shARehoLDeR iNfoRMAtioN - DCC plc

shARehoLDeR iNfoRMAtioN - DCC plc

shARehoLDeR iNfoRMAtioN - DCC plc

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

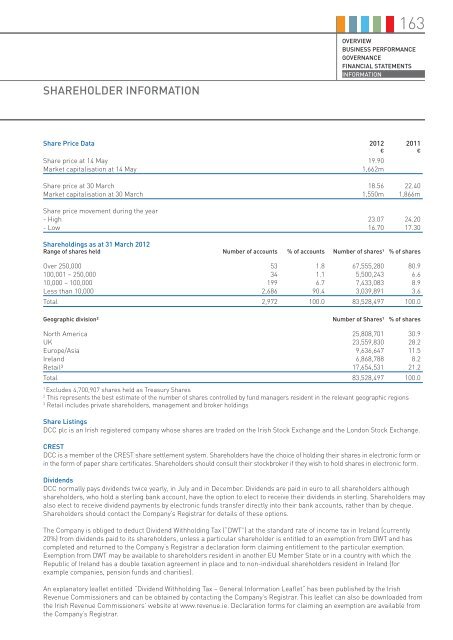

163OVERVIEWBUSINESS PERFORMANCEGOVERNANCEFINANCIAL STATEMENTSINFORMATIONShareholder InformationShare Price Data 2012 2011€ €Share price at 14 May 19.90Market capitalisation at 14 May 1,662mShare price at 30 March 18.56 22.40Market capitalisation at 30 March 1,550m 1,866mShare price movement during the year- High 23.07 24.20- Low 16.70 17.30Shareholdings as at 31 March 2012Range of shares held Number of accounts % of accounts Number of shares¹ % of sharesOver 250,000 53 1.8 67,555,280 80.9100,001 – 250,000 34 1.1 5,500,243 6.610,000 – 100,000 199 6.7 7,433,083 8.9Less than 10,000 2,686 90.4 3,039,891 3.6Total 2,972 100.0 83,528,497 100.0Geographic division²Number of Shares¹ % of sharesNorth America 25,808,701 30.9UK 23,559,830 28.2Europe/Asia 9,636,647 11.5Ireland 6,868,788 8.2Retail³ 17,654,531 21.2Total 83,528,497 100.01Excludes 4,700,907 shares held as Treasury Shares2This represents the best estimate of the number of shares controlled by fund managers resident in the relevant geographic regions3Retail includes private shareholders, management and broker holdingsShare Listings<strong>DCC</strong> <strong>plc</strong> is an Irish registered company whose shares are traded on the Irish Stock Exchange and the London Stock Exchange.CREST<strong>DCC</strong> is a member of the CREST share settlement system. Shareholders have the choice of holding their shares in electronic form orin the form of paper share certificates. Shareholders should consult their stockbroker if they wish to hold shares in electronic form.Dividends<strong>DCC</strong> normally pays dividends twice yearly, in July and in December. Dividends are paid in euro to all shareholders althoughshareholders, who hold a sterling bank account, have the option to elect to receive their dividends in sterling. Shareholders mayalso elect to receive dividend payments by electronic funds transfer directly into their bank accounts, rather than by cheque.Shareholders should contact the Company’s Registrar for details of these options.The Company is obliged to deduct Dividend Withholding Tax (“DWT”) at the standard rate of income tax in Ireland (currently20%) from dividends paid to its shareholders, unless a particular shareholder is entitled to an exemption from DWT and hascompleted and returned to the Company’s Registrar a declaration form claiming entitlement to the particular exemption.Exemption from DWT may be available to shareholders resident in another EU Member State or in a country with which theRepublic of Ireland has a double taxation agreement in place and to non-individual shareholders resident in Ireland (forexample companies, pension funds and charities).An explanatory leaflet entitled “Dividend Withholding Tax – General Information Leaflet” has been published by the IrishRevenue Commissioners and can be obtained by contacting the Company’s Registrar. This leaflet can also be downloaded fromthe Irish Revenue Commissioners’ website at www.revenue.ie. Declaration forms for claiming an exemption are available fromthe Company’s Registrar.

164 D C C A N N U A L R E P O R T A N D A C C O U N T S 2 0 1 2Shareholder Information (continued)WebsiteThrough <strong>DCC</strong>’s website, www.dcc.ie, stakeholders and other interested parties can access information on <strong>DCC</strong> in an easy-tofollowand user-friendly format. As well as information on the Group’s activities, users can keep up to date on <strong>DCC</strong>’s financialresults and share price performance through downloadable reports and interactive share price tools. The site also providesaccess to archived financial data, annual reports, stock exchange announcements and investor presentations.Electronic CommunicationsFollowing the introduction of the Transparency Regulations 2007, and in order to adopt a more environmentally friendly andcost-effective approach, the Company provides information concerning the Company (such as the Annual Report, InterimReport and Notice of Annual General Meeting) to shareholders electronically via <strong>DCC</strong>’s website, www.dcc.ie, and only sends aprinted copy to those shareholders who specifically request a copy. Shareholders who receive information electronically willcontinue to receive certain communications by post (such as share certificates, dividend cheques, dividend payment vouchersand tax vouchers). Shareholders who wish to alter the method by which they receive communications should contact theCompany’s Registrar.Financial Calendar• Preliminary results announced – 15 May 2012• Ex-dividend date for the final dividend – 23 May 2012• Record date for the final dividend – 25 May 2012• Interim Management Statement – 20 July 2012• Annual General Meeting - 20 July 2012• Proposed payment date for final dividend – 26 July 2012• Interim results to be announced – 6 November 2012• Proposed payment date for the interim dividend – December 2012• Interim Management Statement – February 2013Annual General Meeting, Electronic Proxy Voting and CREST VotingThe 2012 Annual General Meeting will be held at The Four Seasons Hotel, Simmonscourt Road, Ballsbridge, Dublin 4, Irelandon Friday 20 July 2012 at 11.00 a.m. The Notice of Meeting together with an explanatory letter from the Chairman and a Form ofProxy accompany this Report.Shareholders may lodge a Form of Proxy for the 2012 Annual General Meeting via the internet. Shareholders who wish tosubmit their proxy in this manner may do so by accessing the Company’s Registrar’s website at www.eproxyappointment.comand following the instructions which are set out on the Form of Proxy.CREST members who wish to appoint a proxy or proxies via the CREST electronic proxy appointment service should refer to thenotes in the Notice of Annual General Meeting or on the Form of Proxy.RegistrarAll administrative queries about the holding of <strong>DCC</strong> shares should be addressed to the Company’s Registrar, ComputershareInvestor Services (Ireland) Limited, Heron House, Corrig Road, Sandyford Industrial Estate, Dublin 18, Ireland.Tel: + 353 1 247 5698Fax: + 353 1 216 3151www.investorcentre.com/ie/contactusInvestor RelationsFor investor enquiries please contact Redmond McEvoy, Investor Relations Manager, <strong>DCC</strong> <strong>plc</strong>, <strong>DCC</strong> House, Brewery Road,Stillorgan, Blackrock, Co Dublin, Ireland.Tel: + 353 1 2799 400Fax: + 353 1 2831 017email: investorrelations@dcc.ie