See Attached File - INSEAD - PhD Programme

See Attached File - INSEAD - PhD Programme

See Attached File - INSEAD - PhD Programme

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

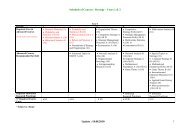

Stakeholders’ Influence on Product Design Decisionswith Exogenous UncertaintyThis study examines how stakeholders exert an influence on product design decisions in the presence ofexogenous uncertainty. Hitherto, research has traditionally viewed firms as one entity, and has prescribed an“optimal” product design decision at firm level. Inspired by field studies at Nokia and Philips, our researchseeks to open the “black box” of R&D organizations by comparing design outputs in various situationsof decision power distribution and task priority. It studies a fundamental yet often overlooked conflict inthe team: the organization’s task priority and the team leader’s position power (project finalization). Italso quantifies two types of personal cost related with stakeholders in development teams and identifiesthe organizational factors which lead to project termination. Simple empirical test is used to support ourinsights.Key words : new product development, stakeholder management, R&D organizations, decision-makingprocess, two-sided incomplete informationHistory : Initial submission1. IntroductionDuring the design stage, product attributes are usually translated into a set of specification values(Ulrich and Eppinger 2003). The choice of product specifications has been identified as one of thefundamental decisions of new product development (NPD)(Krishnan and Ulrich 2001). Properlydefined product specification constitutes the first step in successful product design (Srinivasanet al. 1997, Kalyanaram and Krishnan 1997). In contrast, poorly defined product specification mayhinder a firm’s ability to incorporate customer preferences and cause delays in the new productdevelopment process (Kalyanaram and Krishnan 1997, Ulrich and Eppinger 2003).Even well-organized firms struggle to set “correct” product specifications (Srinivasan et al. 1997).A persistent challenge arises from the imprecise information provided by market research. Thisinformation is often fuzzy and inaccurate, which makes it extremely difficult to achieve objectiveand actionable measurement of the target value (Srinivasan et al. 1997).Another challenge comes from the management of the product development team. In many firms,the product is designed by a team made up of personnel from different functional areas such asMarketing, R&D, Manufacturing, and so on (Pinto et al. 1993, Tatikonda and Montoya-Weiss 2001),each with diverse backgrounds and preferences (Atuahene-Gima and Evangelista 2000). Despite a1

2 Author: Influence of Stakeholders on Product Design Decisionspotential for conflicts of interest within development teams (Pelled and Adler 1994), methods suchas job rotations, communications and a collaborative culture (Pinto et al. 1993, Pelled and Adler1994) have been found to mitigate this potential.In practice, however, conflicts of interest persist (Brown and Eisenhardt 1995). Indeed, they mayeven be beneficial for firms under certain conditions. 1 Experienced engineers typically subscribeto the view that, “A good car is always a product with a lot of conflicts and compromises” (Sobeket al. 1998).A third challenge arises from the combination of imprecise information and the team members’diverse backgrounds. Although they share a common goal, team members tend to make theirown individual interpretations (Dougherty 1992). For example, where a firm specifies “usability”as the target of product design, design engineers might seek to identify a product usage, thathas not yet been articulated while overlooking the need to satisfy current consumer desires. Formarketing purposes, however, usability will derive from observing customers’ existing applicationsof a product. Each party, therefore, will propose different “optimal values” to achieve the sametarget.In summary, lack of an objective and consistent definition of the design target tends to preventdifferent parties in development teams from taking coordinated actions (Loch et al. 2006), whichmay in turn lead to a delay in the product launch or even to the termination of the project (Gerwinand Barrowman 2002). In essence, product design decisions often become a negotiation (Bucciarelli1994) between various parties involved (Atuahene-Gima and Evangelista 2000).Unfortunately, existing literature has tended to look at product design decision at the firmlevel without opening the “black box” of the development team’s complex internal interactions.In the related literature, a product is viewed as “a bundle of well defined attributes” (Srinivasanet al. 1997). The decision on the value of one attribute is thus a process of finding the bestvalue optimizing system (product) as well as component performance in the interest of “we” (thefirm) (Shi et al. 2001, Gu et al. 2002, Michalek et al. 2005), while team members’ individual“expected optimal value” is considered irrelevant. As the product complexity increased and moreattributes were introduced, the optimization problem became mathematically more difficult tosolve. Therefore, a couple of heuristics such as Greedy Search, Genetic Algorithm, and NestedPartitions were developed and applied (Shi et al. 2001).1 For example, when facing competition, an organization’s internal conflicts might be used as one “strategic incentive”to mitigate the risk of being caught in too much competition (Balasubramanian and Bhardwaj 2004).

Author: Influence of Stakeholders on Product Design Decisions 3Although this stream of literature has a strong desire for objective choice of product specification,there are still some fundamental limitations to objectivity due to the fuzzy borderline between whatis and what is not feasible in a real decision context (Roy 2005). In practice, many decisions madeunder uncertainties usually result neither from calculations in terms of joint preference functionnor awareness of consistent identities, but from interactions among individuals pursuing their owninterests (March 1994). Particularly in an R&D environment, different parties will struggle to exerttheir departmental or personal influence on new products (Pinto et al. 1993) due to the personalrisks involved in undertaking NPD projects (Atuahene-Gima and Evangelista 2000) which arelinked to the organization’s priorities (Loch et al. 2006).As a result, few managerial implications can be inferred from existing literature about what maybe the most “implementable” product design in a specific organizational context.This study takes a “stakeholder management” perspective to tackle the third challenge facingmanagers. Research on stakeholder management under uncertainty defines stakeholders as “partieswho are affected by the project, have a interest in it, and can influence it” (Loch et al. 2006).Specifically, we focuses on strategic interactions between marketing and design engineers in onedevelopment team. By applying a rigorous game theoretic method, this study analyzes two importantaspects of organizational design as well as the interaction between them: stakeholders’ taskpriority and the distribution of decision power.Viewing product design as a “continuum” of the decision-making process, the study quantifiesthe team leader’s position power as well as stakeholders’ personal interest in a development team.In addition, it shows one fundamental conflict in the development process: the mismatch betweenthe team leader’s position power (“final say on product design”) and the team member’s taskpriority may lead to “blocking” of the design progress. The priority uncertainty can be resolvedthrough the team member’s informative “signalling” only if the team leader’s power is sufficientlyrestricted. Organizational factors leading to project termination (delay) are also studied.This work relates to other findings on the antecedent of a team leader’s position power (Ibarra1993, Atuahene-Gima and Evangelista 2000), although no detailed quantitative analysis of thecomplex decision-making process has been conducted in these studies. Our study looks at theconsequence of stakeholder influence and asks other questions: How exactly does the team leader’sposition power matter to the product design? How do stakeholders strategically exert their influenceon product design decisions?In this study, we capture a commonly observed characteristics of the R&D environment: stakeholdersare multi-tasking and the priority of each task reflects their personal interests (Kavadias

4 Author: Influence of Stakeholders on Product Design Decisionsand Loch 2003, Loch et al. 2006). Previous studies have typically treated task priority as a “strategic”factor managed at firm level (Chao and Kavadias 2008) and it is implicitly assumed to beexogenous to a team’s individual decision making. Our study makes the stakeholder’s task priorityendogenous with the decision making by putting termination cost on involved parties if the projectis terminated. 2Task priority is closely related to other implicit incentives in R&D organizations (e.g. Siemsen(2008), Hutchison-Krupat and Kavadias (2009)). The parties involved in high-priority projects forthe organization often incurs a much heavier career loss when negative outcomes arise than thoseinvolved in low-priority projects (Faure 2009). Managers might also hesitate to terminate a “badproduct” for fear of being punished for the product’s failure (Simester and Zhang 2009). Therefore,the termination cost indicates the underlining importance of the focal project for stakeholders.Previous literature on information exchange among team members tends to assume that at leastone party owns some valuable “accurate” information about external uncertainty, such as marketdemand uncertainty (Kalyanaram and Krishnan 1997) and technology uncertainty (Bhattacharyaet al. 1998) and highlights the importance of information acquisition and hedging (Krishnan et al.1997, Bhattacharya et al. 1998, Loch and Terwiesch 2005, 2007), whereas internal uncertaintycaused by strategic interactions among stakeholders is not addressed. In contrast, we look at anR&D environment where design decisions have to be made with inaccurate information aboutexogenous uncertainties and none of the parties involved is certain of the “true” underlying value.Such an environment is commonly observed in many radical innovation projects with high marketand/or technology uncertainty. In such a situation, it becomes extremely difficult to apply one“objectively correct” criterion to justify one decision over another (Loch et al. 2006). For example,in the fuel cell project at Siemens, progress was delayed many times due to a debate about the“technology target” between R&D engineers and the Accounting department (Cui et al. 2009). In asurvey of R&D managers, a majority of respondents regarded coordination in such an environmentas an activity involving the use of power (Gandz and Murray 1980).Set within the framework of product developers’ “negotiations” (Bucciarelli 1994, Ulrich andEppinger 2003), our study distinguishes itself from the broad bargaining literature in which a proposalis repeatedly offered by one party with only one-sided incomplete information. 3 Although2 This view is different from previous research such as Mihm and Cui (2009), in which the final decision is modeledas a dictatorship decision. In most business environments, however, team members always have the option to quit orsimply drag down the project by not performing. Conceptually, our study suggests that what really matters for theteam members is how much career loss or termination cost he/she is prepared to take if he/she chooses to quit or notperform.3 We refer the reader to one excellent review chapter in Fudenberg and Tirole (1991).

