ATM Risk Management and Controls - EuroJournals

ATM Risk Management and Controls - EuroJournals

ATM Risk Management and Controls - EuroJournals

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

162 European Journal of Economics, Finance <strong>and</strong> Administrative Sciences - Issue 21 (2010)<br />

transactions”. The plastic card contains a magnetic stripe or a chip that contains a unique card number<br />

<strong>and</strong> some security information, such as an expiration date <strong>and</strong> card validation code (CVC).<br />

Kalakota <strong>and</strong> Whinston, (1996) mentioned that the financial services industry has been through<br />

'structural <strong>and</strong> operational changes since the mid-1990s, <strong>and</strong> innovative use of new information<br />

technology, electronic commerce. Hamelink, (2000) indicated that these associated cost reductions are<br />

driving ongoing changes in banking New technology brings benefits <strong>and</strong> risks <strong>and</strong> new challenges for<br />

human governance of the developments.<br />

RCBC (2007), mentioned that authentication of the user is provided by the customer entering a<br />

personal identification number (PIN). Mir<strong>and</strong>a F, Cosa R <strong>and</strong> Barriuso (2006), highlighted that<br />

customers transacting on these <strong>ATM</strong>s are guided by instructions displayed o the video screens. These<br />

<strong>ATM</strong>s normally dispense two or more denominations of paper money. Customer’s advice slips are<br />

automatically printed <strong>and</strong> dispensed except for balance enquires. All deposits have to be accounted for<br />

by the bank staff, before they are credited to customers’ accounts.<br />

Marcia Crosl<strong>and</strong> of NCR Corp. (2010) indicated that aside from revenue generation <strong>and</strong> cost<br />

savings, <strong>ATM</strong>s are becoming the face of many financial institutions. For many consumers, <strong>ATM</strong>s are<br />

becoming the only interaction they have with their banks. In addition, <strong>ATM</strong>s are also becoming a<br />

competitive mark for many banks. Therefore, it is imperative to ensure that the customer's experience<br />

with the <strong>ATM</strong> is safe <strong>and</strong> secure.<br />

Mike Fenton (2000), mentioned that over the past three decades consumers have come to<br />

depend on <strong>and</strong> trust the <strong>ATM</strong> to conveniently meet their banking needs. In recent years there has been<br />

a proliferation of <strong>ATM</strong> frauds across the globe. Managing the risk associated with <strong>ATM</strong> fraud as well<br />

as diminishing its impact are important issues that face financial institutions as fraud techniques have<br />

become more advanced with increased occurrences.<br />

Diebold Inco. (2002) indicated that the <strong>ATM</strong> is only one of many electronic funds transfer<br />

(EFT) devices that are vulnerable to fraud attacks. Card theft, or the theft of card data, is the primary<br />

objective for potential thieves because the card contains all relevant account information needed to<br />

access an account.<br />

Recent global <strong>ATM</strong> consumer research indicates that one of the most important issues for<br />

consumers when using an <strong>ATM</strong> was personal safety <strong>and</strong> security. As financial institutions use the<br />

migration of cash transactions to self-service terminals as a primary method of increasing branch<br />

efficiencies, the <strong>ATM</strong> experience must be as safe <strong>and</strong> accommodating as possible for consumers.<br />

The industry has grave difficulty in measuring <strong>ATM</strong> fraud given the lack of a national<br />

classification, the secrecy surrounding such frauds, <strong>and</strong> the unfortunate fact that one cannot know the<br />

true cost of fraud until one is hit with it. Even low-cost solutions, such as customer awareness,<br />

challenge banks that fear scaring customers away from the <strong>ATM</strong>, or worse, into the doors of a<br />

competitor.<br />

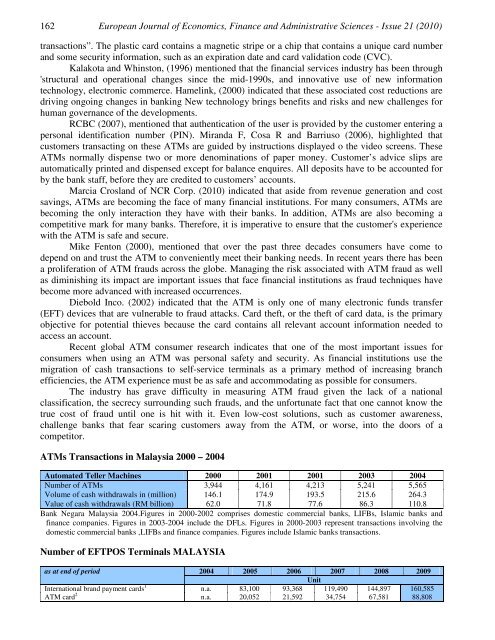

<strong>ATM</strong>s Transactions in Malaysia 2000 – 2004<br />

Automated Teller Machines 2000 2001 2001 2003 2004<br />

Number of <strong>ATM</strong>s 3,944 4,161 4,213 5,241 5,565<br />

Volume of cash withdrawals in (million) 146.1 174.9 193.5 215.6 264.3<br />

Value of cash withdrawals (RM billion) 62.0 71.8 77.6 86.3 110.8<br />

Bank Negara Malaysia 2004.Figures in 2000-2002 comprises domestic commercial banks, LIFBs, Islamic banks <strong>and</strong><br />

finance companies. Figures in 2003-2004 include the DFLs. Figures in 2000-2003 represent transactions involving the<br />

domestic commercial banks ,LIFBs <strong>and</strong> finance companies. Figures include Islamic banks transactions.<br />

Number of EFTPOS Terminals MALAYSIA<br />

as at end of period 2004 2005 2006 2007 2008 2009<br />

Unit<br />

International br<strong>and</strong> payment cards 1 n.a. 83,100 93,368 119,490 144,897 160,585<br />

<strong>ATM</strong> card 2 n.a. 20,052 21,592 34,754 67,581 88,808