 157: ASC 820 establishes a three-level h

- Page 158 and 159: Statement of changes in net assetsP

- Page 160 and 161: Putnam VT High Yield FundInvestment

- Page 162 and 163: The fund’s portfolio 12/31/09CORP

- Page 164 and 165: CORPORATE BONDS AND NOTES (82.6%)*

- Page 166 and 167: CORPORATE BONDS AND NOTES (82.6%)*

- Page 168 and 169: CORPORATE BONDS AND NOTES (82.6%)*

- Page 170 and 171:

SENIOR LOANS (7.6%)* c cont. Princi

- Page 172 and 173:

CREDIT DEFAULT CONTRACTS OUTSTANDIN

- Page 174 and 175:

Statement of assets and liabilities

- Page 176 and 177:

Financial highlights (For a common

- Page 178 and 179:

Putnam VT Income FundInvestment obj

- Page 180 and 181:

The fund’s portfolio 12/31/09MORT

- Page 182 and 183:

MORTGAGE-BACKED SECURITIES (51.2%)*

- Page 184 and 185:

MORTGAGE-BACKED SECURITIES (51.2%)*

- Page 186 and 187:

CORPORATE BONDS AND NOTES (25.3%)*

- Page 188 and 189:

CORPORATE BONDS AND NOTES (25.3%)*

- Page 190 and 191:

CORPORATE BONDS AND NOTES (25.3%)*

- Page 192 and 193:

PURCHASED OPTIONS Expiration date/

- Page 194 and 195:

WRITTEN OPTIONSExpirationOUTSTANDIN

- Page 196 and 197:

INTEREST RATE SWAP CONTRACTS OUTSTA

- Page 198 and 199:

Statement of assets and liabilities

- Page 200 and 201:

Financial highlights (For a common

- Page 202 and 203:

Putnam VT International Equity Fund

- Page 204 and 205:

The fund’s portfolio 12/31/09COMM

- Page 206 and 207:

ASC 820, Fair Value Measurements an

- Page 208 and 209:

Statement of changes in net assetsP

- Page 210 and 211:

Putnam VT International Growth Fund

- Page 212 and 213:

The fund’s portfolio 12/31/09COMM

- Page 214 and 215:

SHORT-TERM INVESTMENTS (4.2%)* Prin

- Page 216 and 217:

Statement of assets and liabilities

- Page 218 and 219:

Financial highlights (For a common

- Page 220 and 221:

Putnam VT International Value Fund*

- Page 222 and 223:

The fund’s portfolio 12/31/09COMM

- Page 224 and 225:

FORWARD CURRENCY CONTRACTS TO BUYUn

- Page 226 and 227:

Statement of assets and liabilities

- Page 228 and 229:

Financial highlights (For a common

- Page 230 and 231:

Putnam VT Investors FundInvestment

- Page 232 and 233:

The fund’s portfolio 12/31/09COMM

- Page 234 and 235:

COMMON STOCKS (98.9%)* cont. Shares

- Page 236 and 237:

Statement of assets and liabilities

- Page 238 and 239:

Putnam VT Mid Cap Value FundInvestm

- Page 240 and 241:

The fund’s portfolio 12/31/09COMM

- Page 242 and 243:

ASC 820, Fair Value Measurements an

- Page 244 and 245:

Statement of changes in net assetsP

- Page 246 and 247:

Putnam VT Money Market FundInvestme

- Page 248 and 249:

The fund’s portfolio 12/31/09U.S.

- Page 250 and 251:

REPURCHASE AGREEMENTS (3.2%)* Princ

- Page 252 and 253:

Statement of changes in net assetsP

- Page 254 and 255:

Putnam VT New Opportunities FundInv

- Page 256 and 257:

The fund’s portfolio 12/31/09COMM

- Page 258 and 259:

COMMON STOCKS (98.9%)* cont. Shares

- Page 260 and 261:

Statement of assets and liabilities

- Page 262 and 263:

Financial highlights (For a common

- Page 264 and 265:

Putnam VT Research FundInvestment o

- Page 266 and 267:

The fund’s portfolio 12/31/09COMM

- Page 268 and 269:

COMMON STOCKS (96.7%)* cont. Shares

- Page 270 and 271:

Statement of assets and liabilities

- Page 272 and 273:

Financial highlights (For a common

- Page 274 and 275:

Putnam VT Small Cap Value FundInves

- Page 276 and 277:

The fund’s portfolio 12/31/09COMM

- Page 278 and 279:

COMMON STOCKS (97.7%)* cont. Shares

- Page 280 and 281:

Statement of assets and liabilities

- Page 282 and 283:

Financial highlights (For a common

- Page 284 and 285:

Putnam VT Vista FundInvestment obje

- Page 286 and 287:

The fund’s portfolio 12/31/09COMM

- Page 288 and 289:

ASC 820, Fair Value Measurement and

- Page 290 and 291:

Statement of changes in net assetsP

- Page 292 and 293:

Putnam VT Voyager FundInvestment ob

- Page 294 and 295:

The fund’s portfolio 12/31/09COMM

- Page 296 and 297:

COMMON STOCKS (92.8%)* cont. Shares

- Page 298 and 299:

Statement of assets and liabilities

- Page 300 and 301:

Financial highlights (For a common

- Page 302 and 303:

Notes to financial statements 12/31

- Page 304 and 305:

time it was opened and the value at

- Page 306 and 307:

applicable to regulated investment

- Page 308 and 309:

Fund nameUndistributed net investme

- Page 310 and 311:

Fund namePutnam VT Global Asset All

- Page 312 and 313:

Fund nameAmount seller soldto the f

- Page 314 and 315:

Fund nameCurrencyof contractamounts

- Page 316 and 317:

Putnam VT Growth and Income FundCla

- Page 318 and 319:

Putnam VT Voyager FundClass IA shar

- Page 320 and 321:

Fund nameDerivatives not accountedf

- Page 322 and 323:

Fund name Income distributions earn

- Page 324 and 325:

Federal tax information (Unaudited)

- Page 326 and 327:

Trustee approval of management cont

- Page 328 and 329:

fee schedules in effect for the fun

- Page 330 and 331:

Putnam Small & Mid—Cap Equity Fun

- Page 332 and 333:

management of the funds. In this re

- Page 334 and 335:

Trustees of the Putnam Funds 12/31/

- Page 336 and 337:

Robert E. Patterson (Born 1945)Trus

- Page 338 and 339:

Officers of the Putnam Funds 12/31/

- Page 340:

PRESORTEDSTANDARDU.S. POSTAGEPAIDLA