Student Accountant - ps1-1

Student Accountant - ps1-1

Student Accountant - ps1-1

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

student accountant issue 23/201015silver medal winnersimon turner, ukSimon Turner, silver medal winner, passes on his top tips for examsuccess and talks about his future plansTypical working dayI am currently an audit executive forRSM Tenon. We have a large rangeof clients and as such each day isdifferent to the next. In the mainmy day is littered with planning andcompletion meetings with membersof the management and directorteam alongside on-site audit workat client offices but often includesbeing in the office to completecomplex consolidations and reportingpacks to the auditors of overseasparent companies.Top exam tipsMy first tip is to start working asearly as you can. The sooner you giveyourself a head start the easier theexam process seems.My second tip is to try and keepdoing normal things within your sociallife. It is hard enough juggling a fulltime job and exams without gettingstressed as a result of having no timeto do anything beyond the mundaneof double entry bookkeeping. I alwaysfound studying was far easier thenext day if I’d managed to relax thenight before.Developing personal skillsThe main thing for me has beeninterpersonal skills. I have met a lot ofnew people during my studies and aspart of completing my PER and thisskill set is really imperative to buildingrelationships with clients as well asothers within RSM Tenon as I look toprogress in my career.ACCA membershipThe Professional level exams were thefinal element I needed to complete andas such I have applied and obtainedmembership already.The ACCA lettersThe ACCA Qualification is arguably thehardest thing I have achieved due to thework/study/life balance. Therefore, Iam proud of having achieved the ACCAletters and that I managed to persevereand manage my time effectively enoughto get through first time.Professionally, it seems to have madequite a difference already as peopleseem to have a bit more confidence inmy ability. In addition, as I don’t haveany study time I am able to get involvedin more at work and have recentlyorganised a young person’s networkingevent as well as being involved in sometechnical projects with regards tofinancial reporting standards.On getting the silver medalGetting the silver medal is a greatfeeling and makes all those darknights looking at inheritance taxseem worthwhile.In the short-term getting the silvermedal has definitely provided mewith a step up the ladder and somenew opportunities. It is a great dooropener as a newly qualified but goingforward it’s important to continue todevelop and move forwardin my career on itsown meritsas examsuccesscan onlytakeme sofar.‘GETTING THE silver medalHAS definitely providedME WITH A step UP THEladder AS WELL AS someGREAT OPPORTUNITIES.’

16 learning centrestudy adviceyour revision tipsacca students and our regional head ofeduCATIon in PAKISTAN share some revision TIPSsadaf khalid, pakistan‘There is no better revision aid than MINDmaps. While going through the text the firsttime, I highlight the main points and thenincorporate them into a mind map right on thetext. That way, I can relate the diagram TOthe text during revision.’Sadaf KhalidIslamabad, PakistanACCA student, currentlystudying for her accaqualification Professionallevel examsMy revision tip: Mind maps. There isno better revision aid than mind maps.While going through the text the firsttime, I highlight the main points andthen incorporate them into a mindmap right on the text. That way, I canrelate the diagram to the text duringrevision. I get through a lot morethan I could with just rereading, andI avoid the feeling that I have missedsomething in the text.ansab waseemlahore, Pakistancat graduate andacca studentMy revision tip: The best thinghelped me in revision was theSyllabus and Study Guide section onthe ACCA website. Go through theStudy Guide for each exam you areattempting. Answer the questionsand prepare again for those youfind difficult.dr afra sajjadPakistanhead of education,ACCA PakistanMy revision tips: A large numberof students do not pass their examsbecause they do not practise underexam conditions. If you study at alearning provider, take the mockexam arranged by the learningprovider, insist on it being checkedby your tutor and discuss yourperformance with your tutor. Donot miss the mock exam and take itseriously. Prepare for the exam. Thefear of failure should not prevent youfrom taking the mock exam.You need to IMPRESS the examiner,so read the instructions carefully,underline the key words and answeraccordingly. Manage your time. 1.8minutes per mark is the golden rule.Presentation is important. If yourhandwriting is poor, leave a linebetween sentences. Your answershould be relevant to the question andscenario requirements. Look for exammarks but complete the entire paper.Do not leave out questions. Visualisesuccess by surviving the examsthrough excellent exam preparation.DR AFRA SAJJAD, ACCA PAKISTAN‘You need to IMPRESS the examiner, so readthe instructions carefully, underline the keywords and answer accoRDINgly. Manage yourtime. 1.8 minutes per MARK is the golden rule.’

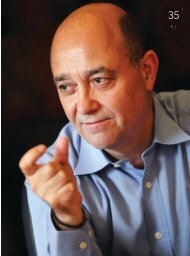

student accountant issue 23/201017the view from...Obaidullah Khawaja, UKobaidullah khawajaadvisory, financial services manager, ernst & youngQ. What is in your inbox?A. My inbox lives with me via myBlackBerry, which I constantly check.On a typical morning, I’ll find my inboxfull of emails from different clients,various partners and directors, as wellas my audit team members in the firm,a few news alerts, accounting updatesand lots of meeting invitations.Q. What impact has the economicclimate had on your role?A. As we all know, a lot of companieshave faced challenges due to theeconomic climate. This has obviouslyled to various audit issues arising andI deal with them as an audit manager. Ihave been spending more time with myclients and have had to be moreengaged, helping them all the way.Q. What part of your job doyou enjoy the most?A.The people. I enjoyestablishing relationships withnew people whether it be clientsor my colleagues.Counselling new entrantsto the firm, or experiencedqualified ACCAs, I find helpingpeople develop in their rolesvery satisfying.Q. What is at the top of yourto-do list?A. Organising my week is my toppriority, that way I am able toprovide my clients with the bestservice, adhere to all deadlines,ensure timely delivery of my workand have a good work-life balance.‘Organising my week is my top priority, thatway I am able to provide my clients withthe best service, adhere to all deadlines,ensure timely delivery of my work andhave a good work-life balance.’fast factsLives: Edinburgh, ScotlandCareer history: Trained at Ernst & Young Pakistan, seconded to EYDubai, London and Edinburgh offices. Part of the EY AcceleratedLeadership ProgrammeHobbies: My free time is spent at the gym and playing musicIf you would like to tell us about your day or life at work,email your details to us at studentaccountant@accaglobal.com

