Rohit Bansal - IIT Roorkee

Rohit Bansal - IIT Roorkee

Rohit Bansal - IIT Roorkee

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

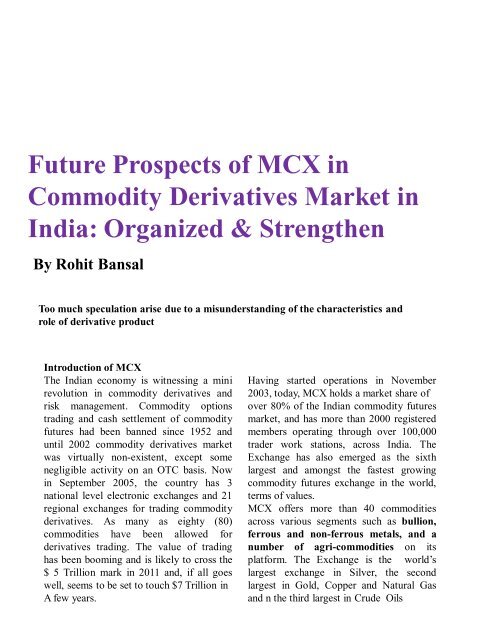

Future Prospects of MCX inCommodity Derivatives Market inIndia: Organized & StrengthenBy <strong>Rohit</strong> <strong>Bansal</strong>Too much speculation arise due to a misunderstanding of the characteristics androle of derivative productIntroduction of MCXThe Indian economy is witnessing a minirevolution in commodity derivatives andrisk management. Commodity optionstrading and cash settlement of commodityfutures had been banned since 1952 anduntil 2002 commodity derivatives marketwas virtually non-existent, except somenegligible activity on an OTC basis. Nowin September 2005, the country has 3national level electronic exchanges and 21regional exchanges for trading commodityderivatives. As many as eighty (80)commodities have been allowed forderivatives trading. The value of tradinghas been booming and is likely to cross the$ 5 Trillion mark in 2011 and, if all goeswell, seems to be set to touch $7 Trillion inA few years.Having started operations in November2003, today, MCX holds a market share ofover 80% of the Indian commodity futuresmarket, and has more than 2000 registeredmembers operating through over 100,000trader work stations, across India. TheExchange has also emerged as the sixthlargest and amongst the fastest growingcommodity futures exchange in the world,terms of values.MCX offers more than 40 commoditiesacross various segments such as bullion,ferrous and non-ferrous metals, and anumber of agri-commodities on itsplatform. The Exchange is the world‟slargest exchange in Silver, the secondlargest in Gold, Copper and Natural Gasand n the third largest in Crude Oils