HOW TO APPLY FOR A CERTIFICATE OF ORIGIN FORM A What is ...

HOW TO APPLY FOR A CERTIFICATE OF ORIGIN FORM A What is ...

HOW TO APPLY FOR A CERTIFICATE OF ORIGIN FORM A What is ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

- 2 -Certificates of Origin Form A are available for sale at the following stationers :(a)(b)(c)(d)Ying Wah Offset Printing PressRoom 13, 2/F, Block AWah Tat Industrial Centre8-10 Wah Sing StreetKwai HingNew Territories(Enquiry : 2401 1080)Swindon Book Co. Ltd.Shop No. 310 and 3463/F, Ocean CentreCanton RoadKowloon(Enquiry : 2730 0183)Yue Cheong HongFlat 14-16, 2/F, Thriving Industrial Centre26-38 Sha Tsui RoadTsuen WanNew Territories(Enquiry : 2413 7883)Cheung Lee Printing Co.Room 319, China Insurance Group Building141 Des Voeux Road CentralHong Kong(Enquiry : 2543 8069)Both the application form and the certificate should be completed bytypewriting. Identical information for copies of the application form and of the certificateshould be reproduced by using carbon papers. Notes adv<strong>is</strong>ing on how to complete theapplication form and the certificate are at Appendices One and Two respectively. Furtherguidance can be obtained from the Customer Service Centre, Certification Branch of theTrade and Industry Department (see section on ‘Enquiries’).For each consignment, a Form A application form (TIC 185B (Rev.)) induplicate together with a Certificate of Origin Form A in triplicate should be submitted tothe Customer Service Centre of Certification Branch on the third floor of Trade andIndustry Department Tower, 700 Nathan Road, Kowloon. The subm<strong>is</strong>sion should bemade at least two clear working days before the departure date of the carrying vessel (th<strong>is</strong>does not include the day of subm<strong>is</strong>sion, the departure day and intervening public holidaysand Sundays). Upon subm<strong>is</strong>sion, a fee currently at $324 by means of postage stampsaffixed to or franked on the original copy of the application form (in yellow) <strong>is</strong> charged.A numbered receipt will then be <strong>is</strong>sued to the applicant, together with the duplicate of theapplication form (in light pink) which <strong>is</strong> retained by the applicant for record purposes.[FU010-c.DOC]

- 3 -If everything <strong>is</strong> in order, the Certificate of Origin Form A will be approvedby the Department. The original plus the duplicate of the certificate will be <strong>is</strong>sued to theapplicant against the relevant receipt through the Customer Service Centre of CertificationBranch on the third floor of Trade and Industry Department Tower, 700 Nathan Road,Kowloon. The triplicate and the application form will be retained by the Department.Normally, a certificate <strong>is</strong> <strong>is</strong>sued in two clear working days after subm<strong>is</strong>sion. However, itmay take a longer time if the preferential eligibility of the products under application <strong>is</strong> indoubt and physical verification <strong>is</strong> required.If the Certificate of Origin Form A application <strong>is</strong> to be refused, a refusalletter will be <strong>is</strong>sued to the applicant, stating the reasons for the refusal. The full set ofapplication form and Certificate of Origin Form A will then be retained by the Department.The Department reserves the right to <strong>is</strong>sue, refuse or cancel any application. Aftersubm<strong>is</strong>sion of an application, the application fee <strong>is</strong> not refundable in any circumstances.Amendment of the Certificate of Origin Form A and the ApplicationWhen amendments are required on the Certificate of Origin Form A and theapplication form after the documents have been submitted to the Department or after theCertificate of Origin Form A has been <strong>is</strong>sued, the amendment procedure in force has to befollowed. Details of the amendment procedure can be obtained from the CustomerService Centre, Certification Branch of the Department.Late Subm<strong>is</strong>sion of Application for Certificate of Origin Form AApplications for Certificates of Origin Form A are required to be submittedat least two clear working days in advance of the departure date of the carrying vessel. Ifthe application <strong>is</strong> not submitted in accordance with th<strong>is</strong> condition, the Department reservesthe right not to accept such late subm<strong>is</strong>sions.Application for Retrospective Issue of Certificate of Origin Form AAs a general rule, the Department will not accept applications forCertificates of Origin Form A after the goods have been shipped. However, in veryspecial cases (e.g. where the failure to apply before shipment was caused by externalcircumstances which were not controlled by the applicant), late applications may beaccepted. In such circumstances, the exporter has to submit the whole set of applicationforms and certificates together with the following supporting documents :(a)(b)(c)a covering letter explaining the reasons for the late application;a copy of the commercial invoice and the bill of lading/air waybill/postalreceipt in respect of the consignments covered by the certificate;a cost statement of the goods concerned if applicable; and[FU010-c.DOC]

