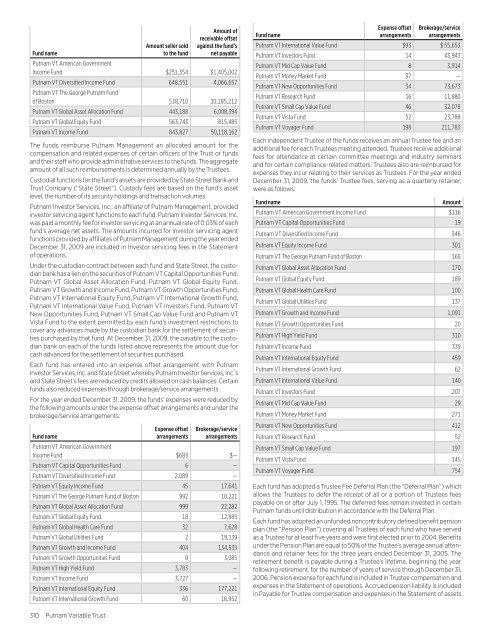

Fund nameAmount seller soldto the fundAmount ofreceivable offsetagainst the fund’snet payable<strong>Putnam</strong> VT American GovernmentIncome Fund $251,354 $1,405,002<strong>Putnam</strong> VT Diversified Income Fund 648,551 4,066,657<strong>Putnam</strong> VT The George <strong>Putnam</strong> Fundof Boston 538,710 10,185,212<strong>Putnam</strong> VT Global Asset Allocation Fund 443,188 6,008,394<strong>Putnam</strong> VT Global Equity Fund 563,743 815,485<strong>Putnam</strong> VT Income Fund 843,827 50,118,162The funds reimburse <strong>Putnam</strong> Management an allocated amount for thecompensation and related expenses of certain officers of the Trust or fundsand their staff who provide administrative services to the funds. The aggregateamount of all such reimbursements is determined <strong>annual</strong>ly by the Trustees.Custodial functions for the fund’s assets are provided by State Street Bank andTrust Company (“State Street”). Custody fees are based on the fund’s assetlevel, the number of its security holdings and transaction volumes.<strong>Putnam</strong> Investor Services, Inc., an affiliate of <strong>Putnam</strong> Management, providedinvestor servicing agent functions to each fund. <strong>Putnam</strong> Investor Services, Inc.was paid a monthly fee for investor servicing at an <strong>annual</strong> rate of 0.03% of eachfund’s average net assets. The amounts incurred for investor servicing agentfunctions provided by affiliates of <strong>Putnam</strong> Management during the year endedDecember 31, 2009 are included in Investor servicing fees in the Statementof operations.Under the custodian contract between each fund and State Street, the custodianbank has a lien on the securities of <strong>Putnam</strong> VT Capital Opportunities Fund,<strong>Putnam</strong> VT Global Asset Allocation Fund, <strong>Putnam</strong> VT Global Equity Fund,<strong>Putnam</strong> VT Growth and Income Fund, <strong>Putnam</strong> VT Growth Opportunities Fund,<strong>Putnam</strong> VT International Equity Fund, <strong>Putnam</strong> VT International Growth Fund,<strong>Putnam</strong> VT International Value Fund, <strong>Putnam</strong> VT Investors Fund, <strong>Putnam</strong> VTNew Opportunities Fund, <strong>Putnam</strong> VT Small Cap Value Fund and <strong>Putnam</strong> VTVista Fund to the extent permitted by each fund’s investment restrictions tocover any advances made by the custodian bank for the settlement of securitiespurchased by that fund. At December 31, 2009, the payable to the custodianbank on each of the funds listed above represents the amount due forcash advanced for the settlement of securities purchased.Each fund has entered into an expense offset arrangement with <strong>Putnam</strong>Investor Services, Inc. and State Street whereby <strong>Putnam</strong> Investor Services, Inc.’sand State Street’s fees are reduced by credits allowed on cash balances. Certainfunds also reduced expenses through brokerage/service arrangements.For the year ended December 31, 2009, the funds’ expenses were reduced bythe following amounts under the expense offset arrangements and under thebrokerage/service arrangements:Fund nameExpense offsetarrangementsBrokerage/servicearrangements<strong>Putnam</strong> VT American GovernmentIncome Fund $683 $—<strong>Putnam</strong> VT Capital Opportunities Fund 6 —<strong>Putnam</strong> VT Diversified Income Fund 2,089 —<strong>Putnam</strong> VT Equity Income Fund 45 17,641<strong>Putnam</strong> VT The George <strong>Putnam</strong> Fund of Boston 992 10,221<strong>Putnam</strong> VT Global Asset Allocation Fund 999 22,282<strong>Putnam</strong> VT Global Equity Fund 18 12,885<strong>Putnam</strong> VT Global Health Care Fund 32 7,628<strong>Putnam</strong> VT