Download - FEAS

Download - FEAS

Download - FEAS

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

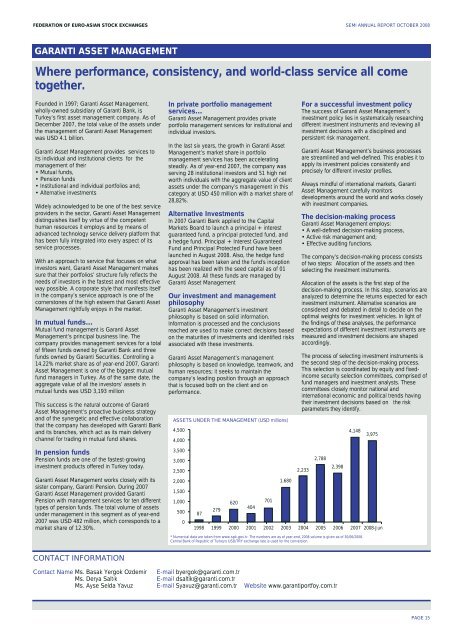

FEDERATION OF EURO-ASIAN STOCK EXCHANGES SEMI ANNUAL REPORT OCTOBER 2008GARANTI ASSET MANAGEMENTWhere performance, consistency, and world-class service all cometogether.Founded in 1997; Garanti Asset Management,wholly-owned subsidiary of Garanti Bank, isTurkey’s first asset management company. As ofDecember 2007, the total value of the assets underthe management of Garanti Asset Managementwas USD 4.1 billion.Garanti Asset Management provides services toits individual and institutional clients for themanagement of their• Mutual funds,• Pension funds• Institutional and individual portfolios and;• Alternative investmentsWidely acknowledged to be one of the best serviceproviders in the sector, Garanti Asset Managementdistinguishes itself by virtue of the competenthuman resources it employs and by means ofadvanced technology service delivery platform thathas been fully integrated into every aspect of itsservice processes.With an approach to service that focuses on whatinvestors want, Garanti Asset Management makessure that their portfolios’ structure fully reflects theneeds of investors in the fastest and most effectiveway possible. A corporate style that manifests itselfin the company’s service approach is one of thecornerstones of the high esteem that Garanti AssetManagement rightfully enjoys in the market.In mutual funds…Mutual fund management is Garanti AssetManagement’s principal business line. Thecompany provides management services for a totalof fifteen funds owned by Garanti Bank and threefunds owned by Garanti Securities. Controlling a14.22% market share as of year-end 2007, GarantiAsset Management is one of the biggest mutualfund managers in Turkey. As of the same date, theaggregate value of all the investors’ assets inmutual funds was USD 3,193 millionThis success is the natural outcome of GarantiAsset Management’s proactive business strategyand of the synergetic and effective collaborationthat the company has developed with Garanti Bankand its branches, which act as its main deliverychannel for trading in mutual fund shares.In pension fundsPension funds are one of the fastest-growinginvestment products offered in Turkey today.Garanti Asset Management works closely with itssister company, Garanti Pension. During 2007Garanti Asset Management provided GarantiPension with management services for ten differenttypes of pension funds. The total volume of assetsunder management in this segment as of year-end2007 was USD 482 million, which corresponds to amarket share of 12.30%.In private portfolio managementservices…Garanti Asset Management provides privateportfolio management services for institutional andindividual investors.In the last six years, the growth in Garanti AssetManagement’s market share in portfoliomanagement services has been acceleratingsteadily. As of year-end 2007, the company wasserving 28 institutional investors and 51 high networth individuals with the aggregate value of clientassets under the company’s management in thiscategory at USD 450 million with a market share of28,82%.Alternative InvestmentsIn 2007 Garanti Bank applied to the CapitalMarkets Board to launch a principal + interestguaranteed fund, a principal protected fund, anda hedge fund. Principal + Interest GuaranteedFund and Principal Protected Fund have beenlaunched in August 2008. Also, the hedge fundapproval has been taken and the fund's inceptionhas been realized with the seed capital as of 01August 2008. All these funds are managed byGaranti Asset ManagementOur investment and managementphilosophyGaranti Asset Management’s investmentphilosophy is based on solid information.Information is processed and the conclusionsreached are used to make correct decisions basedon the maturities of investments and identified risksassociated with these investments.Garanti Asset Management’s managementphilosophy is based on knowledge, teamwork, andhuman resources; it seeks to maintain thecompany’s leading position through an approachthat is focused both on the client and onperformance.ASSETS UNDER THE MANAGEMENT (USD millions)4,5004,0003,5003,0002,5002,0001,5001,0005000872796204047011,680For a successful investment policyThe success of Garanti Asset Management’sinvestment policy lies in systematically researchingdifferent investment instruments and reviewing allinvestment decisions with a disciplined andpersistent risk management.Garanti Asset Management’s business processesare streamlined and well-defined. This enables it toapply its investment policies consistently andprecisely for different investor profiles.Always mindful of international markets, GarantiAsset Management carefully monitorsdevelopments around the world and works closelywith investment companies.The decision-making processGaranti Asset Management employs:• A well-defined decision-making process,• Active risk management and;• Effective auditing functions.The company’s decision-making process consistsof two steps: Allocation of the assets and thenselecting the investment instruments.Allocation of the assets is the first step of thedecision-making process. In this step, scenarios areanalyzed to determine the returns expected for eachinvestment instrument. Alternative scenarios areconsidered and debated in detail to decide on theoptimal weights for investment vehicles. In light ofthe findings of these analyses, the performanceexpectations of different investment instruments aremeasured and investment decisions are shapedaccordingly.The process of selecting investment instruments isthe second step of the decision-making process.This selection is coordinated by equity and fixedincomesecurity selection committees, comprised offund managers and investment analysts. Thesecommittees closely monitor national andinternational economic and political trends havingtheir investment decisions based on the riskparameters they identify.2,2332,7882,3984,1483,9751998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008-Jun* Numerical data are taken from www.spk.gov.tr. The numbers are as of year-end, 2008 volume is given as of 30/06/2008.Central Bank of Republic of Turkey's USD/TRY exchange rate is used for the conversion.CONTACT INFORMATIONContact Name Ms. Basak Yergok Ozdemir E-mail byergok@garanti.com.trMs. Derya Salt›kE-mail dsaltik@garanti.com.trMs. Ayse Selda Yavuz E-mail Syavuz@garanti.com.tr Website www.garantiportfoy.com.trPAGE 15