WW World 3-4.2009 - Wilh. Wilhelmsen ASA

WW World 3-4.2009 - Wilh. Wilhelmsen ASA

WW World 3-4.2009 - Wilh. Wilhelmsen ASA

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

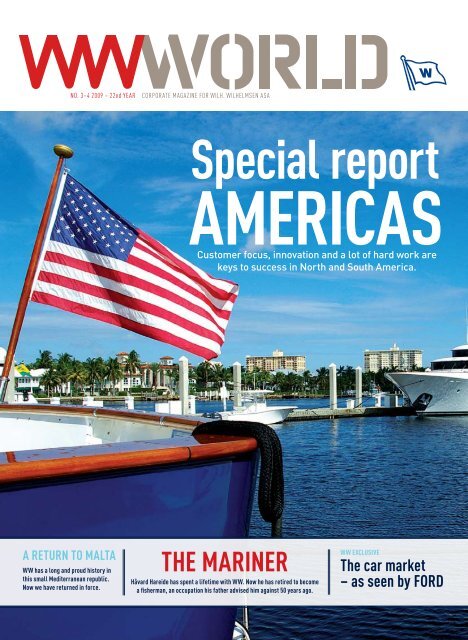

no. 3–4 2009 – 22nd yearcorporate magazine for <strong>Wilh</strong>. <strong>Wilh</strong>elmsen <strong>ASA</strong>Special reportAmericasCustomer focus, innovation and a lot of hard work arekeys to success in North and South America.A RETURN TO MALTA<strong>WW</strong> has a long and proud history inthis small Mediterranean republic.Now we have returned in force.THE MARINERHåvard Hareide has spent a lifetime with <strong>WW</strong>. Now he has retired to becomea fisherman, an occupation his father advised him against 50 years ago.<strong>WW</strong> EXCLUSIVEThe car market– as seen by FORD

<strong>WW</strong> exclusiveConfidentabout the futureIngvar Sviggum, vice president marketing, sales and service forFord of Europe says the recovery we’re seeing is ‘fragile’ – and thatthe European car industry may not reach pre-downturn productionand sales levels until 2014. But Ford is doing better than most.Text and photos: Kaia Means“You can cut costs so far,but at the end of the dayyou need your customers towant to buy your products”16 <strong>WW</strong>WORLD 3–4 200917

