Annual Report 2010 2009 2008 2007 - Kvaerner

Annual Report 2010 2009 2008 2007 - Kvaerner

Annual Report 2010 2009 2008 2007 - Kvaerner

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Annual</strong> report <strong>2010</strong>

2 Aker Solutions annual report <strong>2010</strong>ContentsContents• Key figures <strong>2010</strong> 3• Letter to shareholders 4• Board of directors’ report 5Summary 5Business overview 5<strong>Report</strong> for <strong>2010</strong> 6Company, people and community 10• <strong>Annual</strong> accounts 17Declaration by the Board of Directorsand President & CFO 17Aker Solutions group 19Aker Solutions ASA 67Auditor’s report 75• Share and shareholder information 76Share and shareholder information 76Analytical information 80• Corporate governance 81Corporate governance 81Board of directors 88Executive chairman and President 90Business management 90Corporate centre functions 92Company information 93Aker Solutions annual report <strong>2010</strong>

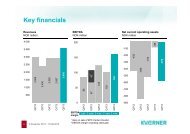

Aker Solutions annual report <strong>2010</strong>This is Aker Solutions3Key figures <strong>2010</strong>(Continuing operations only)Orders and results <strong>2010</strong> <strong>2009</strong>Order backlog 31 December NOK mill 50 775 52 740Order intake NOK mill 46 341 49 048Operating revenues NOK mill 46 267 49 856EBITDA NOK mill 3 778 4 095EBITDA-margin Percent 8.2% 8.2%Net profit NOK mill 1 658 2 186Cash flowCash flow from operational activities NOK mill 2 131 4 245Balance sheetBorrowings NOK mill 8 224 7 515Equity ratio Percent 25.9% 22.8%Return on equity Percent 17.3% 25.5%Return on captial employed 1 Percent 12.1% 14.4%ShareShare price 31 December NOK 99.25 75.45Dividend per share 2 NOK 2.75 2.60Basic earnings per share (NOK) NOK 5.96 7.86Diluted earnings per share (NOK) NOK 5.95 7.85EmployeesEmployees 31 December Full time equivalents 19 444 19 415HSELost time incident frequency Per million worked hours 0.83 0.90Total recordable incident frequency Per million worked hours 2.62 2.68Sick leave rate Percent of worked hours 2.04 2.181) Including discontinued operations2) Proposed dividends for <strong>2010</strong>

4 Aker Solutions annual report <strong>2010</strong>This is Aker SolutionsLetter to shareholdersThere are certain milestones that define acompany like Aker Solutions. I believe thethree-way split of Kværner, from which AkerSolutions emerged back in 2004, was sucha moment. I believe that <strong>2010</strong> will also godown in history as one of the more significantyears in the history of our company.One reason for this is that we have managedthe aftermath of the <strong>2008</strong>-09 financialturmoil quite well. Although revenuesdeclined somewhat, order backlog andprofits were relatively stable, despite experiencingunfortunate quality and performanceissues that diluted our returns.Reducing such costs is naturally a paramountobjective of our continual improvementwork in Aker Solutions.Our earnings before interest, tax, depreciationand amortisation (EBITDA) wereNOK 4.3 billion for the year <strong>2010</strong> and thenet profit was NOK 2.0 billion. Our financialposition is strong and is reflected in theboard’s proposal to pay NOK 2.75 pershare in dividend, in line with our dividendpolicy.The numbers from <strong>2010</strong> are now history.Of more importance are the steps we havedecided to take for the future; steps whichaim to create a more focused AkerSolutions, with a more simplified and transparentstructure. We are building an organisationwhich I believe will accelerate growthand put emphasis on our company values.First of all, we have divested substantialparts of our non-oil and gas related businessesand we are reallocating our financialand organisational resources. During <strong>2010</strong>we announced several divestments with acombined value of NOK 7 billion. Whenthese transactions were completed in thefirst quarter of 2011, our net debt was zero,providing a strong foundation for furthergrowth.Secondly, as we enter into 2011, weprepare for a two-fold future. In May thisyear, shareholders will be invited to decideon a transfer of our large scale engineering,procurement and construction (EPC)project business to a new company.The relocated EPC company will have astrong position in the North Sea fielddevelop ment market and key positions inselected international target markets foronshore and offshore EPC projects. Thenewly structured Aker Solutions willcontinue to provide engineering solutions,product solutions and field life solutions tothe upstream oil and gas industry.The separation will take place through ade-merger and all Aker Solutions ownerswill receive shares in the new company.Investors can thereafter adjust their shareholdingaccording to their preferred investmentprofile. Aker ASA, which through AkerHolding is the leading shareholder in AkerSolutions, has stated that it will maintain itsshareholding in both companies after thedemerger.Preparations for these changes are wellunderway and include the establishment ofnew organisations and leadership teams forboth companies.In this transition period, it is with greatpleasure that I have accepted the board’schallenge to continue as executive chairman,and as part of this role also functionas CEO. This will allow us to continue theimplementation of our strategy at fullspeed, and at the same time further clarifythe profile and mandate of the newPresident and CEO of the company.I have appointed a new leadership teamwhich I will work with in this interim period.The composition of the team reflects ourambitions both to keep leadership close tobusiness and to further internationaliseAker Solutions. The new leadership teamincludes eight business leaders who willreport directly to me.Also a part of the leadership team aresix function heads from the corporatecentre that have the responsibility forshaping and safeguarding our activitieswithin key functional areas. The corporatecentre includes several new functions,which we believe will be particularly importantin driving through our strategy.The following four topics are on the top ofour operational improvement agenda:Customer focus: Build strong and lastingrelationships to individual customers anddevelop regional and country strategies.Quality and performance: Chase operationalexcellence (HSE, project management,cost efficiency), reduce quality costsand continue to strengthen performanceculture.People: Retain and attract the best andmost competent people and ensure highquality programs for people and leadershipdevelopment.Technology: Focus existing technologyprocesses and initiatives in the operatingbusinesses and identify and co-ordinateresearch and development initiatives.The above mentioned four priorities arereflected in the new corporate centre withChief Operating Officer, Chief TechnologyOfficer and Chief Strategic Marketingintroduced as new functions within AkerSolutions. My expectation is that with thisnew organisation we will be better positionedto inspire and to drive the functionalpriorities across the business units andhence, further improve the performance ofAker Solutions.Furthermore, with the structuralchanges and the operational improvementinitiatives outlined above, we believe AkerSolutions and the new EPC company arewell prepared to face the challenges andopportunities that lie ahead.It is our intention to see both AkerSolutions and the new EPC company grow.The world needs more oil and gas, and ourpeople and teams have the technology,competence and experience required toproduce hydrocarbons in a safe andenvironmentally careful way.We believe the fundamentals are inplace, for a lot of hard work that stillremains.Øyvind EriksenExecutive Chairman

