Putnam Voyager Fund - Putnam Investments

Putnam Voyager Fund - Putnam Investments

Putnam Voyager Fund - Putnam Investments

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

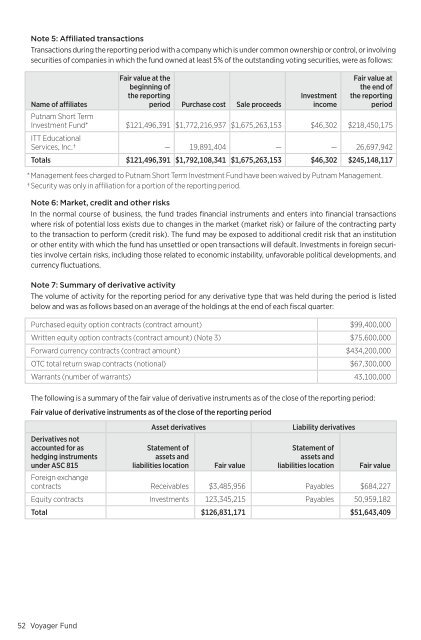

Note 5: Affiliated transactionsTransactions during the reporting period with a company which is under common ownership or control, or involvingsecurities of companies in which the fund owned at least 5% of the outstanding voting securities, were as follows:Name of affiliatesFair value at thebeginning ofthe reportingperiod Purchase cost Sale proceedsInvestmentincomeFair value atthe end ofthe reportingperiod<strong>Putnam</strong> Short TermInvestment <strong>Fund</strong> * $121,496,391 $1,772,216,937 $1,675,263,153 $46,302 $218,450,175ITT EducationalServices, Inc. † — 19,891,404 — — 26,697,942Totals $121,496,391 $1,792,108,341 $1,675,263,153 $46,302 $245,148,117* Management fees charged to <strong>Putnam</strong> Short Term Investment <strong>Fund</strong> have been waived by <strong>Putnam</strong> Management.† Security was only in affiliation for a portion of the reporting period.Note 6: Market, credit and other risksIn the normal course of business, the fund trades financial instruments and enters into financial transactionswhere risk of potential loss exists due to changes in the market (market risk) or failure of the contracting partyto the transaction to perform (credit risk). The fund may be exposed to additional credit risk that an institutionor other entity with which the fund has unsettled or open transactions will default. <strong>Investments</strong> in foreign securitiesinvolve certain risks, including those related to economic instability, unfavorable political developments, andcurrency fluctuations.Note 7: Summary of derivative activityThe volume of activity for the reporting period for any derivative type that was held during the period is listedbelow and was as follows based on an average of the holdings at the end of each fiscal quarter:Purchased equity option contracts (contract amount ) $99,400,000Written equity option contracts (contract amount ) (Note 3 ) $75,600,000Forward currency contracts (contract amount ) $434,200,000OTC total return swap contracts (notional ) $67,300,000Warrants (number of warrants ) 43,100,000The following is a summary of the fair value of derivative instruments as of the close of the reporting period:Fair value of derivative instruments as of the close of the reporting periodDerivatives notaccounted for ashedging instrumentsunder ASC 815Asset derivativesStatement ofassets andliabilities locationFair valueLiability derivativesStatement ofassets andliabilities locationFair valueForeign exchangecontracts Receivables $3,485,956 Payables $684,227Equity contracts <strong>Investments</strong> 123,345,215 Payables 50,959,182Total $126,831,171 $51,643,40952 <strong>Voyager</strong> <strong>Fund</strong>