<strong>WW</strong> EXCLUSIVENORWAY: The <strong>WW</strong> group and its jointlyowned ship-operating companiesare among the largest transportersof rolling cargo and cars worldwide.We asked Ford of Europe vice president IngvarSviggum, one of the automotive industry’s realveterans, about how he sees the present crisisand the future for the industry.Q: How has the financial crisis affectedthe car industry, and how has Fordof Europe weathered the crisis?A: The crisis has been very severe – one ofthe most dramatic in living memory, even fora 64-year-old like myself!The decline in demand across the world hashad a negative impact in many business areas,and notably in the car industry. For example,our wholesale sales at Ford of Europe in thesecond quarter of the year were down by132,000 units compared to the same quarterlast year to 400,000 vehicles sold, and ourrevenue declined from $11.5 billion to $7.2 billionfor the second quarter 2009. Yet despitethese very severe economic headwinds, we havemade steady progress, returning to profit in thesecond quarter after just two quarters of loss.We’re the no. 2 best-selling brand in theEuropean market, steadily increasing our marketshare over the course of the year, and wenow have 9 per cent in our main 19 Europeaningvar sviggum➜ Vice president marketing, sales andservice for Ford of Europe since 2008.➜ Started his career at Ford Norway in 1963 as atrainee.➜ He has held many positions, includingmanaging director, Ford Norway and managingdirector and vice chairman, Ford of Spain.➜ Mr. Sviggum was brought into the Ford ofEurope central senior management team in1989 as director, marketing plans and programs.➜ He became executive director, Europeansales operations for Ford of Europe in 1998➜ In 1999, he was appointed vice president,European sales operations➜ He is also a Ford Motor Company vicepresident.FORD'S MAN: Ingvar Sviggum, vice president marketing,sales and service for Ford of Europe recognises thatthere is still an over-capacity in the car market.markets. So we are taking a bigger slice of thepie even though the pie is getting smaller inabsolute terms. Cutting capacity, together witha strong focus on reducing costs, has been a keypart in our efforts to sustain a healthy businessand to return to sustainable profitabilityas soon as possible.But the key factor has been to ensure thatwe continue to deliver great products to ourcustomers. You can cut costs so far, but at theend of the day you need your customers to wantto buy your products.Having said that, I’m very confident aboutour future, and feel we are in the right positionto make even further gains with our newproducts once the market starts to recover, asit eventually must.Q: Does Europe need continued scrappageschemes like the ones implementedin Germany, France, Spain, Italy, andthe UK?A: Scrappage schemes – especially inGermany – have helped to keep the Europeanauto market buoyant in 2009. Without themwe would have been faced with a far weakermarket. But the underlying market remainsweak as some of the key structural issues stillneed to be addressed – for example, fears ofunemployment, confidence in an improvementand access for customers to credit at reasonableinterest rates.I believe scrappage schemes should continue foras long as practically possible, and then be phasedout in an orderly way to avoid destabilising reductionsin demand that could damage the fragileimprovement we have seen in recent months.In addition to scrappage, member states andthe EU also need to continue to support all elementsof the automotive value chain throughinnovative actions until the economic crisishas ended.Q: Has the car industry reached a watershedwhen it comes to moving awayfrom fossil fuels? Or will cars withpetrol and diesel engines constitutethe majority of sales for many yearsto come?A: Petrol and diesel-engined vehicles willcontinue to be the majority of vehicle salesin the years ahead, but we will see an increasingmove to new generations of clean dieseltechnologies and petrol engines based aroundadvanced fuel-saving direct injection technologies.The benefit of these technologies is thatthey are affordable and can be applied across alarge number of vehicles.We believe through offering high-volume,affordable low CO 2solutions for millions ofcustomers, we can make a real difference, tothe environment and to the customer. Our goalis to exceed our product CO 2goal, which callsfor a 30 per cent reduction in the CO 2emissionsof our new US and European vehicles by2020, compared to the 2006 model year.As for other CO 2reducing technologies, webelieve there is no single technological solution.That’s why we are working on a broadportfolio of solutions in addition to advanceddiesel and petrol technologies. These includefurther advances in areas like a new generationof fuel-saving transmission and weight reduction.We’re improving alternative fuel poweredvehicles (AFVs) including bio-ethanolpowered Flexifuel technology plus CNG/LPG(compressed natural gas/liquefied petroleumgas) models for countries with supporting fuelinfrastructure. We’re working on electrificationand hybridization of technologies, regenerativecharging and plug-in hybrid technology,and the development of pure battery electricvehicles (BEVs). In addition we are workingon hydrogen-powered internal combustionengines and highly energy efficient, hydrogenpoweredfuel cell technology, which we see inthe long term as possible solutions to reducecar-based CO 2emissions, provided hydrogenis derived from sustainable sources.Q: Where do you see the most opportunitiesfor growth?A: It’s important that we look at every opportunityto grow ourpresence, whetherin traditional marketsor in some ofthe growth markets,such as Russia andEastern Europe.Unfortunately thecurrent economicsituation has seenvehicle sales plummetin Russia.Longer termthough, we will seeRussia and EasternEurope recover andthey will be areasfor growth. This ispart of the reasonwhy we have establisheda manufacturing presence not only inSt Petersburg, but also in Romania at our newfacility in Craiova.Q: How does increased productionin Korea, India and China affect theindustry?A: The world is becoming increasingly moreglobal when it comes to competition, butthe key is to embrace this as an opportunityrather than simply perceiving it as a threat.Just recently Ford made a number of majorannouncements concerning new investmentsin India and China that will help us to establishourselves even more in those key markets.So we welcome competition in this moreglobal business environment, but we need freeand fair trade between markets to ensure weall operate within a level playing field and thatthere are no artificial barriers to trade.Q: In our globalised economy, wherecars are being made in many differentcountries, are good logisticalsolutions steadily becoming moreimportant? What are the challengesin logistics and distribution, and howcan service suppliers to the car industrycontribute to ease a difficultsituation?A: It’s also about how you leverage your assetson a global basis. Just look at what we’redoing at Ford through our ONE Ford approach.At Ford, we look at every business opportunityfrom the perspective of whether it can beleveraged at the global level. An all-new FordFocus built on this platform is being launchedglobally in 2010.Certainly though, logistics and support fromour logistics suppliers is a critical factor in ouroperations. We need to ensure we have robustand efficient processes in place to ensure thesystem operates as smoothly as possible. Weare of course also driving the process fromorder to delivery. The time between productionoffline and key in customer’s hands are wasteand dead time. Therefore a very efficient andreliable distribution system is vital for totalprofitability.Q: Which types of cars will becomemore popular in the coming years?Do SUVs have a future? Are there anynew Ford models coming up?A: Of course there are new Ford models!As you can see with the new C-MAX, we’vereplaced one model with two derivatives – afive-seater and a seven-seater model – becausewe felt there was a space in the market for twodistinct product offerings.I think the economic situation, CO 2taxationand the volatility of oil prices is forcing manycustomers to reconsider their vehicle needs,hence the greater interest in smaller vehiclesand the fact that we are now able to sell a carlike the Fiesta not only in Europe and Asia-Pacific but also in North America from 2010.And yes, SUVs do still have a future!Q: What do you see coming in the industryin the next one to five years – oreven further ahead?A: There is still a huge issue of over-capacity.Decreased demand as a consequence of the economicdownturn has only further aggravatedover-capacity in the European auto industry.One of Ford of Europe’s keys to success has,and continues to be, our ability to match productionwith market demand, i.e. not producevehicles that the market doesn’t need.Fuel economy and CO 2reduction will continueto be primary drivers for the auto industryand will increasingly become a customercompetitivearea for car manufacturers.I think we will definitely see more customerfocusedtechnologies in our vehicles – muchmore of an overlap between the digital worldI think the vehicleindustry in Europe maynot reach the production andsales levels of before theeconomic downturn for thenext five years or so”we experience outside our vehicle and in ourvehicle. There will be more choice and moreinnovation on offer to customers, and the opportunityto better tailor a vehicle to the owner’sspecific lifestyle needs and aesthetic wants, suchas through Ford’s Individual programme.All in all, I think the next five years will be atime when it has never been better to be a newvehicle customer, and especially a customer ofa new Ford vehicle.18 <strong>WW</strong>WORLD 3–4 2009<strong>WW</strong>WORLD 3–4 2009 19