Aker Solutions annual report <strong>2010</strong>Board of directors’ report5Board of directors’ reportSummaryAker Solutions has emerged from the <strong>2008</strong>-09 financial turmoil on a strong note.Revenues declined in <strong>2010</strong> but profitsremained at similar levels as the previousyear. Earnings before interest, tax anddepreciation (EBITDA) for the year wasNOK 4.3 billion, including businessesaccounted for as discontinued operations.In <strong>2010</strong> order intake was NOK 51.9billion, on the same level as in <strong>2009</strong>. Orderbacklog at the end of <strong>2010</strong> was NOK 55.4billion including discontinued operations,marginally down from the end of <strong>2009</strong>.Bidding activity increased through <strong>2010</strong>,signalling that the company’s main marketsare on the rebound.In <strong>2010</strong> Aker Solutions concluded acomprehensive strategy process. In linewith the direction set out by the board andmanagement to focus and streamline thebusiness, Aker Solutions agreed to the saleof parts of the Process & Construction(P&C) business area, and the sale of themarine specialist subsidiary Aker MarineContractors (AMC).The board also resolved to propose tothe general meeting, that the large projectEPC (engineering, procurement andconstruction) business within the EnergyDevelop ment & Services business area islaunched into a new company, separatefrom the rest of Aker Solutions. This separationis due to be completed in the secondhalf of 2011.Two focused, well trimmed organisationswill emerge, both positioned for growth.Aker Solutions provides product solutions,engineering solutions and field life solutionsfor the oil and gas industry. The new EPCcompany, provisionally named AkerContractors, will have a strong position inthe North Sea field development marketwith key positions in selected internationaltarget regions. Both companies were presentedat the company’s capital marketsday in December. They are described infurther detail below.Although operations have improved inmany parts of the business, a more detailedanalysis reveals opportunities for furtherimprovement and increased profits. Thecontinued losses in the drilling riser businessand weak financial performance on apower project in the United States areimportant reminders in this respect.The board and management have identifiedseveral areas of improvement andactions are under way. The following areaswill be specifically addressed: customerrelations, quality in project execution,technology and finally, organisationaldevelopment and recruitment and retentionof personnel.In terms of organisation, a new andmore transparent operating business structurewas complemented by a corporatecentre charged with responsibility andmeans to chase operational improvementsand synergies throughout the company.Aker Solutions expects that the restructuringwill unleash energy and drive in eachof the new, streamlined businesses andultimately contribute to accelerated growth.The market fundamentals for AkerSolutions are good, but the board wouldlike to point out that any assessment offuture conditions are subject to uncertainty.The company expects that annual averagegrowth in the years 2011-2015 could be inthe 9-15 percent range, partly as a result ofgrowing markets, growing market sharesand revenues from businesses acquired inthe period.Business overviewPrincipal operationsAker Solutions provides engineeringsolutions, product solutions, field lifesolutions and executes large and complexfield development projects for the oil andgas industry.In <strong>2010</strong> the group had four reportingsegments: Energy Development & Services(ED&S), Subsea, Products & Technologies(P&T) and Process & Construction (P&C).Each of these business areas is describedbelow in the “Presentation of the <strong>2010</strong>accounts” section.The P&C business area was involved inengineering and construction services,primarily in the mining and metals, energyand environmental and downstream oil, gasand petrochemicals industry segments. InDecember an agreement was reached todivest a significant part of this business.The transaction was completed in February2011.Following the sale of the P&Cbusinesses and restructuring of the oil andgas business, a new reporting structurewas implemented with effect from March2011.The Aker Solutions group is organised ina number of separate legal entities. AkerSolutions is used as the common trademarkfor most of these entities.At the end of <strong>2010</strong> the group had 19 444employes in continued businesses andactivities in more than 25 countries. Itshead office is in Norway, at Fornebuoutside Oslo. The parent company, AkerSolutions ASA, is listed on the Oslo StockExchange.MarketsDemand for Aker Solutions’ technology,products and services is driven by theworld’s increasing consumption of oil andgas for transportation, energy productionand industrial purposes.Market prospects are regarded as good.The world’s energy consumption isexpected to continue to grow. Combinedwith declining reserves and reduced oil andgas production in many parts of the world,this is expected to generate a persistentneed for new developments.For many years, the North-WestEuropean continental shelf has been theworld’s primary geographical market foroffshore oil and gas activities. Historically,this was also Aker Solutions’ home marketand a breeding ground for new technologiesand solutions.This region continues to play a key rolefor Aker Solutions, although the compositionof this market is shifting. With thematuring of the oil and gas fields in theregion, demand has grown for technologiesand solutions required for increased oil andgas recovery, satellite field developmentsand maintenance and modificationsrequired to extend the lifespan of existingfield infrastructure.Over the past 15-20 years, other

6 Aker Solutions annual report <strong>2010</strong>Board of directors’ reportgeographical markets have become increasinglyimportant. International oil companieshave shifted the focus of theirexploration activities to new frontier areas.National oil companies supported bygoverments with ambitious developmentplans are playing an important role in manyregions.Today Brazil represents the most rapidlygrowing single market in the offshoreindustry. Other countries with recent stronggrowth and high national ambitions arefound in West Africa, South and South EastAsia, around the Caspian Sea and in theArctic region.One common denominator for thesefrontier regions is the fact that remaining oiland gas reserves are increasingly difficult toproduce from. New fields are often locatedin deep waters, tough climate and remoteareas. Exploration and production in suchregions typically involve development ofnew technology, deployment of groundbreakingproducts and large and complexprojects.The oil price influences oil companies’priorities for, and choices between, newdevelopments, upgrades to existing facilitiesand commitments to improvingrecovery from producing fields. Oil pricesthereby affect activity in Aker Solutions’main markets. The group’s share of newdeliveries compared with lifecycle servicesmay accordingly vary over time in line withoil price trends.Aker Solutions’ success depends on thetrust the company inspires in its customers.The most important success factor forachieving that trust is to deliver qualityproducts and projects predictably accordingto agreed milestones.Strategic target areasIn a thorough strategy process in <strong>2010</strong>, theboard observed that Aker Solutions enjoysa prominent position in many of these geographicalmarkets and industry segments.The company’s portfolio of servicesincludes engineering competence,products, technologies and integratedsolutions.Its long tenure in the oil service industryhas left it with distinctive relations andexperience which are embedded in individualsand in organisational structures. Thecompany also enjoys a growing installedbase of products and solutions that representsopportunity for service and repeatsales.The strategy work also revealed areaswhere the company clearly has room forimprovement. In its concluding strategymeeting, the board pointed to the followingthree priorities: Firstly: focus the business;secondly: reorganise for greater transparencyand better positioning in growingmarkets; and thirdly: chase operationalimprovements. As a result, Aker Solutionswill begin 2011 with strengthened focus onquality in project execution, technology,customer relations and people and teams.A more focused portfolio was achievedby divestment of parts of the P&C businessarea and the marine operation businessagreed in <strong>2010</strong>. The formation of an internationalEPC contract company will furtherstreamline operations. These transactionsare further described below. Over time, thecompany will further scale down its financialexposure in ships and marineequipment.The future Aker Solutions will provideengineering solutions, product solutionsand field life solutions for the upstream oiland gas industry. Its range of offeringsinclude deepwater drilling technologies,subsea oil and gas production systems,well services, mooring and offloadingsystems, well-stream processing technologies,as well as life-of-field solutionsthrough its maintenance, modification andoperations business. Aker Solutions willalso offer front end engineering design andconcept studies as stand-alone services tooil companies and construction companies.These changes and the correspondingchanges to the business segment compositionand operating model will result in amore transparent company. It will be ableto offer greater flexibility to customers andbe well placed to capture opportunities forgrowth.The relatively large and complex businessareas known from before have beenreorganised into new and more focusedsegments: Engineering Solutions, ProductSolutions and Field Life Solutions. ProductSolutions consists of the following foursub-segments: Subsea, Drilling Technologies,Mooring & Loading Systems andProcess Systems. Field Life Solutionsconsists of Well Intervention Services,Oilfield Service & Marine Assets andMaintenance, Modifications & Operations.The new business structure was complementedby a corporate centre chargedwith responsibility and means to chaseoperational improvements throughout thecompany and achieve synergies in keyareas across the businesses such ascompetence sharing, lessons learned,technology and customer relations.The starting point for reinforcement ofoperational quality and performance will bethe company’s six core values: Customerdrive, People and teams, Open and directdialogue, Hands-on management,Delivering results and HSE mindset.For more than 20 years, the companyhas worked hard to improve health, safetyand environmental (HSE) performance. Inthe industries which Aker Solutions work,excellence in HSE is considered to be alicence to operate. Consequently this areahas had – and will continue to have aspecial place in the company’s culture.Now corresponding efforts will be made toadvance and strengthen the other fivevalues.<strong>Report</strong> for <strong>2010</strong>HighlightsOperational highlights and milestones for<strong>2010</strong> are described in the business areareview later in this report. The mainstrategic and structural highlights for <strong>2010</strong>were as follows.Launching Aker ContractorsThe new company provisionally namedAker Contractors will be a focused EPC(engineering, procurement and construction)company with a strong position in theNorth Sea field development market, keypositions in selected international targetregions, and offerings of distinct offshoreproducts within a global market. The newcompany will continue to target offshoreand onshore EPC field developmentprojects with the ambition to maintain itsstrong position in the North Sea and furthergrow its international presence.Assuming approval from the generalmeeting, the new company will be establishedthrough a demerger. Until this transactionis concluded Aker Contractors willoperate as an increasingly self-containedentity with separate board and management.This new structure will offer customersmore flexibility in alternative delivery

