collateral posted to the fund is held in a segregated account by the fund’s custodian and with respect to thoseamounts which can be sold or repledged, is presented in the fund’s portfolio. Collateral posted to the fund whichcannot be sold or repledged totaled $13,355,210 at the close of the reporting period.Collateral pledged by the fund is segregated by the fund’s custodian and identified in the fund’s portfolio. Collateralcan be in the form of cash or debt securities issued by the U.S. Government or related agencies or other securitiesas agreed to by the fund and the applicable counterparty. Collateral requirements are determined based on thefund’s net position with each counterparty.Termination events applicable to the fund may occur upon a decline in the fund’s net assets below a specifiedthreshold over a certain period of time. Termination events applicable to counterparties may occur upon a declinein the counterparty’s long-term and short-term credit ratings below a specified level. In each case, upon occurrence,the other party may elect to terminate early and cause settlement of all derivative and foreign exchangecontracts outstanding, including the payment of any losses and costs resulting from such early termination, asreasonably determined by the terminating party. Any decision by one or more of the fund’s counterparties to electearly termination could impact the fund’s future derivative activity.At the close of the reporting period, the fund had a net liability position of $93,652 on open derivative contractssubject to the Master Agreements. Collateral posted by the fund at period end for these agreements totaled$119,988 and may include amounts related to unsettled agreements.Securities lending The fund may lend securities, through its agent, to qualified borrowers in order to earn additionalincome. The loans are collateralized by cash in an amount at least equal to the fair value of the securities loaned. Thefair value of securities loaned is determined daily and any additional required collateral is allocated to the fund onthe next business day. The risk of borrower default will be borne by the fund’s agent; the fund will bear the risk ofloss with respect to the investment of the cash collateral. Income from securities lending is included in investmentincome on the Statement of operations. Cash collateral is invested in <strong>Putnam</strong> Cash Collateral Pool, LLC, a limitedliability company managed by an affiliate of <strong>Putnam</strong> Management. <strong>Investments</strong> in <strong>Putnam</strong> Cash Collateral Pool,LLC are valued at its closing net asset value each business day. There are no management fees charged to <strong>Putnam</strong>Cash Collateral Pool, LLC. At the close of the reporting period, the fund received cash collateral of $419,799,552 andthe value of securities loaned amounted to $401,175,374. Certain of these securities were sold prior to the close ofthe reporting period and are included in Receivable for investments sold on the Statement of assets and liabilities.Interfund lending The fund, along with other <strong>Putnam</strong> funds, may participate in an interfund lending programpursuant to an exemptive order issued by the SEC. This program allows the fund to borrow from or lend to other<strong>Putnam</strong> funds that permit such transactions. Interfund lending transactions are subject to each fund’s investmentpolicies and borrowing and lending limits. Interest earned or paid on the interfund lending transaction will be basedon the average of certain current market rates. During the reporting period, the fund did not utilize the program.Lines of credit The fund participates, along with other <strong>Putnam</strong> funds, in a $392.5 million unsecured committed lineof credit and a $235.5 million unsecured uncommitted line of credit, both provided by State Street. Borrowingsmay be made for temporary or emergency purposes, including the funding of shareholder redemption requestsand trade settlements. Interest is charged to the fund based on the fund’s borrowing at a rate equal to the Federal<strong>Fund</strong>s rate plus 1.25% for the committed line of credit and the Federal <strong>Fund</strong>s rate plus 1.30% for the uncommittedline of credit. A closing fee equal to 0.04% of the committed line of credit and 0.04% of the uncommitted line ofcredit has been paid by the participating funds. In addition, a commitment fee of 0.11% per annum on any unutilizedportion of the committed line of credit is allocated to the participating funds based on their relative net assets andpaid quarterly. During the reporting period, the fund had no borrowings against these arrangements.Federal taxes It is the policy of the fund to distribute all of its taxable income within the prescribed time period andotherwise comply with the provisions of the Internal Revenue Code of 1986, as amended (the Code), applicableto regulated investment companies. It is also the intention of the fund to distribute an amount sufficient to avoidimposition of any excise tax under Section 4982 of the Code.The fund is subject to the provisions of Accounting Standards Codification 740 Income Taxes (ASC 740). ASC 740sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expectedto be taken in a tax return. The fund did not have a liability to record for any unrecognized tax benefits in the accompanyingfinancial statements. No provision has been made for federal taxes on income, capital gains or unrealizedappreciation on securities held nor for excise tax on income and capital gains. Each of the fund’s federal tax returnsfor the prior three fiscal years remains subject to examination by the Internal Revenue Service.46 <strong>Voyager</strong> <strong>Fund</strong>

