Annual Report 2011 - Colombo Stock Exchange

Annual Report 2011 - Colombo Stock Exchange

Annual Report 2011 - Colombo Stock Exchange

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

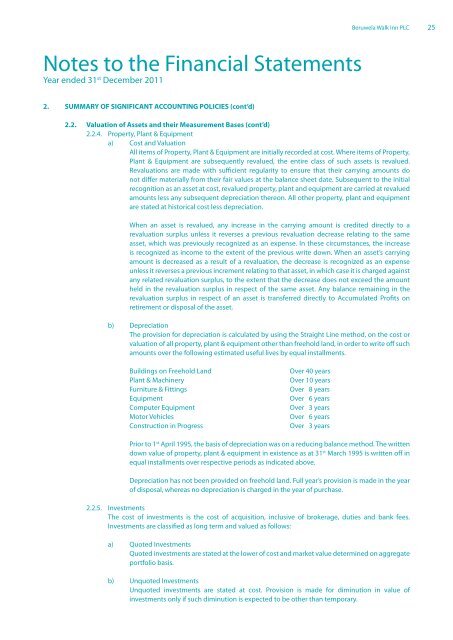

Beruwela Walk Inn PLC 25Notes to the Financial StatementsYear ended 31 st December <strong>2011</strong>2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (cont’d)2.2. Valuation of Assets and their Measurement Bases (cont’d)2.2.4. Property, Plant & Equipmenta) Cost and ValuationAll items of Property, Plant & Equipment are initially recorded at cost. Where items of Property,Plant & Equipment are subsequently revalued, the entire class of such assets is revalued.Revaluations are made with sufficient regularity to ensure that their carrying amounts donot differ materially from their fair values at the balance sheet date. Subsequent to the initialrecognition as an asset at cost, revalued property, plant and equipment are carried at revaluedamounts less any subsequent depreciation thereon. All other property, plant and equipmentare stated at historical cost less depreciation.When an asset is revalued, any increase in the carrying amount is credited directly to arevaluation surplus unless it reverses a previous revaluation decrease relating to the sameasset, which was previously recognized as an expense. In these circumstances, the increaseis recognized as income to the extent of the previous write down. When an asset’s carryingamount is decreased as a result of a revaluation, the decrease is recognized as an expenseunless it reverses a previous increment relating to that asset, in which case it is charged againstany related revaluation surplus, to the extent that the decrease does not exceed the amountheld in the revaluation surplus in respect of the same asset. Any balance remaining in therevaluation surplus in respect of an asset is transferred directly to Accumulated Profits onretirement or disposal of the asset.b) DepreciationThe provision for depreciation is calculated by using the Straight Line method, on the cost orvaluation of all property, plant & equipment other than freehold land, in order to write off suchamounts over the following estimated useful lives by equal installments.Buildings on Freehold LandPlant & MachineryFurniture & FittingsEquipmentComputer EquipmentMotor VehiclesConstruction in ProgressOver 40 yearsOver 10 yearsOver 8 yearsOver 6 yearsOver 3 yearsOver 6 yearsOver 3 yearsPrior to 1 st April 1995, the basis of depreciation was on a reducing balance method. The writtendown value of property, plant & equipment in existence as at 31 st March 1995 is written off inequal installments over respective periods as indicated above.Depreciation has not been provided on freehold land. Full year’s provision is made in the yearof disposal, whereas no depreciation is charged in the year of purchase.2.2.5. InvestmentsThe cost of investments is the cost of acquisition, inclusive of brokerage, duties and bank fees.Investments are classified as long term and valued as follows:a) Quoted InvestmentsQuoted investments are stated at the lower of cost and market value determined on aggregateportfolio basis.b) Unquoted InvestmentsUnquoted investments are stated at cost. Provision is made for diminution in value ofinvestments only if such diminution is expected to be other than temporary.