Global Utilities Fund 2 19,139<strong>Putnam</strong> VT Growth and Income Fund 404 134,535<strong>Putnam</strong> VT Growth Opportunities Fund 9 3,085<strong>Putnam</strong> VT High Yield Fund 3,783 —<strong>Putnam</strong> VT Income Fund 3,727 —<strong>Putnam</strong> VT International Equity Fund 336 177,221<strong>Putnam</strong> VT International Growth Fund 60 16,952Fund nameExpense offsetarrangementsBrokerage/servicearrangements<strong>Putnam</strong> VT International Value Fund $93 $ 55,653<strong>Putnam</strong> VT Investors Fund 14 43,943<strong>Putnam</strong> VT Mid Cap Value Fund 8 3,914<strong>Putnam</strong> VT Money Market Fund 37 —<strong>Putnam</strong> VT New Opportunities Fund 34 73,673<strong>Putnam</strong> VT Research Fund 16 11,880<strong>Putnam</strong> VT Small Cap Value Fund 46 32,078<strong>Putnam</strong> VT Vista Fund 52 23,788<strong>Putnam</strong> VT Voyager Fund 198 211,783Each independent Trustee of the funds receives an <strong>annual</strong> Trustee fee and anadditional fee for each Trustees meeting attended. Trustees receive additionalfees for attendance at certain committee meetings and industry seminarsand for certain compliance-related matters. Trustees also are reimbursed forexpenses they incur relating to their services as Trustees. For the year endedDecember 31, 2009, the funds’ Trustee fees, serving as a quarterly retainer,were as follows:Fund nameAmount<strong>Putnam</strong> VT American Government Income Fund $116<strong>Putnam</strong> VT Capital Opportunities Fund 19<strong>Putnam</strong> VT Diversified Income Fund 346<strong>Putnam</strong> VT Equity Income Fund 301<strong>Putnam</strong> VT The George <strong>Putnam</strong> Fund of Boston 165<strong>Putnam</strong> VT Global Asset Allocation Fund 170<strong>Putnam</strong> VT Global Equity Fund 189<strong>Putnam</strong> VT Global Health Care Fund 100<strong>Putnam</strong> VT Global Utilities Fund 137<strong>Putnam</strong> VT Growth and Income Fund 1,091<strong>Putnam</strong> VT Growth Opportunities Fund 20<strong>Putnam</strong> VT High Yield Fund 310<strong>Putnam</strong> VT Income Fund 339<strong>Putnam</strong> VT International Equity Fund 459<strong>Putnam</strong> VT International Growth Fund 62<strong>Putnam</strong> VT International Value Fund 140<strong>Putnam</strong> VT Investors Fund 207<strong>Putnam</strong> VT Mid Cap Value Fund 29<strong>Putnam</strong> VT Money Market Fund 271<strong>Putnam</strong> VT New Opportunities Fund 412<strong>Putnam</strong> VT Research Fund 52<strong>Putnam</strong> VT Small Cap Value Fund 197<strong>Putnam</strong> VT Vista Fund 145<strong>Putnam</strong> VT Voyager Fund 754Each fund has adopted a Trustee Fee Deferral Plan (the “Deferral Plan”) whichallows the Trustees to defer the receipt of all or a portion of Trustees feespayable on or after July 1, 1995. The deferred fees remain invested in certain<strong>Putnam</strong> funds until distribution in accordance with the Deferral Plan.Each fund has adopted an unfunded noncontributory defined benefit pensionplan (the “Pension Plan”) covering all Trustees of each fund who have servedas a Trustee for at least five years and were first elected prior to 2004. Benefitsunder the Pension Plan are equal to 50% of the Trustee’s average <strong>annual</strong> attendanceand retainer fees for the three years ended December 31, 2005. Theretirement benefit is payable during a Trustee’s lifetime, beginning the yearfollowing retirement, for the number of years of service through December 31,2006. Pension expense for each fund is included in Trustee compensation andexpenses in the Statement of operations. Accrued pension liability is includedin Payable for Trustee compensation and expenses in the Statement of assets310 <strong>Putnam</strong> Variable Trust

