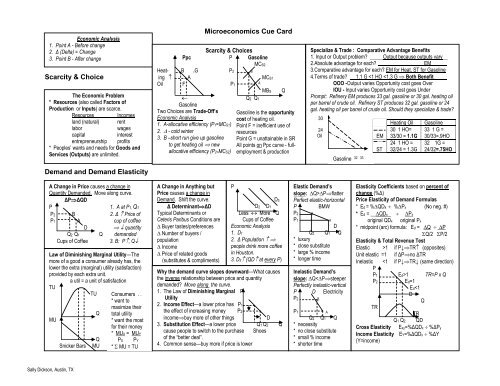

Microeconomics Cue Card - the Educator Login page!

Microeconomics Cue Card - the Educator Login page!

Microeconomics Cue Card - the Educator Login page!

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Supply & Supply ElasticityA Change in Price causes a change in QuantitySupplied. Move along curve.ΔPΔQSEco AnalysisP S 1. A at P1, QS1P2 B 2. Δ Price ofP1 A cup of coffee QuantityQ1 Q2 Q suppliedCups of Coffee3. B: P2, QS2A Change in Anything butPrice causes a change inSupply. Shift <strong>the</strong> curve.Δ DeterminantΔSTypical Determinants orCeteris Paribus conditions resource (factor) prices technology or technique taxes/subsidies price of o<strong>the</strong>r goods production substitution Price expectations Number of sellersP S2 S1S3QLess MoreCups of CoffeeEconomic Analysis1. S12. Δ Starbucks opensmore stores# sellers3. S3 (QS at every P)Elasticity of supply No TR test--Slope of CurveP S* Immediately P2Inelastic supply P1Vertical or steepQ1&2 Q* Short RunMore elastic due to P Sfirm´s intense use of P2fixed resources P1(upslopiing)Q1 Q2 Q* Long RunAll resources canchangeElastic supplyHorizontal, flatThe key determinant of price elasticityof supply is <strong>the</strong> amount of time a sellerhas to change <strong>the</strong> amount of <strong>the</strong> good<strong>the</strong>y can produce (or supply).Price Elasticity Coefficient of Supplybased on % of change, not slopePP1,2Q1 Q2ES = %ΔQSx / %ΔPxSQSupply / Demand Equilibrium – Product Markets (Industry)PP2P1AEfficiency Loss = Dead Weight Loss Govt. taxes or regulations or monopoly powerreduce consumer and/or producer surpluses below society’s allocative efficiency.Government Price FloorPS=MCSPf f Floor -Pe e WheatBQ1 Q2D1QD Qe QSEco Analysis1. Before--PeQegiPod’sD=MBSQAmountof surplus2. Change – Govt. sets pricefloor to help farmers at Pf.3. After—OS>QD Surplusof wheat & efficiency loss area―efg‖SD2QEco Analysis1. A--P1, Q12. Δ greaterpopularity (Δpreferences)D3. B--P2,Q2Government Price CeilingPS=MCSPePccQD Qe QSEco Analysis1. Before–PeQedePP1P2ApartmentsCeilingD=MBSQShortageamount2. Change – Govt. sets apt.price ceiling to help poor.3. After – QD>QSApartment shortage &efficiency loss area ―cde‖ABQ1 Q2S1DiPod’sS2QEco Analysis1. A—P1, Q12. Δ—faster,smaller chips(Δ technology)S3. B--P↓, QExcise Taxes and Tax Incidence(Who really pays <strong>the</strong> tax depends onelasticity of supply and of demand.)PS2P2P1PsellerB tax Surplus / ShortageDisequilibriumPriceS$20 Excess Quantity SuppliedQS>QD = Surplus$15 Equilibrium Price=MarketPrice QS=QD$10 Excess Quantity DemandedD QD>QS = ShortageQD Qe QSMusic CD’sAmount ofEconomic Analysissurplus1. Before change - $15/CD, quantity at Qe2. Change: Seller raises price to $20 on new hit CD3. After change – Surplus because QS > QD at <strong>the</strong>higher priceS1Cons.TaxD A CosmeticsProd. TaxDAnalysis Q2 Q1 Q1. A-- No tax at equilibrium P1 , Q12. Δ --Govt. taxes cosmeticsperunit costsS↓ (excise–business tax)3. B – P2, Q2 : Consumer tax=(P2-P1)Q2; Producer tax=(P1-Pseller)Q2;Efficiency Loss area ―D‖Tariff=import tax=customs dutyPrice S USTextilesPUSnotradePW+TariffPWorldD TT DDQ1 Q2 Q3 Q4 Q5 Q1. Before--Pw+Tariff., produces Q2 , hasefficiency loss areas ―D‖, gets tariffrevenues areas ―T‖,and imports Q2 to Q4.2. Change—WTO treaty requires US toremove tariffs3. After – P↓(US pays PWorld ), Q↓(domestically producing to Q1); M (USimports Q1 – Q5)Consumer & Producer Surplus** Consumers’ surplus is <strong>the</strong> differencebetween that paid (Pe) and what one wouldhave paid based on utility (Phi)P(Area ―e,Phi,Pe‖)Phi CSSPePlo PSQuota – limit on <strong>the</strong> quantity of importsPriceS1PUS no tradePUS+quotaPWorldeDQeQ(Area ―e,Plo,Pe‖)** Producers’ surplus is <strong>the</strong> difference in <strong>the</strong>price charged (Pe) and <strong>the</strong> price a sellercould sell for based on costs (Plo).D PP DS2S3DUS Steel Q1 Q2 Q3 Q4 Q5 Q1. Before – US pays PUS+quota,produces Q2 , has efficiency loss areas―D‖, import producer gets extra profits―P‖, and <strong>the</strong> US imports Q2 to Q4.2. Change – WTO outlaws quotas3. After – P↓ (US pays PWorld ), QUS↓(domestically producing to Q1),M ( US imports Q1 – Q5)Sally Dickson, Austin, TX