Aker Solutions annual report <strong>2010</strong>Board of directors’ report7models for offshore greenfield oil and gasdevelopments. Aker Contractors will positionitself for large EPC contracts whichtypically would involve delivery of completeplatforms and integrated solutions.Sale of P&CAs mentioned above, Aker Solutionsdecided to divest most of its onshore nonoiland gas related process and constructionbusinesses. Parallel paths were exploredwith a spin-off and listing of theentity with a new brand as the base case.At the end of <strong>2010</strong> an agreement wasreached to transfer most of Aker Solutions’process and construction businesses toJacobs Engineering Group. The agreedtransaction value is NOK 5.5 billion (USD913 million). The consideration was settledin cash at completion in February 2011.For Aker Solutions, the transaction hada positive net cash effect of approximatelyNOK 3.8 billion (USD 634 million), and acash to treasury effect of approximatelyNOK 4.2 billion (USD 701 million). Net gainis estimated to be approximately NOK 2.4billion (USD 400 million).The transaction did not include the USEPC centre in Houston, and the UnionConstruction business located in the USand Canada. They will be part of the newAker Contractors company describedabove.Sale of AMCIn October <strong>2010</strong> an agreement was madeto sell Aker Marine Contractors (AMC), asubsidiary within the Subsea business area,to the Singapore listed company EzraHoldings Ltd (Ezra) in exchange for equityinstruments in Ezra and other consideration.Furthermore 50 percent of AkerSolutions’ ownership in the Aker Connector(now AMC Connector) installation vesselwill be transferred to Ezra.The transaction was completed in March2011. AMC is valued at USD 250 million. Ofthis, USD 50 million was settled in cash,USD 100 million in shares in Ezra HoldingsLtd, equivalent to approximately sevenpercent ownership, and USD 50 million in aconvertible bond with maturity after 36months. The final USD 50 million plus interestwill be settled in cash on and subsequentto delivery of Aker Connector,which is expected to take place in fourthquarter 2011.New office projectsAker Solutions has been involved in thedevelopment of two major office buildingsfor the company in Norway. In December<strong>2010</strong>, majority ownership of the building inOslo was transferred to other investors anda letter of intent to sell the Stavangerproperty was signed.The two transactions are expected togive a cash effect of approximately NOK500 million each which will be recognisedin 2012 when the buildings are completed.The Oslo transaction was completed in<strong>2010</strong>. The sale of the Stavanger property isexpected to be concluded in first half of2011. Aker Solutions will retain an ownershipinterest of 25 percent in bothproperties.Management changesIn June <strong>2010</strong> President & CEO SimenLieungh left the company. Since then, ChiefFinancial Officer Leif H Borge has beenPresident of Aker Solutions ASA, whileØyvind Eriksen in his capacity as executivechairman has taken on the role of CEO forthe group.A new leadership team was effective asof March 2011. The team consists of theheads of eight sub-segments and sixcorporate centre managers and is headedby the executive chairman.The team composition reflects the newcorporate structure and the corporatestrategic priorities described above. Chiefoperating officer, chief technology officerand chief strategic marketing are newfunctions in the corporate leadership team.Three of the team members are non-Norwegian citizens. Two are women.Each member of the 2011 corporateleadership team are presented on page 90of this report. Members of the <strong>2010</strong>executive team are listed on page 41.The identification and appointment ofPresident & CEO for Aker Solutions and thenew company Aker Contractors is ongoing.Presentation of the accountsAker Solutions presents its accounts inaccordance with the International Financial<strong>Report</strong>ing Standards (IFRS) as adopted bythe EU. Unless otherwise specified, figuresin brackets present comparative data forthe corresponding accounting period orbalance sheet date for the previous year.In Aker Solutions’ consolidated financialstatements, the P&C businesses that havebeen transferred to Jacobs are classified asdiscontinued operations. In <strong>2010</strong> thesebusinesses had operating revenues of NOK4 500 million (NOK 4 221 million) andEBITDA of NOK 522 million (NOK 273million). Furthermore, AMC is classified asdisposal group held for sale.Income statementConsolidated operating revenues for <strong>2010</strong>for continuing operations declined by 7.2percent to NOK 46 267 million (NOK 49 856million). Earnings before interest, tax, depreciationand amortisation continuingoperations (EBITDA) amounted to NOK3 778 million (NOK 4 095 million), adecrease of 7.7 percent from <strong>2009</strong>. TheEBITDA margin in <strong>2010</strong> was 8.2 percent(same as in <strong>2009</strong>).The decrease in operating revenues andEBITDA is partly due to fairly low activitywithin some of Aker Solutions’ operationsand partly due to phasing of projects.However, due to good execution on someimportant projects, the EBITDA marginincreased somewhat.Depreciation, impairment charges andamortisation from continuing operationstotalled NOK 871 million (NOK 897 million).Consolidated earnings before interestand taxes from continuing operations(EBIT) were NOK 2 907 million (NOK 3 198million). Net financial expenses amountedto NOK 552 million (NOK 229 million).The group hedges currency risk for allproject exposures in accordance with wellestablishedpractice. Although this providesa full currency hedge, parts of the hedging(about 20 percent) do not meet the requirementsfor hedge accounting specified inIFRS. This means that fluctuations in thevalue of the associated hedging instrumentsare recognised with full effect asfinancial items in the accounts. Theaccounting effect appears as an expense ofNOK 84 million (income of NOK 161 million)in a separate line under financial items. Theunderlying projects hedged by the unqualifiedhedging instruments have had apositive accounting effect of NOK 23million (negative effect of NOK 81 million),which is recognised as an ordinary operatingexpense.Associated companies and jointventures reported a loss of NOK 32 million(gain of NOK 112 million). The <strong>2009</strong> figure

