CII Communique July 2011

CII Communique July 2011

CII Communique July 2011

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

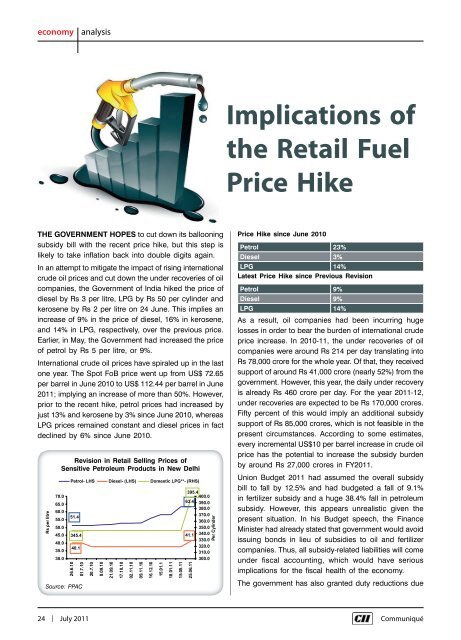

economyanalysisImplications ofthe Retail FuelPrice HikeThe Government hopes to cut down its ballooningsubsidy bill with the recent price hike, but this step islikely to take inflation back into double digits again.In an attempt to mitigate the impact of rising internationalcrude oil prices and cut down the under recoveries of oilcompanies, the Government of India hiked the price ofdiesel by Rs 3 per litre, LPG by Rs 50 per cylinder andkerosene by Rs 2 per litre on 24 June. This implies anincrease of 9% in the price of diesel, 16% in kerosene,and 14% in LPG, respectively, over the previous price.Earlier, in May, the Government had increased the priceof petrol by Rs 5 per litre, or 9%.International crude oil prices have spiraled up in the lastone year. The Spot FoB price went up from US$ 72.65per barrel in June 2010 to US$ 112.44 per barrel in June<strong>2011</strong>; implying an increase of more than 50%. However,prior to the recent hike, petrol prices had increased byjust 13% and kerosene by 3% since June 2010, whereasLPG prices remained constant and diesel prices in factdeclined by 6% since June 2010.Revision in Retail Selling Prices ofSensitive Petroleum Products in New DelhiSource: PPACPrice Hike since June 2010Petrol 23%Diesel 3%LPG 14%Latest Price Hike since Previous RevisionPetrol 9%Diesel 9%LPG 14%As a result, oil companies had been incurring hugelosses in order to bear the burden of international crudeprice increase. In 2010-11, the under recoveries of oilcompanies were around Rs 214 per day translating intoRs 78,000 crore for the whole year. Of that, they receivedsupport of around Rs 41,000 crore (nearly 52%) from thegovernment. However, this year, the daily under recoveryis already Rs 460 crore per day. For the year <strong>2011</strong>-12,under recoveries are expected to be Rs 170,000 crores.Fifty percent of this would imply an additional subsidysupport of Rs 85,000 crores, which is not feasible in thepresent circumstances. According to some estimates,every incremental US$10 per barrel increase in crude oilprice has the potential to increase the subsidy burdenby around Rs 27,000 crores in FY<strong>2011</strong>.Union Budget <strong>2011</strong> had assumed the overall subsidybill to fall by 12.5% and had budgeted a fall of 9.1%in fertilizer subsidy and a huge 38.4% fall in petroleumsubsidy. However, this appears unrealistic given thepresent situation. In his Budget speech, the FinanceMinister had already stated that government would avoidissuing bonds in lieu of subsidies to oil and fertilizercompanies. Thus, all subsidy-related liabilities will comeunder fiscal accounting, which would have seriousimplications for the fiscal health of the economy.The government has also granted duty reductions due24 | <strong>July</strong> <strong>2011</strong> Communiqué