and liabilities. The Trustees have terminated the Pension Plan with respect toany Trustee first elected after 2003.Each fund has adopted a distribution plan (the “Plan”) with respect to itsclass IB shares pursuant to Rule 12b-1 under the Investment Company Act of1940. The purpose of the Plan is to compensate <strong>Putnam</strong> Retail ManagementLimited Partnership, a wholly-owned subsidiary of <strong>Putnam</strong> <strong>Investments</strong>, LLCand <strong>Putnam</strong> Retail Management GP, Inc., for services provided and expensesincurred in distributing shares of each fund. The Plan provides for paymentby each fund to <strong>Putnam</strong> Retail Management Limited Partnership at an <strong>annual</strong>rate of up to 0.35% of the average net assets attributable to that fund’s class IBshares. The Trustees have approved payment by each fund at an <strong>annual</strong> rateof 0.25% of the average net assets attributable to that fund’s class IB shares.Note 3 — Purchases and sales of securitiesDuring the year ended December 31, 2009, cost of purchases and proceeds from sales of investment securities (other than short-term investments) were as follows:U.S. Government securitiesOther securitiesFund name Purchases Sales Purchases Sales<strong>Putnam</strong> VT American Government Income Fund $3,627,660 $3,685,530 $260,877,803 $274,540,127<strong>Putnam</strong> VT Capital Opportunities Fund — — 10,021,862 11,864,980<strong>Putnam</strong> VT Diversified Income Fund — — 717,745,342 605,762,031<strong>Putnam</strong> VT Equity Income Fund — — 368,939,674 405,372,428<strong>Putnam</strong> VT The George <strong>Putnam</strong> Fund of Boston 23,050,121 8,390,384 433,443,259 477,224,288<strong>Putnam</strong> VT Global Asset Allocation Fund — — 316,089,396 340,330,934<strong>Putnam</strong> VT Global Equity Fund — — 228,761,353 263,456,849<strong>Putnam</strong> VT Global Health Care Fund — — 40,590,246 57,169,669<strong>Putnam</strong> VT Global Utilities Fund — — 96,339,166 121,540,745<strong>Putnam</strong> VT Growth and Income Fund — — 715,777,893 924,629,170<strong>Putnam</strong> VT Growth Opportunities Fund — — 41,517,816 42,338,553<strong>Putnam</strong> VT High Yield Fund — — 236,750,902 221,419,183<strong>Putnam</strong> VT Income Fund — — 1,062,633,838 1,101,422,978<strong>Putnam</strong> VT International Equity Fund — — 596,751,815 681,278,218<strong>Putnam</strong> VT International Growth Fund — — 142,027,665 190,660,108<strong>Putnam</strong> VT International Value Fund — — 209,940,147 236,211,981<strong>Putnam</strong> VT Investors Fund — — 310,417,794 348,549,686<strong>Putnam</strong> VT Mid Cap Value Fund — — 41,760,449 45,178,407<strong>Putnam</strong> VT New Opportunities Fund — — 325,234,494 400,252,880<strong>Putnam</strong> VT Research Fund — — 82,996,681 92,229,719<strong>Putnam</strong> VT Small Cap Value Fund — — 201,994,955 227,827,625<strong>Putnam</strong> VT Vista Fund — — 438,485,676 466,680,435<strong>Putnam</strong> VT Voyager Fund — — 1,680,125,779 1,736,740,940<strong>Putnam</strong> VT Money Market Fund: Cost of purchases and proceeds from sales (including maturities) of investment securities (all short-term obligations) aggregated$4,009,158,409 and $4,112,807,364, respectively.For the year ended December 31, 2009, <strong>Putnam</strong> VT International Growth Fund had a redemption-in-kind which resulted in redemptions out of the fund totaling$42,010,086, including cash redemptions of $1,891,403.Written option transactions for those funds that invested in them during the year ended December 31, 2009 are summarized as follows:Fund nameCurrencyof contractamountsWritten optionsoutstandingat beginning ofyearOptionsopenedOptionsexercisedOptionsexpiredOptionsclosedWritten optionsoutstandingat end of year<strong>Putnam</strong> VT American GovernmentIncome Fund Contract amounts USD 94,158,000 151,886,800 (18,232,000) (18,232,000) — 209,580,800Premiums received $3,468,572 $8,883,208 $(555,165) $(555,165) $— $11,241,450<strong>Putnam</strong> VT Diversified Income Fund Contract amounts USD 142,237,000 495,876,800 (47,455,000) (47,455,000) — 543,203,800Contract amounts EUR — 33,410,000 — — (33,410,000) —Total contractamounts 142,237,000 529,286,800 (47,455,000) (47,455,000) (33,410,000) 543,203,800Premiums received $6,087,691 $29,780,246 $(2,135,475) $(2,135,475) $— $31,596,987Premiums received $— $1,446,374 $— $— $(1,446,374) $—Total premiumsreceived $6,087,691 $31,226,620 $(2,135,475) $(2,135,475) $(1,446,374) $31,596,987<strong>Putnam</strong> VT The George <strong>Putnam</strong> Fundof Boston Contract amounts USD 71,688,000 — — — (71,688,000) —Premiums received $3,404,934 $— $— $— $(3,404,934) $—<strong>Putnam</strong> Variable Trust 311