Author: Influence of Stakeholders on Product Design Decisions 5some models do allude to alternative-offer bargaining with two-sided incomplete information (Chatterjeeand Samuelson 1987, Watson 1998), they usually discuss the equilibriums under infinitehorizons with time value discount. In our model, “negotiation” is terminated under finite horizonsand there is no time depreciation parameter.In Section 2, we define three types of decision power in the design process. The baseline modelis presented in Section 3. In Sections 4 and 5, we compare design outputs under different decisionprocesses and team leader’s position power structures. Managerial implications are discussed inSection 6. Empirical evidence and pointers for future research are presented at the end of the paper.1.1. Motivation Examples: Product Design Decisions in Nokia and PhilipsOur research was inspired by comparative case studies of two multinational firms in China. Theinterviewees included product managers, supervising engineers and sales managers from the HardwareDevelopment division in Nokia (China) and the Speaker Development Center of Philips (China).Thanks to the special customer-supplier relationship between the two firms, some interviewees werefamiliar with the decision-making process of the other company.Across Nokia and Philips, a junior design engineer is on average involved in three or four projects;experienced senior design engineers may be involved in up to ten projects simultaneously. In Nokia’sMarketing division, people are involved in only two or three projects at most; Philips’ Marketingemployees can participate in as many as five projects.One phenomenon we discovered from two companies is that team members could hardly tell howmany other projects their colleagues were undertaking and how the top management split theircolleagues’ working hours. In addition, many team members were very reluctant to publicize theircomplete project portfolios to other colleagues. This is similar to the observations in other R&Dcontexts such as university labs and scientific institutions.Two other commonalities were observed at Nokia and Philips. First, in both firms, most of thenew product initiatives are proposed by the R&D division, i.e., by design engineers. Second, due tothe prevalence of manufacturing outsourcing, both firms put an emphasis on marketing and R&Dactivities in Chinese markets. Procurement department offers suggestions regarding the choice ofmaterials and component suppliers.From our interviews, we discovered that product revision and finalization decisions were takenby different parties in Philips (China) and Nokia (China). At Nokia, design engineers were in chargeof revising product details and presenting product specifications for the final approval by theMarketing division. At Philips, design engineers usually determine the final specifications, whileMarketing simply offers revision opinions before the design was finalized.

6 Author: Influence of Stakeholders on Product Design DecisionsAs one product manager at Nokia commented, “In our company, Marketing decides what specificationshould be used and what it should look like.” An engineer from Philips added, “Nokia isdifferent from us,· · · Most of their products are decided by people with ‘soft’ minds, who do notalways understand technologies.” At Philips, as one supervising engineer noted, “The decisionsare technology-driven · · · the philosophy is to let new concepts lead the market.” Figures 1 and 2summarize the findings from the two companies.DesignerMarketingInitiation Revision FinalizationFigure 1Stakeholders’ Participation in Product Design Decisions at NokiaDesigner Marketing DesignerInitiation Revision FinalizationFigure 2Stakeholders’ Participation in Product Design Decisions at PhilipsThe arrows define the sequence of the decision process and the doted boxes describe the boundaryof one stakeholder’s dominant influence. Figure 1 represents a bi-polar influence structure underwhich stakeholders respectively participate in two extremes of the decision process. In contrast,Figure 2 represents an embedded influence structure in which one stakeholder participates bothbefore and after the decision stages in which another stakeholder plays a leading role.2. Stakeholder’s Influences in the Product Design ProcessThe decision-making process can be depicted as a continuum including a sequence of decision stages(Mintzberg 1979, Jensen 2001), in which a stakeholder’s influence is embedded. The “participation”(Saunders 1981) of stakeholders at different stages constitutes a source of decision power.In organization studies, decision power is defined as the “potential ability to influence behaviour,to change the course of events, to overcome resistance and to get people to do things that theywould not otherwise do” (Pfeffer 1992). It is most frequently used under conditions of moderateinterdependence (Pfeffer 1992).Aligned with these studies in general decision-making contexts, we specifically examine threemilestone decisions in setting product specifications: initiation, revision and finalization (Ulrichand Eppinger 2003).Through participating in each stage, product developers manifest three types of decision power:

Author: Influence of Stakeholders on Product Design Decisions 7One Design CycleAnother Design CycleYesNoDesign ConsensusGo to ProductionYesInitiation Revision FinalizationProjectTerminationInitiationRevisionInitial deadlinetimeFigure 3 Decision Making Process within Design Cycle (adapted from Ulrich and Eppinger (2003))• Initiation power is manifested by exerting an influence on establishing and proposing initialtarget value. The initiation of a product project might be undertaken by any functional area in afirm and is the step preceding specification revision and finalization.• Revision power is manifested by revising and confirming the product specification initiatedduring the previous stage. The specification chosen at this stage may or may not be identical to theinitial value. At revision stage, product developers are able to exchange project-related informationsuch as market risk, technology risk, etc.. If overwhelming agreement is reached at this stage, thedesign process ends with consensus specification.• Finalization power is the team leader’s position-specific ability to decide what to do if noconsensus is reached during the revision stage. Enforced finalization often creates friction betweenthe parties involved (Eisenhardt and Tabrizi 1995, Loch et al. 2006). We call the efforts the teamleader needs to spend on imposing his final say as the “coordination cost”.Conceptually, the coordination cost captures the effectiveness of the team leader’s position powerin the development team. 4 In reality, the coordination cost measures the ease with which the teamleader can get senior management’s endorsement; conversely, it might also be seen as a potentialfor loss of trust and relationships between team members (Loch et al. 2006). For example, anexperienced team leader usually obtains senior management’s support more easily than a lessexperienced one. As a result, his/her coordination cost is lower than that of a junior colleague.3. Model DevelopingIn contrast to the vertical distribution of decision power in economics (e.g. Aghion and Tirole(1997), Athey and Roberts (2001)) and other emerging research on NPD (e.g. Hutchison-Krupatand Kavadias (2009)), we focus on studying how the horizontal distribution of decision powerinfluences product design. Such a way of power distribution is commonly observed in productdevelopment projects (Mintzberg 1979, Ibarra 1993, Mihm and Cui 2009).4 Some literature differentiates between a manager’s “formal authority” and “real authority” (Aghion and Tirole1997). In this study, however, a team leader’s coordination cost is the consequence of both types of authority. Thelower the coordination cost is, the more position power the team leader has.

8 Author: Influence of Stakeholders on Product Design DecisionsHowever, generating an exhaustive list of distributions becomes challenging because any minorchange in the type of stakeholder (preference) and decision process (sequence of events) might influencethe decision output. One way to simplify the analysis is to focus on the dominant influence ofsome key stakeholders under certain decision processes. Our study focuses on strategic interactionsbetween Marketing and design engineers, who are identified as important stakeholders involved indevelopment teams (Griffin and Hauser 1996), at three “basic” stages of decision making.Image that a firm initiates a product development project. The overall project target is definedas“to maximize expected profit”. Assume each unit of the new product incurs manufacturing costc = k ρ f, which is a function of product attribute f and k > 0. Suppose f can be described in awell-ordered specification space (Terwiesch and Loch 2004) with feasible range [0, f]. One examplemight be the “maximal resolution” of a computer monitor or “fatigue resistance level” of a bearing.For simplicity, the specification space is taken to be single dimensional and ρ = 1. Suppose thatthe product design starts with one “default” specification value f 0 , which may be the attributeinstalled in other products in the same line or simply the industry’s standard.The product’s retail price is the manufacturing cost plus a profit margin, which is a fixed ratiom of manufacturing cost with m > 0. Therefore, P = c + mc = (m + 1)kf. Let product demandfunction D = af − bP + ε where a > 0 and b > 0. The random term ε captures the potential marketshock exogenous to the firm’s decision-making process with E[ε] > 0. The market shock mightbe quite severe for newly developed concepts and products launched to the market (Loch andTerwiesch 2005). Last, we assume the firm also incurs a fixed sunk cost S.Hence, the firm’s expected profit isE[P rofit] = E[mkf(af − b(1 + m)kf + ε)] − S (1)The firm’s objective function is thereforemax mk[a − bk(1 + m)]f 2 + E[ε]mkf − S (2)In feasible range f ∈ [0, f], when a − bk(1 + m) ≥ 0, f ∗ = f. When a − bk(1 + m) < 0, f ∗ > 0. Thisstudy focuses on the latter case and the parameters are set in such a way that 0 < f ∗ < f.By first order condition, firm’s optimal product specification value f ∗ =it increases with the expected market shock.E[ε]. Note that2[bk(1+m)−a]The firm decides the project will be implement by one crossfunctional team composed of personalfrom both Marketing and Design and the team is authorized to decide product specificationsautonomously. The goal of maximizing profit is shared by all team members and each member’s

