Subprime risk management lessons

Subprime risk management lessons

Subprime risk management lessons

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

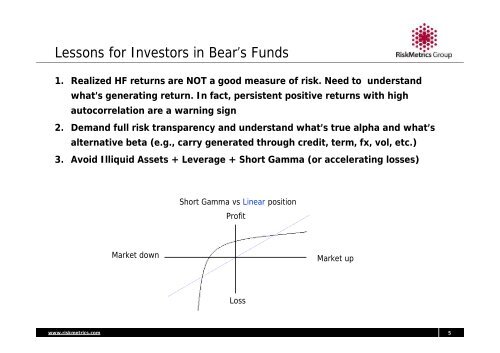

Lessons for Investors in Bear’s Funds1. Realized HF returns are NOT a good measure of <strong>risk</strong>. Need to understandwhat’s generating return. In fact, persistent positive returns with highautocorrelation are a warning sign2. Demand full <strong>risk</strong> transparency and understand what’s true alpha and what’salternative beta (e.g., carry generated through credit, term, fx, vol, etc.)3. Avoid Illiquid Assets + Leverage + Short Gamma (or accelerating losses)Short Gamma vs Linear positionProfitMarket downMarket upLosswww.<strong>risk</strong>metrics.com 5