8 Aker Solutions annual report <strong>2010</strong>Board of directors’ reportincludes a gain of NOK 109 million on thesale of the holding in ODIM ASA.Tax expense was NOK 697 million (NOK783 million). This corresponded to an effectivetax rate of 29.6 percent (26.4 percent).Consolidated net profit from continuingoperations in <strong>2010</strong> was NOK 1 658 million(NOK 2 186 million). Profit from discontinuedoperations net of income tax wasNOK 352 million (NOK 145 million), and netprofit for <strong>2010</strong> was NOK 2 010 million (NOK2 331 million). This represented basic earningsper share of NOK 7.27 (NOK 8.40).Basic earnings per share for continuingoperations were NOK 5.96 (NOK 7.86).Cash flowConsolidated cash flows from operatingactivities depend on a number of factors,including progress with and delivery ofprojects, changes in working capital andpre-payments from customers. Net cashflow from operations was NOK 2 131million (NOK 4 245 million).Net cash flow from investment activitiesin <strong>2010</strong> was negative NOK 2 109 million(NOK 3 927 million, of which around NOK1 400 million related to the acquisitionscarried out in April <strong>2009</strong>). Net cash flowfrom financing activities was negative NOK121 million (NOK 278 million), withdividends for the previous year of NOK 700million (NOK 431 million).Balance sheet and liquidityConsolidated interest-bearing debtamounted to NOK 8.2 billion (NOK 7.5billion) as of 31 December <strong>2010</strong>.Long-term debt consists of five bondloans in the Norwegian market. These loansincluded one of NOK 572 million maturingin 2011, two of NOK 150 million and NOK300 million respectively which mature in2013, and two of NOK 1 913 million andNOK 187 million maturing in 2014. Thebond loans have floating interest rates withthe exception of the NOK 150 million loanmaturing in 2013 and of NOK 1 913 millionmaturing in 2014, which have a fixed rate.Parts of the loans with floating rateshave been converted to fixed rates throughinterest swap agreements, and parts of theloans with fixed rates have been convertedto floating rates. 44 percent of the totalbond loans accordingly have fixed rates.The average remaining term to maturity forthese loans is just under three years.In addition, a syndicated bank facility ofEUR 750 million (corresponding to NOK5 864 million) was established in October2006, maturing in October 2012. NOK2 800 million of this facility had been drawndown as of 31 December <strong>2010</strong>.A credit facility of NOK 2 000 million wasestablished by the group in December <strong>2008</strong>with a term of 18 months and an option toextend this period by a further 18 months.The company exercised the extensionoption in <strong>2010</strong> and the credit facility has afinal maturity in December 2011. No drawingshad been made on this facility as of 31December <strong>2010</strong>.A term loan of NOK 750 million with amaturity of five years was established withan international bank during the fourthquarter of <strong>2009</strong> to strengthen the group’sfinancial platform even further. This loanmatures in October 2014.Fixed interest agreements entered intofor 2011 on that date covered 46 percent ofthe total debt.Consolidated non-current assets totalledNOK 15.9 billion (NOK 16.1 billion) as of 31December <strong>2010</strong>, of which goodwillamounted to NOK 6.2 billion (NOK 7.4billion). The reduction in goodwill in <strong>2010</strong> ismainly due to reclassification of goodwill toheld for sale related to the expected transactionsof AMC and P&C.Net interest-bearing liabilities totalledNOK 4 180 million (NOK 3 705 million) as of31 December <strong>2010</strong>.Book equity including non-controllinginterests totalled NOK 10 354 million (NOK9 123 million) as of 31 December <strong>2010</strong>.Non-controlling interests amounted to NOK189 million (NOK 147 million). The group’sequity ratio was 25.9 percent (22.8 percent)of the total balance sheet as of 31 December<strong>2010</strong>.Consolidated capital adequacy andliquidity are good, and help to ensure thatthe group is well equipped to meet thechallenges and opportunities faced overthe next few years.Segment reviewsFrom 2011 Aker Solutions will present itsaccounts with three reporting segments:Product Solutions, Engineering Solutionsand Field Life Solutions. Product Solutionsinclude the following sub-segments:Subsea, Drilling Technologies, ProcessSystems and Mooring & Loading Systemswhile Field Life Solutions include thesub-segments Maintenance, Modifications& Operations (MMO), Well InterventionServices and Oilfield Services & MarineAssets.In the review of <strong>2010</strong> accounts below,reporting follows the old business areastructure which was effective until March2011.Energy Development & ServicesThe business area experienced high activityin the North Sea maintenance,modifications and operations market andon several international projects includingSakhalin I, Kashagan and Hebron. In addition,some new North Sea developmentsalso contributed to a good workloadthrough the year.Operating revenues totalled NOK 20 876million (NOK 19 827 million). EBITDA wasNOK 2 040 million (NOK 1 116 million). TheEBITDA margin was 9.8 percent, improvingfrom 5.6 percent in <strong>2009</strong>. The improvementpartly reflected contract formats in theorder backlog and improvements in operations.The order backlog as of 31December <strong>2010</strong> was NOK 26 265 million(NOK 25 396 million).Maintaining a strong position in theNorth Sea market and further increasing itsinternational competitiveness were two keytargets for the ED&S business area in <strong>2010</strong>.Several significant contracts related to newfield developments and field life extensionswere awarded, supporting this ambition.The business area reported high activityon the operations in Kazakhstan andRussia throughout <strong>2010</strong> and delivery of thegroundbreaking Gjøa semi-submersiblefrom the Stord yard. Within studies andFEEDs, tendering activity has been highwith several contract wins.In order to build flexible, cost-effectivedelivery models, a joint venture was establishedwith the Kazakh industrial groupKazKiproNefteTrans and the cooperationwith COOEC’s Quingdao yard in China hasbeen further developed.From March 2011, ED&S was separatedinto three business segments: Engineering,MMO (a sub-segment within AkerSolutions’ reporting segment Field LifeSolutions) and Aker Contractors (the EPCbusiness) which will be established as aseparately listed company on the OsloStock Exchange.

Aker Solutions annual report <strong>2010</strong>Board of directors’ report9SubseaThe business area performed relatively wellin a demanding market. Total operatingrevenues in <strong>2010</strong> were NOK 11 844 million(NOK 12 972 million). EBITDA was NOK1 170 million (NOK 1 399 million) andEBITDA margin decreased from 10.8percent in <strong>2009</strong> to 9.9 percent. The EBITDAwas negatively affected by low capacityutilisation for the installation vessels and nowell intervention work for the vessel SkandiAker. Record high well services activitylevel in the North Sea and increasedactivity within lifecycle services affected theresults positively. The order backlog at theend of <strong>2010</strong> was NOK 15 356 million (NOK12 395 million).Key contract awards in <strong>2010</strong> includedthe USD 300 million Iara & Guara contractoffshore Brazil, and the NOK 3.4 billioncontract to deliver a subsea gas compressionstation to Statoil’s Åsgard field in theNorth Sea.Execution of key projects has been astrong focus throughout the year. Successfuldeliveries have been made to DongEnergy’s two fast-track projects, Trym andOselvar. In August, first oil was producedfrom Statoil’s demanding Morvin HP/HTfield, through a subsea production systemfrom Aker Solutions. The groundbreakingOrmen Lange subsea gas compressionpilot project also progressed well, withstart-up of system testing commencing asplanned in Q4 <strong>2010</strong>.The investment programme hascontinued in <strong>2010</strong>. During <strong>2010</strong> AkerSolutions has increased capacity byinvestments in subsea infrastructure, drivenparticularly by developments in the NorthSea and off Brazil, South-East Asia and WestAfrica. The group expects to continue thisinvestment programme in the years to come.The divestment of Aker MarineContractors was announced in October<strong>2010</strong>. The transaction was completed inMarch 2011 as previously described.From March 2011 the business area wassplit in three sub-segments: Subsea, WellIntervention Services and Oilfield Services& Marine Assets. The first is a part of thereporting segment Product Solutions whilethe last two are part of the reportingsegment Field Life Solutions.Products & TechnologiesProducts & Technologies experiencedlower activity during <strong>2010</strong> compared to<strong>2009</strong>. The decline was mainly due to ageneral slowdown in drilling rig new builds,resulting in a lack of new contracts forcomplete drilling packages in <strong>2009</strong> and into<strong>2010</strong>.Operating revenues decreased by 19.8percent from the year before and came toNOK 10 206 million (NOK 12 729 million).EBITDA for <strong>2010</strong> was NOK 859 million(NOK 1 304 million), and profitabilitydecreased to an EBITDA margin of 8.4percent (10.2 percent).Profit in the business area was adverselyaffected by performance issues in thedrilling riser business. Mitigating actionswere initiated and the issues are expectedto be resolved in the first half of 2011.The order backlog as of 31 December<strong>2010</strong> was NOK 7 360 million (NOK 9 632million). The main contracts awardedduring the year were two complete drillingequipment packages to Daewoo and onefor an undisclosed customer, in addition toseveral smaller contracts within processtechnologies and offshore and marineequipment.Four complete drilling equipmentpackages were delivered during <strong>2010</strong> andten drilling equipment packages arescheduled for delivery in 2011. The activitywithin process systems, deck machineryand mooring equipment has been highthroughout the year. The installed base ofproducts continues to grow and provides astrong basis for continued growth inlifecycle services.In August, a new iPort technology centrewas opened in Stavanger, combiningsimulators, technological facilities andservices under one roof. In Brazil, a newdrilling lifecycle services centre wasopened in Rio das Ostras, bringing to theBrazilian market the first 240° dome baseddrilling equipment simulator. This visualisationand simulator technology has provento be a powerful tool to increase efficiencyin design and operation of offshoreproducts and solutions.From March 2011 the business area wassplit in three sub-segments: DrillingTechnologies, Process Systems andMooring & Loading Systems, which will allbe part of the reporting segment ProductSolutions.Process & ConstructionIn <strong>2010</strong> Process & Construction enjoyedhigh activity within the mining and metals,and energy and environmental segmentswhile other segments within onshore oil,gas and process still experienced slowmarkets.Operating revenues fell by 8.7 percent toNOK 8 703 million (NOK 9 534 million).EBITDA was NOK 213 million (NOK 484million). The EBITDA margin fell to 2.4percent (5.1 percent). The order backlogstood at NOK 6 594 million at year end<strong>2010</strong> (NOK 9 037 million). These numbersinclude discontinued operations.The main reason for the decrease inEBITDA was the delay and cost increaseson the Longview power project. This wasdue to, among other factors, force majeureevents, changes to the project, and thirdparty actions in furnishing engineeringservices, equipment and materials, all ofwhich have directly and adversely impactedAker Solutions’ project work. As a consequenceof this, Aker Solutions decided toreverse previously reported profits on thisproject in third quarter <strong>2010</strong>. Additionallosses were recognised in fourth quarter<strong>2010</strong>.A major natural gas fired power plant,the Halton Hills Generating Facility forTransCanada Energy Ltd. was completed inCanada. The single biggest contractawarded during the year was the design,supply, installation, construction andcommissioning for a Biomass renewableenergy plant for RWE in Scotland.In December, a transfer of the majorityof the operations in the Process &Construction business area to JacobsEngineering Group Inc was agreed. Thetransaction was closed in February 2011.The transfer does not include the US EPCcentre in Houston and the UnionConstruction business located in the USand Canada, which will all be part of thenew Aker Contractors company.Going concernBased on the group’s financial results andposition, the board affirms that the annualaccounts for <strong>2010</strong> have been prepared onthe assumption that the company is agoing concern.

