office market munich - BNP PARIBAS Real Estate Deutschland

office market munich - BNP PARIBAS Real Estate Deutschland

office market munich - BNP PARIBAS Real Estate Deutschland

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

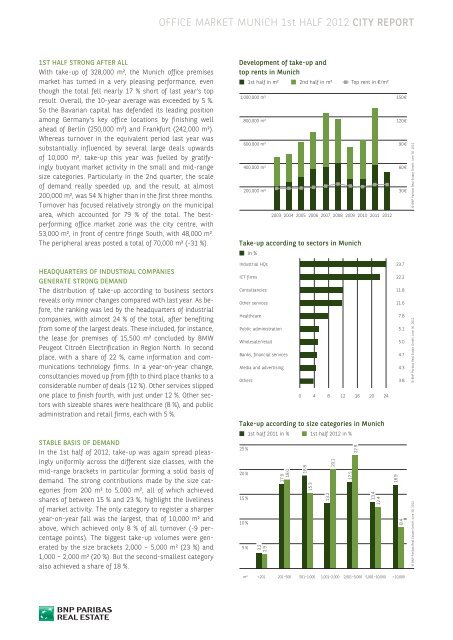

1ST HALF STRONG AFTER ALL<br />

With take-up of 328,000 m², the Munich <strong>office</strong> premises<br />

<strong>market</strong> has turned in a very pleasing performance, even<br />

though the total fell nearly 17 % short of last year’s top<br />

result. Overall, the 10-year average was exceeded by 5 %.<br />

So the Bavarian capital has defended its leading position<br />

among Germany’s key <strong>office</strong> locations by finishing well<br />

ahead of Berlin (250,000 m²) and Frankfurt (242,000 m²).<br />

Whereas turnover in the equivalent period last year was<br />

substantially influenced by several large deals upwards<br />

of 10,000 m², take-up this year was fuelled by gratifyingly<br />

buoyant <strong>market</strong> activity in the small and mid-range<br />

size categories. Particularly in the 2nd quarter, the scale<br />

of demand really speeded up, and the result, at almost<br />

200,000 m², was 54 % higher than in the first three months.<br />

Turnover has focused relatively strongly on the municipal<br />

area, which accounted for 79 % of the total. The bestperforming<br />

<strong>office</strong> <strong>market</strong> zone was the city centre, with<br />

53,000 m², in front of centre fringe South, with 48,000 m².<br />

The peripheral areas posted a total of 70,000 m² (-31 %).<br />

HEADQUARTERS OF INDUSTRIAL COMPANIES<br />

GENERATE STRONG DEMAND<br />

The distribution of take-up according to business sectors<br />

reveals only minor changes compared with last year. As before,<br />

the ranking was led by the headquarters of industrial<br />

companies, with almost 24 % of the total, after benefiting<br />

from some of the largest deals. These included, for instance,<br />

the lease for premises of 15,500 m² concluded by BMW<br />

Peugeot Citroën Electrification in Region North. In second<br />

place, with a share of 22 %, came information and communications<br />

technology firms. In a year-on-year change,<br />

consultancies moved up from fifth to third place thanks to a<br />

considerable number of deals (12 %). Other services slipped<br />

one place to finish fourth, with just under 12 %. Other sectors<br />

with sizeable shares were healthcare (8 %), and public<br />

administration and retail firms, each with 5 %.<br />

STABLE BASIS OF DEMAND<br />

In the 1st half of 2012, take-up was again spread pleasingly<br />

uniformly across the different size classes, with the<br />

mid-range brackets in particular forming a solid basis of<br />

demand. The strong contributions made by the size categories<br />

from 200 m² to 5,000 m², all of which achieved<br />

shares of between 15 % and 23 %, highlight the liveliness<br />

of <strong>market</strong> activity. The only category to register a sharper<br />

year-on-year fall was the largest, that of 10,000 m² and<br />

above, which achieved only 8 % of all turnover (-9 percentage<br />

points). The biggest take-up volumes were generated<br />

by the size brackets 2,000 – 5,000 m² (23 %) and<br />

1,000 – 2,000 m² (20 %). But the second-smallest category<br />

also achieved a share of 18 %.<br />

OFFICE MARKET MUNICH 1st HALF 2012 CITY REPORT<br />

Development of take-up and<br />

top rents in Munich<br />

1st half in m² 2nd half in m² Top rent in €/m²<br />

1,000,000 m²<br />

800,000 m²<br />

600,000 m²<br />

400,000 m²<br />

200,000 m²<br />

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012<br />

Take-up according to sectors in Munich<br />

in %<br />

Industrial HQs<br />

ICT firms<br />

Consultancies<br />

Other services<br />

15.3<br />

150 €<br />

120 €<br />

Healthcare<br />

7.8<br />

2012<br />

Public administration<br />

5.1 30, June<br />

Wholesale/retail<br />

5.0<br />

GmbH,<br />

Banks, financial services<br />

4.7 <strong>Estate</strong> <strong>Real</strong><br />

Media and advertising<br />

4.3<br />

Paribas <strong>BNP</strong><br />

Others 3.8 ©<br />

0 4 8 12 16 20 24<br />

Take-up according to size categories in Munich<br />

25 %<br />

20 %<br />

15 %<br />

10 %<br />

5 %<br />

1st half 2011 in % 1st half 2012 in %<br />

3.2<br />

2.9<br />

17.0<br />

18.0<br />

m² < 201 201–500<br />

18.8<br />

13.2<br />

20.1<br />

17.5<br />

22.9<br />

13.4<br />

12.4<br />

16.9<br />

90 €<br />

60 €<br />

30 €<br />

23.7<br />

22.2<br />

11.8<br />

11.6<br />

8.4<br />

501–1,000 1,001–2,000 2,001–5,000 5,001–10,000 > 10,000<br />

© <strong>BNP</strong> Paribas <strong>Real</strong> <strong>Estate</strong> GmbH, June 30, 2012<br />

© <strong>BNP</strong> Paribas <strong>Real</strong> <strong>Estate</strong> GmbH, June 30, 2012