ATM Risk Management and Controls - EuroJournals

ATM Risk Management and Controls - EuroJournals

ATM Risk Management and Controls - EuroJournals

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

164 European Journal of Economics, Finance <strong>and</strong> Administrative Sciences - Issue 21 (2010)<br />

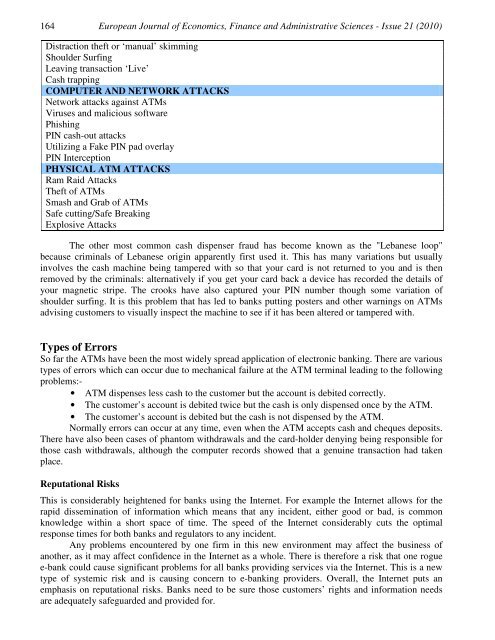

Distraction theft or ‘manual’ skimming<br />

Shoulder Surfing<br />

Leaving transaction ‘Live’<br />

Cash trapping<br />

COMPUTER AND NETWORK ATTACKS<br />

Network attacks against <strong>ATM</strong>s<br />

Viruses <strong>and</strong> malicious software<br />

Phishing<br />

PIN cash-out attacks<br />

Utilizing a Fake PIN pad overlay<br />

PIN Interception<br />

PHYSICAL <strong>ATM</strong> ATTACKS<br />

Ram Raid Attacks<br />

Theft of <strong>ATM</strong>s<br />

Smash <strong>and</strong> Grab of <strong>ATM</strong>s<br />

Safe cutting/Safe Breaking<br />

Explosive Attacks<br />

The other most common cash dispenser fraud has become known as the "Lebanese loop"<br />

because criminals of Lebanese origin apparently first used it. This has many variations but usually<br />

involves the cash machine being tampered with so that your card is not returned to you <strong>and</strong> is then<br />

removed by the criminals: alternatively if you get your card back a device has recorded the details of<br />

your magnetic stripe. The crooks have also captured your PIN number though some variation of<br />

shoulder surfing. It is this problem that has led to banks putting posters <strong>and</strong> other warnings on <strong>ATM</strong>s<br />

advising customers to visually inspect the machine to see if it has been altered or tampered with.<br />

Types of Errors<br />

So far the <strong>ATM</strong>s have been the most widely spread application of electronic banking. There are various<br />

types of errors which can occur due to mechanical failure at the <strong>ATM</strong> terminal leading to the following<br />

problems:-<br />

• <strong>ATM</strong> dispenses less cash to the customer but the account is debited correctly.<br />

• The customer’s account is debited twice but the cash is only dispensed once by the <strong>ATM</strong>.<br />

• The customer’s account is debited but the cash is not dispensed by the <strong>ATM</strong>.<br />

Normally errors can occur at any time, even when the <strong>ATM</strong> accepts cash <strong>and</strong> cheques deposits.<br />

There have also been cases of phantom withdrawals <strong>and</strong> the card-holder denying being responsible for<br />

those cash withdrawals, although the computer records showed that a genuine transaction had taken<br />

place.<br />

Reputational <strong>Risk</strong>s<br />

This is considerably heightened for banks using the Internet. For example the Internet allows for the<br />

rapid dissemination of information which means that any incident, either good or bad, is common<br />

knowledge within a short space of time. The speed of the Internet considerably cuts the optimal<br />

response times for both banks <strong>and</strong> regulators to any incident.<br />

Any problems encountered by one firm in this new environment may affect the business of<br />

another, as it may affect confidence in the Internet as a whole. There is therefore a risk that one rogue<br />

e-bank could cause significant problems for all banks providing services via the Internet. This is a new<br />

type of systemic risk <strong>and</strong> is causing concern to e-banking providers. Overall, the Internet puts an<br />

emphasis on reputational risks. Banks need to be sure those customers’ rights <strong>and</strong> information needs<br />

are adequately safeguarded <strong>and</strong> provided for.