Author: Influence of Stakeholders on Product Design Decisions 9performance is evaluated against identical criteria. However, team members have different expectationsregarding market shock. Therefore, the utility function of party i in a development teamcan be defined asu i = mk[a − bk(1 + m)]f 2 + ε i mkf − S + T 0 (3)where i ∈ {d, m}, ε i is the perceived market shock for party i. T 0 is each party’s “baseline” benefitsfrom being involved in the project team.Similarly, f ∗ i =expected profit.E[ε i ]2[bk(1+m)−a] . f ∗ irepresents party i’s expected optimal specification maximizingWithout loss of generalizability, let E[ε d ] > E[ε m ] ≥ 0. It immediately follows that f ∗ d > f ∗ m.Assume each party is aware of the other party’s expected optimal value through communications.However, ε is exogenous and not realized during the design stage. Hence, both parties are uncertainwhich optimal f ∗ iwill eventually maximizes the firm’s as well as their own expected payoff.In this study, we let Marketing play the role of team leader and the product designer serve asteam member. The team leader always has the final say on what should be done if no consensusis achieved by a certain time horizon (Clark and Fujimoto 1991, Gerwin and Barrowman 2002).Depending on what type of decision power he/she has, the team member may or may not participatein the initiation and revision stage of product design.We model a multiple stage decision process upon a bargaining model between two parties withdiffering “expected optimum”. Stakeholder’s initiation and revision power are modelled as an offerto a counterpart, which is binding if the counter party accepts. In other words, design consensusis reached when all team members agree with a specification value.If no consensus is reached at the revision stage, the team leader needs to evoke finalizationpower, which is modelled as one final offer to the team member incurring a coordination cost. Ifthe team member accepts the leader’s final decision, the design ends in consensus. Otherwise, theproduct design cycle is terminated with default value f 0 and both the team leader and memberincur termination cost c t i, where t ∈ {h, l}. Assume c h iorganization to each member and is unknown by others.> c l i > 0. It is privately assigned by theConsidering that stakeholders incur career loss only when negative project outcome arises (Faure2009), we ignore the time value by letting discount parameter equal one in each decision stage.We also abstract out the information exchange effect at the revision stage to isolate the influencestakeholders exert on product design. Therefore, the stakeholder’ expected “optimal specification”remains constant through the design cycle.

10 Author: Influence of Stakeholders on Product Design DecisionsLastly, suppose that before the project starts, Marketing (team leader) believes that designer(team member) has a high termination cost with probability q 0 . After observing the designer’sproposal, Marketing’s updated belief is q 1 . Similarly, the designer initially believes that Marketing’stermination cost is high with probability p 0 . After marketing’s proposal, the designer’s updatedbelief is p 1 . All the probabilities are nonnegative and not greater than 1.Define for party i of type t, the set of product specifications that party i would prefer to projecttermination is: Ω t i = {f|E[u i (f)] ≥ E[u i (f 0 )] − c t i}.Let fi t = arg max E[u j (f)], where i, j ∈ {d, m} and i ≠ j. ff∈Ω t it represents the expected optimalispecification value for stakeholder j from the set of specifications that stakeholder i with type twould prefer to project termination.From equation 3, f t d = arg maxmk[a − bk(1 + m)]f 2 + E[ε m ]mkf − S + T 0 such that:mk[a − bk(1 + m)]f 2 + E[ε d ]mkf − S + T 0 ≥ mk[a − bk(1 + m)]f 2 0 + E[ε d ]mkf 0 − S + T 0 − c t d (4)Let R t = mk[a − bk(1 + m)]f 2 0 + E[ε d ]mkf 0 − c t d, the above condition becomes:mk[a − bk(1 + m)]f 2 + E[ε d ]mkf − R t ≥ 0Note that when f ∗ m ∈ Ω l d, Marketing doesn’t need to care about the designer’s termination costbecause he/she can forcefully enforce f ∗ m without running the risk of project termination. Therefore,when the default specification f 0 and the team leader’s expected optimum f ∗ m are fixed, thespecification value is always decided at f ∗ m if c l d ≥ E[u d (f 0 )] − E[u d (f ∗ m)].When fm ∗ /∈ Ω l d, solving the constrained optimization function gives us:√f t E[ε d ]d =2[bk(1 + m) − a] − E[ε d ]R t[2[bk(1 + m) − a] ]2 −mk[bk(1 + m) − a]orf t d = f ∗ d −√(f ∗ d )2 −R tmk[bk(1 + m) − a]Because c h d > c l d, by principal of constrained optimization, we must have: f ∗ m ≤ f h d < f l d ≤ f ∗ d .(5)When marketing knows the designer’s priority, the best specification value the designercan propose that deters marketing from enforcing finalization power is defined ast ˆf d =arg max E[u d (f)]. It immediately follows that ˆf l{f|E[u m(f)]≥E[u m(fd t)]−e} d > ˆf d h and ˆf d t > fd t if e > 0.We further solve the constrained maximization problem with ˆf d t = arg max E[u d (f)] subject to:E[u m (f)] ≥ E[u m (f t d)] − e

Author: Influence of Stakeholders on Product Design Decisions 11expectedprofitmarketingelc ddesignerT 0-S*f mlf d∧lf df 0*f dspecification valueFigure 4Stakeholder’s optimal specification valuesThe condition is equivalent to:mk[a − bk(1 + m)]f 2 + E[ε m ]mkf ≥ mk[a − bk(1 + m)](f t d) 2 + E[ε m ]mkf t d − eDefine C t = mk[a − bk(1 + m)](f t d) 2 + E[ε m ]mkf t d.orSolving constrained optimization problem of ˆf t d, we getˆf t d =√E[ε m ]2[bk(1 + m) − a] + {ˆf t d = f ∗ m +√E[ε m ]2[bk(1 + m) − a] }2 +(f ∗ m) 2 +e − C tmk[bk(1 + m) − a]e − C tmk[bk(1 + m) − a](6)(7)4. Product Specification Decisions under Non-restrictive FinalizationPowerIn this section, we examine how the distribution of initiation and revision power affects the designoutputs when the team leader’s finalization power is not restricted (e = 0). Organizations of thistype are usually characterized by a “heavyweight” team leader with credible experience (Clark andFujimoto 1991) or a corporate culture where the team leader’s autonomy is highly respected (Lochet al. 2006).When e = 0, we can see that ˆf t d = f t d. Since there is no cost for Marketing to enforce specificationfinalization, the best value the designer can achieve is no better than Marketing’s offer at the laststage. Marketing’s finalization power eventually serves as a “threat” to constrain the designer’s

12 Author: Influence of Stakeholders on Product Design Decisionsaggressive proposal upfront. We conclude that under non-restrictive finalization power, the specificationvalue is decided at fd t if the team leader is certain about the team member’s priority t.Design consensus is always achieved without the risk of project termination.Lemma 1. When e = 0 and q 0 ∈ {0, 1}, marketing (team leader)’s expected payoff is E[u m (fd)].tThe risk of project termination is zero.4.1. Bi-Polar Decision ModelIn a bi-polar model, the team leader (Marketing) and the team member (designer) exert theirinfluences at “two poles” of one continuous decision process. The sequence of events is shown inFigure 5.Team membersreceive marketresearch informationand formulate theirexpected ε iTeam members areprivately assignedwith terminationcost c itDesignerinitiates f 1Marketing decides to accept orreject. If accepts, product featureis decided with f 1 , otherwise,proposes alternative f 2Designer decides to accept or reject.If accepts, product feature isfinalized with f 2 ; otherwise, projectterminates with f 0 incurringtermination cost for both parties.Figure 5Bi-Polar Decision Making Process (Model One)From a game theoretic perspective, two distributions of decision power are equivalent in thismodel: (1) team leader’s power of finalization and revision, team member’s power of initiation; (2)team leader’s power of finalization, team member’s power of initiation and revision.Before proceeding to the analysis of the complex decision process described in Figure 5, we startwith the simple case where Marketing (team leader) is a single decision maker and exerts dominantcontrol over the entire design process. In this case, the designer only serves as a decision “follower”.Marketing directly proposes specification value f ∗ to the designer and he/she chooses to reject oraccept.Therefore, f ∗ needs to maximize E[u m (f)] subject to f ∈ Ω t d. Note that when E[u m (fd)] l