10 Aker Solutions annual report <strong>2010</strong>Board of directors’ reportParent company accounts andallocation of net profitThe parent company, Aker Solutions ASAhad a net profit of NOK 3 153 million for<strong>2010</strong> (NOK 1 052 million). Pursuant to thecompany’s dividend policy, the board proposesthat an ordinary dividend of NOK2.75 per share be paid. The board therebyproposes the following allocation of netprofit:Dividend NOK 741 millionOther equity NOK 2 412 millionTotal allocated NOK 3 153 millionUnrestricted equity after the proposeddividend payment amounts to NOK 5 874million.DividendThe parent company’s dividend policyinvolves an intention to pay shareholdersan annual dividend of 30-50 percent of netprofit. The dividend will be paid in cashand/or through share buy-backs.The board will propose a total dividendof NOK 2.75 per share for <strong>2010</strong> to theannual general meeting. Shareholders willthen have received about 38 percent of netprofit in the form of share buy-backs anddividend for the fiscal year.Events after the balance sheet dateIn February 2011, Aker Solutionscompleted the sale of parts of its Process& Construction business area to Jacobs, aspreviously described.The transaction value was approximatelyNOK 5.5 billion and the considerationwas settled in cash at completion.In February 2011, the rulings related tothe 2003 contract with Hitachi America Ltd.were presented. Hitachi was awarded damagesbut the conclusion did not have amaterial effect on the financial statementsof Aker Solutions.In March 2011, Aker Solutionscompleted the transfer of ownership ofsubsidiary Aker Marine Contractors (AMC)to Singapore listed Ezra Holdings Ltd. Inthe transaction, AMC is valued at USD 250million, as previously described.Company, people and communityCorporate governance and riskmanagementCorporate governance in Aker Solutions isperformed within the framework of severaldifferent legal regulations and principles.The respective national legal regulationswill always prevail at our different locationsaround the world.As Aker Solutions exercises ultimategovernance and control from its headquarters in Norway, and is listed on OsloStock Exchange, Norwegian legislation isnaturally a significant framework in terms ofcompany and securities legislation,financial reporting and other corporateissues.Aker Solutions has therefore adoptedthe Norwegian code of practice forcorporate governance. A special statementon the way Aker Solutions observes thecode of practice issued by the NorwegianCorporate Governance Board can be foundon page 81 of this annual report.The corporate governance in AkerSolutions is the traditional model where theshareholders through the annual generalmeeting appoint the board of directors toact as their representatives in governingthe company.The board of directors sets the strategicdirection, the overall governance structure,values and main policies. The policies, ofwhich there are 20, provide direction onacceptable performance and guidedecision-making in all parts of thecompany. The policy framework providesthe delegated authority and authorisationsof the chief executive officer and theorganisation.Among its members, the board of AkerSolutions has appointed an auditcommittee. In <strong>2010</strong> this committee waschaired by Ida Helliesen. Other members ofthe committee at the end of <strong>2010</strong> were AtleTeigland and Lone Fønss Schrøder. FønssSchrøder replaced Øyvind Eriksen on theaudit committe when he assumed the roleas executive chairman in June <strong>2010</strong>.Risk managementThe intention of the governance frameworkis to minimise risk through guidingbehaviour and decisions in the directionthat is most appropriate for the company.The management in Aker Solutions has putin place business processes, managementmeetings and organisational structures toensure that the governing framework isbeing adhered to.Aker Solutions manages risks based onfour main areas.These are the strategic andfinancial risks, reputation risks, risks relatedto mergers and acquisitions and the risksrelated to the operations and projectexecution.Strategic risks arise from pursuing thewrong markets, segments, services andproducts or customers. These aremanaged through the annual strategyprocess. In this process the board ofdirectors ensures that the overall direction,markets and customers are reflected in thestrategies.Financial risk includes currency, interestrate, counterparty and liquidity risk. Thecorporate treasury function is responsiblefor managing financial market risk and thegroup’s exposure to financial markets. AkerSolutions has defined procedures androutines for managing the group’s financialmarket exposure.■■Currency risk: operating units in AkerSolutions identify their own foreigncurrency exposure and mitigate this viacorporate treasury when contracts areawarded. Such cover is provided in theoperating unit’s functional currency. Allmajor contracts are furthermore hedgedin the external market and documentedto qualify for hedge accounting. Morethan 80 percent of project relatedcurrency risk exposure either qualifyfor hedge accounting or are embeddedderivatives.■■Interest rate risk: it has been decidedthat 30–50 percent of the group’s grossdebt will have fixed interest rates withdurations related to the outstandingdebt at any given time.Floating and fixed interest rate loansare combined with interest rate swaps.46 percent of the borrowings had fixedinterest rate at the balance date.■■Counterparty risk: assessmentsare made of major contractualcounterparties and sub-contractors.Risk is reduced through bank and parentcompany guarantees and/or structuringof payment terms. Where bank risk andthe placement risk for surplus liquidityare concerned, specific maximum levelshave been set for the group’s exposureto each financial institution. A special

