SME POLICY SERIES 2 : SME Exchanges in India - Federation of ...

SME POLICY SERIES 2 : SME Exchanges in India - Federation of ...

SME POLICY SERIES 2 : SME Exchanges in India - Federation of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

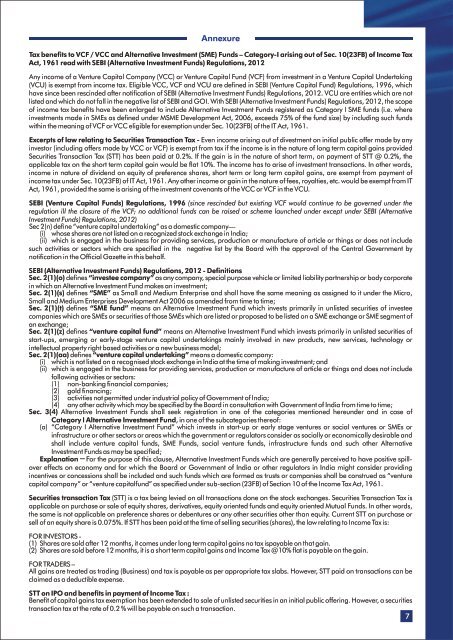

AnnexureTax benefits to VCF / VCC and Alternative Investment (<strong>SME</strong>) Funds – Category-I aris<strong>in</strong>g out <strong>of</strong> Sec. 10(23FB) <strong>of</strong> Income TaxAct, 1961 read with SEBI (Alternative Investment Funds) Regulations, 2012Any <strong>in</strong>come <strong>of</strong> a Venture Capital Company (VCC) or Venture Capital Fund (VCF) from <strong>in</strong>vestment <strong>in</strong> a Venture Capital Undertak<strong>in</strong>g(VCU) is exempt from <strong>in</strong>come tax. Eligible VCC, VCF and VCU are def<strong>in</strong>ed <strong>in</strong> SEBI (Venture Capital Fund) Regulations, 1996, whichhave s<strong>in</strong>ce been resc<strong>in</strong>ded after notification <strong>of</strong> SEBI (Alternative Investment Funds) Regulations, 2012. VCU are entities which are notlisted and which do not fall <strong>in</strong> the negative list <strong>of</strong> SEBI and GOI. With SEBI (Alternative Investment Funds) Regulations, 2012, the scope<strong>of</strong> <strong>in</strong>come tax benefits have been enlarged to <strong>in</strong>clude Alternative Investment Funds registered as Category I <strong>SME</strong> funds (i.e. where<strong>in</strong>vestments made <strong>in</strong> <strong>SME</strong>s as def<strong>in</strong>ed under M<strong>SME</strong> Development Act, 2006, exceeds 75% <strong>of</strong> the fund size) by <strong>in</strong>clud<strong>in</strong>g such fundswith<strong>in</strong> the mean<strong>in</strong>g <strong>of</strong> VCF or VCC eligible for exemption under Sec. 10(23FB) <strong>of</strong> the IT Act, 1961.Excerpts <strong>of</strong> law relat<strong>in</strong>g to Securities Transaction Tax - Even <strong>in</strong>come aris<strong>in</strong>g out <strong>of</strong> divestment on <strong>in</strong>itial public <strong>of</strong>fer made by any<strong>in</strong>vestor (<strong>in</strong>clud<strong>in</strong>g <strong>of</strong>fers made by VCC or VCF) is exempt from tax if the <strong>in</strong>come is <strong>in</strong> the nature <strong>of</strong> long term capital ga<strong>in</strong>s providedSecurities Transaction Tax (STT) has been paid at 0.2%. If the ga<strong>in</strong> is <strong>in</strong> the nature <strong>of</strong> short term, on payment <strong>of</strong> STT @ 0.2%, theapplicable tax on the short term capital ga<strong>in</strong> would be flat 10%. The <strong>in</strong>come has to arise <strong>of</strong> <strong>in</strong>vestment transactions. In other words,<strong>in</strong>come <strong>in</strong> nature <strong>of</strong> dividend on equity <strong>of</strong> preference shares, short term or long term capital ga<strong>in</strong>s, are exempt from payment <strong>of</strong><strong>in</strong>come tax under Sec. 10(23FB) <strong>of</strong> IT Act, 1961. Any other <strong>in</strong>come or ga<strong>in</strong> <strong>in</strong> the nature <strong>of</strong> fees, royalties, etc. would be exempt from ITAct, 1961, provided the same is aris<strong>in</strong>g <strong>of</strong> the <strong>in</strong>vestment covenants <strong>of</strong> the VCC or VCF <strong>in</strong> the VCU.SEBI (Venture Capital Funds) Regulations, 1996 (s<strong>in</strong>ce resc<strong>in</strong>ded but exist<strong>in</strong>g VCF would cont<strong>in</strong>ue to be governed under theregulation ill the closure <strong>of</strong> the VCF; no additional funds can be raised or scheme launched under except under SEBI (AlternativeInvestment Funds) Regulations, 2012)Sec 2(n) def<strong>in</strong>e “venture capital undertak<strong>in</strong>g” as a domestic company—(i) whose shares are not listed on a recognized stock exchange <strong>in</strong> <strong>India</strong>;(ii) which is engaged <strong>in</strong> the bus<strong>in</strong>ess for provid<strong>in</strong>g services, production or manufacture <strong>of</strong> article or th<strong>in</strong>gs or does not <strong>in</strong>cludesuch activities or sectors which are specified <strong>in</strong> the negative list by the Board with the approval <strong>of</strong> the Central Government bynotification <strong>in</strong> the Official Gazette <strong>in</strong> this behalf.SEBI (Alternative Investment Funds) Regulations, 2012 - Def<strong>in</strong>itionsSec. 