Author: Influence of Stakeholders on Product Design Decisions 13If marketing proposes fd h , it will be accepted by a high-type designer and rejected by a lowtypedesigner. Marketing’s expected payoff is q 0 E[u m (fd h )] + (1 − q 0 )(E[u m (f 0 )] − c t m). Therefore,Marketing of type t would propose fdh if and only ifq 0 E[u m (f h d )] + (1 − q 0 )(E[u m (f 0 )] − c t m) ≥ E[u m (fd)]lOrq 0 ≥ E[u m(f l d)] − E[u m (f 0 )] + c t mE[u m (f h d )] − E[u m(f 0 )] + c t mObserve that E[um(f d l )]−E[um(f 0)]+c t mE[u m(fis increasing in c td h)]−E[um(f 0)]+c m. We can therefore define two threshold variablescritical for the following t manalysis:andClearly, β > α. 5α = E[u m(f l d)] − E[u m (f 0 )] + c l mE[u m (f h d )] − E[u m(f 0 )] + c l mβ = E[u m(f l d)] − E[u m (f 0 )] + c h mE[u m (f h d )] − E[u m(f 0 )] + c h mDepending on initial belief q 0 and termination cost c t m, Marketing of type t will impose a differentfinalization value f ∗ . Following the above analysis, when q 0 < α, Marketing would enforce f l d. Whenq 0 > β, Marketing would enforce f h d . It clearly follows that when α < q 0 ≤ β, Marketing of cost c l mimposes f h d and of c h m imposes f l d.Table 1 summarizes the equilibrium specification values under a single decision maker’s managementin different situations.Marketing’s Priority Designer’s Priority q 0 ≤ α α < q 0 ≤ β q 0 > βH H fd l fd l fdhH L fd l fd l f 0L H fd l fd h fdhL L fd l f 0 f 0Table 1Summary of Equilibrium Product Features when Team Leader of All Decision PowersFrom Table 1, we make three observations.First, looking at the rows, the project has the highest chance of termination when both Marketingand designer have a low termination cost. In this case, the only chance of design consensus isreached when the team leader also believes that the team member’s priority is low (q 0 ≤ α).5 α is an increasing function of c l m, c l d and a decreasing function of c h d. β is similar except that it is increasing in c h mrather than c l m.

14 Author: Influence of Stakeholders on Product Design DecisionsSecond, looking at the columns, the project is most likely to be terminated when the teamleader puts a high estimation on the team member’s task priority, which makes the team leaderaggressively impose finalization power to approach his/her preferred specification value.Third, α constitutes a critical value of the team leader’s belief below which the project is neverterminated. Therefore, we could use α as a parameter to measure the project stability. The valueof α depends on the team leader’s expected payoff with f t d and default specification f 0 as well astermination cost for the team leader of low priority. As we can see, α ≈ 1 when c l m → ∞. Thisimplies that as the team leader’s task priority gets sufficiently high, the project bears zero risk oftermination.Under the single decision maker model, the team leader has no information about the teammember’s task priority when the final decision is imposed. If the team leader acts too aggressively,the termination cost may be incurred with positive probability - a “bad” outcome which both theteam leader and the member wish to avoid. Due to the priority uncertainty, even a team leader offull decision power without restrictions cannot enforce his own optimal value f ∗ m. Therefore, theteam member’s privacy of task priority protects his interest from being completely exploited byteam leader’s position power, at the risk of potential project termination.Once we extend the analysis to two stages where the team member gets the chance to offer aproposal before the team leader’s final decision, a puzzle intuitively arises: Is there any chancethat the team member might be willing to reveal his priority by offering a specification value thatthe team leader would rather accept than run the risk of project termination? In this way, designcoordination is improved, hence α increases compared with the previous scenario.Note that each stakeholder i is only aware of his own project termination cost. The informationabout the other party j’s c t j, is “incomplete” for party i.Define z t = arg max E[u d (f)], such that E[u m (f)] ≥ max{E[u m (f l d)], q 1 E[u m (f h d )] + (1 −q 1 )(E[u m (f 0 )] − c t m)} − e.We observe two points about z t . First, z t is a specification value, that if accepted by Marketingof type t, gives him at least the same utility that he would receive from taking his own optimaldesign decision. Second, z t optimizes the designer’s utility given the acceptable specification setby Marketing. If the designer proposes any f 1 > z t , marketing of type t will reject and enforce aworse f 2 for the designer. Hence, z t is the designer’s best proposal that prevents Marketing fromenforcing the final decision.Next, we show a useful lemma.Lemma 2. If q 1 ≤ E[um(f d l )]−E[um(f 0)]+c t mE[u m(f, zd h)]−E[um(f 0)]+c t t = fd.lm

Author: Influence of Stakeholders on Product Design Decisions 15Recall Lemma 1 that product specification would be f l d if Marketing is certain that the designer isassigned with low project priority. Lemma 2 shows that when Marketing’s updated belief regardingthe designer’s priority is below critical threshold α, the design outcome is similar to that withcomplete information.Before going into a detailed analysis, we check the lower bound of stakeholders’ expected payoffsin a bi-polar decision model.Lemma 3. In a bi-polar decision model, when e = 0 and q 0 ∈ (0, 1), marketing’s expected payoffis at least E[u m (f l d)].Lemma 4. In a bi-polar decision model, when e = 0 and q 0 ∈ (0, 1), low-priority designer’sexpected payoff is at least E[u d (f l d)].One corollary immediately follows:Corollary 1. In a bi-polar decision model, when e = 0, low-priority designer always proposesf l d in equilibrium.Depending on the team leader’s initial belief structure, different equilibria exist:Proposition 1. (pooling equilibrium) If q 0 ≤ α, the following strategies and belief constitute aunique perfect Bayesian equilibrium:{a ∗ t =f 1∗t= f l daccept if f 1 = fd l or f 1 ≤ fdhpropose f 2 = fdh otherwises ∗ t ={ 1 if f 2 ≥ f t d0 otherwiseq ∗ 1 ={q0 if f 1 = f l d1 otherwiseIn this equilibrium, the designer’s proposal is always f l d and Marketing always accepts the proposalwhich equals to f l d or below f h d . Since the designer of various priorities “pools” initial proposals,Marketing cannot infer any additional information about the designer’s priority from hisproposal f 1 . Therefore, q 1 = q 0 following the equilibrium proposal f l d.Proposition 1 describes the situation where the team leader believes that the focal project isonly of low importance for the team member. In this case, the specification value is always decidedat f l d without the risk of project termination. One interviewee at Nokia recalled a project in 2002where, per Marketing’s request, the R&D division started to improve the phones’ user interfacein order to benchmark local competitors. At the same time, the R&D division was also involved

16 Author: Influence of Stakeholders on Product Design Decisionsin a hardware development project assigned by global headquarters. As a result, only two juniorengineers were assigned to this project. This project came in time but “We gave up a lot of plans”,as one interviewee from Marketing stressed.Proposition 2. (designer pooling, marketing separating equilibrium) If α < q 0 ≤ β, the followingstrategies and belief constitute a unique perfect Bayesian equilibrium:{a ∗ h =f 1∗t= f l daccept if f 1 = fdor l f 1 ≤ fdhpropose f 2 = fdh otherwise{a ∗ accept if fl =1 ≤ fdhpropose f 2 = fdh otherwises ∗ t ={ 1 if f 2 ≥ f t d0 otherwiseq ∗ 1 ={q0 if f 1 = f l d1 otherwiseIn this equilibrium, similar to what we observe in Proposition 1, the designer initiates the proposalf 1 = f l d. However, Marketing’s initial belief is greater than threshold α. Therefore, low-priorityMarketing acts more aggressively by declining f l d and only accepts a more favorable value f h d . Atthe same time, Marketing’s initial belief is not too high (q 0 ≤ β), which excludes the possibilitythat it would decline any specification greater than f h d .This equilibrium describes the situation in which the team leader has a reasonable estimationof the team member’s task priority. In this case, the team leader’s action depends on his own taskpriority. This situation is observed in most of projects we investigated at Nokia and Philips.Proposition 3. (designer semi-separating, marketing pooling equilibrium) If q 0 > β, the followingstrategies and belief constitute a unique perfect Bayesian equilibrium:{fh 1∗ =f l df 1∗l= f l dz ∈ [fd h , fd ∗ ] and z ≠ fdl{a ∗ acceptt =propose f 2 = fdhwith probability δotherwiseif f 1 ≤ fdhotherwise{ 1 if fs ∗ t = 2 ≥ fdt0 otherwise{ q0 δq1 ∗ =q 0 δ+1−q 0if f 1 = fdl1 otherwiseδ = 1−q 0q 0E[u m(f l d )]−E[um(f 0)]+c h mE[u m(f h d )]−E[um(f l d )]