Law of Diminishing Returns—As extraunits of a variable resource/input (labor) areadded to fixed resources (capital,land),output (product, quantity) will decline atTPsome point.TP 1) If TP,MP2) If TP LessDiminishing,1 2 3MP↓ to 0MPQ3) If TP↓,Labor1 2 3MP QMPNegative.Fixed inputs-Short run onlyShort Run Production Costs—TC=FC+VCATC=AFC+AVCTCCost FC VCCostAVCTCAFCVCFCQATCAVCAFCTC/Q=ATCVC/Q=AVCFC/Q=AFCFixed costscan’t changein <strong>the</strong> shortrun.Variable costscan change in<strong>the</strong> short run.Marginal Costs: MC is <strong>the</strong> cost of producingone more unit of output.MC crossesCostsATC andAVC atMC <strong>the</strong>ir lowestpoints.ATCAVCNorelationshipbetweenMC andAFCQMC at lowest point whenMarginal Product (MP) is at itshighest point. These curves are mirror images.Long Run ATC – All resources variable, none fixedATCEconomies Constant Diseconomiesof Scale Returns of Scale LR ATCto Scaleq1 q2 OutputEconomies of Scale due to labor & managerialspecialization, efficient capitalper unit costs↓Constant Returns to Scaleper unit costs constantDiseconomies of Scale due to inefficiencies fromlarge, impersonal bureaucracyper unit costsPerfect Competition – The FirmCharacteristics**Very largenumber of firms**Standardizedproducts**Price takers**Easy entry intoand easy exit frommarket**No non-pricecompetition(advertising)**Ex: AgricultureMonopoly – THEORY OF FIRMCharacteristics**One firm=industry**Unique productwith no closesubstitutes**Price maker**Many barriers,entry blocked**Little advertisingexcept for publicrelations**Ex: local utilities,patented drugsProfit Maximization RuleMR=MCp P=MC ATCMCp e MR=dATCEconomic profitfFirm q q*p=MR=d=AR for firm*q where MR=MC*economic profits area(p,e,f,ATC)Why Demand andMR aren’t <strong>the</strong> same:MRAVCpMCATCATC e AVCpLoss fMR=dFirm q q*p=MR=d=AR for firm*q where MR=MC*loss area (ATC,e,f,p)--pricebelow ATC & above AVC*Fixed costs are covered(space between ATC & AVC).Profit Maximizing RuleMR=MCP/CMCPm e ATCATCProfitsfMR=MCQm MR Q**Qm where MR=MC**Pm where Qm intersects D**Eco Profit = (Pm-ATC)Qmor Economic Profit=TR-TC**Efficiency loss (e, f, MR=MC)DppShut Down DecisionP MC Pc=MCpm A MC ATC Eli Lily producespcBProzacDqm qc QMR1. A P1, Q1 – Monopoly with profits, efficiency loss2. Δ The patent protecting Prozac runs out ando<strong>the</strong>r firms now produce <strong>the</strong> generic drug competition firm becomes price taker3. B ↓pc, qcSally Dickson, Austin, TX