- 4 -(d)packing l<strong>is</strong>t.Th<strong>is</strong> request should be submitted to the General<strong>is</strong>ed PreferenceCertification Section of the Certification Branch for approval. The Department mayrequest the exporter to produce samples of the goods covered by the certificate forinspection. Further guidance can be obtained from the Customer Service Centre,Certification Branch of the Department (see section on ‘Enquiries’).Other Issuing Organ<strong>is</strong>ationsApart from the Trade and Industry Department, the following fiveGovernment Approved Certification Organ<strong>is</strong>ations are also author<strong>is</strong>ed to <strong>is</strong>sue Certificatesof Origin Form A for GSP exports to Canada, Norway and the Russian Federation :(a)(b)(c)(d)(e)The Hong Kong General Chamber of Commerce22/F, Silvercorp International Tower707-713 Nathan RoadKowloon(Enquiry : 2395 5515)The Indian Chamber of Commerce, Hong Kong2/F, 69 Wyndham StreetHong Kong(Enquiry : 2525 0138)Federation of Hong Kong IndustriesSuite 1701, Wai Fung Plaza664 Nathan RoadKowloon(Enquiry : 2396 3318)The Chinese Manufacturers’ Association of Hong Kong1/F, CMA Building64 Connaught Road CentralHong Kong(Enquiry : 2545 6166)The Chinese General Chamber of Commerce4/F, 24-25 Connaught Road CentralHong Kong(Enquiry : 2526 0623)Enquiries regarding the <strong>is</strong>sue of certificates by these organ<strong>is</strong>ations shouldbe made to the Certification Offices of these organ<strong>is</strong>ations.[FU010-c.DOC]

- 5 -Penalties for MalpracticeCertificates of Origin Form A <strong>is</strong>sued by the Trade and Industry Departmentand the five Government Approved Certification Organ<strong>is</strong>ations are legally protected.Furn<strong>is</strong>hing false information on a Certificate of Origin Form A application/certificate orm<strong>is</strong>use of the certificate may result in a maximum fine of $500,000 and two years’impr<strong>is</strong>onment.EnquiriesAll enquiries about <strong>is</strong>sue of Certificates of Origin Form A by the Trade andIndustry Department should be directed to :General<strong>is</strong>ed Preference Certification SectionCertification BranchTrade and Industry Department3/F, Trade and Industry Department Tower700 Nathan RoadKowloon(Tel. 2398 5545)[FU010-c.DOC]