18 learning centreper supportonline linksThe ACCA website has a wide range of support to help you get yourpractical experience requirement (PER) for acca membershipPER interactive case studiesFollow the journey of six individuals– four trainees and two workplacementors – through PER. Explore typicalquestions raised and challenges facedthroughout the PER cycle and someof the choices and options availableto you.Access the PER interactivecase studiesFurther resources, including SupportSheets and Case Studies are availablefrom myACCA.How to use the TraineeDevelopment Matrix (TDM)A guide to help you through the variousfunctions of the trainee developmentmatrix (TDM) – this is also availablethrough myACCA.TDM guidance videosACCA has produced 18 short videosand podcasts which give a step-by-stepguide to assist trainees and workplacementors in completing the TDM.Access the TDM guidance videosHelp with getting aworkplace mentorThis guide has been designed to give toa person you would like to act as yourworkplace mentor. It briefly describesthe nature of the role and the benefitsto them.PER guide for traineesThis guide explains all you need toknow about ACCA’s practical experiencerequirements in detail.Other resourcesPerformance objectives bookletThe performance objectives bookletcontains detailed information to helpworkplace mentors guide traineeson each performance objective theyhave to achieve, and understandthe values and attitudes traineesshould demonstrate as they gain theirpractical experience.Answering challenge questionsA guide to help you understand howto approach the challenge questionswhich are related to the performanceobjectives. The guide contains sampleanswers to help you understand whata suitable answer may look like.Trainee support sheets¤ Setting and meetingperformance objectives¤ Getting practical experience¤ Ensuring personal effectiveness¤ How to find a mentor.The support sheets provide guidance onwhat you need to do to help you achieveyour practical experience.Focus on performanceobjectives – publishedin previous issues ofstudent accountantProfessionalism, ethicsand governance1 Demonstrate the applicationof professional ethics, valuesand judgment2 Contribute to the effectivegovernance of an organisation3 Raise awareness ofnon‐financial riskPersonal effectiveness4 Manage self5 Communicate effectively6 Use information andcommunications technologyBusiness management7 Manage on-going activities in yourarea of responsibility8 Improve departmental performance9 Manage an assignmentFinancial accounting andreporting10 Prepare financial statements forexternal purposes11 Interpret financial transactions andfinancial statementsPerformance measurement andmanagement accounting12 Prepare financial information formanagement13 Contribute to budget planning andproduction14 Monitor and control budgetsFinance and financial management15 Evaluate potential business/investment opportunities and therequired finance options16 Manage cash using active cashmanagement and treasury systemsAudit and assurance17 Prepare for and collect evidencefor audit18 Evaluate and report on auditTaxation19 Evaluate and computetaxes payable20 Assist with tax planning.

student accountant issue 23/201019per supportannual returnAs part of the PER, every trainee is required to submit an annual returnstating what practical experience they have obtained in the Past 12 monthsThe purpose of the annual returnis to help you and ACCA track yourpractical experience and your progresstowards gaining ACCA membership.It also allows ACCA to assist you bydeveloping products and servicesto help support your trainingand development.Even if you are not currently workingin a relevant role, for example if you area full-time student, you must make anannual PER return.How do I make an annual return?To complete your annual return selectthe ‘annual return’ button in the onlineTDM – this can be accessed throughmyACCA. There are various sections youneed to complete depending on yourworking status but the whole processwill only take you a few minutes. Theannual return allows you to:¤ view or confirm the performanceobjectives that have been signed offto date by your workplace mentor(s)if relevant to your circumstances¤ confirm the time (in months) thatyou have been in a relevant role sinceyour last annual return¤ confirm that the information you havegiven is true by signing a declarationand agreeing that you are committedto your development and to ACCA’sCode of Ethics.When do I have to do my annualreturn by?The closing date to make your annualreturn is 1 January each year. But thisdoes not mean that you have to waituntil December to make your return,you can complete your annual returnonline at any time during the year. Forexample, if you know that you will bePER1January2January3January4Januarystudying full time for the rest of the yearand will not be in a relevant workingrole, you can make your annual returnnow, stating that you have no relevantwork experience to record at this time.I am not working do I still needto make an annual return?Yes. All trainees are required tocomplete an annual return, includingthose studying on a full-time basis,those working in a non-relevantrole, and those not working for otherreasons, such as ill health.I have already made my annualreturn for this year buthave more experience to declare –what do I do?If you need to, you can make morethan one annual return in a year,however please be aware that yourmost recent entry will overwrite whatyou declared previously, so make sureyour latest entry includes any previousinformation entered. You can record aslittle as one month’s experience whenyou make your annual return – if itis relevant it will all add up to the 36months required.PER auditACCA reviews trainees’ workplaceachievement. Non-completion ofthe annual reporting requirement,lack of recording, and continuednon‐achievement of performanceobjectives (where you are in a relevantrole), will be among the factors takeninto account when selecting traineerecords for review. Trainees’ online TDMor paper-based records will be subjectto the same levels of PER audit.