2(1)(o) def<strong>in</strong>es “<strong>in</strong>vestee company” as any company, special purpose vehicle or limited liability partnership or body corporate<strong>in</strong> which an Alternative Investment Fund makes an <strong>in</strong>vestment;Sec. 2(1)(s) def<strong>in</strong>es “<strong>SME</strong>” as Small and Medium Enterprise and shall have the same mean<strong>in</strong>g as assigned to it under the Micro,Small and Medium Enterprises Development Act 2006 as amended from time to time;Sec. 2(1)(t) def<strong>in</strong>es “<strong>SME</strong> fund” means an Alternative Investment Fund which <strong>in</strong>vests primarily <strong>in</strong> unlisted securities <strong>of</strong> <strong>in</strong>vesteecompanies which are <strong>SME</strong>s or securities <strong>of</strong> those <strong>SME</strong>s which are listed or proposed to be listed on a <strong>SME</strong> exchange or <strong>SME</strong> segment <strong>of</strong>an exchange;Sec. 2(1)(z) def<strong>in</strong>es “venture capital fund” means an Alternative Investment Fund which <strong>in</strong>vests primarily <strong>in</strong> unlisted securities <strong>of</strong>start-ups, emerg<strong>in</strong>g or early-stage venture capital undertak<strong>in</strong>gs ma<strong>in</strong>ly <strong>in</strong>volved <strong>in</strong> new products, new services, technology or<strong>in</strong>tellectual property right based activities or a new bus<strong>in</strong>ess model;Sec. 2(1)(aa) def<strong>in</strong>es “venture capital undertak<strong>in</strong>g” means a domestic company:(i) which is not listed on a recognised stock exchange <strong>in</strong> <strong>India</strong> at the time <strong>of</strong> mak<strong>in</strong>g <strong>in</strong>vestment; and(ii) which is engaged <strong>in</strong> the bus<strong>in</strong>ess for provid<strong>in</strong>g services, production or manufacture <strong>of</strong> article or th<strong>in</strong>gs and does not <strong>in</strong>cludefollow<strong>in</strong>g activities or sectors:(1) non-bank<strong>in</strong>g f<strong>in</strong>ancial companies;(2) gold f<strong>in</strong>anc<strong>in</strong>g;(3) activities not permitted under <strong>in</strong>dustrial policy <strong>of</strong> Government <strong>of</strong> <strong>India</strong>;(4) any other activity which may be specified by the Board <strong>in</strong> consultation with Government <strong>of</strong> <strong>India</strong> from time to time;Sec. 3(4) Alternative Investment Funds shall seek registration <strong>in</strong> one <strong>of</strong> the categories mentioned hereunder and <strong>in</strong> case <strong>of</strong>Category I Alternative Investment Fund, <strong>in</strong> one <strong>of</strong> the subcategories there<strong>of</strong>:(a) “Category I Alternative Investment Fund” which <strong>in</strong>vests <strong>in</strong> start-up or early stage ventures or social ventures or <strong>SME</strong>s or<strong>in</strong>frastructure or other sectors or areas which the government or regulators consider as socially or economically desirable andshall <strong>in</strong>clude venture capital funds, <strong>SME</strong> Funds, social venture funds, <strong>in</strong>frastructure funds and such other AlternativeInvestment Funds as may be specified;Explanation ─ For the purpose <strong>of</strong> this clause, Alternative Investment Funds which are generally perceived to have positive spillovereffects on economy and for which the Board or Government <strong>of</strong> <strong>India</strong> or other regulators <strong>in</strong> <strong>India</strong> might consider provid<strong>in</strong>g<strong>in</strong>centives or concessions shall be <strong>in</strong>cluded and such funds which are formed as trusts or companies shall be construed as “venturecapital company” or “venture capitalfund” as specified under sub-section (23FB) <strong>of</strong> Section 10 <strong>of</strong> the Income Tax Act, 1961.Securities transaction Tax (STT) is a tax be<strong>in</strong>g levied on all transactions done on the stock exchanges. Securities Transaction Tax isapplicable on purchase or sale <strong>of</strong> equity shares, derivatives, equity oriented funds and equity oriented Mutual Funds. In other words,the same is not applicable on preference shares or debentures or any other securities other than equity. Current STT on purchase orsell <strong>of</strong> an equity share is 0.075%. If STT has been paid at the time <strong>of</strong> sell<strong>in</strong>g securities (shares), the law relat<strong>in</strong>g to Income Tax is:FOR INVESTORS -(1) Shares are sold after 12 months, it comes under long term capital ga<strong>in</strong>s no tax ispayable on that ga<strong>in</strong>.(2) Shares are sold before 12 months, it is a short term capital ga<strong>in</strong>s and Income Tax @10% flat is payable on the ga<strong>in</strong>.FOR TRADERS –All ga<strong>in</strong>s are treated as trad<strong>in</strong>g (Bus<strong>in</strong>ess) and tax is payable as per appropriate tax slabs. However, STT paid on transactions can beclaimed as a deductible expense.STT on IPO and benefits <strong>in</strong> payment <strong>of</strong> Income Tax :Benefit <strong>of</strong> capital ga<strong>in</strong>s tax exemption has been extended to sale <strong>of</strong> unlisted securities <strong>in</strong> an <strong>in</strong>itial public <strong>of</strong>fer<strong>in</strong>g. However, a securitiestransaction tax at the rate <strong>of</strong> 0.2 % will be payable on such a transaction.7