Author: Influence of Stakeholders on Product Design Decisions 17In this equilibrium, the team leader believes that the focal project is of critical importance for theteam member. In such a situation, Marketing, regardless of its own task priority, acts aggressivelyand imposes a specification value only a designer of high priority would accept. A low-prioritydesigner proposes fd l because that is the best value for marketing from the designer’s acceptableset. In the face of Marketing’s aggression, a high-priority designer will protect himself in a mixedstrategy by creating positive chance of mimicking a low-priority designer.Compared with the equilibria described in Propositions 1 and 2, this equilibrium bears thehighest risk of termination, stemming from the mismatch between the team leader’s judgment onthe team member’s priority and the team member’s true task priority. This mismatch propels theteam leader to act over-aggressively and creates a lot of friction leading to project termination.Comparing design outputs in a single decision-maker model (summarized in Table 1) and a bipolardecision model, we find that both the product specification values and risk of terminationare identical. This implies that under the management of non-restrictive team leadership, theinformation advantage informed stakeholder (designer) is willing to give up is not strong enoughto substitute for dominant stakeholder (marketing)’s position power. Hence, design coordinationis not improved by letting the team member participate in the stages before design finalization.4.2. Embedded Decision Model with More Design IterationsIn an embedded decision model the team leader exerts a dominant influence on both the projectinitiation and the finalization stage. The team member participates in the revision stage and hisinfluence is constrained in the “middle” stage of the design process. One interesting question toexplore is: How could a team leader take advantage of the additional chance of exerting influencecompared to a bi-polar model? Does the risk of project termination change? The sequence of eventsis described in Figure 6.Team membersformulate theirexpected ε i and areprivately assignedwith c itMarketinginitiates f 1Designer decides to accept orreject. If accepts, product featureis decided with f 1 , otherwise,proposes alternative f 2Marketing decides to accept orreject. If accept, productfeature is decided with f 2 ; ifreject, marketing proposes f 3Designer decides to accept or rejectf 3 . If accepts, product feature isdecided with f 3 ; otherwise, projectterminates with f 0 incurringtermination cost for both parties.Figure 6Embedded Decision Making Process (Model Two)The analysis of each equilibrium is quite complex. While a detailed analysis of the three cases isincluded in the Appendix, 6 we briefly explain the intuition here.6 To be simple, we constrain the team leader’s finalization specification to f 3 = f 1 . However, the equilibrium specificationvalue and risk of termination do not change as we remove this constraint.

18 Author: Influence of Stakeholders on Product Design DecisionsIn Model Two, Marketing needs to determine two actions: to initiate a proposal and make a finaloffer. Compared with Model One, where Marketing decides only one action, Marketing’s expectedpayoff cannot be worse, because it can at least “pool” its actions f 1 without releasing any additionalinformation. On the other hand, the expected payoff for the designer in Model Two cannot beworse than Model One either because he/she can always reject Marketing’s initial proposal f 1 andget the equilibrium design outputs in Model One. On balance, the design outputs (specificationvalue and risk of project termination) do not change across the two models.We therefore conclude thatProposition 4. Under fixed non-restrictive finalization power, redistribution of initiation andrevision power do not change the equilibrium design outputs in terms of specification value and riskof project termination.The risk of project termination increases with the team leader’s initial estimation about the teammember’s task priority.5. Product Specification Decisions under Restrictive FinalizationPowerThe above analysis shows that under non-restrictive finalization power, design coordination cannotbe improved by redistributing initiation and revision power. In this section, we restrict the teamleader’s finalization power in Model One (coordination cost e > 0) and study how it affects designoutputs.With positive coordination cost, equilibria are not unique. However, some interesting equilibriacan be found and we compare them with those when e = 0.Proposition 5. (pooling equilibrium)Let z ∈ (max{fd, l f ˆd h}, z l]. If q 0 ≤ γ = E[um(f d l )]−E[um(f 0)]+c l m +e, the following strategies and beliefconstitute a perfect Bayesian equilibrium :{a ∗ t =E[u m(f h d )]−E[um(f 0)]+c l mf 1∗t = z,accept if f 1 = z or f 1 ≤ f ˆdhpropose f 2 = fdh otherwise{ 1 if fs ∗ t = 2 ≥ fdt0 otherwise{q1 ∗ q0 if f=1 = z1 otherwiseIn this equilibrium, variable γ is the critical threshold below which a consensus decision is alwaysmade. Clearly, γ increases with e and γ > α when e > 0. This implies that keeping other factors

Author: Influence of Stakeholders on Product Design Decisions 19equal, project stability decreases with the team leader’s position power. In addition, the consensusspecification z is strictly greater than f l d, the consensus value decided under non-restrictivefinalization power. In the following, a conclusion can be drawn.Proposition 6. As the team leader’s finalization power reduces (coordination cost e increases),the project has greater chance of having a consensus decision without project termination and theconsensus specification becomes more favorable for the team member.Under non-restrictive finalization power, the team leader always enforces his finalization powerand no effective “signalling” of each other’s task priority can be expected. In such a situation, thedesign outputs are sensitive to the team leader’s initial belief. Observed from Proposition 5, the sensitivitydeteriorates as team leader’s finalization power shrinks (project stability α increases). Thisimplies that, when the team leader’s position power is restricted to a certain level, we might finda belief-proof equilibrium where design coordination is achieved solely through effective signalling.Proposition 7. (designer separating equilibrium)√Given any sufficiently large coordination cost e( (fm) ∗ 2 e−C+h> f lmk[bk(1+m)−a] d − fm), ∗ the followingstrategies and belief constitute a unique perfect Bayesian equilibrium :⎧⎪⎨a ∗ t =⎪⎩f 1∗t = ˆf t d ,acceptaccept with probability φif f 1 ≤ f ˆdhif f 1 = ˆf dlpropose f 2 = fd l with probability 1 − φ if f 1 = ˆf dlpropose f 2 = fdh otherwises ∗ t ={ 1 if f 2 ≥ f t d0 otherwise{0 if f1q1 ∗ == ˆf dl where φ = E[u d ( f ˆd h)]−E[u d (f 0)]+c l d1 otherwiseE[u d ( f ˆd l )]−E[u d (f 0)]+c l dIn this equilibrium, any proposal from the designer of task priority i will reveal his true taskpriority and the risk of termination is reduced to zero. The team leader’s optimal strategy is“pooling” regardless of his own termination cost. When the project is of high priority for the teammember, the product specification is decided at ˆ f h d .7 When team member is of low priority, productspecification is set at value ˆf l d with probability φ, and f l d with probability 1 − φ.Note that φ increases with c l d and ˆf l d > f l d. Therefore, the designer of low priority has a higherchance of getting a preferred specification as his termination cost increases. This implies that whenpriority uncertainty can be resolved through effective signalling, increasing the team member’sminimal interest in the focal project does not hurt the team member’s bargaining position butbenefits his interest in product design.7 In this equilibrium, ˆ fhd> f l d.

20 Author: Influence of Stakeholders on Product Design Decisions6. Discussion and Managerial ImplicationsAccording to the above analysis, when the team member involves sufficiently strong interest in theproject (c l d ≥ E[u d (f 0 )] − E[u d (fm)]), ∗ the project runs no risk of termination and the specificationis always decided to be fm. ∗ Conversely, when the project is of no critical importance for both theteam member and the team leader (c l d < E[u d (f 0 )] − E[u d (fm)] ∗ and c l m < E[u m (f 0 )] − E[u m (fd)]),lthe project always ends with the default value f 0 .Interestingly, when the project is of high importance for the team leader while relatively lesscritical for the team member (c l d < E[u d (f 0 )]−E[u d (fm)] ∗ and c l m > E[u m (f 0 )]−E[u m (fd)]), l differentscenarios emerge. Table 2 summarizes the findings. In rows, {i, j} where i, j ∈ {H, L} representsthe task priority of Marketing (leader) and designer (member), respectively. In columns, the firstscenario is the case where the team leader is fully aware of the team member’s task priority undernon-restrictive position power. The second column is the case with priority uncertainty under nonrestrictiveposition power. The last column on the right represents the coordinative design outputsunder restrictive position power (e is sufficiently large).Priority Transparency Non-restrictive Power Restrictive Power{H, H} fd h fd l if q 0 ≤ β and fd h otherwise f ˆh d{H, L} fd l fd l if q 0 ≤ β and f 0 otherwisel ˆf dwith prob. φ and fd l with 1 − φ{L, H} fd h fd l if q 0 ≤ α and fd h otherwise f ˆh d{L, L} f l d f l d if q 0 ≤ α and f 0 otherwise ˆfldwith prob. φ and f l d with 1 − φTable 2Comparing Design Outputs under Stakeholders’ InteractionsWith exogenous uncertainties, the managerial method the firm should undertake will depend onhow senior management at firm level judges random shock’s “true” underlying expectation value.We illustrate this point by a simple example.Assume that the exogenous market shock is binomially distributed with two potential realizations:E[ε m ] and E[ε d ]. In this case, a firm’s expected optimal specification f ∗ should be a linearcombination of two stakeholders’ optimal values. The closer f ∗ gets to the team leader’s preference(fm), ∗ the more the firm should make priority transparent. At extreme, the firm should make teammember’s task priority sufficiently high. When f ∗ approaches the team member’s preference (fd ∗ ),the firm should take measures to restrict the team leader’s influence.In many organizations, stakeholders’ task priorities on focal projects are given: They are decided“strategically” at firm or business unit level (Chao and Kavadias 2008). In those environments,