Aker Solutions annual report <strong>2010</strong>Board of directors’ report11debtor list is signed annually by thegroup’s CFO.■■Liquidity risk: the group’s policy is tomaintain satisfactory liquidity at thecorporate level. This liquidity bufferis expressed as the sum of undrawnbank credit facilities and available cashand bank deposits. Working capitalwill vary over time, depending on thecomposition of revenues in the varioussegments – and good liquidity is important.Reputation risks could typically be bothhard to identify and assess as they canappear in many forms and situations. Albeitelusive and intangible in its nature it cannevertheless have the most severe impacton a business. Aker Solutions has chosento focus reputation risk on assessments ofthe risks related to countries with specialchallenges, frameworks for managing risksand making decisions and the processesfor ensuring compliance with policies.Merger and acquisition risks can arise fromdecisions to invest in other companies.Typically the risks are related to the pricingof an acquisition, buying a company thatdoes not fit well with the existing portfolioor a company with hidden problems. Risksin this category are managed through aspecial corporate investment committee.Operations and project execution risks areoften more specific and related to potentialincidents or challenges in a project or otherbusiness operations. These are typicallydirectly managed by the operating businessesand followed up by corporatethrough the fixed monthly and quarterlyreview structure and the corporate riskcommitteeThe board receives monthly reports on thecompany’s performance and the status ofits most important individual projects.Risk management at corporate levelControl of risks and compliance withpolicies represent key activities of thecorporate functions. As part of the strategyprocess in <strong>2010</strong>, the strenght of thiscorporate role was further emphasised andstrengthened.Each corporate function has a globalresponsibility for following up policies andassociated framework for its respectivearea. This applies regardless of theapproach adopted for organising thebusiness, and is pursued in part through aclose dialogue with the company’scorporate risk and investment committeesand through monthly meetings related tofinancial and operational reporting by thebusiness areas. Each corporate functionwill also follow up its area of responsibilityoutside these formal processes throughdirect dialogue with the businesses.The corporate functions which are mostrelevant to risk managment are as follows:Enterprise Risk coordinates risk managementoutside the traditional project andfinancial areas, and monitors and mitigatesrisks by way of ensuring coordination of thecompliance program and overall businessethics standards.Internal Compliance ensures that the unitshave established and implemented thenecessary systems and routines forensuring compliance with both financialand operational procedures and systemswithin the group, and conducts regularvisits to and checks of units with consequentreporting of possible improvementmeasures.Project and Operational Support providessupport for project assessments in thetendering and execution phases, and chairsthe corporate risk committee which reviewsall major tenders prior to bid approval andevaluates project performance.Corporate Treasury is responsible forfinancial market risk and the group’sexposure to financial markets, and is apermanent member of the CorporateInvestment Committee. Any acquisition,disposal or capex investment that requireapproval from CEO or CFO is reviewed bythis committee prior to final approval.Corporate Insurance handles the purchaseof the group’s insurance programme andprovides insurance-related support forprojects, as well as operating as thegroup’s captive underwriter.Corporate Tax manages Aker Solutions’ taxaffairs, delegates responsibilities forcompliance with the tax policy and followup execution of the tax policy in thebusiness. Taxes include, but are not limitedto, corporate and personal income taxes,value added taxes (VAT), sales taxes,customs, duties, payroll taxes, employmenttaxes and stamp duties.Corporate Business Development ensuresthat all merger and acquisitions, majorrestructurings, real estate transactions andstrategic partnerships are managedeffectively. A key control for BusinessDevelopment is the Corporate InvestmentCommittee.Corporate Legal supports all the abovementionedfunctions in their managementof risk, in part through permanent membershipof the Corporate Risk and InvestmentCommittees, and is also responsible forcontractual and legal follow-up of projects,partners, contracts and disputes.Risk management in operating entitiesEach operating unit is responsible forensuring compliance with corporateprocedures and systems and with all otherapplicable regulations and legal requirements.The corporate staff and theoperating units collaborate closely toidentify, monitor, report on and manage riskfor the whole group. This ensurescompliance with requirements from theboard of directors and with internal andexternal frame conditions and regulations.The Project Execution Model (PEM) isa key element in the operating units’operating system. The PEM is themethodology followed when executingprojects. All risk management processesand controls shall be described in therespective operating system of the businessunit. The process descriptions in thePEM vary according to the type of businessor project being performed but thegeneral requirements of the PEM are thesame across the company.The PEM has defined phases forprojects. The main phases are Feasibility &Concept, Tender & Kick-off, SystemDefinition, Detailing & Fabrication,Assembly & Erection and System Completion.In each of these phases there are definedmilestones that the project needs topass and between all the phases there aregates.In order for a project to move from onegate to another a gate review is executed.

12 Aker Solutions annual report <strong>2010</strong>Board of directors’ reportThis follows a set of defined controls andtemplates, all of which must be passed andcompleted. Risk review is a key control inthe gate review. The gate review is approvedby the project manager and all documentationshall be stored for future reference.All projects in Aker Solutions have aregister where identified risks and opportunitiesare categorised and assessed interms of impact and probability. Mostprojects use the standard template in therisk dashboard tool, known as the Risk andOpportunity Register, while some havedeveloped their own registers.All these risk registers are live documentsthat support follow-up of all risks inthe project as well as the improvementopportunities. It is the responsibility of themanager for any project to manage therisks in the project and to update the riskregister. Depending on the size of theproject, and the complexity, a project mayalso have a separate Risk Manager.Risks in the operating entities arereported to the CEO in monthly operatingreviews. These reviews form the main internalmanagement control procedures andreporting line across Aker Solutions. Thereport consists of a written report and asubsequent review meeting with the CEO,CFO and other functional staff as required.The operating entities are required toperform regular audits of their projects andoperations to ensure they follow the establishedprocesses and procedures. Everyyear management of the unit reviews itsoperating system to ensure its integrity andrelevance to operations. This reviewincludes assessment of opportunities forimprovement and the need for changes tothe operating system, strategy andobjectives.Aker Solutions has also implemented aControl Self Assessment (CSA) which iscompulsory for operating entities. In thisprocess, the operating units assess thequality and relevance of the establishedcontrol activities. The timing of the CSA isdetermined by the Corporate CFO. Furthermore,each of the business units is requiredto conduct an annual evaluation of itsinternal financial reporting control systems.Finally, Internal Compliance may alsodecide to conduct reviews of individualoperating units’ compliance with systemsand procedures. In <strong>2010</strong> such reviews wereconducted in 8 units.Corporate responsibilityAker Solutions influences the economicposition, environment and lives of peopleand their communities in many parts of theworld. This position carries great responsibilityand calls for solid governance andrisk management within all areas of operation.Environmental, social responsibilityand governance issues are deeply embeddedin the activity of operating entities aswell as the functional resources.The company’s history and values, aswell as international norms such as the UNGlobal Compact, the Global <strong>Report</strong>ing Initiativeand the OECD guidelines, form thebasis of Aker Solutions’ corporate responsibility(CR) principles and of the way it reportsin this area.A comprehensive set of policies andcompliance procedures are in place to ensurethat the entities operate according tosound principles in this respect. In <strong>2010</strong>focus has continued to be high on ethics,whistle-blowing and combat of financialcrime. Furthermore, the company has conducteda thorough review of all third partyrepresentation agreements and updatedthe country risk management process.Following this review, the restrictedcountries list was expanded in <strong>2010</strong> toinclude Myanmar (Burma), Iran, NorthKorea, Sudan and Western Sahara(Morocco). These are countries where AkerSolutions will not engage in any newbusiness or investment activities.Targeted training programmes help tostrengthen understanding of, and ensurecompliance with Aker Solutions’ rules. Thecode of conduct is available on the group’swebsite.In <strong>2010</strong>, particular attention has beengiven to business ethics and the code ofconduct for operations abroad. An importantpart of Aker Solutions’ strategy is togrow its business and presence in targetedmarkets outside of Norway. Although theoperational conditions and challenges willdiffer from one market to another, there isonly one standard for Aker Solutions’conduct of business world wide; fullcompliance with applicable laws andinternal policies. This is a prerequisite for allour operations. Having in mind thechallenges that some businesses andprojects might be faced with from time totime, there has been a targeted effort toassist the businesses with, inter alia,awareness training, reviews of agreementsand potential partners, the performance ofintegrity due diligence, the auditing ofcooperation partners books and recordsand the set-up of business structures innew markets. During <strong>2010</strong>, the corporatefunctions and the operating businesseshave been re-organised in a manner thatwill allow for a continuation and even closerfollow-up of this work in the years to come.Aker Solutions became a member of theUN’s Global Compact in <strong>2008</strong>. Both globallyand locally, this opens up opportunitiesfor dialogue and collaboration with otherenterprises, voluntary organisations, unionsand governmental authorities on a range ofcrucial issues.Aker ASA’s frame agreement withNorway’s United Federation of TradeUnions and the International MetalworkersFederation commits Aker Solutions toworking towards good labour relations andto respecting human and workers’ rights inthe communities in which it operates.Aker Solutions has extended itssuccessful partnership with the NorwegianRed Cross to the end of 2011. This collaborationincorporates financial support,exchanges of knowledge and voluntarycontributions.Health, safety and the environmentConcern for health, safety and the environment(HSE) is one of Aker Solutions’ corevalues. It has been a top managementdrivenguiding principle in the business formany years. The fundamental principle andattitude is that all incidents can beprevented. On that basis, Aker Solutionsworks continuously to prevent incidentswhich could cause harm to personnel or tomaterial or non-material assets.Driven by careThe Just Care concept was introducedas a common symbol for the group’s HSEculture and work in 2005. A key element isthat each person accepts personal responsibilityfor HSE, based on care for peopleand the environment. Through Just Care,the HSE message reaches the individualemployee more effectively. Managers asrole models and a strong commitment tocommunication and training createattitudes which integrate HSE in everydaywork.