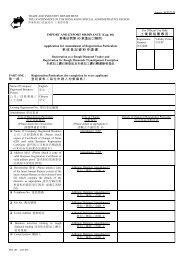

Appendix One<strong>HOW</strong> <strong>TO</strong> COMPLETE THE APPLICATION <strong>FOR</strong>M (TIC 185B (REV.))(I)Completion of applicationThe application form (TIC 185B (Rev.)) contains declarations by both themanufacturer and the exporter as to the accuracy of information given on theapplication. It must therefore be completed personally by the proprietor or by apartner or principal officer author<strong>is</strong>ed by the company exporting/manufacturing thegoods. The application requires, among other things, the following details :(a)Means of transport and route, and final destinationThe means and route by which the goods are to be transported, thedeparture date of the vessel and the final destination must be clearly statedand must also tally with the details as stated in Box 3 of the Certificate ofOrigin Form A. Where container service <strong>is</strong> util<strong>is</strong>ed in the transportation ofgoods, the closing date of the container must be stated. Where the finaldestination <strong>is</strong> a place other than the port of d<strong>is</strong>charge, th<strong>is</strong> must be stated inthe ‘Final Destination if on Carriage’ column.(b)Description of goodsThe description of goods, their marks and numbers, quantity, value andbrand names or labels should be clearly stated in the relevant columns of theapplication form. The description of goods, their quantity and brandnames or labels appearing on both the exporter’s and manufacturer’sdeclarations must be identical. They must also tally with those stated onthe Certificate of Origin Form A. If the goods do not carry any brandnames or labels, the word ‘Nil’ should be inserted in the relevant columnsof both declarations. The marks and numbers of goods appearing on boththe exporter’s declaration and the Certificate of Origin Form A should alsobe identical. It should also be noted that the quantity of goods and thenumber of packages must be recorded both in letters and numerals, e.g.‘ONE HUNDRED (100) DOZEN’‘TEN (10) CAR<strong>TO</strong>NS’In addition, applicants for Certificates of Origin Form A are required todeclare on the application form the 8-digit Harmon<strong>is</strong>ed CommodityDescription and Coding System (Harmon<strong>is</strong>ed System) codes of each of theproducts covered by the Certificate of Origin Form A. The HS codesshould be bracketed and placed beside the description of goods on the‘exporter page’ of the application form. The 8-digit HS codes for anyparticular product can be found in the ‘Hong Kong Imports & ExportsClassification L<strong>is</strong>t (Harmon<strong>is</strong>ed System)’.[FU010-c.DOC]

- 2 -(c)Name of factory, its address and reg<strong>is</strong>tration numberThe manufacturer should ensure that the factory’s full name and correctaddress are completed. He should also state the factory’s valid FactoryReg<strong>is</strong>tration Number which <strong>is</strong> given by the Department when its applicationfor reg<strong>is</strong>tration for certification purposes <strong>is</strong> approved. Th<strong>is</strong> number <strong>is</strong> notthe Business Reg<strong>is</strong>tration Number which <strong>is</strong> given by the BusinessReg<strong>is</strong>tration Office of the Inland Revenue Department.(d)Declaration as to GSP origin criteriaManufacturers are required, for goods which will qualify for preference onlyif certain requirements are met in the manufacture of such goods, to statethat such requirements are met; th<strong>is</strong> statement should be made inparagraph 5 of the manufacturer’s declaration, i.e. the reverse page of theapplication form.Origin criteria, and therefore the declarations, vary from product to productand from one importing country to another. Consequently, manufacturersshould consult the General<strong>is</strong>ed Preference Certification Section of theCertification Branch in regard to the correct declaration to be made. Afalse or incorrect declaration may not only result in the application beingrefused but also in legal proceedings being taken against the company or thedeclarant.(e)Materials and parts used in the manufacture of the productsAll materials and parts used, whether imported or locally made, and theircountry of origin, should be stated in the manufacturer’s declaration.However, for products composed of many component parts, only the majorparts are required in the declaration.(f)Work done in Hong KongManufacturers should state clearly the manufacturing processes performedin the reg<strong>is</strong>tered factory prem<strong>is</strong>es for the production of the goods atparagraph 3(A) of the manufacturer’s declaration. If the whole or part ofthe work <strong>is</strong> sub-contracted to other factories or persons, the sub-contractingarrangement procedure in force should be followed. Details of thesub-contracting arrangements are obtainable from the Local SubcontractingSection, Certification Branch of the Department (Tel. 2398 5531). Thefollowing details should be clearly stated in the relevant paragraphs :(i)Sub-contracting of principal process or entire productionThe Approval Reference Number for the sub-contracting, the names,the addresses and valid Factory Reg<strong>is</strong>tration Numbers of allsub-contractors, the processes carried out and the quantity producedby the sub-contractors should be quoted in paragraph 3(B)(i). The[FU010-c.DOC]

