Annual Report 10-11 - Elder Pharmaceuticals Ltd.

Annual Report 10-11 - Elder Pharmaceuticals Ltd.

Annual Report 10-11 - Elder Pharmaceuticals Ltd.

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

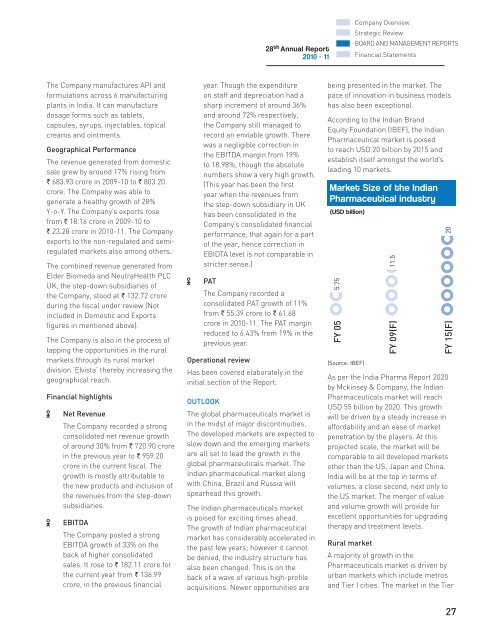

28 th <strong>Annual</strong> <strong>Report</strong>20<strong>10</strong> - <strong>11</strong>Company OverviewStrategic ReviewBOARD AND MANAGEMENT REPORTSFinancial StatementsThe Company manufactures API andformulations across 6 manufacturingplants in India. It can manufacturedosage forms such as tablets,capsules, syrups, injectables, topicalcreams and ointments.Geographical PerformanceThe revenue generated from domesticsale grew by around 17% rising from` 683.93 crore in 2009-<strong>10</strong> to ` 803.20crore. The Company was able togenerate a healthy growth of 28%Y-o-Y. The Company’s exports rosefrom ` 18.16 crore in 2009-<strong>10</strong> to` 23.28 crore in 20<strong>10</strong>-<strong>11</strong>. The Companyexports to the non-regulated and semiregulatedmarkets also among others.The combined revenue generated from<strong>Elder</strong> Biomeda and NeutraHealth PLCUK, the step-down subsidiaries ofthe Company, stood at ` 132.72 croreincluded in Domestic and ExportsThe Company is also in the process oftapping the opportunities in the ruralmarkets through its rural marketdivision ‘Elvista’ thereby increasing thegeographical reach.Financial highlightsNet RevenueThe Company recorded a strongconsolidated net revenue growthof around 30% from ` 720.90 crorein the previous year to ` 959.20growth is mostly attributable tothe new products and inclusion ofthe revenues from the step-downsubsidiaries.EBITDAThe Company posted a strongEBITDA growth of 33% on theback of higher consolidatedsales. It rose to ` 182.<strong>11</strong> crore forthe current year from ` 136.99year. Though the expenditureon staff and depreciation had asharp increment of around 36%and around 72% respectively,the Company still managed torecord an enviable growth. Therewas a negligible correction inthe EBITDA margin from 19%to 18.98%, though the absolutenumbers show a very high growth.year when the revenues fromthe step-down subsidiary in UKhas been consolidated in theperformance, that again for a partof the year, hence correction inEBIDTA level is not comparable instricter sense.)PATThe Company recorded aconsolidated PAT growth of <strong>11</strong>%from ` 55.39 crore to ` 61.68crore in 20<strong>10</strong>-<strong>11</strong>. The PAT marginreduced to 6.43% from 19% in theprevious year.Operational reviewHas been covered elaborately in theinitial section of the <strong>Report</strong>.OUTLOOKThe global pharmaceuticals market isin the midst of major discontinuities.The developed markets are expected toslow down and the emerging marketsare all set to lead the growth in theglobal pharmaceuticals market. TheIndian pharmaceutical market alongwith China, Brazil and Russia willspearhead this growth.The Indian pharmaceuticals marketis poised for exciting times ahead.The growth of Indian pharmaceuticalmarket has considerably accelerated inthe past few years; however it cannotbe denied, the industry structure hasalso been changed. This is on theacquisitions. Newer opportunities arebeing presented in the market. Thepace of innovation in business modelshas also been exceptional.According to the Indian BrandEquity Foundation (IBEF), the IndianPharmaceutical market is poisedto reach USD 20 billion by 2015 andestablish itself amongst the world’sleading <strong>10</strong> markets.Market Size of the IndianPharmaceutical industry(USD billion)5.75FY 05(Source: IBEF)<strong>11</strong>.5FY 09(F)20FY 15(F)As per the India Pharma <strong>Report</strong> 2020by Mckinsey & Company, the Indian<strong>Pharmaceuticals</strong> market will reachUSD 55 billion by 2020. This growthwill be driven by a steady increase inaffordability and an ease of marketpenetration by the players. At thisprojected scale, the market will becomparable to all developed marketsother than the US, Japan and China.India will be at the top in terms ofvolumes, a close second, next only tothe US market. The merger of valueand volume growth will provide forexcellent opportunities for upgradingtherapy and treatment levels.Rural marketA majority of growth in the<strong>Pharmaceuticals</strong> market is driven byurban markets which include metrosand Tier I cities. The market in the Tier27