- Page 1 and 2:

PutnamVariable Trust12 | 31 | 09Ann

- Page 3 and 4:

Message from the TrusteesDear Fello

- Page 5:

This page intentionally left blank.

- Page 8 and 9:

The fund’s portfolio 12/31/09MORT

- Page 10 and 11:

MORTGAGE-BACKED SECURITIES (33.2%)*

- Page 12 and 13:

At December 31, 2009, liquid assets

- Page 14 and 15:

INTEREST RATE SWAP CONTRACTS OUTSTA

- Page 16 and 17:

Statement of changes in net assetsP

- Page 18 and 19:

Putnam VT Capital Opportunities Fun

- Page 20 and 21:

The fund’s portfolio 12/31/09COMM

- Page 22 and 23:

COMMON STOCKS (98.4%)* cont. Shares

- Page 24 and 25:

ASC 820 establishes a three-level h

- Page 26 and 27:

Statement of changes in net assetsP

- Page 28 and 29:

Putnam VT Diversified Income FundIn

- Page 30 and 31:

The fund’s portfolio 12/31/09MORT

- Page 32 and 33:

MORTGAGE-BACKED SECURITIES (51.1%)*

- Page 34 and 35:

MORTGAGE-BACKED SECURITIES (51.1%)*

- Page 36 and 37:

CORPORATE BONDS AND NOTES (19.1%)*

- Page 38 and 39:

CORPORATE BONDS AND NOTES (19.1%)*

- Page 40 and 41:

ASSET-BACKED SECURITIES (8.0%)* con

- Page 42 and 43:

SENIOR LOANS (3.1%)* c Principal am

- Page 44 and 45:

CONVERTIBLE BONDS AND NOTES (0.4%)*

- Page 46 and 47:

WRITTEN OPTIONSExpirationOUTSTANDIN

- Page 48 and 49:

INTEREST RATE SWAP CONTRACTS OUTSTA

- Page 50 and 51:

CREDIT DEFAULT CONTRACTS OUTSTANDIN

- Page 52 and 53:

The following is a reconciliation o

- Page 54 and 55:

Statement of changes in net assetsP

- Page 56 and 57:

Putnam VT Equity Income FundInvestm

- Page 58 and 59:

The fund’s portfolio 12/31/09COMM

- Page 60 and 61:

Key to holding’s abbreviationsADR

- Page 62 and 63:

Statement of changes in net assetsP

- Page 64 and 65:

Putnam VT The George Putnam Fund of

- Page 66 and 67:

The fund’s portfolio 12/31/09COMM

- Page 68 and 69:

CORPORATE BONDS AND NOTES (11.5%)*

- Page 70 and 71:

CORPORATE BONDS AND NOTES (11.5%)*

- Page 72 and 73:

MORTGAGE-BACKED SECURITIES (4.7%)*

- Page 74 and 75:

ASSET-BACKED SECURITIES (1.2%)* con

- Page 76 and 77:

Statement of assets and liabilities

- Page 78 and 79:

Financial highlights (For a common

- Page 80 and 81:

Putnam VT Global Asset Allocation F

- Page 82 and 83:

The fund’s portfolio 12/31/09COMM

- Page 84 and 85:

COMMON STOCKS (48.8%)* cont. Shares

- Page 86 and 87:

COMMON STOCKS (48.8%)* cont. Shares

- Page 88 and 89:

COMMON STOCKS (48.8%)* cont. Shares

- Page 90 and 91:

COMMON STOCKS (48.8%)* cont. Shares

- Page 92 and 93:

MORTGAGE-BACKED SECURITIES (14.4%)*

- Page 94 and 95:

MORTGAGE-BACKED SECURITIES (14.4%)*

- Page 96 and 97:

U.S. GOVERNMENT AND AGENCYMORTGAGE

- Page 98 and 99:

CORPORATE BONDS AND NOTES (13.4%)*

- Page 100 and 101:

CORPORATE BONDS AND NOTES (13.4%)*

- Page 102 and 103:

CORPORATE BONDS AND NOTES (13.4%)*

- Page 104 and 105:

ASSET-BACKED SECURITIES (2.9%)* con

- Page 106 and 107:

e See Note 6 to the financial state

- Page 108 and 109:

WRITTEN OPTIONSExpirationOUTSTANDIN

- Page 110 and 111:

CREDIT DEFAULT CONTRACTS OUTSTANDIN

- Page 112 and 113:

The following is a reconciliation o

- Page 114 and 115:

Statement of changes in net assetsP

- Page 116 and 117:

Putnam VT Global Equity FundInvestm

- Page 118 and 119:

The fund’s portfolio 12/31/09COMM

- Page 120 and 121:

ADR after the name of a foreign hol

- Page 122 and 123:

Statement of assets and liabilities

- Page 124 and 125:

Financial highlights (For a common

- Page 126 and 127:

Putnam VT Global Health Care Fund*I

- Page 128 and 129:

The fund’s portfolio 12/31/09COMM

- Page 130 and 131:

Statement of assets and liabilities

- Page 132 and 133:

Financial highlights (For a common

- Page 134 and 135:

Putnam VT Global Utilities Fund*Inv

- Page 136 and 137:

The fund’s portfolio 12/31/09COMM

- Page 138 and 139:

Statement of assets and liabilities

- Page 140 and 141:

Financial highlights (For a common

- Page 142 and 143:

Putnam VT Growth and Income FundInv

- Page 144 and 145:

The fund’s portfolio 12/31/09COMM

- Page 146 and 147:

COMMON STOCKS (97.2%)* cont. Shares

- Page 148 and 149:

Statement of assets and liabilities

- Page 150 and 151:

Financial highlights (For a common

- Page 152 and 153:

Putnam VT Growth Opportunities Fund

- Page 154 and 155:

The fund’s portfolio 12/31/09COMM

- Page 156 and 157:

ASC 820 establishes a three-level h

- Page 158 and 159:

Statement of changes in net assetsP

- Page 160 and 161:

Putnam VT High Yield FundInvestment

- Page 162 and 163:

The fund’s portfolio 12/31/09CORP

- Page 164 and 165:

CORPORATE BONDS AND NOTES (82.6%)*

- Page 166 and 167:

CORPORATE BONDS AND NOTES (82.6%)*

- Page 168 and 169:

CORPORATE BONDS AND NOTES (82.6%)*

- Page 170 and 171:

SENIOR LOANS (7.6%)* c cont. Princi

- Page 172 and 173:

CREDIT DEFAULT CONTRACTS OUTSTANDIN

- Page 174 and 175:

Statement of assets and liabilities

- Page 176 and 177:

Financial highlights (For a common

- Page 178 and 179:

Putnam VT Income FundInvestment obj

- Page 180 and 181:

The fund’s portfolio 12/31/09MORT

- Page 182 and 183:

MORTGAGE-BACKED SECURITIES (51.2%)*

- Page 184 and 185:

MORTGAGE-BACKED SECURITIES (51.2%)*

- Page 186 and 187:

CORPORATE BONDS AND NOTES (25.3%)*

- Page 188 and 189:

CORPORATE BONDS AND NOTES (25.3%)*

- Page 190 and 191:

CORPORATE BONDS AND NOTES (25.3%)*

- Page 192 and 193:

PURCHASED OPTIONS Expiration date/

- Page 194 and 195:

WRITTEN OPTIONSExpirationOUTSTANDIN

- Page 196 and 197:

INTEREST RATE SWAP CONTRACTS OUTSTA

- Page 198 and 199:

Statement of assets and liabilities

- Page 200 and 201:

Financial highlights (For a common

- Page 202 and 203:

Putnam VT International Equity Fund

- Page 204 and 205:

The fund’s portfolio 12/31/09COMM

- Page 206 and 207:

ASC 820, Fair Value Measurements an

- Page 208 and 209:

Statement of changes in net assetsP

- Page 210 and 211:

Putnam VT International Growth Fund

- Page 212 and 213:

The fund’s portfolio 12/31/09COMM

- Page 214 and 215:

SHORT-TERM INVESTMENTS (4.2%)* Prin

- Page 216 and 217:

Statement of assets and liabilities

- Page 218 and 219:

Financial highlights (For a common

- Page 220 and 221:

Putnam VT International Value Fund*

- Page 222 and 223:

The fund’s portfolio 12/31/09COMM

- Page 224 and 225:

FORWARD CURRENCY CONTRACTS TO BUYUn

- Page 226 and 227:

Statement of assets and liabilities

- Page 228 and 229:

Financial highlights (For a common

- Page 230 and 231:

Putnam VT Investors FundInvestment

- Page 232 and 233:

The fund’s portfolio 12/31/09COMM

- Page 234 and 235:

COMMON STOCKS (98.9%)* cont. Shares

- Page 236 and 237:

Statement of assets and liabilities

- Page 238 and 239:

Putnam VT Mid Cap Value FundInvestm

- Page 240 and 241:

The fund’s portfolio 12/31/09COMM

- Page 242 and 243:

ASC 820, Fair Value Measurements an

- Page 244 and 245:

Statement of changes in net assetsP

- Page 246 and 247:

Putnam VT Money Market FundInvestme

- Page 248 and 249:

The fund’s portfolio 12/31/09U.S.

- Page 250 and 251:

REPURCHASE AGREEMENTS (3.2%)* Princ

- Page 252 and 253:

Statement of changes in net assetsP

- Page 254 and 255:

Putnam VT New Opportunities FundInv

- Page 256 and 257:

The fund’s portfolio 12/31/09COMM

- Page 258 and 259:

COMMON STOCKS (98.9%)* cont. Shares

- Page 260 and 261:

Statement of assets and liabilities

- Page 262 and 263: Financial highlights (For a common

- Page 264 and 265: Putnam VT Research FundInvestment o

- Page 266 and 267: The fund’s portfolio 12/31/09COMM

- Page 268 and 269: COMMON STOCKS (96.7%)* cont. Shares

- Page 270 and 271: Statement of assets and liabilities

- Page 272 and 273: Financial highlights (For a common

- Page 274 and 275: Putnam VT Small Cap Value FundInves

- Page 276 and 277: The fund’s portfolio 12/31/09COMM

- Page 278 and 279: COMMON STOCKS (97.7%)* cont. Shares

- Page 280 and 281: Statement of assets and liabilities

- Page 282 and 283: Financial highlights (For a common

- Page 284 and 285: Putnam VT Vista FundInvestment obje

- Page 286 and 287: The fund’s portfolio 12/31/09COMM

- Page 288 and 289: ASC 820, Fair Value Measurement and

- Page 290 and 291: Statement of changes in net assetsP

- Page 292 and 293: Putnam VT Voyager FundInvestment ob

- Page 294 and 295: The fund’s portfolio 12/31/09COMM

- Page 296 and 297: COMMON STOCKS (92.8%)* cont. Shares

- Page 298 and 299: Statement of assets and liabilities

- Page 300 and 301: Financial highlights (For a common

- Page 302 and 303: Notes to financial statements 12/31

- Page 304 and 305: time it was opened and the value at

- Page 306 and 307: applicable to regulated investment

- Page 308 and 309: Fund nameUndistributed net investme

- Page 310 and 311: Fund namePutnam VT Global Asset All

- Page 314 and 315: Fund nameCurrencyof contractamounts

- Page 316 and 317: Putnam VT Growth and Income FundCla

- Page 318 and 319: Putnam VT Voyager FundClass IA shar

- Page 320 and 321: Fund nameDerivatives not accountedf

- Page 322 and 323: Fund name Income distributions earn

- Page 324 and 325: Federal tax information (Unaudited)

- Page 326 and 327: Trustee approval of management cont

- Page 328 and 329: fee schedules in effect for the fun

- Page 330 and 331: Putnam Small & Mid—Cap Equity Fun

- Page 332 and 333: management of the funds. In this re

- Page 334 and 335: Trustees of the Putnam Funds 12/31/

- Page 336 and 337: Robert E. Patterson (Born 1945)Trus

- Page 338 and 339: Officers of the Putnam Funds 12/31/

- Page 340: PRESORTEDSTANDARDU.S. POSTAGEPAIDLA