- 3 -sub-contractor <strong>is</strong> also required to complete the Declaration bySub-contractor column beside paragraph 3(B)(i).(ii)Sub-contracting of subsidiary processesThe applicant manufacturer may take one of the following twocourses :Either : Insert the Approval Reference Number for thesub-contracting in paragraph 3(B)(ii).Or : Provide full details of each process and eachsub-contractor (the name and address) employed inparagraph 3(B)(iii).(iii)Sub-contracting to outworkersThe processes performed by such outworkers should be stated inparagraph 3(C).(g)Inspection of goodsThe Customs and Exc<strong>is</strong>e Department will generally carry out consignmentchecks on the goods to be exported to verify the accuracy of the informationprovided in the declaration. Manufacturers are therefore adv<strong>is</strong>ed to stateclearly in paragraph 7 the place where the goods may be inspected, such asthe factory prem<strong>is</strong>es, its warehouses, or any other places where the goodsare stored before shipment. It should also be noted that goods should beavailable for inspection for at least two clear working days following thedate of subm<strong>is</strong>sion.(h)Author<strong>is</strong>ed signature and office addressThe correct office addresses of both the exporter and the manufacturer mustbe clearly stated. All signatures should be repeated in block letters, andChinese character signatures should be repeated in Engl<strong>is</strong>h block letters.All signatures should also be stamped with the company’s business chop.Furthermore, signatory of the manufacturer should be those reg<strong>is</strong>teredunder the Department’s Factory Reg<strong>is</strong>tration.(II)Amendments to applicationThe Department normally permits amendments to be made to the application form.Th<strong>is</strong> can be done by typewriting or handwriting, signed by the signatory of theapplication or h<strong>is</strong>/her author<strong>is</strong>ed official, and stamped with the company’s businesschop. The Department, however, reserves the right to require the subm<strong>is</strong>sion of afresh application.[FU010-c.DOC]

- 4 -(III)Insufficient space on the applicationWhere the space provided on the application form <strong>is</strong> not sufficient to accommodateall the details, (e.g. because the consignment contains too many items),exporters/manufacturers may complete the information on a blank white sheet ofpaper and affix it to the application form, at the appropriate columns and choppedand signed at the joining line by the signatory of the application or h<strong>is</strong> author<strong>is</strong>edofficial.[FU010-c.DOC]

Appendix Two<strong>HOW</strong> <strong>TO</strong> COMPLETE <strong>CERTIFICATE</strong> <strong>OF</strong> <strong>ORIGIN</strong> <strong>FOR</strong>M A(I)Completion of applicationThe Certificate of Origin Form A must be completed by the exporter in accordancewith the rules and conditions shown on the reverse side of the certificate.Exporters are adv<strong>is</strong>ed to exerc<strong>is</strong>e great care in filling out the form. The formrequires, among other things, the following details:(a)Name and address of consigneeIn Box 2 of the certificate, the name and address of overseas buyer to whomthe goods are consigned should be given. In cases where the goods areconsigned to a bank or forwarding agent because of terms on L/C etc., thename and address of the overseas buyer should also be provided, e.g.‘Consignee: ABC Bank(address of the bank)Notifying party : XYZ Co.(address of the company)’Please be informed that the consignment under the GSP scheme of theRussian Federation <strong>is</strong> subject to direct purchase.(b)Means of transport and routeAs one of the conditions for qualifying for preference tariff treatment <strong>is</strong> thatthe goods must be consigned direct from Hong Kong to the country ofdestination except in cases where any intermediate transit, transhipment ortemporary warehousing ar<strong>is</strong>es from requirement of transportation, themeans of transport and route in Box 3 should be clearly stated, e.g.(i)Where the goods are consigned and transported directly to Montreal,Canada :‘From Hong Kong to Montreal, Canada, per s.s. (name of vessel) on(sailing date).’(ii)Where the goods are consigned and transported to Montreal, Canada,passing through Toronto :‘From Hong Kong to Montreal, Canada, via Toronto per s.s. (nameof vessel) on (sailing date).’Please be informed that the consignment under the GSP scheme ofthe Russian Federation <strong>is</strong> subject to direct shipment.[FU010-c.DOC]

