Application Form - Rrfinance.com

Application Form - Rrfinance.com

Application Form - Rrfinance.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

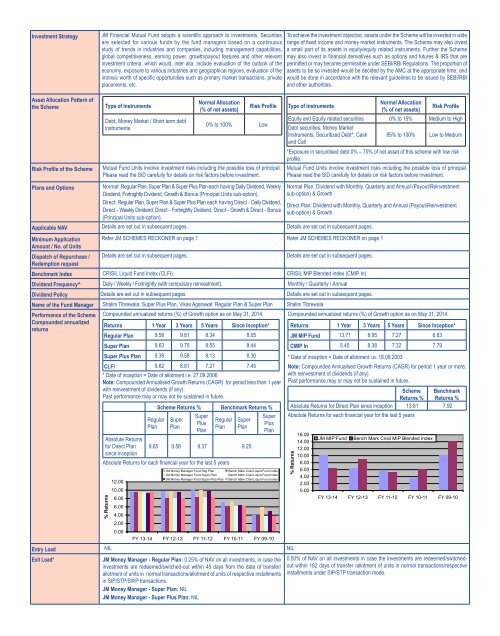

Investment StrategyJM Financial Mutual Fund adopts a scientific approach to investments. Securitiesare selected for various funds by the fund managers based on a continuousstudy of trends in industries and <strong>com</strong>panies, including management capabilities,global <strong>com</strong>petitiveness, earning power, growth/payout features and other relevantinvestment criteria, which would, inter alia, include evaluation of the outlook of theeconomy, exposure to various industries and geographical regions, evaluation of theintrinsic worth of specific opportunities such as primary market transactions, privateplacements, etc.To achieve the investment objective, assets under the Scheme will be invested in widerange of fixed in<strong>com</strong>e and money market instruments. The Scheme may also investa small part of its assets in equity/equity related instruments. Further the Schememay also invest in financial derivatives such as options and futures & IRS that arepermitted or may be<strong>com</strong>e permissible under SEBI/RBI Regulations. The proportion ofassets to be so invested would be decided by the AMC at the appropriate time, andwould be done in accordance with the relevant guidelines to be issued by SEBI/RBIand other authorities.Asset Allocation Pattern ofthe SchemeRisk Profile of the SchemePlans and OptionsType of InstrumentsDebt, Money Market / Short term debtinstrumentsNormal Allocation(% of net assets)Risk Profile0% to 100% LowMutual Fund Units involve investment risks including the possible loss of principal.Please read the SID carefully for details on risk factors before investment.Normal: Regular Plan, Super Plan & Super Plus Plan each having Daily Dividend, WeeklyDividend, Fortnightly Dividend, Growth & Bonus (Principal Units sub-option).Direct: Regular Plan, Super Plan & Super Plus Plan each having Direct - Daily Dividend,Direct - Weekly Dividend, Direct - Fortnightly Dividend, Direct - Growth & Direct - Bonus(Principal Units sub-option).Type of InstrumentsNormal Allocation(% of net assets)Risk ProfileEquity and Equity related securities 0% to 15% Medium to HighDebt securities, Money MarketInstruments, Securitized Debt*, Cash 85% to 100% Low to Mediumand Call*Exposure in securitised debt 0% – 70% of net asset of this scheme with low riskprofile.Mutual Fund Units involve investment risks including the possible loss of principal.Please read the SID carefully for details on risk factors before investment.Normal Plan: Dividend with Monthly, Quarterly and Annual (Payout/Reinvestmentsub-option) & GrowthDirect Plan: Dividend with Monthly, Quarterly and Annual (Payout/Reinvestmentsub-option) & GrowthApplicable NAV Details are set out in subsequent pages. Details are set out in subsequent pages.Minimum <strong>Application</strong> Refer JM SCHEMES RECKONER on page 1 Refer JM SCHEMES RECKONER on page 1Amount / No. of UnitsDispatch of Repurchase / Details are set out in subsequent pages.Details are set out in subsequent pages.Redemption requestBenchmark Index CRISIL Liquid Fund Index (CLFI) CRISIL MIP Blended Index (CMIP In)Dividend Frequency^ Daily / Weekly / Fortnightly (with <strong>com</strong>pulsory reinvestment). Monthly / Quarterly / AnnualDividend Policy Details are set out in subsequent pages. Details are set out in subsequent pages.Name of the Fund Manager Shalini Tibrewala: Super Plus Plan, Vikas Agarawal: Regular Plan & Super Plan Shalini TibrewalaPerformance of the Scheme Compounded annualized returns (%) of Growth option as on May 31, 2014.Compounded annualized returns (%) of Growth option as on May 31, 2014.Compounded annualizedreturnsReturns 1 Year 3 Years 5 Years Since Inception* Returns 1 Year 3 Years 5 Years Since Inception*Regular Plan 9.56 9.81 8.34 8.05JM MIP Fund 13.71 8.95 7.27 6.63Super Plan 9.63 9.75 8.55 8.44Super Plus Plan 9.39 9.58 8.13 8.30CLFI 9.62 8.81 7.27 7.45* Date of inception = Date of allotment i.e. 27.09.2006Note: Compounded Annualised Growth Returns (CAGR) for period less than 1 yearwith reinvestment of dividends (if any).Past performance may or may not be sustained in future.RegularPlanScheme Returns % Benchmark Returns %SuperPlanSuperPlusPlanRegularPlanSuperPlanAbsolute Returnsfor Direct Plan 9.65 9.58 9.37 9.25since inceptionAbsolute Returns for each financial year for the last 5 yearsSuperPlusPlanCMIP In 5.45 8.38 7.32 7.79* Date of inception = Date of allotment i.e. 18.09.2003Note: Compounded Annualised Growth Returns (CAGR) for period 1 year or more,with reinvestment of dividends (if any).Past performance may or may not be sustained in future.Scheme BenchmarkReturns % Returns %Absolute Returns for Direct Plan since inception 13.81 7.92Absolute Returns for each financial year for the last 5 yearsEntry Load NIL NILExit Load*JM Money Manager - Regular Plan: 0.25% of NAV on all investments, in case theinvestments are redeemed/switched-out within 45 days from the date of transfer/allotment of units in normal transactions/allotment of units of respective installmentsin SIP/STP/SWP transactions.JM Money Manager - Super Plan: NILJM Money Manager - Super Plus Plan: NIL0.50% of NAV on all investments in case the investments are redeemed/switchedoutwithin 182 days of transfer /allotment of units in normal transactions/respectiveinstallments under SIP/STP transaction mode.