IGB CORPORATION BERHAD PART A STATEMENT in relation to ...

IGB CORPORATION BERHAD PART A STATEMENT in relation to ...

IGB CORPORATION BERHAD PART A STATEMENT in relation to ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

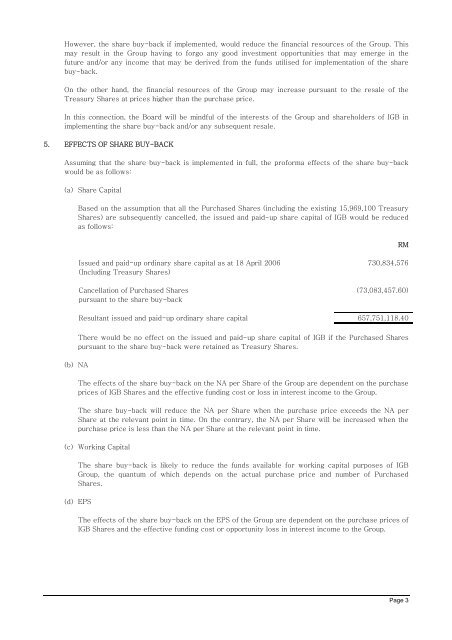

However, the share buy-back if implemented, would reduce the f<strong>in</strong>ancial resources of the Group. Thismay result <strong>in</strong> the Group hav<strong>in</strong>g <strong>to</strong> forgo any good <strong>in</strong>vestment opportunities that may emerge <strong>in</strong> thefuture and/or any <strong>in</strong>come that may be derived from the funds utilised for implementation of the sharebuy-back.On the other hand, the f<strong>in</strong>ancial resources of the Group may <strong>in</strong>crease pursuant <strong>to</strong> the resale of theTreasury Shares at prices higher than the purchase price.In this connection, the Board will be m<strong>in</strong>dful of the <strong>in</strong>terests of the Group and shareholders of <strong>IGB</strong> <strong>in</strong>implement<strong>in</strong>g the share buy-back and/or any subsequent resale.5. EFFECTS OF SHARE BUY-BACKAssum<strong>in</strong>g that the share buy-back is implemented <strong>in</strong> full, the proforma effects of the share buy-backwould be as follows:(a) Share CapitalBased on the assumption that all the Purchased Shares (<strong>in</strong>clud<strong>in</strong>g the exist<strong>in</strong>g 15,969,100 TreasuryShares) are subsequently cancelled, the issued and paid-up share capital of <strong>IGB</strong> would be reducedas follows:RMIssued and paid-up ord<strong>in</strong>ary share capital as at 18 April 2006(Includ<strong>in</strong>g Treasury Shares)Cancellation of Purchased Sharespursuant <strong>to</strong> the share buy-back730,834,576(73,083,457.60)Resultant issued and paid-up ord<strong>in</strong>ary share capital 657,751,118.40(b) NAThere would be no effect on the issued and paid-up share capital of <strong>IGB</strong> if the Purchased Sharespursuant <strong>to</strong> the share buy-back were reta<strong>in</strong>ed as Treasury Shares.The effects of the share buy-back on the NA per Share of the Group are dependent on the purchaseprices of <strong>IGB</strong> Shares and the effective fund<strong>in</strong>g cost or loss <strong>in</strong> <strong>in</strong>terest <strong>in</strong>come <strong>to</strong> the Group.The share buy-back will reduce the NA per Share when the purchase price exceeds the NA perShare at the relevant po<strong>in</strong>t <strong>in</strong> time. On the contrary, the NA per Share will be <strong>in</strong>creased when thepurchase price is less than the NA per Share at the relevant po<strong>in</strong>t <strong>in</strong> time.(c) Work<strong>in</strong>g CapitalThe share buy-back is likely <strong>to</strong> reduce the funds available for work<strong>in</strong>g capital purposes of <strong>IGB</strong>Group, the quantum of which depends on the actual purchase price and number of PurchasedShares.(d) EPSThe effects of the share buy-back on the EPS of the Group are dependent on the purchase prices of<strong>IGB</strong> Shares and the effective fund<strong>in</strong>g cost or opportunity loss <strong>in</strong> <strong>in</strong>terest <strong>in</strong>come <strong>to</strong> the Group.Page 3