Subprime risk management lessons

Subprime risk management lessons

Subprime risk management lessons

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

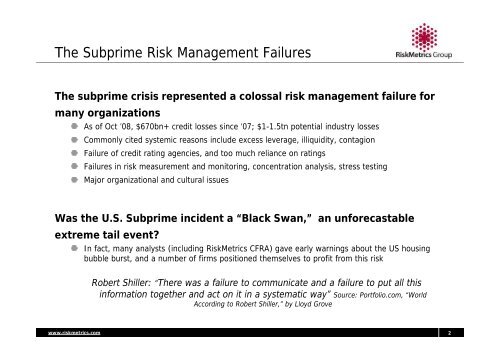

The <strong>Subprime</strong> Risk Management FailuresThe subprime crisis represented a colossal <strong>risk</strong> <strong>management</strong> failure formany organizationsAs of Oct ’08, $670bn+ credit losses since ‘07; $1-1.5tn potential industry lossesCommonly cited systemic reasons include excess leverage, illiquidity, contagionFailure of credit rating agencies, and too much reliance on ratingsFailures in <strong>risk</strong> measurement and monitoring, concentration analysis, stress testingMajor organizational and cultural issuesWas the U.S. <strong>Subprime</strong> incident a “Black Swan,” an unforecastableextreme tail event?In fact, many analysts (including RiskMetrics CFRA) gave early warnings about the US housingbubble burst, and a number of firms positioned themselves to profit from this <strong>risk</strong>Robert Shiller: “There was a failure to communicate and a failure to put all thisinformation together and act on it in a systematic way” Source: Portfolio.com, “WorldAccording to Robert Shiller,” by Lloyd Grovewww.<strong>risk</strong>metrics.com 2