Aarhus – Capital of Wind Energy - Aarhus.dk

Aarhus – Capital of Wind Energy - Aarhus.dk

Aarhus – Capital of Wind Energy - Aarhus.dk

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

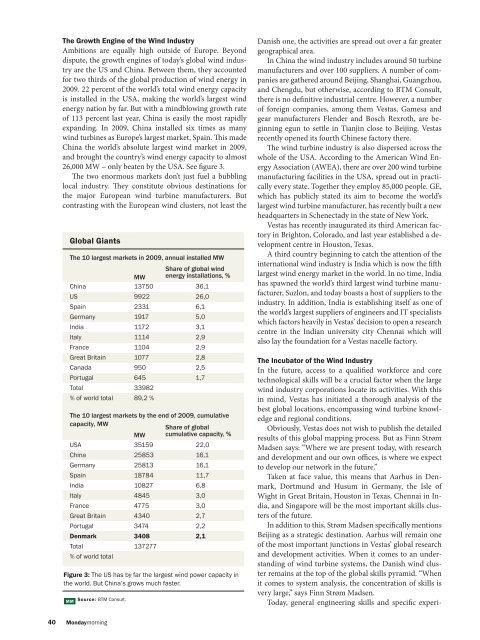

The Growth Engine <strong>of</strong> the <strong>Wind</strong> IndustryAmbitions are equally high outside <strong>of</strong> Europe. Beyonddispute, the growth engines <strong>of</strong> today’s global wind industryare the US and China. Between them, they accountedfor two thirds <strong>of</strong> the global production <strong>of</strong> wind energy in2009. 22 percent <strong>of</strong> the world’s total wind energy capacityis installed in the USA, making the world’s largest windenergy nation by far. But with a mindblowing growth rate<strong>of</strong> 113 percent last year, China is easily the most rapidlyexpanding. In 2009, China installed six times as manywind turbines as Europe’s largest market, Spain. This madeChina the world’s absolute largest wind market in 2009,and brought the country’s wind energy capacity to almost26,000 MW <strong>–</strong> only beaten by the USA. See figure 3.The two enormous markets don’t just fuel a bubblinglocal industry. They constitute obvious destinations forthe major European wind turbine manufacturers. Butcontrasting with the European wind clusters, not least theGlobal GiantsThe 10 largest markets in 2009, annual installed MWShare <strong>of</strong> global windMW energy installations, %China1375036,1US992226,0Spain23316,1Germany19175,0India11723,1Italy11142,9France11042,9Great Britain 10772,8Canada9502,5Portugal6451,7Total33982% <strong>of</strong> world total 89,2 %The 10 largest markets by the end <strong>of</strong> 2009, cumulativecapacity, MWShare <strong>of</strong> globalMW cumulative capacity, %USA3515922,0China2585316,1Germany2581316,1Spain1878411,7India108276,8Italy48453,0France47753,0Great Britain 43402,7Portugal34742,2Denmark34082,1Total137277% <strong>of</strong> world totalFigure 3: The US has by far the largest wind power capacity inthe world. But China’s grows much faster.Source: BTM Consult.Danish one, the activities are spread out over a far greatergeographical area.In China the wind industry includes around 50 turbinemanufacturers and over 100 suppliers. A number <strong>of</strong> companiesare gathered around Beijing, Shanghai, Guangzhou,and Chengdu, but otherwise, according to BTM Consult,there is no definitive industrial centre. However, a number<strong>of</strong> foreign companies, among them Vestas, Gamesa andgear manufacturers Flender and Bosch Rexroth, are beginningegun to settle in Tianjin close to Beijing. Vestasrecently opened its fourth Chinese factory there.The wind turbine industry is also dispersed across thewhole <strong>of</strong> the USA. According to the American <strong>Wind</strong> <strong>Energy</strong>Association (AWEA), there are over 200 wind turbinemanufacturing facilities in the USA, spread out in practicallyevery state. Together they employ 85,000 people. GE,which has publicly stated its aim to become the world’slargest wind turbine manufacturer, has recently built a newheadquarters in Schenectady in the state <strong>of</strong> New York.Vestas has recently inaugurated its third American factoryin Brighton, Colorado, and last year established a developmentcentre in Houston, Texas.A third country beginning to catch the attention <strong>of</strong> theinternational wind industry is India which is now the fifthlargest wind energy market in the world. In no time, Indiahas spawned the world’s third largest wind turbine manufacturer,Suzlon, and today boasts a host <strong>of</strong> suppliers to theindustry. In addition, India is establishing itself as one <strong>of</strong>the world’s largest suppliers <strong>of</strong> engineers and IT specialistswhich factors heavily in Vestas’ decision to open a researchcentre in the Indian university city Chennai which willalso lay the foundation for a Vestas nacelle factory.The Incubator <strong>of</strong> the <strong>Wind</strong> IndustryIn the future, access to a qualified workforce and coretechnological skills will be a crucial factor when the largewind industry corporations locate its activities. With thisin mind, Vestas has initiated a thorough analysis <strong>of</strong> thebest global locations, encompassing wind turbine knowledgeand regional conditions.Obviously, Vestas does not wish to publish the detailedresults <strong>of</strong> this global mapping process. But as Finn StrømMadsen says: “Where we are present today, with researchand development and our own <strong>of</strong>fices, is where we expectto develop our network in the future.”Taken at face value, this means that <strong>Aarhus</strong> in Denmark,Dortmund and Husum in Germany, the Isle <strong>of</strong>Wight in Great Britain, Houston in Texas, Chennai in India,and Singapore will be the most important skills clusters<strong>of</strong> the future.In addition to this, Strøm Madsen specifically mentionsBeijing as a strategic destination. <strong>Aarhus</strong> will remain one<strong>of</strong> the most important junctions in Vestas’ global researchand development activities. When it comes to an understanding<strong>of</strong> wind turbine systems, the Danish wind clusterremains at the top <strong>of</strong> the global skills pyramid. “Whenit comes to system analysis, the concentration <strong>of</strong> skills isvery large,” says Finn Strøm Madsen.Today, general engineering skills and specific experi-ence within narrow technology fields can be found in a fargreater concentration in other parts <strong>of</strong> the world. But FinnStrøm Madsen emphasizes that the historic understanding<strong>of</strong> wind turbine systems prevalent in Denmark is unique.