Author: Influence of Stakeholders on Product Design Decisions 21when the team member (designer)’s priority is high, the most effective way of implementing theteam leader’s wish is to make the priority transparent. Conversely, when team member’s priorityis low, keeping task priority invisible and increasing the leader’s position power best serves theinterests of the team leader.By contrast, Table 2 also shows that in any situation, restricting the team leader (marketing)’sposition power yields the highest specification value. In other words, restricting the team leader’scontrol over design finalization is the most effective way of achieving product design against theteam leader’s wishes.The analysis from this study predicts that under non-restrictive position power, the projectbears a higher chance of project termination (therefore a delay) when the team leader believes thatthe project is of high priority for the team member (Table 1). From the interviews at Nokia andPhilips, we collate simple empirical evidence to test this hypothesis.In total, 14 interviewees cited 17 projects, all of which were managed by senior project managerswith at least seven years product development experience. Interviewees self-reported whetherthe project was delayed compared with the original plan. We used an open-end semi-structuredquestionnaire and the questions about project output (delay) did not immediately follow the questionson evaluation of the team member’s priority. This method reduced potential respondent bias(Weisberg 2005). The priority evaluation was categorized as either “high” or “low”. A simple 2 × 2contingency analysis is shown in the following table.Delayed Projects Non-delayed Projects TotalH 5 2 7L 2 8 10Total 7 10 17Table 3Contingency Analysis of Dominant Stakeholder’s Belief and Project DelayAmong seven delayed projects, the team leaders put a “high” value on team member’s priority infive projects. The conditional probability of “delay” given high evaluation is therefore 5 or 71.4%,7which is over 50%. We apply Fisher’s test (the alternative to a chi-square test when the numberof observations in the cells is small and unequally distributed): The null hypothesis that a delayedproject has an equal chance of occurring among high and low priority estimations by team leadersis rejected with a one-tailed significance of 0.05. 88 Fisher Exact test p = 0.049

22 Author: Influence of Stakeholders on Product Design DecisionsThe results from this study also offer new angels from which to examine some previous empiricalfindings. For example, a powerful team leader (“heavyweight”) can normally help ease internalfriction (Clark and Fujimoto 1991), “maintain a disciplinary vision” (Eisenhardt and Tabrizi 1995)thus shorten development time. However, when the team leader’s position power is operationallymeasured as his final say regarding product design, resource allocation, etc., no significant linkagebetween team leader’s power and development time was found (Eisenhardt and Tabrizi 1995).Our study offers one contingent prediction to this empirical puzzle: When the team member’stask priority is high, the powerful team leader indeed facilitates product development (no projecttermination). This echoes an observation by Toyota that its engineers (team member) are usuallyinvolved in only one project and that their future career is closely connected with the success ofthat product (Clark and Fujimoto 1991). Conversely, when the team member’s task priority is low(high level of multi-tasking), a powerful leader may even hinder the product design. In this case, a“less-powerful” team leader might be a better choice, as observed in many IT company contexts. 9In conclusion, our study takes a stakeholder management perspective to examine the productspecification decision. Other than the uncertainties external to organizations, we highlight theimportance of the organizations’ internal uncertainty (task priority) for product design.Our findings show that under non-restrictive position power, redistribution of initiation andrevision power does not change design outputs. The project is never terminated when the teammember or leader’s interest involved is sufficiently strong, or when the task priority is transparent,or when the team member’s task priority is high under non-restrictive position power, or when theteam leader’s position power is sufficiently restricted.On the other hand, with a powerful team leader, the project has the highest chance of terminationwhen the focal project is of low importance for both parties, or the team leader overestimates thetask priority the team member has truly assigned.The uncertainty of task priority influences the specification decision in two respects. On thepositive side, priority uncertainty mitigates the ability of the team leader to extract concessionsfrom team members, in which case, a “balanced” product specification may be achieved. It alsooffers an organizational tool for firms to internally direct rather than eliminate conflicting productdesigns facing exogenous uncertainty. On the negative side, priority uncertainty may slow downthe development process, leading to the delay of the product launch.9 Note that in reality, many issues other than organizational factors may lead to project termination. The hypothesiswe provide is only one potential explanation when other factors keep equal.

Author: Influence of Stakeholders on Product Design Decisions 23This implies that an ideal “product reorientation” can only happen when position power, prioritytransparency, and the dominant stakeholder’s belief are moved in the same direction. Forexample, when a firm wants to make the product design more “customer-oriented”, distributingthe finalization power to Marketing 10 is the first policy option. However, if the design engineer isassigned a low task priority or Marketing behaves over-aggressively after being empowered, the riskof project termination may increase. As a remedy to this, making priority transparent is essential.The analysis in this study is built upon three “component decisions” in one design cycle. Inreality, the design of new products may extend across multiple periods composed of many designcycles. The distribution of decision power as well as the stakeholder’s task priority may even changefrom one cycle to another. However, the analysis of a single design cycle constitutes an initial steptoward our understanding of the complex design process with multiple cycles.The organization’s internal factors such as decision power and task priority - which are key toour analysis - serve to overcome the shortcomings of the existing literature, in which the firm isconsidered to be a unified and consistent entity. They also may then play a valuable role in thebroader research agenda that seeks to understand the unique structure of R&D organizations,which enables them to grow and be competitive in the product market.ReferencesAghion, P., J. Tirole. 1997. Formal and real authority in organizations. Journal of Political Economy 105(1)1–29.Athey, S., J. Roberts. 2001. Organizational design: Decision rights and incentive contract. The AmericanEconomic Review 91(2) 200–205.Atuahene-Gima, K., F. Evangelista. 2000. Cross-functional influence in new product development: Anexploratory study of marketing and R&D perspective. Management Science 46(10) 1269–1284.Balasubramanian, S., P. Bhardwaj. 2004. When not all conflict is bad: Manufacturing-marketing conflictand strategic incentive design. Management Science 50(4) 489–502.Bhattacharya, S., V. Krishnan, V. Mahajan. 1998. Managing new product definition in highly dynamicenvironments. Management Science 44(11) s5–s64.Brown, S., K. M. Eisenhardt. 1995. Product development: past research, present findings and future directions.Academy of Management Review 20(2) 343–378.Bucciarelli, L. 1994. Designing Engineers. MIT Press, Cambridge, MA.10 It is fair to assume that in a well organized firm, marketing usually has better expertise and information regardingcustomer needs than engineers.

24 Author: Influence of Stakeholders on Product Design DecisionsChao, R., S. Kavadias. 2008. A theoretical framework for managing the new product development portfolio:When and how to use strategic buckets. Management Science 54(5) 907–921.Chatterjee, K., L. Samuelson. 1987. Bargaining with two-sided incomplete information: An infinite horizonmodel with alternating offers. The Review of Economics Studies 54(2) 175–192.Clark, K. B., T. Fujimoto. 1991. Product Development Performance. Harvard Business School Press, Boston.Cui, Z., C. Loch, B. Grossmann, R. He. 2009. How the provider selection and management contribute tosuccessful innovation outsourcing. Working Paper, <strong>INSEAD</strong>.Dougherty, D. 1992. Interpretive barriers to successful product innovation in large firms. OrganizationScience 3(2) 179–202.Eisenhardt, K. M., B. N. Tabrizi. 1995. Accelerating adaptive processes: Product innovation in the globalcomputer industry. Administrative Science Quarterly 40(1) 84–110.Faure, C. 2009. Attribution biases in the evaluation of new product development team members. Journalof Product Innovation Management 26(4) 407–423.Fudenberg, D., J. Tirole. 1991. Game Theory. MIT Press, Cambridge, MA.Gandz, J., V. Murray. 1980. The experience of workplace politics. Academy of Management Journal 23(2)237–251.Gerwin, D., N. Barrowman. 2002. An evaluation of research on Integrated Product Development. ManagementScience 48(7) 938–953.Griffin, A., J. Hauser. 1996. Integrating R&D and marketing: A review and analysis of the literature. Journalof Product Innovation Management 13 191–215.Gu, X., J. Renaud, L. M. Ashe, S. Batill, A. Budhiraja, L. Krajewski. 2002. Decision based collaborativeoptimization. Journal of Mechanical Design 124(1) 1–13.Hutchison-Krupat, J., S. Kavadias. 2009. The effect of implicit and explict incentives on NPD portfolioselection. Working Paper, Georgia Institute of Technology.Ibarra, H. 1993. Network centrality, power, and innovation involvement: Determinants of technical andadministrative roles. The Academy of Management Journal 36(3) 471–501.Jensen, M. 2001. Foundations of Organizational Strategy. Havard University Press, Cambridge, M.A.Kalyanaram, G., V. Krishnan. 1997. Deliberate product definition: Customizing the product definitionprocess. Journal of Marketing Research 34(2) 276–285.Kavadias, S., C. Loch. 2003. Optimal project sequencing with recourse at a scarce resource. Production andOperations Management 12(4) 433–444.Krishnan, V., S. D. Eppinger, D. E. Whitney. 1997. A model-based framework to overlap product developmentactivities. Management Science 43(4) 437–451.