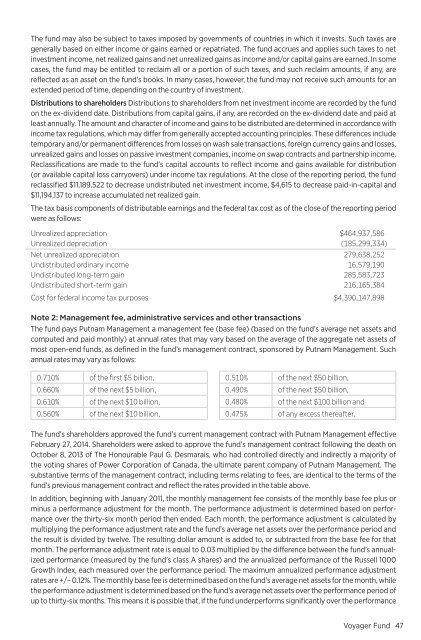

The fund may also be subject to taxes imposed by governments of countries in which it invests. Such taxes aregenerally based on either income or gains earned or repatriated. The fund accrues and applies such taxes to netinvestment income, net realized gains and net unrealized gains as income and/or capital gains are earned. In somecases, the fund may be entitled to reclaim all or a portion of such taxes, and such reclaim amounts, if any, arereflected as an asset on the fund’s books. In many cases, however, the fund may not receive such amounts for anextended period of time, depending on the country of investment.Distributions to shareholders Distributions to shareholders from net investment income are recorded by the fundon the ex-dividend date. Distributions from capital gains, if any, are recorded on the ex-dividend date and paid atleast annually. The amount and character of income and gains to be distributed are determined in accordance withincome tax regulations, which may differ from generally accepted accounting principles. These differences includetemporary and/or permanent differences from losses on wash sale transactions, foreign currency gains and losses,unrealized gains and losses on passive investment companies, income on swap contracts and partnership income.Reclassifications are made to the fund’s capital accounts to reflect income and gains available for distribution(or available capital loss carryovers) under income tax regulations. At the close of the reporting period, the fundreclassified $11,189,522 to decrease undistributed net investment income, $4,615 to decrease paid-in-capital and$11,194,137 to increase accumulated net realized gain.The tax basis components of distributable earnings and the federal tax cost as of the close of the reporting periodwere as follows:Unrealized appreciation $464,937,586Unrealized depreciation (185,299,334)Net unrealized appreciation 279,638,252Undistributed ordinary income 16,579,190Undistributed long-term gain 285,583,723Undistributed short-term gain 216,165,384Cost for federal income tax purposes $4,390,147,898Note 2: Management fee, administrative services and other transactionsThe fund pays <strong>Putnam</strong> Management a management fee (base fee) (based on the fund’s average net assets andcomputed and paid monthly) at annual rates that may vary based on the average of the aggregate net assets ofmost open-end funds, as defined in the fund’s management contract, sponsored by <strong>Putnam</strong> Management. Suchannual rates may vary as follows:0.710 % of the first $5 billion,0.660 % of the next $5 billion,0.610 % of the next $10 billion,0.560 % of the next $10 billion,0.510 % of the next $50 billion,0.490 % of the next $50 billion,0.480 % of the next $100 billion and0.475 % of any excess thereafter.The fund’s shareholders approved the fund’s current management contract with <strong>Putnam</strong> Management effectiveFebruary 27, 2014. Shareholders were asked to approve the fund’s management contract following the death onOctober 8, 2013 of The Honourable Paul G. Desmarais, who had controlled directly and indirectly a majority ofthe voting shares of Power Corporation of Canada, the ultimate parent company of <strong>Putnam</strong> Management. Thesubstantive terms of the management contract, including terms relating to fees, are identical to the terms of thefund’s previous management contract and reflect the rates provided in the table above.In addition, beginning with January 2011, the monthly management fee consists of the monthly base fee plus orminus a performance adjustment for the month. The performance adjustment is determined based on performanceover the thirty-six month period then ended. Each month, the performance adjustment is calculated bymultiplying the performance adjustment rate and the fund’s average net assets over the performance period andthe result is divided by twelve. The resulting dollar amount is added to, or subtracted from the base fee for thatmonth. The performance adjustment rate is equal to 0.03 multiplied by the difference between the fund’s annualizedperformance (measured by the fund’s class A shares) and the annualized performance of the Russell 1000Growth Index, each measured over the performance period. The maximum annualized performance adjustmentrates are +/– 0.12%. The monthly base fee is determined based on the fund’s average net assets for the month, whilethe performance adjustment is determined based on the fund’s average net assets over the performance period ofup to thirty-six months. This means it is possible that, if the fund underperforms significantly over the performance<strong>Voyager</strong> <strong>Fund</strong>47