Application Form - Rrfinance.com

Application Form - Rrfinance.com

Application Form - Rrfinance.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

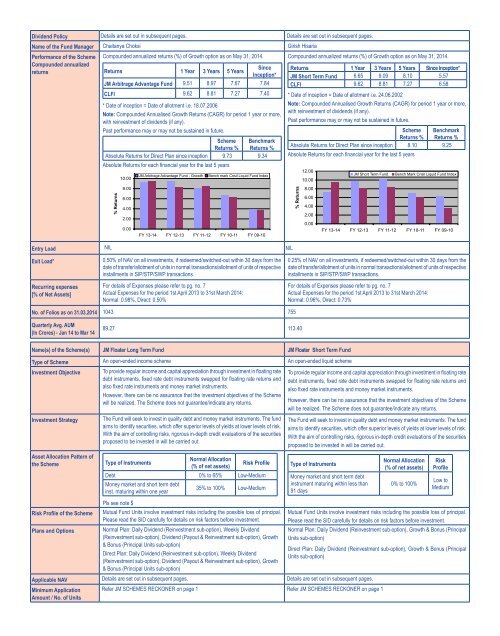

Dividend Policy Details are set out in subsequent pages. Details are set out in subsequent pages.Name of the Fund Manager Chaitanya Choksi Girish HisariaPerformance of the SchemeCompounded annualizedreturnsCompounded annualized returns (%) of Growth option as on May 31, 2014.Returns 1 Year 3 Years 5 YearsSinceInception*JM Arbitrage Advantage Fund 9.51 8.97 7.67 7.84CLFI 9.62 8.81 7.27 7.40* Date of inception = Date of allotment i.e. 18.07.2006Note: Compounded Annualised Growth Returns (CAGR) for period 1 year or more,with reinvestment of dividends (if any).Past performance may or may not be sustained in future.Scheme BenchmarkReturns % Returns %Absolute Returns for Direct Plan since inception 9.73 9.34Absolute Returns for each financial year for the last 5 yearsCompounded annualized returns (%) of Growth option as on May 31, 2014.Returns 1 Year 3 Years 5 Years Since Inception*JM Short Term Fund 6.65 9.09 8.10 5.57CLFI 9.62 8.81 7.27 6.58* Date of inception = Date of allotment i.e. 24.06.2002Note: Compounded Annualised Growth Returns (CAGR) for period 1 year or more,with reinvestment of dividends (if any).Past performance may or may not be sustained in future.Scheme BenchmarkReturns % Returns %Absolute Returns for Direct Plan since inception 8.10 9.25Absolute Returns for each financial year for the last 5 yearsEntry Load NIL NILExit Load*Recurring expenses[% of Net Assets]0.50% of NAV on all investments, if redeemed/switched-out within 30 days from thedate of transfer/allotment of units in normal transactions/allotment of units of respectiveinstallments in SIP/STP/SWP transactions.For details of Expenses please refer to pg. no. 7Actual Expenses for the period 1st April 2013 to 31st March 2014:Normal: 0.98%, Direct: 0.50%0.25% of NAV on all investments, if redeemed/switched-out within 30 days from thedate of transfer/allotment of units in normal transactions/allotment of units of respectiveinstallments in SIP/STP/SWP transactions.For details of Expenses please refer to pg. no. 7Actual Expenses for the period 1st April 2013 to 31st March 2014:Normal: 0.96%, Direct: 0.73%No. of Folios as on 31.03.2014 1043 755Quarterly Avg. AUM(In Crores) - Jan 14 to Mar 1489.27 113.40Name(s) of the Scheme(s) JM Floater Long Term Fund JM Floater Short Term FundType of Scheme An open-ended in<strong>com</strong>e scheme An open-ended liquid schemeInvestment ObjectiveInvestment StrategyAsset Allocation Pattern ofthe SchemeTo provide regular in<strong>com</strong>e and capital appreciation through investment in floating ratedebt instruments, fixed rate debt instruments swapped for floating rate returns andalso fixed rate instruments and money market instruments.However, there can be no assurance that the investment objectives of the Schemewill be realized. The Scheme does not guarantee/indicate any returns.The Fund will seek to invest in quality debt and money market instruments. The fundaims to identify securities, which offer superior levels of yields at lower levels of risk.With the aim of controlling risks, rigorous in-depth credit evaluations of the securitiesproposed to be invested in will be carried out.Type of InstrumentsNormal Allocation(% of net assets)Risk ProfileDebt 0% to 65% Low-MediumMoney market and short term debtinst. maturing within one year35% to 100% Low-MediumTo provide regular in<strong>com</strong>e and capital appreciation through investment in floating ratedebt instruments, fixed rate debt instruments swapped for floating rate returns andalso fixed rate instruments and money market instruments.However, there can be no assurance that the investment objectives of the Schemewill be realized. The Scheme does not guarantee/indicate any returns.The Fund will seek to invest in quality debt and money market instruments. The fundaims to identify securities, which offer superior levels of yields at lower levels of risk.With the aim of controlling risks, rigorous in-depth credit evaluations of the securitiesproposed to be invested in will be carried out.Type of InstrumentsMoney market and short term debtinstrument maturing within less than91 daysPls see note $Risk Profile of the Scheme Mutual Fund Units involve investment risks including the possible loss of principal.Please read the SID carefully for details on risk factors before investment.Plans and OptionsNormal Plan: Daily Dividend (Reinvestment sub-option), Weekly Dividend(Reinvestment sub-option), Dividend (Payout & Reinvestment sub-option), Growth& Bonus (Principal Units sub-option)Direct Plan: Daily Dividend (Reinvestment sub-option), Weekly Dividend(Reinvestment sub-option), Dividend (Payout & Reinvestment sub-option), Growth& Bonus (Principal Units sub-option)Applicable NAV Details are set out in subsequent pages. Details are set out in subsequent pages.Minimum <strong>Application</strong> Refer JM SCHEMES RECKONER on page 1 Refer JM SCHEMES RECKONER on page 1Amount / No. of UnitsNormal Allocation(% of net assets)0% to 100%RiskProfileLow toMediumMutual Fund Units involve investment risks including the possible loss of principal.Please read the SID carefully for details on risk factors before investment.Normal Plan: Daily Dividend (Reinvestment sub-option), Growth & Bonus (PrincipalUnits sub-option)Direct Plan: Daily Dividend (Reinvestment sub-option), Growth & Bonus (PrincipalUnits sub-option)