Author: Influence of Stakeholders on Product Design Decisions 25Krishnan, V., K. Ulrich. 2001. Product development decisions: A review of the literature. ManagementScience 47(1) 1–21.Loch, C., A. De Meyer, M. Pich. 2006. Managing the Unknowns: A New Approach to Managing HighUncertainty and Risk in Projects. Wiley, New York.Loch, C. H., C. Terwiesch. 2005. Rush and be wrong or wait and be late? A model of information incollaborative process. Production and Operations Management 14(3) 331–343.Loch, C. H., C. Terwiesch. 2007. Coordination and information exchange. C. Loch, S. Kavadias, eds.,Handbook of New Product Development Management. Butterworth Heinemann, Amsterdam, 315–343.March, J. 1994. A Primer on Decision Making: How Decision Happens. Free Press, New York, NY.Michalek, J., F. Feinberg, P. Papalambros. 2005. Linking marketing and engineering product design decisionsvia analytical target cascading. Journal of Product Innovation Management 22(1) 42–62.Mihm, J., Z. Cui. 2009. The decision making process and implicit incentives in multifuntional teams. WorkingPaper, <strong>INSEAD</strong>.Mintzberg, H. T. 1979. The Structuring of Organizations. Prentice Hall, Englewood Cliffs, NJ.Pelled, L. H., P. Adler. 1994. Antecendents of intergroup conflicts in multifunctional product developmentteam: A conceptual model. IEEE Transactions on Engineering Management 41(1) 1008–1023.Pfeffer, J. 1992. Managing with Power: Politics and Influences in Organizations. Harvard Business SchoolPress, Boston, MT.Pinto, M. B., J. K. Pinto, J. E. Prescott. 1993. Antecents and consequences of project team cross-functionalcooperation. Management Science 39(10) 1281–1297.Roy, B. 2005. Paradigms and challenges. J. Figueira, S. Greco, M. Enrgott, eds., Multiple Criteria DecisionAnalysis: State of the Art Surveys. Springer, New York, NY.Saunders, C. S. 1981. Management information systems, communications, and departmental power: anintegrative model. The Academy of Management Review 16(3) 431–442.Shi, L., S. Olafsson, Q. Chen. 2001. An optimization framework for product design. Management Science47(12) 1681–1692.Siemsen, E. 2008. The hidden perils of career concerns in R&D organizations. Management Science 54(5)863–877.Simester, D., J. Zhang. 2009. Why are bad products so hard to kill? Working Paper, MIT.Sobek, D., J. Liker, A. Ward. 1998. Another look at how Toyota integrates product development. HarvardBusiness Review July–August 36–48.Srinivasan, V., W. S. Lovejoy, D. Beach. 1997. Integrated product design for marketability and manufacturing.Journal of Marketing Research 34(1) 154–163.

26 Author: Influence of Stakeholders on Product Design DecisionsTatikonda, M., M. Montoya-Weiss. 2001. Integrating operations and marketing perspectives of product innovation:The influence of organizational process factors and capabilities on development performance.Management Science 47(1) 151–172.Terwiesch, C., C. H. Loch. 2004. Collaborative prototyping and the pricing of custom designed products.Management Science 50(2) 145–158.Ulrich, K. T., S. D. Eppinger. 2003. Product Design and Development. 3rd ed. McGraw Hill, New York.Watson, J. 1998. Alternative-offer bargaining with two sided incomplete information. The Review of EconomicsStudies 65(3) 573–594.Weisberg, H. 2005. The Total Suvery Error Approach. University of Chicago Press, Chicago, IL.Appendix A:Proofs of Lemmas and PropositionsIn the following proofs, the “type” of marketing (designer) denotes his termination cost c t i, where i ∈ {d, m}and t ∈ {h, l}. Marketing (designer) of high (low) type means that his termination cost is high (low).In Model One, define f 1 (p 0 ) ∈ R as the designer’s initial specification proposal.Define a t (f 1 , q 1 ) as marketing’s response to the designer’s initial proposal. a t = accept when marketingaccepts f 1 and a t = f 2 (f 1 , q 1 ) ∈ R when marketing rejects and proposes new value.Define s t (f 2 , p 1 ) ∈ {0, 1} as the designer’s strategy when marketing makes final offer f 2 . Let s t = 1 denotes“accept” and s t = 0 denotes “reject” and project terminates.In Model Two, define f 1 (q 0 ) ∈ R as marketing’s initial specification proposal.Define a t (f 1 , p 1 ) as the designer’s response to marketing’s initial proposal. The designer either acceptsf 1 (a t = accept) or proposes new value f 2 (f 1 , p 1 ) ∈ R.Define η t (f 1 , f 2 , q 1 ) ∈ {0, 1} as marketing’s strategy after observing designer’s proposal f 2 . And η t = 1 ifmarketing accepts f 2 , and η t = 0 if marketing rejects f 2 and proposes f 3 . Define ˆη as the realization of η.Define ξ t (f 1 , p 1 ) ∈ {0, 1} as the designer’s strategy after observing marketing’s action η t = 0. And ξ t = 1 ifthe designer accepts f 1 and ξ t = 0 if the designer rejects f 1 and project terminates.Proof of Lemma 2. The result immediately follows because z t = f l dwhen q 1 E[u m (f h d)] + (1 −q 1 )(E[u m (f 0 )] − c t m) ≤ E[u m (fd)].l □Proof of Lemma 3. Either type of marketing can always assure himself at least E[u m (fd)] l throughenforcing his finalization power since both type of the designer will accept fd.l □Proof of Lemma 4. When e = 0, marketing will enforce either f h dor fd. l And f h d> fd. l Either proposalis acceptable for low-type designer. Hence, he gets at least E[u d (fd)].l □Proof of Corollary 1. By Lemmas 3 and 4, f l dis the only specification value which satisfies bothinequalities. □Proof of Proposition 1. s ∗ tis straightforward. The designer accepts f 2 if and only if his expected utilityexceeds that of default specification f 0 minus his termination cost.

Author: Influence of Stakeholders on Product Design Decisions 27We therefore begin by ensuring that designer will not deviate from proposing f 1∗ = f l d. When q 1 = q 0 atequilibrium, by lemma 2, we must have E[u d (z l )] = E[u d (f d l)] ifq 0 ≤ E[u m(fd)] l − E[u m (f 0 )] + c l m= αE[u m (fd h )] − E[u m (f 0 )] + c l mthe designer of both types will receive E[u d (f l d)] in equilibrium because f l dis accepted by marketing of anytype. Because the designer prefers f l dto any other proposal that is always accepted, it only remains toconsider deviations which induce marketing to enforce specification finalization. Given f ∗ m/∈ Ω l dand marketing’sequilibrium strategy a ∗ t, deviation triggering finalization yields E[u d (f t d)] for each type, which lowersdesigner’s expected utility since E[u d (f l d)] > E[u d (f h d)].We now turn to check marketing’s best response. Recall that z t is the policy, which if accepted by marketingof type t gives the same utility he should obtain from adopting his optimal specification decision when q 1 = q 0 .Since E[u m (z l )] > E[u m (z h )] and z l = f l din this equilibrium, marketing of both types will prefer acceptingdesigner’s proposal to enforcing f h d. Following out of equilibrium of designer, the belief q 1 = 1 makes f 2 = f h dthe best response.Beliefs on q ∗ 1 = q 0 is determined by Bayes’s rule.The uniqueness is satisfied by checking the equilibrium for high-type designer.Assume there exists another equilibrium where high-type designer plays mixed strategy by puttingpositive probability δ on proposing f l dand 1 − δ on other f ≠ f l d, and δ ∈ [0, 1). When observingf l d, by Bayes’s rule, marketing’s updated belief q 1 =q 0 δE[u m(f h d )]+(1−q 0)(E[u m(f 0 )]−c t m )q 0 δ+1−q 0q 0 δq 0 δ+1−q 0. For marketing, proposing f h dyields, which must be smaller than E[u m (f l d)]. Otherwise, marketing will proposef h dand the designer can be better off by making δ = 1. Therefore, δ ≤ 1−q 0q 0E[u m(f l d )]−E[um(f 0)]+c h mE[u m(f h d )]−E[um(f l d )]only if 1−q 0q 0with the condition q 0 ≤ α.and□E[u m(fd l )]−E[um(f 0)]+c t mE[u m(f. δ is feasibled h)]−E[um(f d l )]< 1. It is equivalent with q 0 > E[um(f d l )]−E[um(f 0)]+c h mE[u m(f, which contradictsd h)]−E[um(f 0)]+c h mProof of Proposition 2. First, consider the designer’s proposal f 1 . By Lemma 2, z h = f l dwhen q 1 = q 0q 1 ≤ E[u m(fd)] l − E[u m (f 0 )] + c h m= βE[u m (fd h )] − E[u m (f 0 )] + c h mGiven that in equilibrium the low type marketing always enforces f 2 = f h d, the expected utility of high and lowtype designer respectively equals to q 0 E[u d (f l d)]+(1−q 0 )E[u d (f h d)] and q 0 E[u d (f l d)]+(1−q 0 )(E[u d (f 0 )]−c l d).There are two potential deviations we need to consider: designer must neither wish to propose f 1 ≠ f l d> f h d,which induces finalization decision by high-type marketing nor propose f 1 ≤ f h d, which is always accepted.Consider the first potential deviation (f 1 ≠ f l d> f h d). Given marketing’s best response f 2 = f h dand s ∗ t, itgenerates expected payoff E[u d (f h d)] for high-type designer and he gets strictly worse off. And for low-typedesigner, his expected payoff does not change. Hence, neither type can benefit from invoking specificationfinalization decision in this case.Next, we consider whether the designer will deviate by proposing f 1 ≤ f h d. For designer of both types,deviation generates E[u d (f 1 )] ≤ E[u d (f h d)] because marketing always accepts this proposal. However, noneof the proposals is profitable for designer of type t according to the definition of f t d.