Aker Solutions annual report <strong>2010</strong>Board of directors’ report13A common HSE cultureEducation occupies a central place in AkerSolutions’ HSE programme. Since it wasintroduced in 2005, the tailored HSEleader ship programme has been completedby more than 2 700 leaders. 200 participatedin <strong>2010</strong>. This programme equipsmanagers with the competence required tobecome better role models and to driveHSE improvements.To reach out to all employees in anefficient way, the group has also developedeLearning programmes for key areas withinHSE. These include the Just Care cultureand HSE as a core value, as well as morespecific topics on mastering stress andprotecting the environment. More than77 000 eLearning sessions have beencompleted since these programmes wereintroduced in <strong>2007</strong>.Clear expectationsA common HSE operating system for thewhole company sets standards for themost important elements in HSE managementand leadership. Regular audits uncoverpossible gaps in relation to expectations,and the necessary counter-measuresare identified and initiated. This systemalso functions as a framework for crossorganisationalsharing and learning.Learning from incidentsOn the basis of an analysis of incidents inrecent years and exchange of experience inthe industry, Aker Solutions developed anew component in its HSE programme in<strong>2008</strong>. Entitled Just Rules, this is a set ofsimple but specific safety regulations forparticular work operations which arejudged on the basis of experience to posehigher risks.Since the implementation more than32 000 employees, contract staff andsubcontractor personnel have participatedin presentations of Just Rules. By makingthe most important preventative measuresmandatory, clear and simple, Just Rulesessentially contributes to preventingserious incidents.AchievementsDespite continuous efforts to avoid seriousincidents, Aker Solutions regrettablysuffered 19 serious personal injuries in<strong>2010</strong>, compared to 23 in <strong>2009</strong> and 18 in<strong>2008</strong>. No fatalities occurred in <strong>2010</strong>.Of these 19 injuries, five involved workingat height, two occurred during liftingoperations, two from falling objects, threefrom energy isolation, three from trippingand four from operating hand tools.The total recordable injury frequency(TRIF) per million working hours fell from2.7 in <strong>2009</strong> to 2.6 in <strong>2010</strong>. The lost-timeinjury frequency (LTIF) per million workinghours declined from 0.9 in <strong>2009</strong> to 0.8.These figures also include Aker Solutions’sub-contractors.All serious incidents and near misses areinvestigated and the lessons from themimplemented with the aim of preventingsimilar incidents in the future.In <strong>2010</strong> the company’s umbilicals manufacturingfacilities in Mobile, US and Moss,Norway both celebrated five years withoutlost time incidents and received companywiderecognition for their results. Also in<strong>2010</strong> Aker Solutions was named the winnerof the prestigious Malaysian NationalOccupational Safety & Health Award in theheavy industry manufacturing category.Sick leaveSick leave amounted to 2.0 percent of totalworking hours in <strong>2010</strong>, compared with 2.2percent the year before. Sick leave hasremained stable at a low level after a cleardecline in 2003-2006. However, it shouldbe noted that differences in local regulationscomplicate a direct comparison ofsick leave between different countries.Although low in comparison withnational average, company statistics showthat sick leave in Aker Solutions’Norwegian operations is relatively higherthan in other areas of the group, with anaverage 4.1 percent in <strong>2010</strong>.Special initiatives have been introducedin <strong>2010</strong> with a focus on exercise andnutrition. The company’s sponsorship ofthe 2011 FIS Nordic World Ski Championshipand participation in the Aker Aktivprogramme is part of this.EnvironmentThe board takes the view that AkerSolutions’ activities pose only a limiteddirect burden on the environment. Nosignificant unintentional discharges oremissions to the surrounding environmentwere recorded in <strong>2010</strong>.Total energy consumption by thebusiness in <strong>2010</strong> (figures for <strong>2009</strong> inbrackets), based on recorded use of oil,gas and electricity, amounted to 473 950(588 206) megawatt-hours. Carbonemissions related to this usage areestimated at 109 573 (136 797) tonnes. Themethodology used derives from the GreenhouseGas Protocol – GHG, and Global<strong>Report</strong>ing Initiative – GRI.Waste recorded in connection with thebusiness totalled 42 171 (45 744) tonnes, ofwhich 86 percent was recycled. <strong>Report</strong>ingprocesses for environmental parametershave been improved, and the figures aboveare being reported since <strong>2008</strong> with greateraccuracy than before.At the end of <strong>2010</strong>, 20 out of 50 operatingunits were certified to the ISO 14001environmental standard. An eLearningprogramme with a particular focus on theenvironment was introduced during <strong>2008</strong>,and 15 000 employees have so farcompleted it.The above mentioned HSE leadershipdevelopment initiatives, eLearning and themanagement system incorporate clearcomponents which focus attention on theenvironment. Collectively, these contributeto continuous improvements in environmentalawareness and attitudes amongmanagers and other employees.This inspires the organisation to achievefurther gains in environmental performancein Aker Solutions’ own activities, and toassist customers in making environmentalimprovements through the productsdeveloped by the group.Examples can be found in such areas ascarbon capture, drilling rigs with a strongenvironmental performance in arctic conditions,treatment of volatile organiccompounds, treatment of sulphur andammonia discharges, installation equipmentand support structures for windturbines, as well as the next generation ofbio fuels.People and teamsKeeping a workforce of highly skilled andmotivated employees and leaders is a keysuccess factor for Aker Solutions. Thecompany continuously strives to increaseattractiveness, recruit new talent anddevelop the competence of people andteams. For most operating entities in AkerSolutions, lack of skilled personnel isregarded as a potential challenge andtherefore systematically addressed.The attention paid by Aker Solutions to

