Download - FEAS

Download - FEAS

Download - FEAS

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

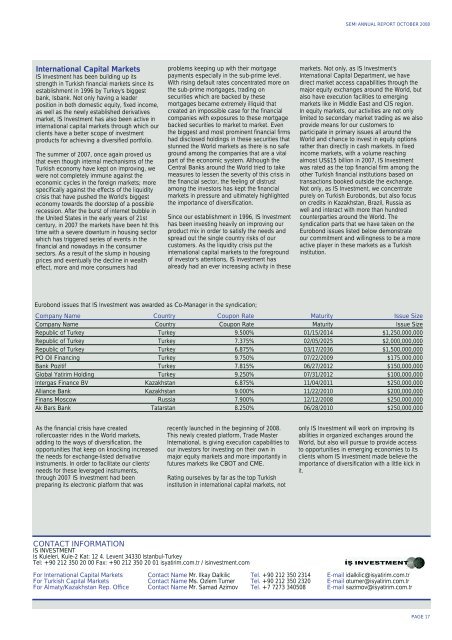

SEMI ANNUAL REPORT OCTOBER 2008International Capital MarketsIS Investment has been building up itsstrength in Turkish financial markets since itsestablishment in 1996 by Turkey's biggestbank, Isbank. Not only having a leaderposition in both domestic equity, fixed income,as well as the newly established derivativesmarket, IS Investment has also been active ininternational capital markets through which ourclients have a better scope of investmentproducts for achieving a diversified portfolio.The summer of 2007, once again proved usthat even though internal mechanisms of theTurkish economy have kept on improving, wewere not completely immune against theeconomic cycles in the foreign markets; morespecifically against the effects of the liquiditycrisis that have pushed the World's biggesteconomy towards the doorstep of a possiblerecession. After the burst of internet bubble inthe United States in the early years of 21stcentury, in 2007 the markets have been hit thistime with a severe downturn in housing sectorwhich has triggered series of events in thefinancial and nowadays in the consumersectors. As a result of the slump in housingprices and eventually the decline in wealtheffect, more and more consumers hadproblems keeping up with their mortgagepayments especially in the sub-prime level.With rising default rates concentrated more onthe sub-prime mortgages, trading onsecurities which are backed by thesemortgages became extremely illiquid thatcreated an impossible case for the financialcompanies with exposures to these mortgagebacked securities to market to market. Eventhe biggest and most prominent financial firmshad disclosed holdings in these securities thatstunned the World markets as there is no safeground among the companies that are a vitalpart of the economic system. Although theCentral Banks around the World tried to takemeasures to lessen the severity of this crisis inthe financial sector, the feeling of distrustamong the investors has kept the financialmarkets in pressure and ultimately highlightedthe importance of diversification.Since our establishment in 1996, IS Investmenthas been investing heavily on improving ourproduct mix in order to satisfy the needs andspread out the single country risks of ourcustomers. As the liquidity crisis put theinternational capital markets to the foregroundof investor's attentions, IS Investment hasalready had an ever increasing activity in thesemarkets. Not only, as IS Investment'sInternational Capital Department, we havedirect market access capabilities through themajor equity exchanges around the World, butalso have execution facilities to emergingmarkets like in Middle East and CIS region.In equity markets, our activities are not onlylimited to secondary market trading as we alsoprovide means for our customers toparticipate in primary issues all around theWorld and chance to invest in equity optionsrather than directly in cash markets. In fixedincome markets, with a volume reachingalmost US$15 billion in 2007, IS Investmentwas rated as the top financial firm among theother Turkish financial institutions based ontransactions booked outside the exchange.Not only, as IS Investment, we concentratepurely on Turkish Eurobonds, but also focuson credits in Kazakhstan, Brazil, Russia aswell and interact with more than hundredcounterparties around the World. Thesyndication parts that we have taken on theEurobond issues listed below demonstrateour commitment and willingness to be a moreactive player in these markets as a Turkishinstitution.Eurobond issues that IS Investment was awarded as Co-Manager in the syndication;Company Name Country Coupon Rate Maturity Issue SizeCompany Name Country Coupon Rate Maturity Issue SizeRepublic of Turkey Turkey 9.500% 01/15/2014 $1,250,000,000Republic of Turkey Turkey 7.375% 02/05/2025 $2,000,000,000Republic of Turkey Turkey 6.875% 03/17/2036 $1,500,000,000PO Oil Financing Turkey 9.750% 07/22/2009 $175,000,000Bank Pozitif Turkey 7.815% 06/27/2012 $150,000,000Global Yatirim Holding Turkey 9.250% 07/31/2012 $100,000,000Intergas Finance BV Kazakhstan 6.875% 11/04/2011 $250,000,000Alliance Bank Kazakhstan 9.000% 11/22/2010 $200,000,000Finans Moscow Russia 7.900% 12/12/2008 $250,000,000Ak Bars Bank Tatarstan 8.250% 06/28/2010 $250,000,000As the financial crisis have createdrollercoaster rides in the World markets,adding to the ways of diversification, theopportunities that keep on knocking increasedthe needs for exchange-listed derivativeinstruments. In order to facilitate our clients'needs for these leveraged instruments,through 2007 IS Investment had beenpreparing its electronic platform that wasrecently launched in the beginning of 2008.This newly created platform, Trade MasterInternational, is giving execution capabilities toour investors for investing on their own inmajor equity markets and more importantly infutures markets like CBOT and CME.Rating ourselves by far as the top Turkishinstitution in international capital markets, notonly IS Investment will work on improving itsabilities in organized exchanges around theWorld, but also will pursue to provide accessto opportunities in emerging economies to itsclients whom IS Investment made believe theimportance of diversification with a little kick init.CONTACT INFORMATIONIS INVESTMENTIs Kuleleri, Kule-2 Kat: 12 4. Levent 34330 Istanbul-TurkeyTel: +90 212 350 20 00 Fax: +90 212 350 20 01 isyatirim.com.tr / isinvestment.comFor International Capital Markets Contact Name Mr. Ilkay Dalkilic Tel. +90 212 350 2314 E-mail idalkilic@isyatirim.com.trFor Turkish Capital Markets Contact Name Ms. Ozlem Tumer Tel. +90 212 350 2320 E-mail otumer@isyatirim.com.trFor Almaty/Kazakhstan Rep. Office Contact Name Mr. Samad Azimov Tel. +7 7273 340508 E-mail sazimov@isyatirim.com.trPAGE 17