28 Author: Influence of Stakeholders on Product Design DecisionsNow we consider marketing’s strategy. Given q ∗ 1 = 1 following an out-of-equilibrium proposal by thedesigner, f h dmust be a best response. We therefore focus on his response to f l d. Because z h = f l din this equilibrium,high- type marketing weakly prefers z h to enforcing his own finalization decision. Because z l < z h ,low-type marketing prefers a finalization proposal to accepting f l d. he prefers proposing f h dIt implies thatwhich is guaranteed in the lemma.q 0 E[u m (f h d)] + (1 − q 0 )(E[u m (f 0 )] − c l m) ≥ E[u m (f l d)]q 0 ≥ E[um(f l d )]−E[um(f 0)]+c l mE[u m(f h d )]−E[um(f 0)]+c l m= αBeliefs on the equilibrium q ∗ 1 = q 0 is determined by Bayes’s rule.The uniqueness check is the similar to Proposition 1.□over f l difProof of Proposition 3. We first check the optimal strategy of designer f 1∗ . For low-type designer,although f 1 = f l dtakes the risk of being rejected, but the rejection leads to the finalization decision low typedesigner cannot accept (by definition of f l d). Since f l d> f h d, low type designer strictly prefers f 1 = f l dto anyother proposal acceptable for marketing. Other f 1 triggering marketing’s finalization decision will lead toproject termination. Therefore, low type designer weakly prefers f 1 = f l d.For high-type designer, proposing f h dgenerates E[u d (f h d)] since it is always accepted by marketing. Thisis obviously better than any other acceptable f 1 < f h d. Proposing any other f 1 > f h dtriggers marketing’sfinalization decision, yielding E[u d (f h d)]. Finally, if f 1 = f l d, it will be rejected by marketing and yieldsE[u d (f h d)]. Therefore, high-type designer is indifferent between proposing f l dstrategy specified in proposition 3.Since mixed strategy δ ≤ 1, we require the condition thatand z and plays the mixedq 0 ≥ E[u m(fd)] l − E[u m (f 0 )] + c h m= βE[u m (fd h )] − E[u m (f 0 )] + c h mWe next consider the marketing’s optimal response a ∗ tto f 1 . If f 1 = f h d, marketing is certain that designeris of high type(q 1 = 1). Both types of marketing is willing to accept f h d, since f h dgenerates as high as thebest acceptable final specification. And both types of marketing can be strictly better off by rejecting f 1 = z,where z ∈ (f h d, f d ] and z ≠ f l dsince E[u m (f h d)] > E[u m (z)].If f 1 = f l d, Bayes’s rule implies that: q 1 =q 0δq 0 δ+1−q 0.Here, it is easy to see that marketing always prefers accepting f h dto proposing f 2 = f h dbecause the lattertakes the risk of being rejected by high-type designer. We now focus on the case where marketing mustchoose between accepting f 1 = f l dand proposing f 2 = f h d. Proposing f 2 = f h dyields expected payoff:q 0 δE[u m (f h d)] + (1 − q 0 )(E[u m (f 0 )] − c t m)q 0 δ + 1 − q 0Marketing prefers proposing f 2 = f h dif the previous equation is greater than E[u m (f l d)], orδ ≥ 1 − q 0q 0E[u m (f l d)] − E[u m (f 0 )] + c t mE[u m (f h d )] − E[u m (f l d)]Given the definition of δ, low-type marketing will strictly prefers to propose f 2 = f h dand high-type marketingwill weakly prefer.The condition q 0 > β excludes any other separating or pooling equilibrium.□

Author: Influence of Stakeholders on Product Design Decisions 29Proof of Proposition 4. The proof of proposition 4 is sufficed by checking the equilibriums under threescenarios.For simplicity, we let f 3 = f 1 through the following analysis. The equilibrium specification values and riskof project termination do not change as we relax this constraint. More analysis can be provided by request.Case One: If q 0 ≤ α, the following strategies and belief constitute a perfect Bayesian equilibrium :f 1∗t∈ [f h d, fd]l⎧⎨ accept if f 1 ≥ f la ∗ dt= propose f 2 = f h mif f 1 < f h d⎩propose f 2 = f l dif f h d≤ f 1 < f l d⎧⎨ 1 if f 2 = f lη ∗ dor f 2 ≤ f 1t= 1 if f 1 < f h dand f 2 ≤ f t m⎩0 f 3∗ = f 1∗ otherwiseξ ∗ t={ 1 if ˆηf 2 + (1 − ˆη)f 1 ≥ f t d0 otherwiseOn the equilibrium path, the beliefs are updated by Bayes’s rule. p ∗ 1 = 1 following marketing’s out ofequilibrium actions, and q ∗ 1 = 1 following designer’s out of equilibrium actions.Proof of Case One. We start the analysis with solving the last stage strategy ξ t . Immediately, it followsfrom the definition of Ω t dthat:{ 1 ∀fξ ∗ t(f 1 , q 1 ) = 1 ∈ Ω t d0 ∀f 1 /∈ Ω t dWe next check the optimality of f 1∗t. Given the other strategies and belief structures, for any f 1 < f h d,each type of marketing gets expected utility E[u m (f t m)]. And for any f 1 > f l d, marketing receives E[u m (f 1 )].Because all f 1 ∈ [f h d, f l d] always yield E[u m (f l d)], marketing of either type prefers f 1 ∈ [f h d, f l d] to any otherproposal and may initiate any of these proposals in this range in equilibrium.We further check the optimality of a ∗ t. First, note that any f 2 ≤ f 1 makes designer worse off. If f 1 < f h d,p ∗ 1 = 1 and f 2 = f h m. When f 1 ∈ [f h d, f l d), any f 2 ≠ f l dwill be rejected by marketing, the expected payoffof designer is hence E[u d (f t d)] ≤ E[u d (f l d)]. Therefore, low-type designer weakly prefers f l d, which high-typedesigner strictly prefers. Similarly, accepting f 1 = f l dis optimal for both types of designer. Last, if f 1 > f l d,any f 2 > f 1 will be rejected and designer gets expected payoff E[u d (f 1 )]. Either type of designer cannot getbetter result than accepting f 1 .We then check the optimality of η ∗ tby two steps. We first check η ∗ tfollowing the equilibrium f 1∗tcheck η ∗ tfollowing out of equilibrium f 1 t.and nextFirst Step: Clearly, marketing of type t is better off by accepting f 2 < f 1∗t, since it is at least better thanrejecting f 2 and sticking to f 1∗t. However, when f l d> f 2 > f 1∗ , each type of marketing will reject f 2 becausethe low-type designer will still reject it and it leads to lower payoff for marketing without reducing theprobability of project termination. Marketing also rejects f 2 > f l dsince his belief is q ∗ 1 = 1. Hence, marketingbelieves that designer will accept f 1∗ rather than let project terminate.Last, we show marketing accepts f 2 = f l d> f 1∗t. The designer of both types makes such revision proposal,therefore marketing’s updated belief is q ∗ 1 = q 0 . Since low type designer will reject following a rejectedrevision f 2 , marketing’s expected payoff if he rejected f 2 is q 0 E[u m (f 1∗t)] + (1 − q 0 )(E[u m (f 0 )] − c t m). Andt