“You find people here who were born and raised in the industry.They have a thorough understanding <strong>of</strong> how windturbines work and are able to look ahead and see whichtype <strong>of</strong> products will be in future demand. This is whyDenmark is so interesting to foreign players <strong>–</strong> particularlythose new to the industry. It all begins with understandingturbines and how they work. If you build on your knowledge<strong>of</strong> how to make a concrete foundation, you will getnowhere,” says Finn Strøm Madsen.According to Peder Bo Sørensen, an expert in the windturbine industry and regional project director <strong>of</strong> Invest inDenmark, a great part <strong>of</strong> this knowledge can be found withthe suppliers and subcontractors <strong>of</strong> the Greater <strong>Aarhus</strong>“The systems have become verycomplex, and a number <strong>of</strong> manufacturershand entire subsystemsover to suppliers instead <strong>of</strong> buyingindividual components.”Peder Bo Sørensen, Project Director, Invest in Denmarkarea. “The systems have become very complex, and anumber <strong>of</strong> manufacturers hand entire subsystems over tosuppliers instead <strong>of</strong> buying individual components. In thatcontext, it is unique that the entire supply chain <strong>of</strong> productionand development is present in the region.”The role <strong>of</strong> the <strong>Aarhus</strong> cluster as a global incubatoris also prominent among foreign manufacturers. As theformer CEO <strong>of</strong> Suzlon in Denmark, Erik Winther Pedersen,states: “We chose to establish ourselves in Denmark,because this was where the expertise was. Simply put, wecould relatively easily recruit experienced personnel fromexisting companies.”Pedersen emphasizes that the skills and traditions <strong>of</strong>the Greater <strong>Aarhus</strong> area are a fertile breeding ground fornew businesses: “It might well be that the dominant universitiesin the wind turbine field are not in <strong>Aarhus</strong>. Butthe companies do have their development and technicaldepartments in Central Denmark. This helps to increasethe attractiveness <strong>of</strong> the region. When a whole region isbuzzing with wind activity, employees know that theyhave good possibilities to jump between the companies,”says Erik Winther Pedersen.Today, 14 different nationalities are employed at Suzlon’s<strong>of</strong>fice in <strong>Aarhus</strong>. Following the takeover <strong>of</strong> theGerman company REpower, Erik Winther Pedersen hasswapped places as CEO with the German, Stephan KarlNeighbourhood GrowthMarket forecast for Northern Europe, megawatt50,00040,00030,00020,00010,0000Today2020 totalGermanySwedenUKPolandLithuaniaLatviaIrelandNetherlandsFinlandEstoniaDenmarkBelgiumFigure 4: <strong>Wind</strong> energy enjoys tremendous growth in some <strong>of</strong>Denmark’s neighbouring countries.Source: Danish <strong>Wind</strong> Industry Association.Mey, who, with his experience from German industrial giantMAN Diesel, will oversee the fusion <strong>of</strong> the two windturbine companies.Booming NeighboursThe region is also an interesting destination in terms <strong>of</strong>market access. Even though the Danish wind turbine marketis miniscule compared to giants like the US and China,or even Southern Europe, the Greater <strong>Aarhus</strong> area enjoysproximity to other Northern European markets: Belgium,Estonia, Finland, Holland, Ireland, Latvia, Lithuania, Poland,Germany, Sweden and Great Britain.According to the Danish <strong>Wind</strong> Industry Association, atleast 4,500 megawatts were installed in these neighbouringmarkets in 2009. The association estimates that the annualincrease in windpower capacity will mount to at least 7,300megawatts by 2020.Furthermore, Denmark has decided to build its largest<strong>of</strong>fshore wind turbine park ever, capable <strong>of</strong> generating400 megawatts, beside the island <strong>of</strong> Anholt in the Kattegatsea, 60 kilometres east <strong>of</strong> <strong>Aarhus</strong> Harbour. While stronggrowth is expected in the Swedish, Polish and Dutch markets,the most powerful expansion is expected in GreatBritain and Germany. Great Britain is planning to increaseits capacity from around 4,000 megawatts in 2009to 26,000 megawatts in 2020, while the German market isexpected to grow from a capacity <strong>of</strong> around 26,000 megawattsin 2009 to 49,000 megawatts by 2020. See figure 4.In total, the wind turbine industry is predicting a combinedgrowth in Denmark’s neighbouring markets <strong>of</strong> morethan 10 percent per annum, from 35 gigawatts today, to atleast 117 gigawatts by 2020.40 Mondaymorning <strong>Aarhus</strong> <strong>–</strong> <strong>Capital</strong> <strong>of</strong> <strong>Wind</strong> <strong>Energy</strong> 41