- 2 -(c)Item numberThe item number in Box 5 <strong>is</strong> to indicate how many items are there in theconsignment under application e.g.‘Item numberDescription of goods1 Ladies’ leather gloves2 Men's’ leather gloves3 Boy’s leather gloves’(d)Marks and numbers of packagesIn Box 6, the marks and numbers of packages given should be identical tothose appearing on the exporter’s declaration on the application form(TIC 185B (Rev.)).(e)Description of goods and origin criteriaThe description of goods must be stated sufficiently in detail to enable thegoods to be identifiable by the customs authority of the importing countryexamining them. The origin criterion must be shown in accordance withthe rules and conditions as stated on the reverse side of the certificate.The Department will refuse to approve any certificate where the origincriterion <strong>is</strong> wrongly stated. Exporters are therefore adv<strong>is</strong>ed to consult theGeneral<strong>is</strong>ed Preference Certification Section of the Certification Branchconcerning the correct origin criterion for the goods covered by thecertificate. To facilitate the classification of goods into their correct origincriterion, the Department may request exporters or manufacturers to submitsamples of the goods for inspection. In addition, the following pointsshould be noted :(i)(ii)The descriptions of goods, marks and numbers of packages andquantity on the certificate should tally with those on the applicationform (TIC 185B (Rev.));The quantity of goods and the number of packages should berecorded both in letters and numerals, e.g.‘ONE HUNDRED (100) DOZEN’‘TEN (10) CAR<strong>TO</strong>NS’(iii)Each last completed entry must be followed immediately by fouraster<strong>is</strong>ks, e.g.‘Plastic beaded cotton purse ****’‘One Hundred (100) Dozen ****’[FU010-c.DOC]

- 3 -(iv)Space after each completed entry must be ruled off so that it wouldnot be possible to add an extra insertion, wording or other remarks,e.g.‘Plastic beaded cotton purse ****’Where the space provided on the Certificate of Origin Form A <strong>is</strong> notsufficient to accommodate all the details, the exporter may complete theinformation on a blank sheet of certificate form and affix it to theCertificate, chopped and signed at the joining line by the signatory of thecertificate.(f)Date of InvoicesThe invoice date(s) in Box 10 should not be later than the date given inBox 12 of the certificate which contains the declaration by the exporter.(g)Declaration by exporterThe person who signs the declaration in Box 12 should also be thesignatory to the exporter’s declaration on the application form (TIC 185B(Rev.)) and the signature should be stamped with the company’s businesschop. The name should be repeated in block letters and the name of theimporting country should be that stated in Box 2 of the certificate.(II)Amendment to CertificateWhen amendments are required on the Certificate of Origin Form A after thecertificate has been <strong>is</strong>sued, applications for amendment must be made in writingwithin 30 days from the date of <strong>is</strong>sue. A new set of Certificate of Origin Form Aincorporating the amendments and the application for amendment both signed bythe signatory of the original certificate application (TIC 185B (Rev.)) or h<strong>is</strong>author<strong>is</strong>ed official and stamped with the company’s business chop should besubmitted. Specimen of the application for amendment and further details ofamendment procedures are obtainable from the Customer Service Centre,Certification Branch of the Department.[FU010-c.DOC]