office market munich - BNP PARIBAS Real Estate Deutschland

office market munich - BNP PARIBAS Real Estate Deutschland

office market munich - BNP PARIBAS Real Estate Deutschland

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SUBSTANTIAL FALL IN VACANCY<br />

The strong demand exhibited in recent quarters is reflected<br />

by the way in which vacancy has developed. Within the<br />

course of a year, this has been reduced by nearly 15 % to<br />

1.4 million m². Exceptionally marked declines were posted<br />

in Arnulfpark (-63 %), Parkstadt Schwabing (-59 %) and<br />

centre fringe North (-44 %), but the volume of ready-to-rent<br />

space also fell considerably in the city centre (-21 %). There<br />

is a clear-cut focus of demand on vacant modern premises.<br />

These currently represent a total volume of 382,000 m²,<br />

which is 43 % less than at the same time last year, and<br />

they now account for only a very small proportion (26 %) of<br />

aggregate vacancy. The vacancy rate has accordingly fallen<br />

by a considerable margin. In the municipal area it is 6.0 %,<br />

and in the <strong>market</strong> area as a whole 7.1 %.<br />

MORE SPACE UNDER CONSTRUCTION – BUT<br />

LESS AVAILABLE<br />

Following the commencement of several projects, the volume<br />

of space under construction, at 274,000 m², is well up<br />

on the prior-year figure (+24 %). However, the still-available<br />

proportion of this space – 119,000 m² – is some 22 %<br />

lower than before, since most of the projects concerned<br />

already have high preletting rates or are destined for owner-<br />

occupation. This development also impacts on the overall<br />

available supply of <strong>office</strong> space (vacancy plus available<br />

premises under construction), which has fallen year-onyear<br />

by 15 % to produce a total at present of 1.56 million m².<br />

PRIME RENT STABLE, AVERAGE RENTS RISING<br />

The prime rent in the Munich <strong>market</strong> area, obtained in the<br />

city centre, has remained steady at 33 €/m² for over a year<br />

now. In many other sub<strong>market</strong>s, though, the pressure of<br />

demand for modern <strong>office</strong> units has made itself apparent<br />

in the form of higher top rents. These sub<strong>market</strong>s include<br />

Parkstadt Schwabing (+14 % to 20 €/m²), Arnulfpark (+10 %<br />

to 22 €/m²), centre fringe North (+9 % to 24 €/m²) and Bogenhausen<br />

(+8 % to 20 €/m²). Average rents have also been<br />

climbing in almost all the <strong>office</strong> <strong>market</strong> zones.<br />

OUTLOOK<br />

The perceptible <strong>market</strong> upswing that began in the 2nd<br />

quarter looks set to continue during the remaining months<br />

of this year, although of course the still unresolved state<br />

debt crisis does raise question marks. Nonetheless, it seems<br />

not unrealistic to expect the year as a whole to produce a<br />

very good result, in the region of around 700,000 m². The<br />

pace of the reduction in vacancy, however, is likely to be<br />

much more restrained than up to now, since upcoming business<br />

relocations will leave premises standing empty. Where<br />

the prime rent is concerned, the most probable scenario is<br />

stabilisation at the present level.<br />

OFFICE MARKET MUNICH 1st HALF 2012 CITY REPORT<br />

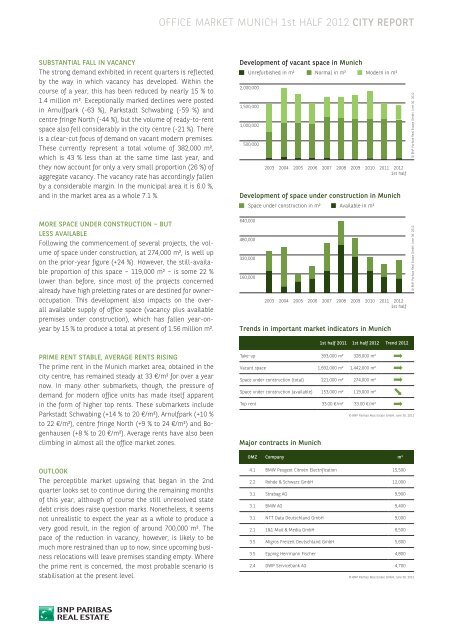

Development of vacant space in Munich<br />

Unrefurbished in m² Normal in m² Modern in m²<br />

2,000,000<br />

1,500,000<br />

1,000,000<br />

500,000<br />

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012<br />

1st half<br />

Development of space under construction in Munich<br />

640,000<br />

480,000<br />

320,000<br />

160,000<br />

Space under construction in m² Available in m²<br />

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012<br />

1st half<br />

Trends in important <strong>market</strong> indicators in Munich<br />

1st half 2011 1st half 2012 Trend 2012<br />

Take-up 393,000 m² 328,000 m²<br />

Vacant space 1,692,000 m² 1,442,000 m²<br />

Space under construction (total) 221,000 m² 274,000 m²<br />

Space under construction (available) 153,000 m² 119,000 m²<br />

Top rent 33.00 €/m² 33.00 €/m²<br />

Major contracts in Munich<br />

© <strong>BNP</strong> Paribas <strong>Real</strong> <strong>Estate</strong> GmbH, June 30, 2012<br />

OMZ Company m²<br />

4.1 BMW Peugeot Citroën Electrification 15,500<br />

2.2 Rohde & Schwarz GmbH 12,000<br />

3.1 Strabag AG 9,900<br />

3.1 BMW AG 9,400<br />

3.1 NTT Data <strong>Deutschland</strong> GmbH 9,000<br />

2.1 1&1 Mail & Media GmbH 6,500<br />

3.5 Migros Freizeit <strong>Deutschland</strong> GmbH 5,600<br />

3.5 Epping Herrmann Fischer 4,800<br />

2.4 DWP Servicebank AG 4,700<br />

© <strong>BNP</strong> Paribas <strong>Real</strong> <strong>Estate</strong> GmbH, June 30, 2012<br />

© <strong>BNP</strong> Paribas <strong>Real</strong> <strong>Estate</strong> GmbH, June 30, 2012<br />

© <strong>BNP</strong> Paribas <strong>Real</strong> <strong>Estate</strong> GmbH, June 30, 2012