14 Aker Solutions annual report <strong>2010</strong>Board of directors’ reportemployee and leadership development isregarded as an important competitiveadvantage. Aker Academy serves as theinternal arena for know-how building andemployee development throughout thegroup. It offers programmes in importantprofessional subject areas such as leadership(at various levels), project execution,commercial management and HSE.In addition, there are online and remote“eLearning” programmes, with a total of24 000 active users in more than 30 countries.More than 118 000 eLearning courseshave been completed by Aker Solutions’people since 2005.The group’s global eLearning portaloffers more than 30 tailored programmescovering areas including project execution,HSE (described above), corporate responsibility,cultural awareness and morecompany-specific, operational topics.Special courses are available in Englishwhich is the company’s corporatelanguage.The commitment to eLearning gives allemployees access to a cost-effective andaccessible range of courses. In addition toboosting professional expertise in keyareas, these courses make a strong contributionto building a common corporateculture, as well as providing opportunitiesfor mandatory certification in specificareas.Corporate programmes offered acrossthe group are supplemented by coursesorganised by local units, while deliveredunder the umbrella of the Aker Academy.Organisation and recruitmentAs of 31 December <strong>2010</strong>, the overall workforcecomprised 24 814 people, including19 444 employed directly and 5 370 oncontract. During the year the overall workforcereduced by 678, as a result of orderintake and activities.Aker Solutions has two main categoriesof employees: skilled workers andoperators (27.8 percent) and white collarstaff (72.2 percent).Of the employees, 50.3 percent workedin Norway, 16.6 percent in the Americas,16.2 percent in the Asia Pacific region, 15.9percent in Europe outside Norway and 1.0percent in Africa and the Middle East.Workforce turnover in <strong>2010</strong> averaged 8.9percent, an increase of 2.2 percent fromthe year before.More than 59 000 applicants from over30 countries were registered in the group’srecruitment system during the year. A totalof 2 128 new employees were recruitedfrom this base, with women accounting for21.3 percent.In <strong>2010</strong> the third class of Aker Solutions’international trainee programme completedtheir final assignments. All ten traineeswere offered permanent employment in thecompany. Since 2006 25 employees havebeen part of the programme. Recruitmentfor class four is under way. A recordnumber of 989 applications were submitted.Up to 15 will be offered to participatein the 24 month programme whichstarts in August 2011.Diversity and equal opportunityWith operations in most parts of the worldand activities that typically involveemployees from several operating entitiesand geographical regions, Aker Solutions isenriched by people from many cultures,religions and ethnic groups. Equal opportunityfor everyone is an established principlefor the group. No differences should existbetween genders or ethnic groups.This commitment to equal opportunity isclearly described in policies and by agreement,for instance in a three-party frameagreement with national and internationaltrade unions. This agreement, which wasextended for a new two-year period in<strong>2010</strong>, covers general employment termsand employee relations, with specific focuson non-discrimination.Each entity is encouraged to seek awork pattern which suits both employeesand the company, and which ensures agood balance between work and privatelife. Examples of work patterns includeflexible working hours, remote or homeworking and compressed working weeks.These benefits are regarded as importantelements in ensuring equal opportunities.Equal opportunity for people of bothgenders is a basic principle in AkerSolutions. For several reasons, mainlyrelated to history and industry tradition,male employees continue to be in majoritywithin the company. Of the total employees80.7 percent were men.Requirements are set for diversity inrecruitment and people development. Ofthe total 2 128 new employees in <strong>2010</strong>,21.3 percent were women. Thecorresponding number for <strong>2009</strong> was 24percent.Management development programmesmake an important contribution to gettingwomen into senior posts. 26 percent ofparticipants in the company’s managementdevelopment programmes in <strong>2010</strong> werewomen. A special executive managementtraining programme completed in <strong>2010</strong> hadsix women participants of a total 27 (22percent). Two female managers have alsoparticipated in McKinsey’s Centred LeadershipProgramme, an external managementand networking scheme for senior femaleexecutives.Of the 815 participants in a culturalawareness programme, 212 are women.Women account for 41 percent of theparticipants in the international traineeprogramme.Three of Aker Solutions’ six shareholderelecteddirectors are women. All directorselected by and amongst employees aremen. This is in accordance with legalrequirements, since women account forless than 20 percent of the overall workforce.The corporate management team hadone female member as of 31 December<strong>2010</strong>. Ten percent of employees in seniormanagement positions are women. Averagepay in the group is somewhat higherfor men than for women. This reflects thefact that, on average, male employeescontinue to have greater pay seniority thanwomen.Performance culture and employee rewardsThe group’s remuneration policy specifiesthat the same pay will be given for thesame work, and that good performance willbe rewarded. Key factors in determiningpay are the scope and level of responsibility,job requirements, levels of expertiseand commitment, results achieved, andlocal pay levels.Aker Solutions is working to increase thecorrespondence between performance andpay. Objectives are set and performance ismeasured on both team and individuallevels, and for both behaviour and commercialdimensions. Objectives are determinedon the basis of strategies and budgetsfor each unit.At least once a year, manager andemployees evaluate the results achieved.This performance dialogue provides thebasis for recognition, rewards and career

Aker Solutions annual report <strong>2010</strong>Board of directors’ report15opportunities, and gives direction forpotential individual performance improvements.Performance based pay is regarded asan attractive part of the total remunerationpaid to employees. Different variable payprogrammes are in place for different typesof positions. <strong>Annual</strong> variable pay is given toemployees on the basis of the commercialresults achieved by the relevant businessunit or project. Managers earn variable payon the basis of the commercial results forthe units they influence and the extent towhich they comply with the group’s values.Variable pay for senior executives isspread over several years to encouragelong-term achievement of results and alasting employee relationship. Furtherdetails of the remuneration of senior executivesare provided in Note 10 Salaries,wages and social security costs to theconsolidated financial statements.Research and developmentAker Solutions has a long standing culturefor innovation and technology development.This is founded on a broad andstrong engineering community with handsonexperience from project driven engineeringand project management throughprocurement, construction, commissioningand operations.The ability to continuously develop andqualify new technology to meet ourcustomers’ needs and secure our competitiveadvantage is fundamental to the groupand it will continue to be further strengthenedgoing forward.In <strong>2010</strong>, the company’s IP position wasfurther developed through new patentfilings and granted applications. Totalresearch and development (R&D) investmentsin <strong>2010</strong> was NOK 329 million (NOK341 million), of which NOK 157 million hasbeen expensed because the criteria forcapitalisation was not met (NOK 164million). In addition the group receivedcontributions from customers and publicfunding worth NOK 110 million for R&D(NOK 22 million) related to specific projects.Aker Solutions strives to maintain investmentlevels in R&D through the businesscycles. For this reason the <strong>2010</strong> R&Dspend was only slightly reduced from <strong>2009</strong>levels despite lower overall revenue for thegroup and fewer projects awarded by customersthrough the year compared to <strong>2009</strong>levels. However, the customer contributionto product development increased significantly.The technology development in AkerSolutions is market driven and costeffective. It is often pursued in close cooperationwith business partners andcustomers worldwide. Our skilled engineeringteams around the world are focused onunderstanding the local and global marketchallenges and translate these into costeffective technical solutions with focus onquality and safety. Aker Solutions’ longstanding track record and experience fromdeveloping and qualifying solutions for theNorth Sea will continue to be exploited andfurther to that developed and exported intoglobal markets.In <strong>2010</strong> the process systems businessengineered and fabricated the first fullstream multistage cyclonic separationsystem using three different types of hydrocyclonesand compact degassing. With acapacity of 40 000 barrels of liquid per day,the system is designed for de-oiling ofheavy oil with very high water productionlevels. In 2011 this CySep system will beinstalled on an offshore heavy oil field in theCampos Basin, where performanceverification testing will be initiated in cooperationwith field operator Petrobras.Within the MMO business the R&Dprojects have focused on integrated operationsand strategic development of technicalintegrity management services (TIMS),enhanced structural integrity maintenanceprograms (SIMP) and implementation ofadvanced non-destructive testing (NDT)inspection technologies.These technologies and services willfurther strengthen our position andcapabili ties within this area and helps usimprove regularity and predictability vital forour clients and authorities. MMO participationin joint industry projects and internaldevelopment programmes have strengthenedour position in areas such as computationalfluid dynamics (Comflow) andwithin analysis of extreme stresses andfatigue in the tensile- and pressure armourlayers of flexible pipes in <strong>2010</strong>.Methods and technologies for thedecommissioning market have been developedas a spin-off of performed removalprojects. The decommissioning market isgrowing with 350 platforms to be removedwithin the next 30 years on the Norwegianand UK sector. Further improvement of thejacket removal technology has beeninitiated.Within Subsea, Aker Solutions continuedto strengthen its production systemsproduct portfolio. New and furtherdeveloped products and solutions werecommercialised within power, processingand boosting.Cost effective installation and operationfriendlysolutions for gas fields, deepwaterapplications and complex fluids were prioritisedin <strong>2010</strong>. During the year, AkerSolutions succeeded in qualifying importantproduct elements which enabled thecompany to take a lead in several of thesegments in which it is competing.Solutions and products for the Brazilianpre-salt fields and solutions for deepwatersubsea well intervention were just some ofthe <strong>2010</strong> achievements.Within power, processing and boosting,Aker Solutions are working together withmajor customers and suppliers to qualifyand commercialise concepts for subseagas compression and ultra-deepwatersubsea boosting. In subsea gas compression,major milestones were reached in<strong>2010</strong> through successful system integrationtesting of the Ormen Lange subsea gascompression pilot station and through theaward of the Åsgard subsea gas compressionproject.The landmark Åsgard project builds onthe technology leap achieved through theOrmen Lange subsea gas compressionpilot, where challenges within real timecondition monitoring and process control,all electric controls, cooling, power distribution,and customising and packaging oftopside technologies for subsea environmenthave been overcome.Aker Solutions is a leading player insteel tube umbilicals. To be able to addressthe increasingly more complex and harshfluids, the company is focusing on qualifyingnew materials and composites. Workhas also been done to further develop andqualify direct electric heating (DEH) cablesfor risers, pipelines and other applications.The first of the company’s deepwatersubsea equipment installation vessels wasdelivered to Petrobras in early <strong>2010</strong>. Thesecond of these vessels – which features atotal solution for installation, completionand well intervention – was also completedand delivered for operation in <strong>2010</strong>.