Monopolistic Competition – Theory of <strong>the</strong> FirmCharacteristics**Many firms**Differentiatedprojects**Limited controlover price**Not many barriersto entry**Much non-pricecompetition—manyads, brand names**Ex: retail trade,clothing,restaurantsResource (Factor, Input) Markets* Resource marketdemand derived from<strong>the</strong> product market.* MPxP=MRPL=DLThe Δ TR from eachadded unit of resource* Wages=MRCL=SLThe Δ TC from eachadded unit* Profit Max Rule:MRPL=MRCL or(mrp’s=DL) = SLMonopolistically Competitive firm reaches Long Run EquilibriumP P/C MCS1 p1 A ATCDemandfairly elastic.S2ProfitsATC1 _ _ _ _ _ _ _ _ _ _ _P1 A p2BP2 B MR1MR2Industry Q1 Q2 Q Firm q2 q1 q1. A Industry at equilibrium P1, Q1 Firm earning eco profits (p1>ATC)2. Δ New firms enter industry, S firm’s d↓ b/c more close substitutesand a smaller share of total demand MR↓3. B Industry ↓P2,Q2; Firm in Long Run Equilibrium at ↓p2=ATC, ↓q2Pure Competition Labor MarketW Market W FirmW2 B SL2 SL1 W2 B s2=MRC2W1 A W1 A s1=MRC1DLdL=MRPAnalysis Q2Q1 Q q2 q1 labor q1. A Firm is wage taker at W1, q12. Δ baby boomers retire market SL↓,firm’s MRC3. B Market to W2,Q2↓ Firm W2, q2↓d2d1Imperfect Competition orMonopsonist (1 firm DL)* Firm can set wages, but ifone more worker hired athigher wage, all currentworkers receive pay raise,so SL MRC.W MRCWcWmBCALabor Qm QcSLMRP=DLQOligopolyCharacterisitcs**Few firms**Standardized ordifferentiated**Interdependencelimits price controlunless collusion**Many barriers toentry**Non-pricecompetition highwith productdifferentiation—ads**Ex: Aircraft, tiresDefinitions—* Strategic Behavior-A firmconsider reactions of o<strong>the</strong>rfirms to its actions.* Concentration Ratio--% ofmarket controlled by largestfirms* Market oligopolistic if atleast 4 firms control 40%* Collusion=Cooperation* Self-interestnon-coop* Cartel—a formal collusionon price, quantity, share* Game Theory—<strong>the</strong> studyof how people behave instrategic situations.Workers (SL) Gain Monopoly Power as a UnionW Organize all workersSL=MRCHow unions raisewages:* Increase demandfor products DL* Increaseproductivity DL* Restrictmembership SL↓* Organize allworkers negotiate WWUWCAsurplusDL=MRPQD QC QS Q1. A Competitive Equilibriumin labor market--WC,QC2. Δ Union negotiates W3. After QDL Qmonopolist; Po < PmEconomic Rent paid for use of LandR SLandR2 B Austin Eco AnalysisReal 1. A at R1, Q0R1 A Estate 2. Δ Population3. B at R2, Q0Q0 QInterest paid for use of Capitalr SLF = Savers, lenders (Households,firms, govts.DLF = Borrowers (Businesses,Homeowners, Govts.)Loanable Fund Market r=real interest %Market Failure and Government SolutionsNegative Externality—Privatecosts born by society/3 rd partyP MCSTax or MCPP2B RegulationP1 C AMBSQ2 Q1 QAnalysis Gasoline1. A—MBS=MCP, Efficiencyloss (A,B,C)=society’s cost,resource overallocation2. Δ—Govt. taxes or regulates3. B—MBS=MCS, P2, Q2↓Positive Externality—Social benefits to 3 rdparties born by private firmsP P MCPSubsidy MCS MCSP2BP1A SubsidyP1AMBS P2BMBPMBSQ 1 Q2 Q Q1 Q2Analysis Higher Education1. A—P1,Q1, under- 1. A—P1,Q1 Underallocationof resources allocation of resources2. Δ—Govt. susidy to 2. Δ—Govt. subsidy toconsumersMB universitiesMC↓3. B—P2, Q2, MBS=MCS 3. B—P2,Q2, MBS=MCSPublic Goods* Govt.provides <strong>the</strong>goods/service* Paid by taxrevenues* Difficult toexclude nonpayersfreeriders* Sharedconsumptionof good,service norivalry forgood/serviceAnti-Trust Laws* Goals: promote competitionand efficiency* Laws: Sherman—nomonopoly & no restraints oftrade (collusive price fixing &dividing markets), Clayton—noprice discrimination not basedon costs, no tying contracts, nointerlocking directorates,Federal Trade Commissionand Wheeler Act—Cease &desist orders & no deceptiveacts and practices (ads),Celler-Kefauver —no anticompetitivemergers.Lorenz Curve—Income Inequality% of Income100 e80 Perfect equality60 Lorenz Curve40 A B20 Complete Inequlity0 20 40 60 80 100% of FamiliesDistance between 0e and LorenzCurve shows degree of inequality.Gini ratio--numeric measure ofoverall dispersion of incomeGini ratio = Area AAreas A+B0 = perfect equality; .249 = Japan;.435 = USA; .519 = Mexico; 1 =complete inequalityCauses of IncomeInequality:* Ability, talent* Education, training* Discrimination* Preferences fortypes of work, leisure* Unequal wealth* Market power* Luck, misfortuneRedistributionTradeoff: Reducedefficiency, production,& income--opportunitycost of greater incomeequalitySally Dickson, Austin, TX